- within Strategy and Accounting and Audit topic(s)

This White Paper sets out the key features of the European Directive on Alternative Investment Fund Managers ("AIFMD") and considers its impact on the fund managers ("AIFMs") that fall within its scope. It is a supplement to our January 2014 White Paper and reflects on recent developments in the AIFMD's implementation.

Throughout the White Paper, Action Points highlight suggestions as to the steps AIFMs should take in relation to current and upcoming AIFMD requirements.

The United Kingdom voted by way of referendum on 23 June 2016 to leave the European Union. A formal separation would require a whole-scale review of UK legislation, including in relation to financial regulation. As of now and during the period of negotiation, the AIFMD as implemented in the United Kingdom will remain in full effect. We will update this White Paper to take into account any changes to the regime which result from Brexit separation proceedings.

APPLICATION AND SCOPE

Subject to certain exemptions (outlined below), the AIFMD applies to:

- All EU AIFMs managing EU alternative investment funds ("AIFs") or non-EU AIFs (irrespective of whether they are marketed in the EU);

- Non-EU AIFMs managing EU AIFs (irrespective of whether they are marketed in the EU); and

- Non-EU AIFMs marketing AIFs (whether EU AIFs or non-EU AIFs) within the EU.

The AIFMD thus applies to AIFMs, not directly to AIFs themselves.

What Is an AIFM?

An AIFM is any legal person whose regular business is managing one or more AIFs. "Managing" for these purposes is broadly defined as providing investment management services, such services being portfolio management or risk management. AIFMs may also undertake administration, marketing and activities related to the assets of AIFs. "Activities related to the assets of AIFs" include real estate administration activities and advice given to undertakings on capital structure, industrial strategy and related matters, as well as other services connected to the management of the AIF and its investments.

What Is an AIF?

An AIF is any collective investment undertaking which raises capital from a number of investors with a view to investing it for the benefit of those investors according to a defined investment policy. Broadly, all funds which are not covered by the AIFMD on Undertakings for Collective Investment in Transferable Securities ("UCITS") (see below) may be caught (including direct and indirect real estate funds), save for those structures specifically carved out or exempted from the scope of the AIFMD.

Guidance from the European Securities and Markets Authority ("ESMA") on key concepts under the AIFMD provides further clarification on the component parts of the AIF definition; for example, the guidance clarifies that a "collective investment undertaking" pools together capital raised from investors and has the purpose of generating a pooled return for its investors from the pooled risk generated by acquiring, holding or selling investment assets. This is distinguished from an entity whose purpose is to manage the underlying assets as part of a commercial or entrepreneurial activity.

KEY PROVISIONS

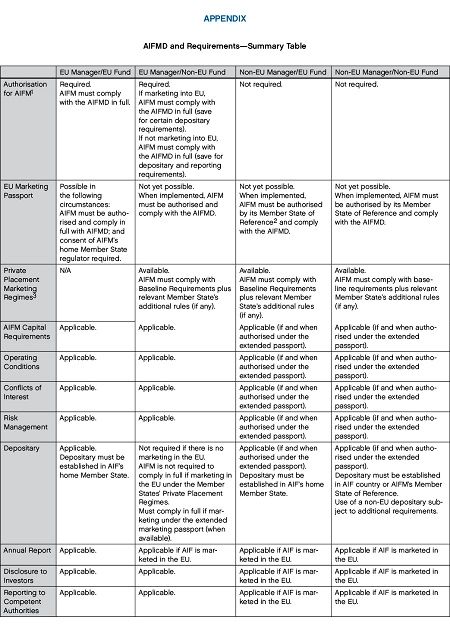

The AIFMD introduced significant obligations and restrictions on AIFMs relating to operational and compliance matters. A number of the provisions in the AIFMD have ramifications for the relationships between AIFMs and their service providers. The AIFMD also regulates the way in which AIFMs may market AIFs. The key provisions of the AIFMD are described in this White Paper. Furthermore, a table setting out the applicability and requirements of the AIFMD in respect of EU/non-EU AIFMs managing and/or marketing EU/non-EU AIFs is included in the Appendix.

Authorisation of AIFMs and Interplay with Other Regimes

The long-term aim of the AIFMD is that all firms which fall within the scope of the AIFMD will eventually be authorised and regulated by an EU financial services regulator.

The one-year transitional period for EU firms managing AIFs (and non-EU firms marketing AIFs to EU investors) to comply with the AIFMD came to an end on 22 July 2014.

