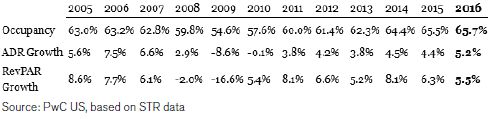

2015 was a record breaking year for the hotel sector: occupancy levels rose to 65.5%, and according to Moody's, RevPar increased by 6.3% over 2014 levels.[i] Forecasts for 2016 are healthy, with a side of cautious optimism. According to Smith Travel Research (STR), demand will grow by 2.2%, exceeding a 1.4% increase in supply.[ii] Similarly, average daily rate ("ADR") is expected to grow to 5.2%, likely leading to an increase in RevPar, which according to PwC's 2016 lodging forecast will increase by 5.5% in 2016.[iii] However, recent research published by Moody's suggests that while past growth is a "good indicator" of future performance, potential market saturation may lead to a "tipping of the scale" where supply outpaces demand.[iv]

Comparison of Occupancy, ADR Growth and RevPar Growth Since 2005

Looking ahead to 2016, what factors may contribute to industry growth and strong fundamentals? How can the hospitality sector bolster their current upward trend? Lower oil prices, a strong US dollar and maturing debt will impact the marketplace in the short term. Forecasting through 2016 and beyond, hotel insiders should focus on the rise of the millennial traveler, refurbishment and renewal with a technological and "green" focus and outpacing market disruptors such as Airbnb.

Low Oil Prices. Strong Dollar. Maturing Debt.

In addition to the strengthening US economy and Bureau of Labor Statistics-certified job growth of approximately 2.3 million in 2015, other forces are playing unique roles in the hotel industry's current performance, including energy prices, a strong dollar and debt maturities.

In 2015, oil prices traded below $50 per barrel, a sharp contrast to $110 per barrel in June 2014.[v] As observed by e-forecasting.com, low oil prices facilitate upticks in travel and vacation plans, with July 2015 delivering a growth rate of 6.9% followed by a 7.6% growth rate in August 2015.[vi] Moving into summer, continued low oil prices should result in increased vacation travel within the US, a boon to hotel occupancy rates.

While a strong US dollar may negatively impact foreign travel to the US in destinations beyond gateway cities, it is not impeding foreign investment. High profile recent acquisitions include the 2015 acquisition of New York City's Baccarat Hotel by an affiliate of Sunshine Insurance Group, and Chinese insurance giant Anbang's late 2014 acquisition of New York City's Waldorf Astoria. Although abandoning its plan to acquire Starwood Hotels & Resorts for $14 billion in late March, Anbang nevertheless expanded its US hotel portfolio by acquiring Strategic Hotels & Resorts for approximately $6.5 billion. In a recent call with investors, Starwood CEO Tom Mangas characterized Anbang as having a "great interest in the US hotel market," something which Mangas noted he could not "see any reason why that would change."[vii] Similarly, at the Hospitality Law Conference in Houston, Kevin Mallory, senior managing director and global head for CBRE Hotels, advised that "the hotel industry is coming off a fantastic year for investment activity. . . the current trend is there's a great deal of foreign investment activity. . . ."[viii]

Another predicted factor behind increasing movement in the hotel sector for 2016 is a pipeline of legacy 10-year CMBS loans originated between 2005 and 2007. Trepp's CRE Research estimates that approximately $19.6 billion in lodging-sector loans will mature in 2016, and $10.9 billion will mature in 2017.[ix] Reporting back the insights gleaned from the Americas Lodging Investment Summit of 2016, the hospitality consulting firm HVS noted that this "wall of maturities" has the potential to create in the next 18 months "the most dynamic financing period the industry has ever experienced."[x] During the first five months of 2015, hotels led all major property types in loan origination, with Trepp's research indicating "healthy market fundamentals, low interest rates and the impending wall of maturities have led to increased lending in the hotel sector."[xi] According to the Mortgage Bankers Association CREF/Multifamily Housing Convention and Expo 2016, "moderate supply increases, strong demand levels, and expensed RevPar growth. . . should continue to make hotels an attractive segment for investment in 2016."[xii]

What's Next for 2016: How Can Hospitality Stay Ahead of the Curve?

