- within Strategy topic(s)

Only a few months after the Organization for Economic Cooperation and Development ("OECD") released its Base Erosion and Profit Shifting ("BEPS") package for the reform of the international tax system to tackle perceived tax avoidance,1 the European Commission (the "Commission") presented a set of proposals titled the "Anti-Tax Avoidance Package" (the "Package") at the end of January. 2

The Commission has been active for many years in the battle against what it sees as "aggressive" tax planning. According to the Commission, the Package complements and reinforces the OECD's BEPS project so that certain BEPS measures can be effectively and smoothly implemented within the Single Market. 3

As stated in an accompanying "Factsheet" on the Anti-Tax Avoidance Package, 4 the Package is required because "corporate tax avoidance deprives public budgets of billions of Euros a year, creates a heavier tax burden for citizens and causes competitive distortions for those businesses that pay their share."

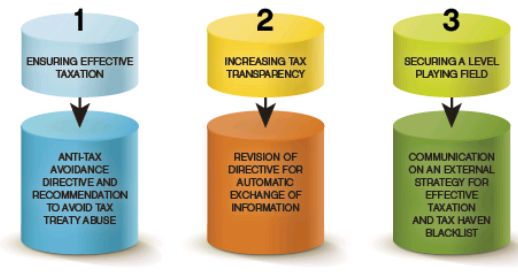

The Package is based on three core pillars: 5

The Commission aims to reach political agreement within the EU on the proposed Directives by May 25, 2016, at the next ECOFIN meeting, with effect from January 1, 2017. However, Directives require unanimous approval of the Member States. The requirement of unanimity is expected to result in some changes to the proposals and, in any case, will most likely delay the enactment past May and possibly postpone its effectiveness until 2018. Indeed, it is likely that certain EU Member States will oppose at least some of the proposals, as they may be viewed as potentially harmful to the investment climate for those countries as well as to their competitiveness both within and outside of the EU. Once approved, and especially once it is implemented into Member State law, the Package will have a significant impact on any tax planning and structuring involving EU companies and businesses operating within the European Union.

THE THREE PILLARS

Ensuring Effective Taxation in the EU: The Anti-Tax Avoidance Directive and Tax Treaty Recommendation

The first pillar of the Package is focused on ensuring that companies pay tax where they derive their profits. The Package includes (i) a proposal for an Anti-Tax Avoidance Directive, laying down legally binding rules against tax avoidance practices (the "Directive")6 as well as (ii) a Recommendation on the implementation of measures against tax treaty abuse (the "Recommendation")7 advising Member States on the best way to protect their double taxation conventions against abuse in a way that is compatible with EU law.

Anti-Tax Avoidance Directive. The Directive presents anti-tax avoidance rules in six specific areas. The proposed rules are specifically stated to be minimum standards that must be implemented into national law by each EU Member State. The Member States will then have the option to maintain or introduce more stringent rules.

The six key anti-avoidance measures are:8

- Interest Limitation: To discourage companies from creating artificial debt arrangements designed to minimize taxes. Interest limitation rules would circumscribe the amount of interest that a company can deduct, thereby generally increasing the amount of taxes paid. Under the Directive, interest would be deductible only up to the greater of 30 percent of an entity's tax-adjusted EBITDA or EUR 1 million. Interestingly (and no doubt of concern to taxpayers), the proposed Directive does not distinguish between intercompany debt and third-party debt. An exemption applies if the ratio of equity to total assets of the taxpayer exceeds the equivalent ratio of the group to which it belongs (and hence its debt–equity ratio is less than that of the group a whole), and a (temporary) exemption applies to financial undertakings, including banks and insurance companies. 9 A carry-forward mechanism is also provided for both excess EBITDA (unused absorption capacity) and excess (unused) interest expense.

- Exit Taxation: To prevent companies from relocating

assets purely to avoid taxation. Exit tax rules would

guarantee that Member States may impose tax on the value of an

asset before it is transferred outside the EU (or even within the

EU, even though that would then create a real impediment to the

freedom of establishment). The proposed Directive includes a

mandatory exit tax to be paid on the difference between the market

value of the assets less their value for tax purposes upon the

migration of a taxpayer (or upon a transfer of assets from or to a

permanent establishment of a taxpayer). However, payment of the

exit tax may be deferred by paying it in installments over a period

of at least five years if the acquirer of the asset is based in the

EU or EEA.

