On April 19, 2016, the U.S. Securities and Exchange Commission ("SEC") held a daylong Compliance Outreach Program for Investment Adviser and Investment Company Senior Officers. The program featured a Private Fund Adviser Topics panel devoted entirely to issues pertinent to investment advisers to hedge, real estate and private equity funds.

In his opening remarks to the Private Fund Adviser Topics panel, Igor Rozenblit, an SEC senior specialized examiner and the co-head of the Private Funds Unit of the SEC's Office of Compliance Inspections and Examinations ("Unit"), provided an overview of the Unit's activities since its 2014 inception. In particular, Rozenblit discussed (i) efforts to increase examiner "pattern recognition" through increased specialization of the examiners in the Unit; (ii) the Unit's bottom-up approach to examining individual private equity and hedge fund advisers, which involves an analysis of the advisers' particular conflicts, pressures and issues; and (iii) the Unit's understanding of compliance risks through top-down analyses of industry dynamics (e.g., the Unit would look at the industry broadly and consider where things may be complex and opaque).

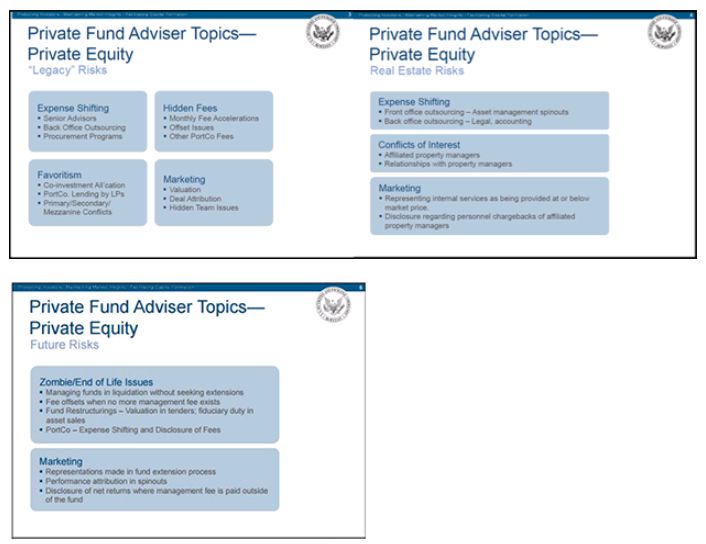

Rozenblit then took the audience through the following slides that identified the Unit's focus in the private equity and real estate fund space:

"Legacy" Risks

Rozenblit identified four categories of "legacy" risks to which private equity funds are particularly vulnerable and which are repeatedly the focus of the Unit's private equity fund adviser examinations: expense shifting, hidden fees, favoritism and marketing. We note that Rozenblit did not directly address marketing "legacy" risks in his comments.

Expense Shifting

- General – Rozenblit identified "expense shifting" as the most common issue raised in private equity fund examinations because of the inherent conflict of interest associated with allocating expenses and the difficulties associated with properly allocating expenses among different constituencies.

- Senior Advisors – Rozenblit acknowledged that it is generally important to investors that a fund's management fee cover a very seasoned and senior management team but indicated that the Unit is concerned primarily with whether the offering documents of a fund accurately reflect the composition of the management team and how that team is compensated, and not with the composition itself (e.g., whether a senior advisor is an affiliate of the manager).

- Back-Office Outsourcing – Rozenblit identified back-office outsourcing as a growing trend among private equity fund advisers that want to charge the fund with the expenses attributable to back-office personnel separately from the management fee. He indicated that to the extent an adviser discloses that back-office personnel will be treated as distinct from the management team, the Unit does not take issue with charging investors separately for these expenses.

Hidden Fees

- Monthly Fee Accelerations – Rozenblit briefly addressed risks surrounding monthly fee accelerations, which he contends are well-understood following the recent SEC enforcement action in this space.

- Offset Issues – Rozenblit discussed discrepancies between an adviser's disclosure to investors regarding management fee offsets and actual allocation of management fee offsets. On this issue, the Unit is concerned both with the accuracy of disclosure to investors regarding such offsets and with potential operational complexity with respect to the allocation of offsets that can lead to regulatory violations. Rozenblit urged advisers to allocate management fee offsets in line with their offering documents even when the adviser believes deviation from the offering document is beneficial to the investors.

Favoritism

- Co-investment – Rozenblit indicated that a private equity fund adviser may differentiate among investors in allocating co-investment opportunities to the extent that the adviser's policy regarding the allocation of such opportunities is properly disclosed to investors. In this regard, Rozenblit encouraged advisers to maintain good policies and procedures related to co-investments.

- Portfolio Company Lending by LPs – Rozenblit discussed instances in which insurance companies become investors in private equity funds in order to generate lending business for their mezzanine arms. As a result of this investment, investors see multiple mezzanine transactions effected with a single limited partner, creating a conflict of interest that Rozenblit contends should be disclosed to investors.

Real Estate Risks

Following his discussion of "legacy" risks to which private equity fund advisers are subject, Rozenblit described the Unit's recent examination of real estate advisers running opportunistic and value-added strategies. The examination focused on how such advisers use service providers – in particular, affiliated service providers – to manage, lease and build out their properties. The examination uncovered a trend among these advisers to spin out asset management professionals into separate companies so that all fees incurred with respect to the receipt of services from such professionals could be charged back to the fund. The Unit considers this behavior acceptable to the extent it is adequately disclosed to investors.

In other instances, the Unit found that some advisers represented to investors that affiliated service providers would be used only if their services were provided at or below market rates but, in actuality, they paid such service providers above-market rates. The Unit also uncovered instances in which advisers failed to disclose personnel chargebacks of affiliated property managers when disclosing the property management fees borne by the investors. Rozenblit further indicated that in situations where real estate advisers use joint venture partners to effectuate deals, the Unit has found that potentially inappropriate side relationships among real estate advisers have gone undisclosed to investors.

Future Risks

Rozenblit concluded with a discussion of future risks to which private equity funds may be vulnerable, focusing primarily on zombie and end-of-life issues. Rozenblit acknowledged that, in general, the fundraising market for private equity funds is currently strong but stated that the fundraising environment is deteriorating and is very bifurcated. He discussed the Unit's concerns with the increasingly common practice for managers to continue to manage funds after the end of the term of the fund and to agree to do so without charging a management fee. He indicated that after the management fee turns off, any monitoring fees paid by portfolio companies become revenue to the manager. He also expressed the Unit's concern with fund restructurings such as stapled secondaries. Due to the conflict inherent in these transactions and their complexity and opacity, the SEC continues to focus on these transactions and views the recent charging of Andrew Caspersen as the first case in this space.

Hedge Fund Risks

After Rozenblit's presentation, Jennifer Duggins, an SEC senior specialized examiner and the co-head of the Unit, very quickly went through the following slides and summarized the Unit's focus in the hedge fund space.

Duggins mentioned that the Unit continues to focus on conflicts of interest in the hedge fund space and, in particular, the trading of proprietary and client accounts on a side-by-side basis and the inherent conflicts that arrangement may present. The Unit is also looking closely at any family offices that may be associated with a hedge fund and trying to identify any conflicts that are not being disclosed to investors in any such hedge fund. Duggins also mentioned that the Unit will continue to focus on valuation, marketing, performance and compliance programs of hedge fund advisers.

With respect to compliance aspects, Duggins indicated that the Unit is seeing the potential for weaker compliance programs at smaller advisers and is continuing to identify conflicts of interest at larger advisers. Further, she mentioned that the Unit is noticing the exclusion of compliance personnel from the research process and the lack of compliance buy-in from the businesses.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.