Hospitality is performing strongly, but looking through 2016 and beyond, industry insiders should consider the rise of the millennial traveler, refurbishment and renewal with a tech and "green" focus and outpacing market disruptors, such as homeshares, in order to keep strong fundamentals on track.

Generation Y (aka, millennials; those born from 1980–2000), outnumber the Baby Boom generation (1946–1964) by three million and are predicted to outnumber boomers by as much as 22 million by 2030.[xiii] Each year, more millennials become the client base of the hospitality industry. To date, millennials comprise 22% of all travelers and have spent approximately $200 billion a year on travel.[xiv] Sarah Kennedy Ellis, Sabre's vice president of marketing for hospitality suggested that by 2017 or 2018, millennials will likely become the biggest spenders on travel.[xv] Understanding this demographic and responding to their needs is a key factor for the hospitality sector's continued growth. Similarly, creative tech-based marketing is also important to attracting millennials. Bob Rauch, president of RAR Hospitality noted in his "Top 10 Hotel Trends for 2016" that "guests are using social media outlets, community apps, and online forums not only to research and book hotels but to gauge the hotel's brand identity."[xvi] The rise of websites such as Oyster.com and TripAdvisor create an online community of information gathering for guests and an opportunity for hotels to make or break their marketing strategies. Best Western president and CEO David Kong advised colleagues at the Hunter Hotel Investment Conference in Atlanta that hotel operators should "up [their] investment in sales and marketing and take as much market share as you can now . . . invest in products and services to build guest loyalty."[xvii]

In the age of the millennial, social media presence can create an identity. For example, Starwood's Parker in Palm Springs, California has gone beyond having its own Facebook or Instagram page; instead, its social media platform is authored by "Mrs. Parker," a fictional character who refers to her followers as "Darlings" and affectionately refers to herself as "Mrs. P." In this sense, the resort can literally speak to its customer base—appearing on a newsfeed, seeming much less like an advertisement and more like a note from an old friend.

Social media platforms are not only a way for players in the hospitality industry to get out their message, but also a way to track their customer base, respond to feedback and bring reservation services to their guests anywhere in the world. Focusing on technological improvements in an effort to create seamless mobile experiences has the potential to increase transactions and revenue, and generate positive shares on social media, while also providing hotels with guest data and personalizing guests' experiences.

Millennials move in a fast-paced digital world, where a check-in kiosk may be preferred over a traditional front desk. The Carlson Rezidor hotel group unveiled in 2014 its "Radisson Red" concept, touted as being in touch with the "ageless millennial mindset" and focusing on technology-based guest interfaces such as app-based check-in, and online concierge services. One observable millennial trend is a reliance on techno-do-it-yourself-ism, while at the same time seeking communal shared experiences. Millennial business travelers are seen to prefer an "alone together" concept, utilizing communal lobby spaces, rather than sitting in their rooms. In line with "alone together," is the rising trend of co-working spaces within hotels.

As more workers seek location-independent jobs, co-working spaces function as communal offices that allow unrelated workers and employees to work in a shared environment. Jessica Festa of Road Warrior Voices spells out several reasons why co-working hotels may be hospitality's future.[xviii] For many hotels, the traditional business center became obsolete as travelers carried their own laptops and tablets. To adapt to this, some have forgone updating their business centers to instead create more inviting, work-friendly lobbies. Second, hotel-based co-working spaces are useful for both guests and non-guests, expanding usability beyond the sphere of guests and their clients to include local location-independent workers. Hotel Schani in Vienna provides desk rentals in its lobby managed by an online Co-working Market Place. The marketplace enables guests to book a room online, select their desired floor, proximity to the elevator, amenities and even furnishing arrangements from a menu on the hotel's web app.[xix] In New York City, the Ace Hotel in Midtown has turned its lobby into a collective workspace for a variety of professionals—designers, academics, stylists, advertising executives, writers, entrepreneurs, etc.— whose fields of work often lack a formal office structure.[xx]

In addition to the expansion of shared spaces and technologically advanced guest interfaces, millennials are also seeking unique, bespoke travel experiences. Kimpton Hotels has responded to this desire by focusing on local design, community integration and locally-sourced food and beverage. According to Greg Oates of Skift.com, Kimpton strives to provide unique experiences to consumers that would otherwise not be readily accessible.[xxi] Kimpton launched a monthly initiative named "Like a Local" that provides guests with hotel staff's personal recommendations for interesting local activities. The Radisson Red also features on their website a curated "Inspirations" page which includes photo tours of "city breaks, adventure and local culture" touting that "we've explored it so you can browse it."