The exit tax would apply even if assets are moved to a jurisdiction where the tax rate is not (substantially) lower than in the State from which they are transferring. This is the case even though the rationale for this rule is to prevent taxpayers from moving assets around to take advantage of lower rates. (But of course there is also a goal of preserving each country's own tax base.) - Switch-Over Clause: To prevent double nontaxation of

certain income. A "switch-over" clause would

minimize the risk of double nontaxation by preventing Member States

from exempting dividends, capital gains, and income from a

permanent establishment if the source of the income has not been

properly taxed in the country of source. Pursuant to a switch-over

clause, EU Member States must apply a credit system instead of an

exemption with respect to (i) dividends and capital gains derived

from shares in a non-EU company, and (ii) income from a permanent

establishment in a non-EU country, if in either situation such

entities are subject to a statutory tax rate (as opposed

to the effective tax rate under the proposed CFC rule) that is less

than 40 percent of the tax rate in the EU country of residence. The

proposal applies regardless of the taxpayer's percentage

ownership interest in the dividend payor or company whose shares it

is selling.

It will already be evident that the implementation of mandatory switch-over clauses would particularly affect holding company jurisdictions with generous participation exemption regimes, including the UK, Luxembourg, and the Netherlands. - Controlled Foreign Company ("CFC") Rule: To deter profit shifting to no- or low-tax countries. CFC rules would be mandatory in all EU Member States. As a result, companies may still be able to shift their profits (always within the constraints of arm's-length transfer pricing, of course), but those profits would then be taxable in the EU. Effectively, the Commission aims to discourage such income shifting by reattributing the income of a passive, low-taxed controlled foreign subsidiary to its parent company back in the EU. The impact of such CFC legislation is to apply whenever the EU country equity interests, directly or indirectly, exceed 50 percent (of vote and/or value) in the hands of one parent company together with any of its affiliates if: (i) the effective tax rate is lower than 40 percent of the effective tax rate in the EU Member State where the parent company is resident; (ii) 50 percent of the income of the subsidiary is passive; and (iii) the principal class of stock of the CFC entity is not regularly (publicly) traded.

- General Anti-Abuse Rule ("GAAR"): To counteract aggressive tax planning when other rules do not apply: A GAAR would afford EU Member States the power to address artificial tax arrangements if other specific rules are not available to combat an otherwise perceived abuse. According to the proposed Directive, non-genuine arrangements (not put into place for valid commercial reasons), or a series thereof, carried out for the essential purpose of obtaining a tax advantage that defeats the purpose of the otherwise applicable tax provisions are to be ignored for the purposes of computing the corporate tax liability. The tax authorities are instead to impose tax on the basis of the real economic substance. Unlike the definition of "abuse" in ECJ case law (Cadbury Schweppes decision), 10 no reference is made to "wholly artificial arrangements to escape the national tax normally payable." Hence, this new GAAR would be implemented everywhere, risks being quite broad.

- Hybrid Mismatch Arrangements: To prevent companies from exploiting national mismatches to avoid taxation. With hybrid rules, mismatches (i.e., the fact that EU Member States treat the same income or entities differently for tax purposes) would be eliminated (or at least minimized), and tax deductions would be allowed in only one Member State, thereby ensuring effective taxation of all items of income at least somewhere. The Directive proposes that in the event of a mismatch, the legal characterization given to a hybrid instrument or entity in the Member State where a payment originates should be followed by the Member State of destination. This is similar to what is provided for in the so-called "Amended Parent–Subsidiary Tax Directive," 11 but it differs from what is proposed under BEPS. 12 The proposal applies to both hybrid instruments and hybrid entities. Notably, the proposal addresses only hybrid mismatches within the EU.

Tax Treaty Recommendation. The Commission has expressed concern that some companies avoid taxes by using so-called "tax treaty shopping," i.e., setting up artificial structures to benefit from the most favorable tax treatment under a range of tax treaties concluded with other Member States. 13 The Recommendation therefore advises EU Member States on how to reinforce their tax treaties against abuse by perceived "aggressive" tax planners in the following two EU-law-compliant ways: 14

- Introducing a general anti-abuse rule in their tax treaties (similar to what is recommended under BEPS), 15 based on a principal purpose test (actually termed the "essential purpose" of the transaction or series of transactions or of the structure); and

- Revising the definition of a "permanent establishment" ("PE") to tackle the artificial avoidance of the PE status, in line with the proposed new provisions in Article 5 of the OECD Model Tax Convention under BEPS. 16

Increasing Tax Transparency: Revising the Directive for Automatic Exchange of Information

The second core pillar aims at increasing transparency, which is seen as critical for identifying aggressive tax planning practices by multinational companies and to ensure fair tax competition. The Package includes a proposal to amend the Directive for Automatic Exchange of Information to ensure that key, tax-related information on multinationals operating within the EU is exchanged on a country-by-country basis between national tax administrations. This would provide all Member States with crucial information necessary to identify risks of tax avoidance and better target their tax audits. 17

Specifically, the parent company of a multinational group would have to collect tax-related information (revenue, profits before tax, taxes paid and accrued, the number of employees, the stated capital, the retained earnings, and tangible assets) for all of its subsidiaries, broken down per country. The parent company would then share this information with the tax authorities in the Member State where it is resident.