From a UK perspective, a UK AIFM must be authorised under Part IV of the Financial Services and Markets Act 2000 by the Financial Conduct Authority ("FCA") to carry on the regulated activity of managing an AIF. Therefore, those firms with an existing permission to carry on a regulated activity may seek a variation of permission to allow them to act as an AIFM.

Furthermore, the United Kingdom's implementation of the AIFMD also necessitated the creation of the new regulated activity of managing a UCITS. A UCITS is an open-ended collective investment scheme ("CIS") that is regulated per the UCITS Directive and can be marketed/sold to EU retail investors. The practical implication of this is that a firm with permission to manage either AIFs or UCITS may also engage in the regulated activity of establishing, operating or winding up a CIS. This approach means that the same firm can manage both UCITS and AIFs if it holds the necessary authorisations, and it is possible for the Part IV permissions of managing an AIF and managing a UCITS to be held together.

Under the AIFMD, an AIFM and a UCITS management company may also be permitted to carry out certain other activities that would otherwise be regulated under The Markets in Financial Instruments Directive 2004/39/EC ("MiFID"). More specifically, firms can perform some or all of the services allowed by Article 6(4) of the AIFMD and Article 6(3) of the UCITS Directive (essentially activities ancillary to operating funds and dealing with fund assets). However, it should be noted that the FCA applies limitations to the permissions where necessary to make it clear that the firm cannot be a manager of AIFs or UCITS and simultaneously perform the full range of activities possible under a MiFID authorisation. This reflects the fact that AIFMD and MiFID authorisations are mutually exclusive.

A firm applying for permission to manage/market AIFs should expect a three- to six-month processing period. The FCA has three months to determine the application with the possibility of a three-month extension where the FCA considers it necessary due to the specific circumstances of the case.

Action Points: Firms intending to register as AIFMs should begin thinking about gathering and preparing supplemental information for the application pack; this process usually takes around six weeks.

Firms which may be intending to manage AIFs and also engage in a broad range of MiFID activities should be aware that structural changes will be required to facilitate such arrangements, given that AIFMD and broader MiFID authorisations are mutually exclusive.

Exemptions

Sub-Threshold AIFMs. A partial exemption to the AIFMD regime for "sub-threshold AIFMs" may be helpful for managers of small real estate, venture capital, hedge and private equity funds. This partial exemption relates to:

- AIFMs managing AIFs that have total assets of less than €100 million; or

- AIFMs managing AIFs that have total assets of less than €500 million, provided (i) the AIFs are not "leveraged" and (ii) no redemption rights exist during a period of five years following the date of initial investment in each AIF.

For the purposes of the AIFMD, "leverage" is broadly defined to include any method by which an AIFM increases the exposure of an AIF it manages, whether through borrowing of cash or securities, or leverage embedded in derivative positions, or by any other means. There is some uncertainty as to whether borrowing by a special purpose vehicle owned by an AIF will constitute "leverage" of the AIF for these purposes.

The AIFMD permitted Member States to establish a de minimis registration regime for these exempt sub-threshold AIFMs, requiring them to register with, and report annually to, regulators but without requiring full AIFMD authorisation. This allows smaller AIFMs to benefit from lighter-touch regulation, but the status also restricts the AIFM's ability to market into other EU jurisdictions (more on marketing below). Sub-threshold AIFMs also have the right to opt in to full authorisation under the AIFMD in order to benefit from the AIFMD marketing passport regime (discussed below).

The AIM thresholds must be considered over the life of the fund. Therefore, where the applicable thresholds are exceeded, the AIFM must decide whether such situation is temporary (i.e. unlikely to exceed the threshold for more than three months). If the situation is temporary, the AIFM is able to maintain its registration-only status. If the situation is not temporary, the AIFM must seek full AIFMD authorisation within 30 calendar days.

This exemption generally applies only to EU AIFMs, but the United Kingdom (alone) has used its discretion under Article 3 of the AIFMD to extend the exemption to include non-EU AIFMs. For the rest of Europe, the relevant provisions of the AIFMD will apply to a non-EU AIFM irrespective of whether it is a "full scope" or sub-threshold AIFM.