With rampant competition among hotel providers in the modern era, mastering the art of original branding can be a key tactic in distinguishing a hotel from its competitors.

Invest in the Environment

Another trend attractive to millennials and useful for boosting property fundamentals is the green movement. A February 2012 report by HVS found that consumers are exceedingly environmentally conscious and support businesses that adopt green practices.[xxii] Implementing green initiatives, including renovating in order to qualify for LEED (Leader in Energy and Environmental Design) Certification, provides an opportunity for hotels to improve their fundamentals both by appealing to environmentally-focused guests, such as the millennial cohort, and by lessening the burden on hotel operators in consuming natural resources. There is great potential in adopting sustainability measures in the hospitality sector since hotels voraciously consume natural resources. US Green Building Council's LEED in Motion: Hospitality report states that US hotels operate for 24 hours a day, seven days a week, while occupying more than five billion square feet of space. LEED is the most widely used green building rating program in the US and has been of increasing importance in the hospitality industry. Sustainable buildings include solar panels, natural ventilation, water storage and shading technologies that improve a building's resilience. In new construction projects, green techniques also include the use of sustainable concrete or timber, materials that are efficient with resources and maximize natural light, and techniques that minimize energy and water use, all of which can help increase a property's fundamentals by decreasing its environmental impact while appealing to guests.

Are Home Shares Cause for Concern?

The factors that help maintain strong fundamentals aren't the only considerations for a bright 2016. The hospitality sector also needs to weigh the impact of market disruptors. How much of a risk does the rise of the sharing economy and websites like Airbnb present to the industry? As of September 30, 2015, hotel REITs produced a total return of -22.2% year-to-date compared to a -4.3% return during the same period for the MSCI US REIT Index.[xxiii] According to the Chilton REIT team, some of the decline can be traced to home-sharing websites like Airbnb.[xxiv]

CBRE Hotels' Americas Research indicated that overall Airbnb supply represents approximately 3% of traditional hotel stock.[xxv] CBRE's research further suggests that the higher the RevPar, the greater the number of Airbnb units; however, the higher the price of an Airbnb the less of a threat such Airbnb is to traditional hotels. A March 2016 report by Moody's indicated that Airbnb tends to compete with leisure guests "mainly with lower-priced hotels that are unaffiliated with major brands."[xxvi] The report further noted that the service is less competitive for business travelers and less competitive with hotels with conference and other amenities services. Moody's overall prediction is that a "supply-demand imbalance from overbuilding in the hotel sector" poses a larger threat to hotel fundamentals than the impact of Airbnb.

A 2013 study conducted by Boston University found that "higher-end chain scales, as well as hotels that cater to transient business travel, should be the most insulated from Airbnb".[xxvii] Further, despite popular belief, shared-space renters were not necessarily traveling alone: 31% of renters traveled as a couple or with another adult, and 22% were families with children. An additional 9% of travelers rented with adult friends or family.[xxviii] Airbnb travelers tend to travel in groups, stay for longer and be more price sensitive than the typical hotel guest. This observation suggests that Airbnb renters are likely seeking a different experience than those travelers seeking an urban, business-focused stay. Moody's cited that "Airbnb is less competitive for business travelers than higher priced, traditional brand name hotels."[xxix] 30-40% of Airbnb travelers have reported they would not have taken their trip were it not for Airbnb.[xxx] As such, the sharing economy and websites like Airbnb may be a growing of the pie, rather than a shrinking of the pieces affected by this disruptor.

Conclusion

Overall, the outlook for the hotel sector appears optimistic, bolstered by strong fundamentals and positive indicators such as low oil prices, foreign interest in US investments due to a strong dollar and increased lending as a result of loan maturities. Despite the hopeful outlook, hotel operators should consider adopting measures to embrace the unfolding demands of the rising millennial customer base, including providing unique, tech-based interactions, integrating co-working spaces and taking sustainability measures. By implementing strategies to address these points, the hotel sector can better hedge for sustained strong market fundamentals in the coming years.

