Real estate investment involves many risks that real estate investment managers and owners are familiar with. These range from "micro" risks, such as tenant disputes and defective property maintenance to "macro risks" such as negative demographic trends and instability in global capital markets. As real estate investment managers seek opportunities in newer, higher-growth markets around the world, they may take on additional risks in the expectation of enhanced reward. Historically, however, real estate investment managers and owners have not had to give particular consideration to the risk of economic crimes committed in relation to their investments and the implications that these might have for them. This is changing and the need to be aware of, and control, the risks that an investment manager can face because of bribery and corruption violations, money laundering and economic sanction regimes is increasingly important.

In this Alert, we describe some of these risks in more detail and provide some suggestions about what real estate investment managers and owners can do to protect themselves against such risks. Without wishing to downplay the seriousness of the risks posed by money laundering and sanctions violations, the focus of this Alert is bribery and corruption.

The Nature of Real Estate

One of the most important distinctions between direct investment in real estate and other investment asset classes such as equities and bonds is the fact that real estate is, by its nature, an operational asset that requires active management at all stages of an investment. In other words, managers and owners ofreal estate must have arrangements in place to build an asset, maintain it, manage it and ultimately dispose of it, though, of course, not all of these stages will apply in the context of every investment. These processes almost invariably lead to interactions with governmental bodies as well as a variety of other third parties. These could be government bodies that deal with land development and use, title registration, land taxation, energy and environmental matters or health and safety. The third parties could be involved in many ways, including in building or refurbishing a property or collecting rents from, or agreeing on rent increases with, occupying tenants. The more complex the asset and the greater the development element, the more extensive the range of such interactions are likely to be. These interactions are conducted by individuals who are either employees of the investment manager or owner, or third parties such as joint-venture partners, property managers, asset managers or other professional intermediaries such as planning or environmental consultants appointed by the investment manager or owner. Each of these interactions gives rise to the risk of unauthorised conduct by the individuals involved, which could amount to acts of bribery and corruption. The consequence of such unauthorised conduct is not restricted to the individuals involved, however. It can also be visited on the investment manager or owner as well, where the investment manager or owner is the principal, with consequences that may be extremely damaging from a legal, a financial and a reputational perspective.

In addition to the possibility of bribery and corruption, real estate tends to be a favoured asset for those who are either seeking to evade economic sanctions or who are seeking to launder the proceeds of criminal activity. These individuals may well use the services of an investment manager to execute the acquisition and management of real estate assets, obfuscating their involvement through a chain of intermediaries and ownership structures. Such investment managers will be at risk, again from a legal, a financial and a reputational perspective, because of their involvement in such matters.

A New Regulatory Environment

"Corrupt individuals and countries will no longer be able to move, launder and hide illicit funds through London's property market." - David Cameron, May 2016

While the greatest degree of post Global Financial Crisis regulatory scrutiny has been reserved for the financial services industry, the real estate industry is increasingly a focus of regulatory attention. We have, in the context of our professional activities, witnessed numerous examples of regulatory intervention taken against highly significant, internationally active real estate investment managers and owners. Some of these actions have been conducted publicly, with the attendant negative publicity. Others have been undertaken privately, with the entities involved being able to resolve or settle the matter that triggered the intervention. Action is possible by regulatory authorities in the countries where the investment manager or owner is located but also in the country in which the asset is located, which is where, in all probability, the offending conduct will occur. In our recent experience we have seen an increase in enforcement activity, and problematic conduct, across many different countries and continents. By way of example, this includes investigations into payments made by property managers in Hong Kong at the request of government officials in order to pass inspections or obtain licences that would allow daily operations at the property to continue and, in Turkey, payment of bribes to government officials as a means of resolving safety issues. In total we have advised in nearly 40 different jurisdictions across five continents on such matters and as well as the accompanying financial and reputational damage, in the worst cases the asset becomes so tainted it may be difficult to sell or at the very least the investment value may be significantly adversely affected. Thus, there is a need for investment managers and owners to be sensitive both to home-country regulation and host-country regulation and to consider the implications of problematic conduct on the value of both their enterprise and their individual investments.

In the context of money laundering and economic sanctions, US, UK, EU and other foreign regulators are increasingly looking to promote transparency. It is therefore incumbent on real estate investment managers to obtain such transparency from their investors through diligent investigation. As an example of this, as we have described in an earlier Alert ("An Englishman's Home is his Castle – Just!"), foreign corporate entities that own real estate assets in the UK will be required to disclose their ultimate beneficial owners (although how far up the chain of beneficial ownership disclosure will be required remains a matter to be resolved).

In the context of bribery and corruption, the regulatory regimes in the US and the UK are, broadly speaking, based on penalising such behaviour, driven by the desire to encourage a pro-active approach to addressing these risks in a pre-emptive manner. It is therefore incumbent on real estate investment managers and owners to ensure that the possibility of such behaviour is curtailed/prevented.

A Structured Approach to Managing Bribery and Corruption

As indicated above, the possibility of acts of bribery and corruption is enhanced by three factors: undertaking activities in higher growth markets around the world, where acts of bribery and corruption are, historically, more common; heightened interactions with governmental bodies and other third parties; and reliance on third parties for such interactions.

