Originally published March 13, 2008

On February 13, 2008, the Securities and Exchange Commission (the "Commission") proposed amendments to Form ADV Part II and certain rules under the Investment Advisers Act of 1940, as amended (the "Advisers Act"), which would significantly alter the manner and form in which investment advisers registered with the Commission disclose information about their operations to clients and prospective clients. The Commission published the proposed Form ADV Part II and rule amendments in a release on March 3, 2008.1 The Commission's proposed amendments are a significant departure from the amendments to Form ADV Part II that were proposed in 2000 but were never approved.2 Comments on the proposed amendments are due by May 16, 2008.

Overview

Two new disclosure documents would be created: a brochure ("Brochure") and a brochure supplement (the "Supplement"). The Brochure would replace the cumbersome check-the-box Part II and Schedule F disclosure forms with a brochure that, in narrative form, describes an adviser's services, fees, business practices and conflicts of interest with clients. The Supplement would provide specific information about the advisory personnel on whom clients rely for investment advice. Both documents would have to be written in plain English. Additionally, the proposed amendments would continue to require advisers that sponsor wrap programs to prepare and deliver a specialized firm brochure ("Wrap Program Brochure") to clients of the wrap program in lieu of the standard Brochure. The Brochure, Wrap Program Brochure, and Supplement would contain the information required by new Form ADV Part 2A, new Form ADV Part 2A Appendix 1, and new form ADV Part 2B, respectively.

Filing Mechanics

The proposed amendments would change how advisers file their Form ADV. Brochures would be filed electronically with the Commission through the Investment Adviser Registration Depository ("IARD"). Once filed, the Brochure would then be available to the public through the Commission's Investment Adviser Public Disclosure ("IAPD") website, as is currently the case with Form ADV Part I. Importantly, the proposed amendments would not require advisers to file their Supplements electronically through the IARD.

Delivery Requirements

Under the proposed amendments an investment adviser would be required to deliver a current Brochure before or at the time of entering into an advisory contract with a client.3 Consistent with current requirements, advisers would not be required to deliver brochures to (1) certain advisory clients receiving only impersonal investment advice,4 or (2) clients that are mutual funds or other registered investment companies. The proposed amendments would extend the latter exception to business development companies. In addition, if an adviser does not have any clients to whom a Brochure is required to be delivered, the adviser would not have to prepare a Brochure.

Brochure Updates

In a notable change from the current delivery obligation in Rule 204-3 under the Advisers Act, the proposed amendments would require advisers to deliver to existing clients a current Brochure at least once each year within 120 days after the end of their fiscal year, as well as a summary of any material changes to their Brochure since the last annual update. The summary may appear on the cover page of the Brochure (or immediately thereafter), or in a separate letter that accompanies the Brochure. As with the initial Brochure, the proposed amendments would require that advisers file their annual update Brochures electronically through the IARD. However, the annual summary would neither be required to be filed with the Commission nor required to be provided to new clients who have not received a previous version of an adviser's Brochure.

In addition to the annual updates, advisers would be required to deliver an interim update (i.e., an update between annual update amendments) to clients if their Brochures are amended to add or materially change information relating to a disciplinary event. Consistent with current requirements, the proposed amendments would also require that an adviser update its Brochure promptly when any information in its brochure becomes materially inaccurate. In addition, the Commission also notes in the Release that advisers, as fiduciaries, have an ongoing obligation to inform their clients of any material information that could affect the advisory relationship. Therefore, advisers may be required to disclose material changes to clients between annual updating amendments even if those changes do not trigger delivery of a required interim update to their Brochures.

The Brochure Supplement

One of the most significant changes from the current disclosure rules is the new requirement that Supplements accompany the adviser's Brochure. The Supplement would provide information about the advisory personnel on whom clients rely for investment advice. The Commission envisions that the Supplement would ordinarily be less than a page long.5

An adviser would have to prepare and deliver a Supplement for each supervised person who: (1) formulates investment advice for that client and has direct client contact; or (2) makes discretionary investment decisions for that client's assets, even if the supervised person has no direct client contact.6 However, advisers are exempt from the Supplement delivery requirement with respect to the following four types of clients:

- Clients to whom an adviser is not required to deliver a Brochure (e.g., registered investment companies);

- Clients who receive only impersonal investment advice;7

- Clients who are "qualified purchasers;"8 and

- Certain "qualified clients" who also are officers, directors, employees, and other persons related to the adviser.9

If an adviser does not have any clients to whom a Supplement would have to be delivered, it need not prepare any Supplements. Likewise, an adviser need not prepare a Supplement for any supervised person who does not have clients to whom the adviser must deliver a Supplement.