Member States would be obliged to automatically exchange reported information with other Member States concerned, giving all authorities the same complete picture and precluding cherry-picking. 18

The Commission has originally noted that public country-by-country reporting was still being considered. 19 Since the release of the Package, however, it appears that the Commission may present legislation as early as April 12, 2016, to provide for public country-by-country reporting, as has been strenuously advocated by various NGOs. 20

Securing a Level Playing Field: Communication on an External Strategy for Effective Taxation and a Tax Haven Blacklist

The third pillar focuses on securing the (in)famous ideal of a "level playing field." The Commission emphasizes that tax avoidance and harmful tax competition are global problems, and as such, actions to prevent them must extend beyond the European Union's borders. Also, developing countries should be included in an international tax "good governance" network to ensure that they can also benefit from the global fight against tax avoidance. The Package therefore contains a Communication on an External Strategy for Effective Taxation (the Strategy) 21 that aims at strengthening cooperation with third countries in the fight against tax avoidance, enhancing EU measures to promote fair taxation globally based on international standards, and creating a common approach to external threats of tax avoidance. The stated goal is to ensure a "fair" and "level playing field" for all businesses and countries. 22

The key measures included in the Strategy are: 23

- Updated tax "good governance" criteria;

- Tax clauses in international agreements;

- Assistance to developing countries on tax matters;

- Tax "good governance" conditions for the receipt of EU funding; and

- A new EU screening and listing process for countries that do not "play fairly."

With respect to the listing process, the Commission proposes a three-step process to reach agreement on an EU blacklist: 24

Step 1: The Commission will identify a set of third countries that may need to be screened using a neutral scoreboard of indicators.

Step 2: Member States should then decide which of these countries should be formally assessed by the EU, followed by a constructive dialogue with those countries selected for screening.

Step 3: After the assessment, the Commission will recommend which countries should be listed and why.

Member States will take the final decision on the identities of those third countries to be listed, but as soon as any such third country meets jointly agreed standards, it may be de-listed.

NEXT STEPS

According to the European Commission's Press Release25 regarding the Package, the two legislative proposals of the Package will be submitted to the European Parliament for consultation and to the Council for adoption. We understand that the Commission aims at reaching political agreement in this regard by May 2016, and that the Directives should become effective beginning in the 2017 fiscal year. 26 The Parliament and Council should also endorse the Tax Treaty Recommendation, and Member States should follow it when revising any of their existing tax treaties or negotiating new ones. Member States should also formally agree on the new External Strategy and decide on how to take it forward as quickly as possible once it has been endorsed by the European Parliament.

In addition to the proposals in the Package, the Commission continues to be active in what it views as illegal State aid granted by Member States via rulings. Much has already been written on this subject, both in the press and in other Jones Day Commentaries. The most recent Commission decision involves so-called "Excess Profit Rulings" issued by the Belgian Government to multinationals (both EU and U.S. in origin), which allow group companies to substantially reduce their tax liability in Belgium. The Commission has determined that this practice constitutes illegal State aid. Following this decision, Belgium should recover more than €700 million from the affected multinationals, even pending an appeal.

JONES DAY'S FIRST IMPRESSIONS (AND IS THIS A FORMULA FOR FAIR TAXATION?)

If formally approved and implemented, the Package will have a significant impact on cross-border tax planning. Perhaps most importantly, the news about the Package has generated concerns that the EU will become a less attractive place to do business. In addition, some of the proposed rules are highly technical and, as such, could trigger double taxation due to the risk of disparate implementation. If that occurs, then it would constitute quite the opposite of "fair" taxation.

In any case, certain Member States are likely to push back on some of the measures (e.g., the United Kingdom with respect to the CFC and interest limitation rules, Ireland on the exit taxation rules, and a number of Member States on the switch-over clause concept). As measures involving direct taxes still require unanimity among Member States, it is possible that parts of the Package will have to be scrapped or at least postponed. Or, it is conceivable that certain measures may nevertheless move forward after agreement by only a qualified majority under the "enhanced cooperation procedure." Otherwise, the European Commission might also move forward with a less ambitious package on which unanimity can be reached.