Originally appeared in CRE Finance World on June 23, 2016.

Footnotes

[i] "Moody's: US Lodging Growth Slowdown Continues in Q4 2015; Cruise Companies Maintain Strength" Moody's Investor Service, January 21, 2016.

[ii] Zacks Equity Research "Hotels Rebound: Sustainable Over the Long Term?" Zacks.com, March 30, 2016.

[iii] Scott D. Berman, "In 2016, Average Daily Rate Reluctantly Takes the Driver's Seat, Says PwC US" PwC, January 25, 2016.

[iv] "Robust 2015 Hotel Performance Masks Softening" Lodging Magazine, March 16, 2016.

[v] "Brent crude oil price dips below $50 a barrel" BBC, January 7, 2015.

[vi] "Hotel Industry Benefits from Lower Oil Prices" E-Forecasting.com, September 22, 2015.

[vii] Hui-yong Yu, "Starwood CEO Sees Hotel M&A Accelerating After Marriott Deal" April 4, 2016.

[viii] Bryan Wroten "Hoteliers Talk 2016's Legal, Investment Issues" Hotel News Now, February 23, 2016.

[ix] Susan Persin "wall of CMBS Loan Maturities Shrinks, Remains Daunting" Trepp CMBS Research, February 2016.

[x] "Seven Key Takeaways from the Americas Lodging Investment Summit 2016 (ALIS)" HVS, 2016.

[xi] "Can Lodging Real Estate Fundamentals Support Continued Growth" Trepp CRE Research, May 2015.

[xii] "Uncertain Outlook for Commercial Lending, Including Hospitality" Hotel Investment News, February 16, 2016.

[xiii] Aisha Carter "How Millennials are Changing Hotels" BisNow, July 8, 2015.

[xiv] "Millennial Expectations are Reshaping Travel Industry" GBrief, February 19, 2016.

[xv] "Sabre: Millenials May Be the Largest Hotel Spenders as soon as 2017" TNooz, March 11, 2016.

[xvi] Bob Rauch, "Top 10 Hotel Trends for 2016" Hospitalitynet, December 2, 2015.

[xvii] "Hunter: Now's the Time to Reinvest in Your Hotels" Hotel News Now, March 18, 2016.

[xviii] Jessica Festa "6 Reasons Coworking Hotels are the Future of Hospitality" Road Warrior Voices, November 2, 2015.

[xix] Christine Lagorio-Chafkin "Co-Working, but for Hotels. (Seriously)" Inc., October 9, 2015.

[xx] Lizzy Goodman "Ace Hotel's Communal Workspace Shows a Winning Hand" FastCompany, August 12, 2011.

[xxi] Greg Oates, "How Kimpton Hotels Built Its Brand on the Local Experience" Skift, October 28, 2013.

[xxii] "Current Trends and Opportunities in Hotel Sustainability" HVS, February 2012.

[xxiii] Chilton REIT Team "The Effect (If Any) of Airbnb on Hotel Companies" Nasdaq, October 1, 2015.

[xxiv] Ibid.

[xxv] Jamie Lane "The Sharing Economy Checks In: An Analysis of Airbnb in the United States" CBRE Hotels' Americas Research.

[xxvi] "Moody's: Continued Hotel Construction a Greater Threat to US Lodging Sector CMBS than Airbnb" Moody's Investor Service, March 15, 2016.

[xxvii] Georgios Zervas et al "The Rise of the Sharing Economy: Estimating the Impact of Airbnb on the Hotel Industry" Boston University, December 14, 2013.

[xxviii] Amber Wojcek, "Shared Lodging Is Here to Stay—How You Can Compete" Travel Media Group, August 24, 2015.

[xxix] "Moody's: Continued Hotel Construction a Greater Threat to US Lodging Sector CMBS than Airbnb" Moody's Investor Service, March 15, 2016.

[xxx] Georgios Zervas et al "The Rise of the Sharing Economy: Estimating the Impact of Airbnb on the Hotel Industry" Boston University, December 14, 2013.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.