Excluded Undertakings. The scope of the AIFMD indicates that investment undertakings which invest the private wealth of investors without raising external capital do not fall within the auspices of the AIFMD. This should be of assistance to family offices. Furthermore, the AIFMD does not apply to holding companies (as defined in the AIFMD) on the understanding that the purpose of this definition is not to exclude managers of private equity funds, or managers of alternative investment funds whose shares are admitted to trading on a regulated market, from the scope of the AIFMD.

The AIFMD also does not apply to the management of pension funds, employee participation or savings schemes; supranational institutions; national central banks or national, regional or local governments; or bodies or institutions which manage funds supporting Social Security or pension systems, nor does it apply to securitisation special purpose vehicles.

Joint Ventures. The broad definition of an AIF causes some concern when it is not possible to state with absolute certainty whether a particular structure constitutes an AIF. For example, the AIFMD explicitly excludes joint ventures from its scope, but this concept was not defined in the AIFMD or by ESMA. For its part, the FCA has provided guidance on how an AIF can be differentiated from a joint venture, but it has also cautioned participants in joint ventures that they will need to review their structural arrangements against the AIFMD secondary measures given that joint ventures can have AIF-like aspects (capital raising, investment policies, external management etc.). Furthermore, the FCA considers that certain property investment firms (in particular, real estate investment trusts) may or may not be covered by the AIFMD, depending on their particular structure. Such vehicles therefore require case-by-case reviews.

Action Points: Fund managers which may fall within the scope of the AIFMD should review proposed fund structures to identify AIFs and the entity which will/should be the AIFM.

If, on its face, the AIFMD will apply, AIFMs should consider whether an exemption or carve-out could be helpful.

Because the United Kingdom's implementing legislation maintained the CIS regime, it continues to be necessary to check whether arrangements constitute a CIS under UK law, not least because of the potential impact on UK marketing activities.

Capital Requirements

The capital requirements under the AIFMD differ depending on whether the AIFM is internally or externally managing the AIF. The capital requirements apply to full-scope AIFMs only, although a sub-threshold UK AIFM may also be subject to the GENPRU / BIPRU rules (see below).

An AIF is internally managed when its governing body elects not to appoint an external AIFM (such as a corporate fund which is managed by its governing body). An AIF that is internally managed will itself be authorised as the AIFM. Where an AIF is not internally managed, the AIFM is the legal person appointed by or on behalf of the AIF to be responsible for managing it (i.e. for providing portfolio management or risk management services).

Initial Capital Requirement and Own Funds.An internally managed AIF is required to maintain initial capital of €300,000.

An external AIFM is required to maintain initial capital of €125,000 and to maintain own funds equal to the higher of:

- One quarter of fixed annual overheads; and

- 0.02 percent of the amount by which the total value of assets under management exceeds €250 million, subject to a cap of €10 million (however, up to 50 percent of this amount is not required if the AIFM benefits from a guarantee from a bank or insurer).

In addition, external AIFMs and internally managed AIFs must also hold either:

- Appropriate professional indemnity insurance; or

- An amount of own funds to cover potential liability for professional negligence (being 0.01 percent of the value of assets under management).

Furthermore, Collective Portfolio Management Investment firms (firms that manage AIFs and also carry out permitted MiFID services) continue to be subject to ongoing GENPRU / BIPRU regulatory capital rules and need to ensure that their own funds satisfy the higher of the requirements under the GENPRU / BIPRU regime and the AIFMD regime. This applies to sub-threshold as well as full-scope AIFMs.

Items included as initial capital (for example, share capital and audited profits) may also be included within own funds for the purposes of meeting capital requirements. For example, if a firm has fully paid up ordinary share capital of £250,000, this amount can count both towards meeting the initial capital and towards meeting the own funds test. The requirements are not cumulative.

"Initial capital" and "own funds" are defined by reference to the Capital Requirements Directive ("CRD"). Therefore, any amendment to the CRD definitions is likely to affect which items an AIFM will be entitled to include within its initial capital or own funds. As a general rule, own funds must be invested in liquid assets or near-liquid/readily convertible assets and not in speculative positions. This applies to all regulatory capital, except the initial capital requirement.

Action Points. When setting up a new fund, AIFMs should consider the relationship between capital requirements and internal versus external management. AIFMs should also consider whether they should employ professional indemnity insurance or additional capital buffers.

Governance and Operating Conditions

The AIFMD requires AIFMs to abide by certain general principles which include, for example: acting in the best interests of the AIF, the investors and the integrity of the market; acting honestly and with due skill, care and diligence; treating investors fairly; and complying with regulatory requirements.