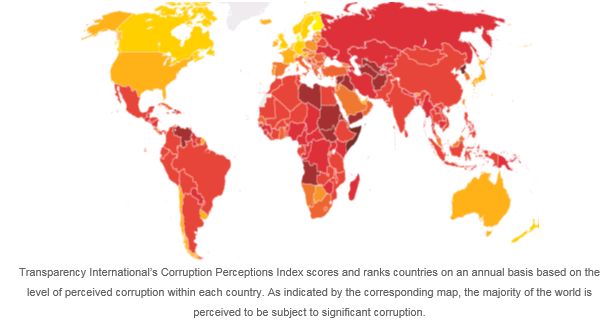

For real estate investment managers and owners who operate in a global context the attractions of pursuing opportunities in higher growth markets is self-evident and, in many cases, is being actively pursued as a strategy. It is interesting to note, however, based on the Corruption Perception Index prepared by Transparency International, that the majority of the world – particularly countries in Asia, Africa and Latin America are subject to significant risks of bribery and corruption: these are the countries shaded in red in the map set out below. Thus, the greater an investment manager or owner's focus on these countries, the more vigilant it should be in relation to the management of actions that could amount to bribery and corruption.

At the core of managing such actions lies a compliance programme. An important purpose of such a programme is to prevent the objectionable conduct from occurring in the first place. If that purpose cannot be achieved, a compliance programme can nonetheless be important in providing a defence to, or at least being a mitigating factor in, any enforcement action taken or proposed relating to the objectionable conduct. As an example, under the Bribery Act 2010 in the UK, the only defence that an investment manager or owner has in respect of the failure to prevent bribery within its organisation is that it had adequate procedures in place at the time the offence was committed, which sought to do so. Similarly in, the USA, regulators look to the sufficiency of an organisation's compliance programme in considering potential penalties in the context of actions under the Foreign Corrupt Practices Act. As an indication of its seriousness in respect of compliance programme implementation, the US Department of Justice recently appointed an in-house counsel specifically to assist with the Fraud Sections review of compliance programmes.

The key question then becomes what constitutes "adequate procedures". In our experience, an anti-bribery and corruption compliance programme should include the following elements:

- Enterprise-Level Awareness: At this level, the key objective is to sensitise the directors and employees of a real estate investment manager or owner, through appropriate policies, procedures and training, about the regulatory regime that applies in relation to bribery and corruption, considering both home country and host country rules. Investment professionals should have a high degree of awareness of the risks posed by offending conduct, both to themselves and to the enterprise, and have the tools to be vigilant in looking for red flags which identify situations where offending conduct could arise or, less optimally, where it has arisen. This element of a compliance programme should be designed to take account of the countries in which an investment manager or owneris, or is expected to, undertake investment activity and the nature of its investments. Thus, where an investment manager or owneris often involved in greenfield developments in emerging markets, its risk profile is greater than if it is only involved in investing in developed and stabilised assets in the USA or Western Europe.

- Pre-Investment Asset Due Diligence: While the due diligence that real estate investment managers or owners undertake prior to committing to particular investment is extensive, bribery and corruption may not have, historically at least, been a key element. In our experience, undertaking the incremental steps to address bribery and corruption issues during the pre-investment diligence phase can be important, particularly where, on the face of it, there is evidence of heightened risk factors. Thus, to take a somewhat simplistic example, if an investment manager is considering the purchase of an office asset which is located in a predominantly residential area of a higher-risk city (say in an emerging market), in addition to examining existence of planning and zoning permissions, it may also be important to examine their provenance and whether there are any circumstances which exist which might lead to the conclusion that such permissions were improperly obtained. Similarly, looking at actions taken by historic property managers could identify reasons why historic property management arrangements should be replaced with new ones following the investment.

- On-Going Asset Due Diligence: Given the nature of real estate as an operating asset, it is, in our view, important for investment managers and owners to first, assess the situations at an individual asset level that may give rise to potential bribery and corruption and then, to monitor those situations, following its investment, more closely. To take another hypothetical example, if an asset requires significant improvement in terms of energy efficiency standards and, in due course, certification by a government department, it is worthwhile monitoring the steps in the process that is to be undertaken to ensure that there is no impropriety at any stage. Thus, as a general proposition, the more asset management intensive an asset is, the greater the need for on-going asset level due diligence and record keeping.

- On-Going Third Party Due Diligence: As we have indicated above, third parties are often, if not generally, involved in the management of real estate assets. A compliance programme should focus on the third parties involved, the tasks that they are mandated to undertake, and ensure that they are aware of the consequences of improper conduct and have their own policies and procedures in place to address these issues. Indeed, a third party's awareness of an approach to managing problematic conduct should be a relevant factor in its being appointed.

This is an area that is continually developing but the momentum is growing and it is at an international level.

"There is nothing as powerful as an idea whose time has come and I believe that's the case with fighting and driving out corruption." – David Cameron, May 2016, in his closing remarks at the Anti-Corruption Summit in London

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.