While the California corporate income tax garners substantial attention from taxpayers doing business in California, municipalities also impose entity-level taxes on businesses that deserve close consideration. These local business taxes may involve more opportunities and traps for the unwary than one would initially perceive. The California city business taxes require an analysis of numerous variables, including industry classification, payroll size, gross receipts and apportionment rules for in-city and out-of-city activities. In this Alert, we focus on the municipal-level tax imposed by the most populous city in California, the Los Angeles Business Tax (LABT).

Imposition of LABT

The City of Los Angeles imposes the LABT on all persons engaged in any trade, calling, occupation, vocation, profession or other means of business in the City of Los Angeles and surrounding cities.1 Companies are considered to be engaged in business in the City of Los Angeles when physically performing work within the city.2 The Los Angeles Office of Finance is responsible for the collection of business taxes. All taxpayers are required to file 2015 LABT returns no later than February 29, 2016.

Common Errors Leading to LABT Overpayments

There are several common errors that may lead to the overpayment of LABT. Often, taxpayers may be designated under the wrong business classification, and as a result, may be paying the LABT at a rate higher than appropriate for their industry. In addition, companies are not consistent in excluding gross receipts from the LABT base for qualified sales activities occurring outside the taxing jurisdiction. In both instances, a review of previously filed LABT returns may serve to substantially reduce a taxpayer's LABT liability.

Common Errors Leading to LABT Exposures

Though some taxpayers may be in the position of overpaying the LABT, others undoubtedly find themselves in the opposite position, with exposure that could be substantial. Again, there are several common errors that lead to LABT underpayments. For example, some businesses which actually are registered in Los Angeles and paying LABT are misclassified, resulting in the reporting of gross receipts at a rate lower than appropriate for their industry.

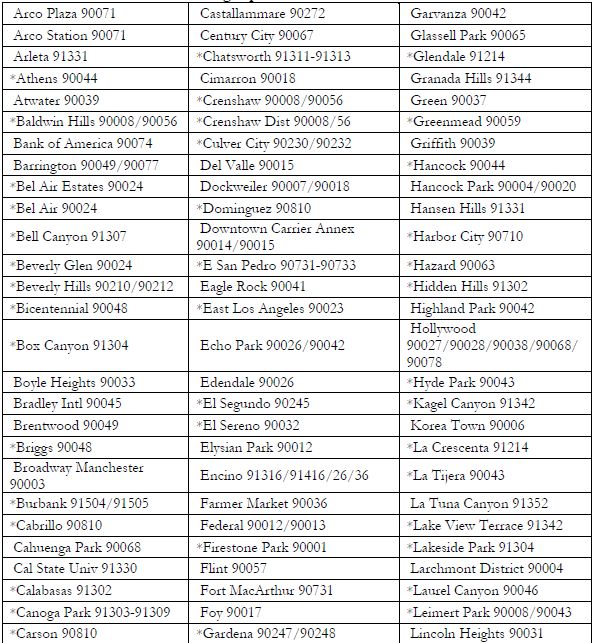

In addition, some businesses may not be aware of the actual boundaries of the Los Angeles city taxing jurisdiction. In some cases, businesses are actually located outside of the City of Los Angeles but sporadically enter the city to make sales through deliveries to customers, kiosks and other forms of temporary physical presence within the following zip codes below.3

Gross Receipts Are Subject to LABT if Permanent and Temporary Forms of Presence Occur Within the following Zip Codes4

Jurisdiction is subject to change. Street address look-up search is available at the Los Angeles Office of Finance Web site: http://finance.lacity.org

"New Business" Exemption

Taxpayers may qualify for an enhanced three-year LABT exemption for a new business that started in the City of Los Angeles or a business that relocated from outside the city on or after January 1, 2010 through December 31, 2015. To qualify, a taxpayer could not have been engaged in business at a fixed location in the city in the immediately preceding tax year. This tax exemption excludes the following: (i) certain construction businesses; (ii) certain film producers; and (iii) any business which was engaged in business inside the City of Los Angeles during the preceding tax period and is engaged in business in the city during the current tax period. A new business must timely register for a Business Registration Tax Certificate to qualify for this exemption.5

Commentary

For taxpayers that upon review of their LABT returns have overpaid their LABT liability, a refund claim should be pursued. As for taxpayers that have underpaid their LABT liability, or businesses that should be reporting LABT liability but are not, remediation efforts to mitigate the amount of LABT ultimately due should be strongly considered. It may be possible to reduce the eight-year look-back period normally imposed on a non-filing business through negotiations with the Los Angeles Office of Finance.6

Footnotes

1 Los Angeles, CA Municipal Code, Ch. II, Art. 1, §§ 21.41 to 21.199.

2 Los Angeles, CA Municipal Code, Ch. II, Art. 1, § 21.06.

3 Published list of zip codes furnished by the Los Angeles Office of Finance.

4 *Asterisk indicates zip code may be partially in the jurisdiction.

5 Los Angeles, CA Municipal Code, Ch. II, Art. 1, § 21.30 & § 21.109. A brand new business or a business that relocates from outside the city is exempt from paying the first year business tax provided the business obtains the Tax Registration Certificate from the city by the end of the second calendar month of the business start date. A business that does not obtain the Tax Registration Certificate by this deadline cannot take the first year exemption and will be liable for the first year tax and any interest and penalties for late filing. Additionally, the city has an exemption for the second and third year of business provided the Business Tax Registration renewal is filed on or before the end of the February deadline of the 2nd and 3rd calendar year of business.

6 Los Angeles, CA Municipal Code, Ch. II, Art. 1, § 21.16.1.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.