Where applicable, the adviser would have to provide a supervised person's Supplement to the client at or before the time that supervised person begins to provide advisory services to that client. However, unlike the proposed filing requirement for the Brochure, the proposed amendments would not require advisers to file Supplements or Supplement amendments with the Commission, and therefore Supplements would not be available publicly on the IAPD.10 In addition, unlike the proposed delivery requirement for Brochures, advisers would not have to annually deliver updated Supplements to clients. However, the proposed amendments would require advisers to update their Supplements if the information contained therein becomes materially inaccurate. In such instances, new clients that are required to receive a Supplement would have to be given the amended version (or the "old" Supplement and a sticker) of the Supplement. Finally, where advisers have delivered a Supplement to existing clients, the proposed amendments would require such advisers to deliver an updated Supplement to their existing clients only to disclose a new disciplinary event or a material change to disciplinary information already disclosed.11

Wrap Fee Program Brochure

The proposed disclosure item requirements for a Wrap Program Brochure would be located in the proposed Appendix 1 to Part 2A. These items would be substantially similar to those currently in Schedule H of Form ADV Part II. However, the Release proposes that the Wrap Program Brochure also disclose: (i) whether any of the adviser's related persons are portfolio managers in the program, and a description of the conflicts that may be present; and (ii) whether related person portfolio managers are subject to the same selection and review as the other portfolio manages who participate in the wrap program and, if they are not, how they are selected and reviewed.

Highlights of Proposed Brochure and Supplement Requirements

Part 2A sets forth 20 topics or items that an investment adviser must discuss in its Brochure. An investment adviser may omit responses to items that do not apply to its business. The investment adviser may order the responses in its Brochure in any way it chooses.