Yet another spanner may have been thrown in the works less than two weeks after the release of the Commission's Package, when Germany's highest court (the Bundesfinanzhof or "BFH") published its decision that the German "interest barrier" rule (which formed the model for the EU proposal to limit interest deductions) violates the fundamental right of equal treatment among taxpayers as well as the "principle of taxation of the net income." Under German Constitutional Law, the BFH had to submit the case to the German Constitutional Court (Bundesverfassungsgericht or "BVerfG") because only the latter has the power to void unconstitutional legislation. The BVerfG is not expected to render its decision on short notice and certainly not before the abovementioned May 2016 ECOFIN meeting, at which a vote on the proposed Directive is planned. And this might make the adoption of the Directive difficult for Germany, as it will be delicate, to say the least, for German lawmakers to incorporate a rule laid down in the Directive that they know the BVerfG might later declare to be void.

It is clear that the Commission anticipates criticism, as it has gone to great lengths to state that significant analysis and consideration has gone into the Package. It is also clear that timing is key, since some Member States have already begun to implement parts of the OECD's BEPS Action Plans in ways that may prove different from those adopted or to be adopted elsewhere. The EU therefore fears fragmentation of the Internal Market if it does not take its own measures now.

Footnotes

1.OECD, "Final BEPS package for reform of the international tax system to tackle tax avoidance," Oct. 2015.

2.European Commission, Press Release, Jan. 28, 2016, "Fair Taxation: Commission presents new measures against corporate tax avoidance."

3.European Commission, Jan. 28, 2016, "The Anti Tax Avoidance Package—Questions and Answers."

4.European Commission, Jan. 28, 2016, "Anti Tax Avoidance Package—Factsheet."

5.European Commission, Jan. 28, 2016, "The Anti Tax Avoidance Package—Questions and Answers."

6.See the Proposal for a Council Directive laying down rules against tax avoidance practices that directly affect the functioning of the internal market, Jan. 28, 2016, COM (2016) 26.

7.Commission Recommendation on the implementation of measures against tax treaty abuse, Jan. 28, 2016, COM (2016) 271.

8.See European Commission, Jan. 28, 2016, "Anti Tax Avoidance Package—Factsheet."

9.However, the Commission apparently intends to provide specific rules for financial and insurance sectors once the international rules are agreed.

10.C-196/04, Cadbury Schweppes plc & Cadbury Schweppes Overseas Ltd. v. Comm'rs of Inland Revenue, Sept. 12, 2006, European Court Reps. 2006 I-07995.

11.Council Directive 2014/86/EU of July 8, 2014 amending Directive 2011/96/EU on the common system of taxation applicable in the case of parent companies and subsidiaries of different Member States, OJ L 219 of July 25, 2014, p. 40.

12.See the Final Report on BEPS Action 2.

13.See European Commission, Jan. 28 2016, "The Anti Tax Avoidance Package—Questions and Answers."

14.See Commission Recommendation on the implementation of measures against tax treaty abuse, Jan. 28, 2016, COM (2016) 271.

15.See the Final Report on BEPS Action 6.

16.See the Final Report on BEPS Action 7.

17. See the European Commission, Press Release, Jan. 28 2016, "Fair Taxation: Commission presents new measures against corporate tax avoidance."

18.See the European Commission, Jan. 28, 2016, "Anti Tax Avoidance Package—Factsheet."

19.See European Commission, Jan. 28, 2016, "The Anti Tax Avoidance Package—Questions and Answers."

20.S. Marks & I. Traynor, "EU proposals will force multinationals to disclose tax arrangements" The Guardian, Feb. 7, 2016, 22:00 GMT.

21.See European Commission, Communication from the Commission to the European Parliament and the Council on an External Strategy for Effective Taxation, Jan. 28, 2016, COM (2016), 24.

22.See European Commission, Press Release, Jan. 28, 2016, "Fair Taxation: Commission presents new measures against corporate tax avoidance."

23.See European Commission, Jan. 28, 2016, "The Anti Tax Avoidance Package—Questions and Answers."

24.See European Commission, Jan. 28, 2016, "The Anti Tax Avoidance Package—Questions and Answers."

25.See European Commission, Press Release, Jan. 28, 2016, "Fair Taxation: Commission presents new measures against corporate tax avoidance."

26.It should be noted that whereas an EU Directive must first be transposed into national law by the Member States, there are complex "constitutional law"-type principles and jurisprudence as to when persons can nonetheless rely on or claim the benefit of an EU Directive, even if it has not yet been implemented (fully or properly) into national law. EU Regulations, by contrast, are self-executing.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.