The delegated Regulation (Regulation 231/2013) which supplements the AIFMD clarifies the general duty of AIFMs to act in the best interests of the AIF, the investors and the integrity of the market. For example, it stipulates that AIFMs should apply appropriate policies and procedures to prevent malpractices such as market timing (taking advantage of out-of-date or stale prices for portfolio securities that impact the calculation of an AIF's net asset value or buying and redeeming units of an AIF within a few days, thereby exploiting the way the AIF calculates its net asset value) or late trading and establish procedures to ensure the AIF is managed efficiently to prevent undue cost being charged to the AIF and its investors.

As a further example, AIFMs need to be aware of their obligation to act with due skill, care and diligence when appointing a prime broker or selecting a counterparty. The AIFM should appoint only entities which are subject to ongoing supervision, are financially sound (that is, the entity abides by capital adequacy requirements) and have an organisational structure appropriate to the services to be provided.

AIFMs are also required to manage conflicts of interest and operate satisfactory risk management and liquidity management systems. Regarding the latter, such procedures could include annual stress tests to simulate liquidity shortages or atypical redemption requests.

Generally, AIFMs should establish a well-documented organisational structure that clearly assigns responsibilities, defines control mechanisms and ensures appropriate information flow between all relevant parties. The delegated Regulation highlights the importance of adopting a proportionate approach when calibrating the requisite policies and procedures to the size and complexity of the AIFM's business.

Action Points. AIFMs should ensure that policies and procedures are compliant with the AIFMD requirements and consider carrying out systems audits and simulations to identify any areas requiring further attention. AIFMs should review the capacity and independence of the compliance, audit and risk management functions, and consider any necessary improvements. Proportionate policy documentation should be in place for AIFMD compliance.

Remuneration

The remuneration requirements in the AIFMD apply to all full-scope AIFMs authorised under the AIFMD and stipulate remuneration policies and practices which promote effective risk management for categories of staff whose professional activities have a material impact on the risk profiles of the AIFs they manage. These categories include senior management, risk takers and control functions (as well as any employee receiving total remuneration that takes him or her into the same remuneration bracket as senior management and risk takers).

In February 2013, ESMA published guidelines clarifying which staff are regarded as falling within the categories described above (and are therefore "Identified Staff" for the purposes of the AIFMD). ESMA also confirmed that the general remuneration requirements need be applied only to Identified Staff but, in any case, it strongly recommended voluntary application to all AIFM staff.

The remuneration requirements apply to:

- All forms of payments or benefits paid by the AIFM;

- Any amount paid by the AIF itself, including carried interest; and

- Any transfer of units or shares of the AIF,

in exchange for professional services rendered by the AIFM Identified Staff.

The cornerstone of the remuneration requirements is that an AIFM establishes a consistent remuneration policy which promotes sound and effective risk management. The AIFMD also sets out a number of principles which should be adopted by AIFMs in a proportionate way.

The requirements are similar (but not identical) to the remuneration provisions implemented in accordance with the CRD. Credit institutions and investment firms subject to the CRD and the AIFMD will therefore have to be aware of where the AIFMD requirements impose additional or different requirements to those in the CRD.

Non-EU AIFMs. Although non-EU AIFMs are not subject to the remuneration requirements, it is important to note that marketing into the EU via the relevant national private placement regime (discussed below) will trigger disclosure requirements which include, amongst other things, information about remuneration paid by the AIFM to its staff and senior management.

Action Points. AIFMs should assess the suitability of current remuneration arrangements and implement the necessary changes. In particular, a comprehensive remuneration policy should be put in place which includes those elements stipulated by the AIFMD.

Non-EU AIFMs seeking to market into the EU ought to consider any confidentiality obligations they owe to their fund(s) or stakeholders in view of remuneration disclosure requirements.

Asset Valuation

Under the AIFMD, for each of the AIFs it manages, an AIFM must ensure that:

- Appropriate and consistent policies and procedures are established for the proper and independent valuation of the assets of those AIFs; and

- The net asset value per share/unit in the AIF is calculated and disclosed to investors.

The delegated Regulation lays down the main features of the valuation policies and procedures. Such policies and procedures should cover all material aspects of the valuation process and controls in respect of the relevant AIF, including (by way of example):

- The competence and independence of the personnel valuing the assets;

- The specific investment strategies of the AIF;

- The controls in place over the selection of valuation inputs, sources and methodologies; and

- The escalation channels for resolving valuation differences.

