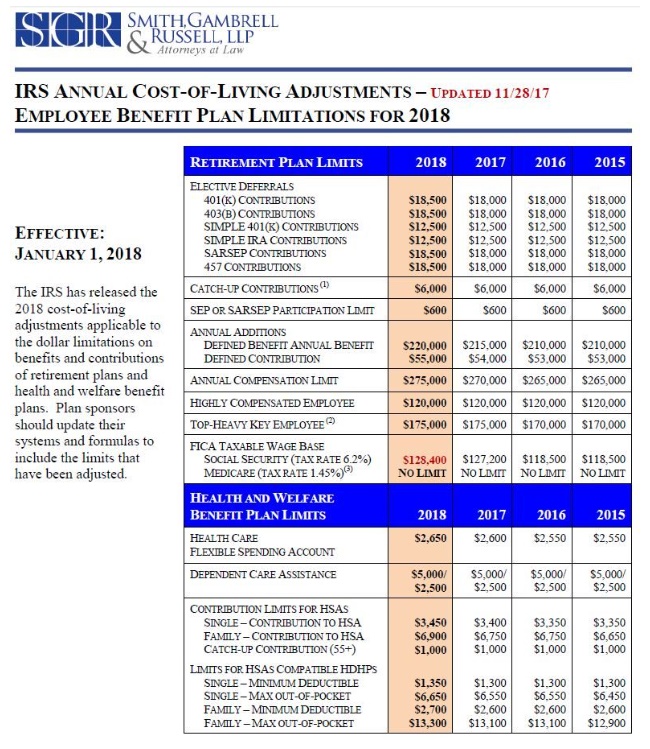

On November 27, 2017, the Social Security Administration announced it is revising the 2018 Taxable Maximum Amount, effective January 1, 2018. Originally, it had announced that the Social Security taxable maximum would be increasing to $128,700 for 2018. However, based on updated wage data, this number has now been adjusted to $128,400.

For a printable version of this chart, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.