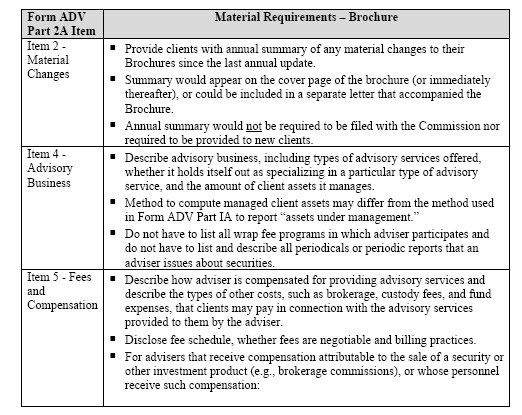

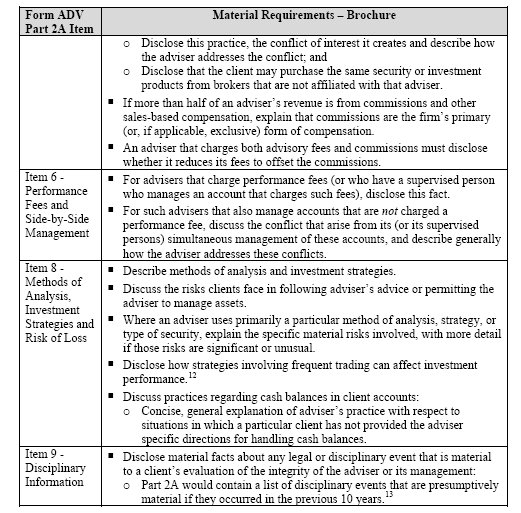

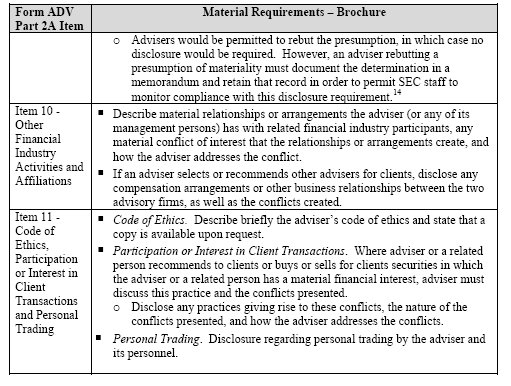

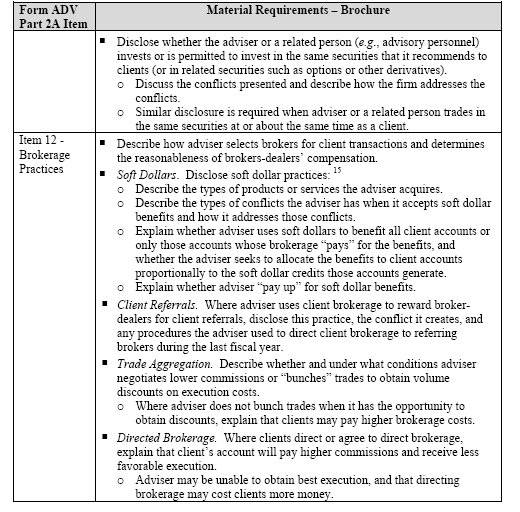

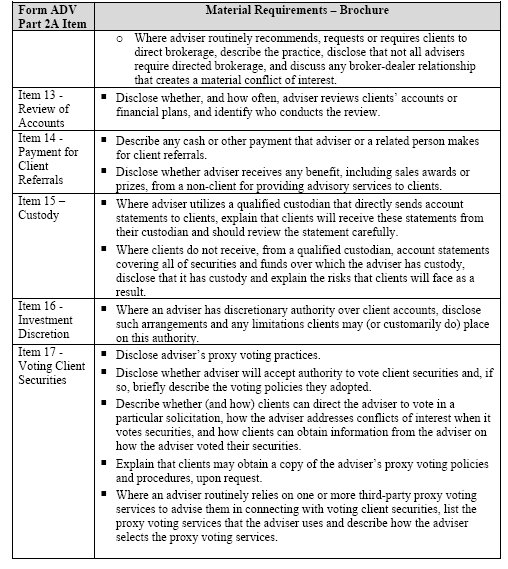

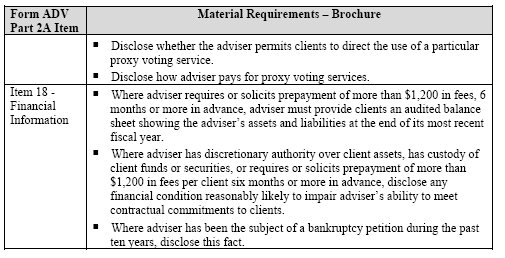

The following table contains a summary of the key items in proposed Part 2A.

The other items of proposed Part 2A are: Item 1 – Cover Page; Item 3 – Table of Contents; Item 7 – Types of Clients; Item 19 – Index; and Item 20 – Requirements for State-Registered Advisers.

Part 2B sets forth 11 topics or items that an investment adviser must discuss in its Brochure Supplements. Like the Brochure, an investment adviser could omit items from its Brochure Supplements that do not apply, and order its responses in any way it chooses.

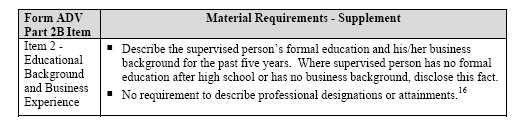

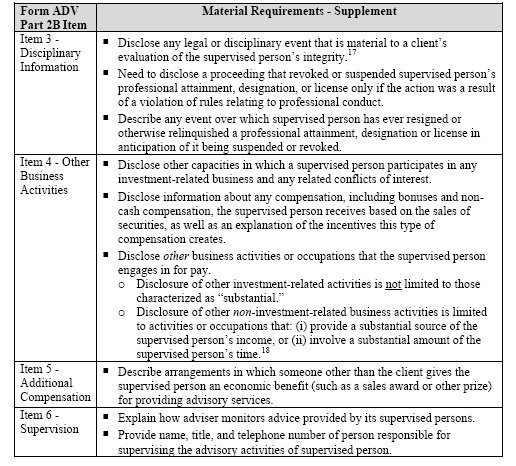

The following table contains a summary of the items in proposed Part 2B.