The valuation policies should set out the responsibilities of all parties involved in the valuation process, including the AIFM's senior management. Where an external valuer is appointed, the policies should set out a process for the exchange of information between the AIFM and the external valuer to ensure all necessary valuation information is provided.

All AIF assets must be valued at least once a year and, additionally, when units of the AIF are issued or redeemed (if the AIF is close-ended) or with "appropriate frequency" (in the case of open-ended AIFs). An AIFM may calculate the valuations itself or appoint an independent external valuer to perform this function.

Delegation

Subject to certain requirements and limitations, the AIFMD permits AIFMs to delegate the performance of some of their functions.

The delegated Regulation sets out the conditions under which an AIFM is permitted to delegate. The conditions are intended to ensure that delegation does not prevent an AIFM from acting in the best interests of investors and that the AIFM retains responsibility for delegated functions. In particular, an AIFM cannot delegate its functions where delegation would render it a mere "letter-box" entity.

An AIFM shall be deemed a letter-box entity and shall no longer be considered the manager of the AIF in, at least, any of the following circumstances:

- The AIFM no longer retains the necessary expertise and resources to supervise the delegated tasks effectively and manage the associated risks;

- The AIFM no longer has the power to take decisions in key areas which fall under the responsibility of senior management (particularly in relation to investment policies and strategies);

- The AIFM loses its contractual rights to instruct and inspect its delegates or the exercise of such rights becomes impossible; or

- The AIFM delegates the performance of investment management functions to an extent that exceeds by a substantial margin the investment management functions performed by the AIFM itself.

In practice, this means that an AIFM can delegate either risk management or portfolio management, but not both. Where portfolio management or risk management is delegated, further restrictions relating to the nature of the delegate apply.

In order to delegate its functions, an AIFM must be able to demonstrate that the delegate is capable of performing, qualified to perform and has sufficient resources to perform the relevant functions delegated; was selected with all due care; and can be effectively monitored and instructed by the AIFM. The delegate's staff must also be sufficiently experienced and of good repute.

An AIFM applying for authorisation under the AIFMD will need to disclose its delegation arrangements (including the identity of the delegate and a description of any potential conflicts of interest) to its regulator. An AIFM must then give its regulator advance notice of any new delegation arrangement. The same details must also be made available to AIF investors before they invest. This information must be updated to reflect any material changes.

Sub-delegation by a delegate is allowed, provided that the following conditions are satisfied:

- The AIFM has consented in advance;

- The AIFM has given prior notice of the sub-delegation to its regulator;

- The requirements applicable to a delegation of the function are also met in relation to the sub-delegation; and

- The delegate reviews the services provided by its sub-delegates on an ongoing basis.

Depositaries

Generally, full-scope AIFMs will need to ensure that a single depositary is appointed for each AIF it manages. However, a depositary is not required in relation to a non-EU AIF that is either (i) managed by a non-EU AIFM and marketed in the EU via national private placement regimes or (ii) managed by an EU AIFM but not marketed in the EU.

The AIFMD specifies which entities can act as a depositary. Originally, it was intended that the AIFMD would allow only an EU credit institution to be a depositary, but this requirement has been relaxed: investment firms and other appropriately authorised persons (such as institutions eligible to be a UCITS depositary) may also carry out the function.

AIFMs of AIFs whose investors have no redemption rights for five years after their initial investment have further flexibility in choosing a depositary. The depositary to such AIFs can be any entity which (i) carries out depositary functions as part of its professional or business activities, (ii) is subject to mandatory professional registration recognised by law and/or professional conduct rules and (iii) can furnish sufficient financial and professional guarantees that it can meet its commitments and effectively perform its functions as depositary.

Generally speaking, the depositary of an EU AIF must either have its registered office or a branch in the AIF's home Member State.

The depositary of a non-EU AIF must either have its registered office or a branch in the AIFM's home Member State. The depositary may be established in the non-EU country in which the AIF is established if a number of conditions are met.

The AIFMD sets out numerous functions and duties for depositaries and restricts their ability to delegate. The delegated Regulation also sets out detailed provisions about the obligations and rights of depositaries and emphasises that a depositary's key function is the protection of the AIF's investors. The delegated Regulation also requires information flow to enable the depositary to have a clear overview and effectively monitor the AIF's assets and cash flow.

