Historically, investors in subprime auto asset-backed securities (ABS) have been able to sleep well at night. They have rested easy in part because credit enhancements in securitizations have protected them from losses. Today, due in large part to the safety expected from credit enhancements, rumblings about the parallels between subprime auto lending and pre-financial crisis subprime mortgage lending – and the cataclysmic end those parallels could portend – have barely disturbed the subprime auto ABS market.

Overcollateralization (O/C) rates are often touted as particularly protective for subprime auto ABS. It's true, of course: As investors have rightfully demanded greater O/C rates on riskier pools, they have created greater protection for themselves. That much we know. What is not as clear, however, are the answers to two more questions: First, will the main indicators of crisis that foretold the subprime mortgage crisis – some of which can be found in varying degrees in subprime auto lending, the underlying auto market and auto ABS performance – eventually cause losses to spike? And second, if so, will O/C and other credit enhancements provide the protections investors expected?

Crisis Indicators

A crisis is a turning point and a battle over loss allocation. It need not entail a full-blown economic meltdown. A review of the main crisis indicators within the areas that are traditionally key sources of ABS risk – lending practices, the underlying market for assets backing pooled loans and ABS practices – reveals that a lot is riding on the structure of auto loan securitizations to prevent the kind of loss allocation battles that could harm lenders and investors alike.

Lending Practices and Factors

Auto lending practices have been a mixed bag across the industry. The industry is dividing between the mainly larger lenders that have pulled back from subprime and lenders that are aggressively pursuing borrowers down the credit scale. Overall, FICO scores have remained steady, but, similar to subprime residential mortgage-backed securities (RMBS), the lowest scores are found in the highest volume auto ABS products. There have been reports of alarmingly low incidences of income verification by at least one major auto lender, but it is unclear how widespread the practice is. Although the share of subprime auto loans has been steady, "deep subprime" has grown. Delinquencies are relatively low but have been rising since 2014, nearing pre-financial crisis levels.

Auto Market

Average auto prices have steadily increased since 2005 to record highs, yet used vehicles are depreciating faster than anticipated due to lease returns, sales incentives on new vehicles and advances in onboard technology. This accelerated depreciation is spurring negative equity to record highs on trade-ins. In fact, nearly a third of all trade-ins in the first half of 2017 had negative equity. Negative equity historically leads to defaults. Moreover, in the auto loan context specifically, negative equity places downward pressure on the performance of new loans as loans can exceed over 100% loan-to-value ratios.

ABS Performance

Losses to auto securitization trusts can come from early termination, either due to prepayment (the trust does not get the interest it expected, where a premium was paid for the loan) or default followed by foreclosure or repossession. The aggregate loss depends on the number of loss events and the severity of losses. Severity, in turn, depends on collateral value and enforcement costs. Subprime auto ABS losses increased to 6.30% in June 2017, up from 6.04% in June 2016. The recovery rate of 42.92% in June 2017 was down from 43.75% in June 2016.

When the pre-financial crisis subprime RMBS trusts incurred losses, the investors may have directed forensic analyses, but in many cases, no action was taken for years – not until investors and trustees were nearly out of time to file suit. They may not have had any urgency due to a number of factors, including misplaced reliance on accrual clauses in agreements that purported to toll the statute of limitations. Such clauses have since been unanimously rejected by the courts. It also took some time for the requisite number of investors to get together to meet the threshold voting requirements needed to direct trustees under the trusts' governing documents. In addition, in some cases, trustees needed to be convinced to take action given competing business interests and conflicts.

There would be no reason to expect such delays this time around, if subprime auto bottoms out. The participants now have the benefit of learnings from RMBS litigation and may not even wait for losses to exceed credit enhancements:

- Trustees now know that they could face lawsuits for failing to perform their duties if they fail to enforce breaches of reps.

- Trustees know that some federal courts have held that an actionable breach of representations and warranties may occur if there has been a "material increased risk of loss," which they may view as a low standard that triggers a duty to act.

- Parties know that servicers could face lawsuits for failing to provide timely notification of breaches.

- Investors and trustees know there likely will be a hard-stop, six-year statute of limitations on repurchase claims that are triggered by breaches of representations and warranties.

- Investors know that the "discovery rule" component of the limitations period for fraud claims was used by defendants to successfully defend fraud claims based on widespread reporting of issues at certain originators before suit was filed.

All of this suggests trustees may be more inclined to act, and investors may urge trustees to act faster than they did in connection with subprime RMBS. At this stage, even if investors haven't started to feel the sting of losses, the trusts themselves have seen losses, which may give rise to actionable claims, at least under the material increase risk of loss threshold. Consequently, loss distribution battles may begin sooner than they did when RMBS troubles surfaced.

Will Credit Enhancements Provide the Protections Investors Expect?