The other items of proposed Part 2B are: Item 1 – Cover Page; Item 7 – Client Information Provided to Portfolio Managers; Item 8 – Client Contact with Portfolio Manager; Item 9 – Additional Information; Item 10 – Index; and Item 11 – Requirements for State-Registered Advisers.

Transition Period

If the proposed amendments are adopted as proposed, existing investment advisers registered with the Commission would be required to comply with the new Part 2 requirements by the date they must make their next annual updating amendment to Form ADV following the date the revised form becomes effective. However, advisers would not be required to comply with the new form requirements earlier than six (6) months after the proposed amendments become effective.

If the proposed amendments are adopted as proposed, new adviser applicants would not be required to include their Brochures as part of their initial application for registration until the date six months after the effective date of the amendments. After that time, the Commission would require that all initial adviser registration applications include a Brochure that satisfies the requirements of Form ADV Part 2A.

Footnotes

1 See Inv. Advisers Act Rel. No. 2711 (March 4, 2008) (the "Release").

2 See Inv. Advisers Act Rel. 1862 (Apr. 5, 2000).

3 Currently, Brochure delivery must occur at least 48 hours prior to entering into an advisory contract, or at the time of entering into the contract if the client has the right to terminate the contract without penalty within five business days thereafter. See current Rule 204-2 under the Advisers Act.

4 Advisers would not be required to deliver Brochures to advisory clients receiving only impersonal investment advice for which the adviser charges less than $500 per year. The current dollar amount is $200.

5 The Commission suggested that advisers could prepare a Supplement for each supervised person or prepare separate Supplements for different groups of supervised persons, such as all supervised persons in a particular office or group.

6 Where a supervised person provides discretionary advice only as part of a team and has no direct client contact, an adviser would not have to provide a supplement for the supervised person.

7 This exception, unlike its analog for Brochure delivery, does not depend on the cost of the impersonal advisory services involved.

8 "Qualified purchasers" is defined in section 2(a)(51)(A) of the Investment Company Act of 1940, as amended.

9 "Qualified clients" is defined in Rule 205-3(d)(iii) under the Advisers Act.

10 An adviser would be required, however, to maintain copies of all Supplements and applicable amendments in its files.

11 As fiduciaries, advisers have an ongoing obligation to inform their clients of any material information that could affect the advisory relationship. As a result, advisers may be required to disclose material changes to clients even if those changes do not trigger a disclosure obligation under the Form ADV.

12 The Commission did not propose a definition of "frequent trading of securities," but instead proposed to permit advisers some flexibility in determining whether the strategies they employ involve frequent trading.

13 The list would include most of the events currently presumed material under existing Rule 206(4)-(4) under the Advisers Act. Proposed Item 9 would state that the listed items are presumed to be material, but do not constitute an exhaustive list of material disciplinary events.

14 Item 9 would note the following four factors an adviser should consider when assessing whether the presumption can be rebutted: (1) the proximity of the person involved in the disciplinary event to the advisory function; (2) the nature of the infraction that led to the disciplinary event; (3) the severity of the disciplinary sanction; and (4) the time elapsed since the date of the disciplinary event. These are the same factors in use under current Rule 206(4)-4 under the Advisers Act. In connection with the ADV Part 2 proposal, the Commission proposed in the Release to withdraw current Rule 206(4)-4, the rule requiring advisers to disclose certain disciplinary and financial information, because the proposed amendments would require advisers to disclose the information required by the rule in their Brochures, Wrap Program Brochures and Supplements, thus making the rule unnecessary.

15 Disclosure must be more detailed for products or services that do not qualify for the safe harbor in Section 28(e) of the 1934 Securities Exchange Act of 1934, as amended.

16 Advisers would be permitted to include information about professional designations and attainments in the Supplement if they so choose.

17 This disciplinary information disclosure requirement for the Supplement is substantially the same as that proposed to be disclosed in an adviser's Brochure.

18 The SEC staff states in the Release that "substantial" for purposes of this item is not defined in order to allow "some flexibility for advisers to determine whether their supervised persons' non-investment related business provides a substantial source of income or involves a substantial amount of time."

© 2008 Sutherland Asbill & Brennan LLP. All Rights Reserved.

This article is for informational purposes and is not intended to constitute legal advice.