The AIFMD imposes liability on depositaries in relation to loss of financial instruments owned by an AIF and held by the depositary. The depositary will avoid such liability only if the loss is caused by an external event beyond its control. These requirements mean that the cost of depositary services is likely to be higher than those of pre-AIFMD administrators and operators to reflect the depositary's additional risk.

Action Points. Given that most full-scope AIFMs need to appoint depositaries (and may also appoint delegates and external valuers), it is important to liaise with the intended service provider/delegate to ensure the counterparty is suitable. AIFMs should consider related budgeting issues and the manner in which such arrangements will be documented.

Disclosure and Transparency

AIFMs are required regularly to report to the relevant competent authority on the principal markets and instruments in which it trades on behalf of the AIF. AIFMs are also required to provide information relating to assets held (including asset liquidity), risk profiles and the results of specified stress tests (and similar information must also be provided to investors on a periodic basis).

AIFMs must produce an annual report with respect to each of the AIFs it manages for each financial year. The report is to be provided to investors on request and made available to the relevant competent authority and should include a balance sheet, an income and expenditure account, a report on activities, any material changes in certain information provided to investors (see next paragraph below) and remuneration figures. Such reports are not made public by the relevant authority.

AIFMs are also required to make available to all investors in each of the AIFs they manage (or market in the EU) certain information before they invest, as well as upon any material changes thereto. The list of disclosure requirements includes: the investment strategy and objectives; the procedures by which the AIF may change its investment strategy; the identities of the AIFM and the AIF's depositary, auditor and any other service providers, and a description of their duties and the investor's rights with respect to them; the valuation procedure and pricing methodology; and fees, charges and expenses, and the maximum amount of these to be borne by the investors.

There are additional disclosure requirements in relation to substantially leveraged AIFs. Under the delegated Regulation, an AIF would be considered to be employing leverage on a substantial basis when its exposure exceeds three times its net asset value. AIFMs of substantially leveraged AIFs must disclose the extent of the leverage and a breakdown of how the leverage arises.

Action Point. AIFMs should review the breadth and depth of their current reporting regime and consider whether additional systems will be required in order to produce the level of disclosure prescribed by the AIFMD.

Private Equity Provisions

AIFMs managing one or more AIFs which individually or jointly acquire control (i.e. more than 50 percent of the voting rights) of a non-listed company will be required to notify the non-listed company, the non-listed company's shareholders and the relevant competent authority of the acquisition. The notification should include details of any change to the voting rights, the conditions under which control has been reached and the date on which control was reached.

Where an AIF buys, sells or holds shares of a non-listed company, the AIFM must notify the competent authority of the proportion of voting rights held by the AIF in the company when that proportion reaches, exceeds or falls below the thresholds of 10, 20, 30, 50 and 75 percent.

The AIFMD also includes asset protection measures which require AIFMs managing one or more AIFs with control of a non-listed company to use their best efforts to prevent asset stripping (i.e. capital reductions, share redemptions, etc.) in the first 24 months of ownership.

Action Points. It should be noted that these requirements do not apply where the non-listed companies concerned are (i) small or medium-sized enterprises or (ii) special purpose vehicles for the purpose of purchasing, holding or administering real estate. AIFMs should consider whether their plans would be caught by the private equity provisions under the AIFMD and what alternative structures could be used, if necessary.

The provisions place restrictions on the AIFM for two years from acquisition of control. It would seem reasonable to assume that these restrictions would not apply if the AIF disposed of the relevant entity. However, the AIFMD does not explicitly state that this is the case, and AIFMs may consider it prudent to seek an undertaking from any buyer regarding the restrictions.

MARKETING UNDER THE AIFMD

Scope

"Marketing" is defined in the AIFMD as any direct or indirect offering or placement at the initiative of the AIFM or on behalf of the AIFM of units or shares in an AIF it manages to investors in the EU. The AIFMD does not apply to passive marketing or reverse solicitation (although attempts to rely on such exemptions must be approached with caution).

As there is no EU-wide guidance on the scope of "marketing", its interpretation differs across Member States. In the United Kingdom, the FCA has published guidance on what constitutes "marketing" in its Perimeter Guidance Manual, part of the FCA Handbook. By way of example, circulating to potential investors draft documents (such as draft presentations, prospectuses or subscription documents) does not qualify as "marketing" for the purposes of the United Kingdom's implementing legislation.