How Subprime Auto Stacks Up Against Subprime RMBS

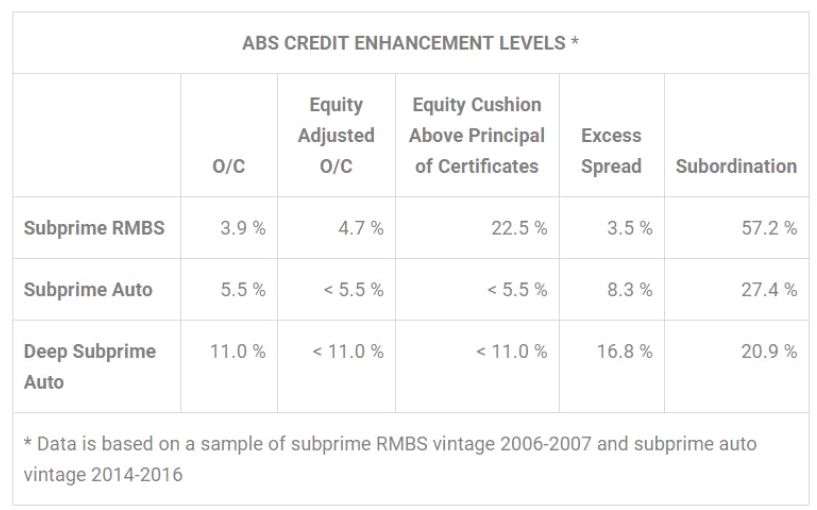

Subprime auto ABS issuers use the same types of credit enhancements that were common in subprime RMBS, including O/C, excess spread and subordination. O/C exists where additional collateral (pooled loans) is placed in the deal so that the aggregate principal of the collateral exceeds the aggregate principal of the certificates issued to ABS investors. The purpose of O/C is for inflowing principal and interest payments on the O/C to allow payments to continue to investors even when borrowers default or are late on payments. Excess spread is the difference between the interest on the collateral and the coupon paid on the certificates held by ABS investors. The idea is that funds provided by the excess spread will be available to help pay investors if borrowers default. Subordination reflects where losses are first allocated to lower tranches before reaching senior levels.

With regard to O/C in particular, it has been observed that O/C rates in recent auto ABS deals are generally higher relative to pre-financial crisis subprime RMBS; however, in those subprime RMBS deals, O/C was expected to provide protection, not only in terms of additional cash payments, but also additional property value available to maximize recoveries given combined loan-to-value ratios (CLTV) represented in offering documents of well-under 100%, often reflecting a 20-25% equity cushion in the underlying homes.

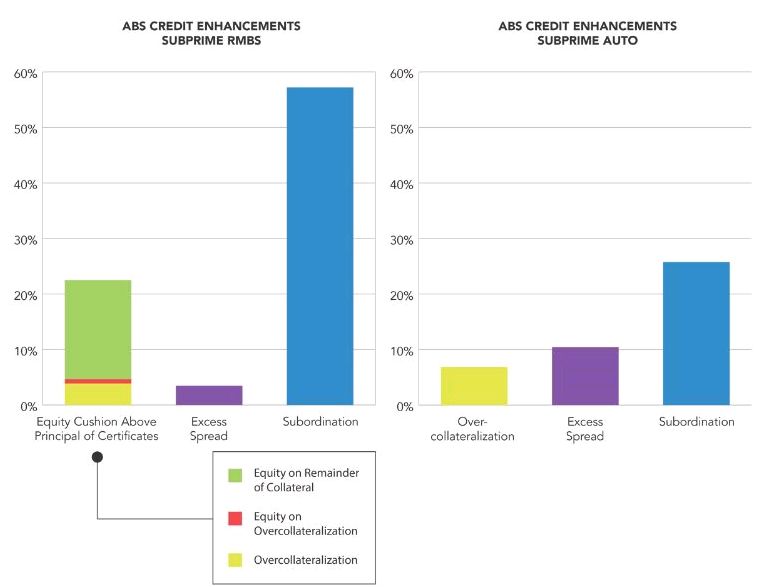

As shown in the charts below, based on a review of subprime RMBS deals that have been the subject of repurchase actions by trustees, when RMBS O/C is adjusted to account for the equity cushion that the O/C provided (the Equity Adjusted O/C), subprime auto ABS O/C rates start to look less favorable. Further, the picture looks worse when the anticipated amount of equity cushion in homes underlying the pooled loans is factored in. Based on CLTV representations, RMBS investors would have expected that the combined amount of protection from O/C and equity cushion would have exceeded the stated principal of ABS certificates (Equity Cushion above Principal of Certificates) by more than 22%, and that's before factoring in any expectations of appreciation. This level of protection far exceeds the amount provided by subprime auto O/C given the vehicles backing the pooled loans are indisputably depreciating assets.

Realization of Excess Spreads May Become Significant in Subprime Auto ABS

Given potentially low recoveries due to depreciation of the underlying vehicles, lower subordination, and the generally low O/C rates relative to RMBS Equity Cushion above Principal of Certificates, there is significant pressure on excess spreads to protect investors. Excess spreads are relatively high – and properly even higher for deep subprime deals – but they only work if payments keep rolling in.

Subprime RMBS was doomed by the faulty assumption of ever-increasing home values. Credit enhancements in those deals could not always fully absorb losses from the real estate crash and its impact on loan performance and recoveries. Subprime auto ABS makes no such mistake regarding vehicles, but the corollary to the assumption of never-ending real estate appreciation may be the presumed continued performance by auto loan borrowers. There are a number of hazard signs on this front, including easier credit as a result of softness in the auto sales market, growing household debt, the student loan debt crisis and now, a new potential disruptor, climate change. Based on the recent series of hurricanes and earthquakes, it seems major climate events – the likes of which have never been seen – have the potential to regionally cause serious financial distress for borrowers. The impact, frequency and location of similar future events on borrower employment and timely access to funds will be hard to predict.

Looking Ahead

Although investors have demanded credit enhancements that correlate to pool risk, they should recognize that relative to subprime RMBS, auto ABS O/C rates are not exceedingly high given the equity cushion that was assumed to have existed in homes backing RMBS. Lenders and sponsors should be wary of the impact accelerated depreciation and easier auto credit may have on loan performance and assess their potential exposure should market, economic, political or even climate-related events create a shock to consumers or the financial system, in turn causing a spike in defaults. A combination of loose lending by some and rising negative equity creates the prospect that loss allocation battles are on the horizon. Motivation by trustees and investors to act quicker than they did with subprime RMBS claims based on the consequences of inaction in the RMBS context and favorable law may be indicators that such battles could be around the corner.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.