Where and To Whom? An EU AIFM may market an EU AIF to professional investors in its home Member State if it first provides the relevant competent authority with certain information about the AIF (including fund documentation and the PPM or prospectus). The competent authority must inform the AIFM within 20 working days whether it may begin its marketing activities.

For the purposes of the AIFMD, "professional investors" are defined with reference to MiFID.

Member States may at their discretion allow EU AIFMs and non-EU AIFMs to market an AIF to retail investors. The United Kingdom permits marketing to retail investors, subject to additional restrictions (including compliance with the financial promotions regime). There is no AIFMD passport (see below) for marketing to retail investors.

AIFMD Passport

An EU manager of EU AIFs (other than a sub-threshold AIFM) may conduct its marketing and management activities across the EU, subject to certain conditions being met. This is known as the "AIFMD passport", or "passporting".

The aim of the passport is to allow managers authorised in one EU Member State to passport management or marketing services across the EU, subject to compliance with the harmonised rules set out in the AIFMD (as opposed to Member States' own rules—see below).

However, as ESMA observed in its July 2015 Opinion to the European Parliament, Council and Commission on the functioning of the passport, that aim has rather been frustrated as a result of the disparate approaches taken by certain Member States in implementing the passporting regime.

Although the AIFMD envisaged the extension of the passporting regime to include all full-scope AIFMs, passporting is not currently available to EU AIFMs of non-EU AIFs, or to non-EU AIFMs of any AIF (hereafter referred to collectively as "Non-Passporting AIFMs"). In its advice to the European Parliament, the Council and the Commission on the application of the AIFMD passport to non-EU AIFMs and AIFs published on 19 July 2016, ESMA concluded that there were no significant obstacles impeding the application of the AIFMD passport to managers in Canada, Guernsey, Japan, Jersey and Switzerland. ESMA was more equivocal about the extension of the passport to AIFMs and AIFs in other jurisdictions, including the United States.

The Parliament, the Council and the Commission are now considering ESMA's advice.

Process. To use the AIFMD passport, the AIFM must notify its home regulator about the AIF it wishes to market. This notification must include the AIF's internal rules, the identity of the depositary and all information on the AIF which is available to investors (as required by the disclosure and transparency provisions noted above).

Within 20 working days of receipt of the notification, the regulator will inform the AIFM whether it can begin marketing the AIF. Approval for marketing will be withheld where the AIFM cannot demonstrate that its management and marketing will be in line with the AIFMD requirements. The regulator will transmit the notification to the other Member States in which the AIFM wishes to market the AIF. If any of the information provided in the notification changes, the AIFM should give notice of the changes to its regulator.

Sub-Threshold AIFMs. If a sub-threshold EU AIFM wishes to avail of the passport, it may "opt in" to the full scope of the AIFMD; it would then need to comply with the AIFMD in full.

Private Placement Regimes

The AIFMD permits individual Member States to allow the active marketing of AIFs by Non-Passporting AIFMs in that Member State's discretion, subject to the fulfilment of certain generally applicable criteria (called "Baseline Requirements"). This is referred to as "national private placement".

The Baseline Requirements for the Member States choosing to permit private placement are:

- The Non-Passporting AIFM must comply with the AIFMD's disclosure and transparency provisions in respect of the AIFs that it markets (and it is marketing, rather than a sale, that is the appropriate trigger);

- The Non-Passporting AIFM must comply with the anti-asset stripping provisions in respect of private equity funds (see above);

- The supervisory authority of each of (i) the non-EU AIFM's home jurisdiction (if applicable); and (ii) the AIF's home jurisdiction (if it is a non-EU AIF) must have entered into cooperation arrangements with regulators in each EU Member State in which the AIF will be marketed; and

- The jurisdiction in which a non-EU AIFM is established (and the jurisdiction in which a non-EU AIF is established, if different) must not be listed as non-cooperative by the Financial Action Task Force.

As a consequence of implementing the AIFMD, certain Member States have prohibited private placement regimes outright, whilst others allow the practice subject to specific local law conditions—this process of exceeding an EU directive's requirements so as to interfere with the regulatory intention is known as "gold-plating".

Action Points. Before marketing a new AIF, AIFMs should take steps to consider whether their marketing documentation will be sufficient to satisfy the AIFMD marketing disclosure requirements and ensure that they have procedures in place to meet ongoing disclosure requirements.

Given the disparate approaches to implementing the passporting and national private placement regimes across EU Member States, AIFMs should take local advice on "marketing" and compliance requirements in each target jurisdiction.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]