THE IMPORTANCE OF ESTATE PLANNING

The goal of estate planning is to direct the transfer and management of your property in a way that makes the most sense for you and your family. While this may sound simple enough, it is only through careful planning that you can achieve this result. Without careful planning, your property may pass on your death to unintended beneficiaries or may be reduced unnecessarily by transfer taxes.

While planning for your death is a significant part of the planning process, estate planning addresses more than just the transfer of your assets upon your death. Your estate plan may also provide for the transfer of assets during your lifetime through gifts. In addition, prudent planning may involve planning for the current management of your assets in the event you become incapacitated or desire independent management of your assets as a matter of convenience.

There are a number of considerations that drive the estate planning process. Family considerations are important. For example, you must consider not only whom you want to receive your assets but when and how. Should your children receive their inheritance outright, or should it be managed for their benefit in trust? When should the trust terminate? Should your spouse be a beneficiary? Who should serve as trustee? Does a program of lifetime gifts make sense?

Perhaps just as important as the family considerations are the tax considerations. There are federal and state transfer taxes that apply to lifetime gifts and transfers at death. It is very important to understand the important tools available to minimize total transfer taxes.

The following is a summary of the basics of estate planning to introduce you to the techniques of estate and tax planning and help guide you through the planning process.

THE NEED FOR A WILL

Property that you own in your name alone and for which there is no beneficiary designation will pass at your death under the supervision of the Probate Court. Such property is often referred to as "probate" property. If you have a will, the terms of the will will control how your probate property is distributed. If you do not have a valid will at the time of your death, however, your probate property will pass as provided by state law (generally, to your spouse and your closest living relatives), which may not be what you want. Having a will, therefore, is the only way to ensure that your probate property will pass to the persons you choose. A will also ensures that you can choose the guardian for your children and the executor who will administer your estate.

Typically, your assets will not be limited to probate property. Assets such as life insurance and retirement benefits are controlled, not by your will, but by beneficiary designation. Similarly, property you hold as joint tenants with right of survivorship passes on your death to the surviving joint tenant without Probate Court involvement. In addition, assets held in trust will pass according to the trust's terms. It is very important, therefore, that you also carefully review how title to your so-called "non-probate" assets will pass in order to avoid having such property distributed to unintended beneficiaries at your death.

SUMMARY OF ESTATE AND GIFT TAXES

The federal government imposes a tax on the transfer of property by lifetime gift or at death. What follows is a summary of the transfer tax structure and current estate planning techniques that are appropriate based on current tax laws.

Estate and Gift Tax Exemption. The estate and gift tax exemption can be used to offset either lifetime gifts that exceed the $14,000 per person "annual exclusion" limit discussed below or transfers at death. Under current law, the total amount of lifetime and testamentary transfers (i.e., transfers at death) that may be excluded from tax is $5,450,000 in 2016. The amount excludable from federal gift tax is $5,450,000 in 2016. These amounts will be indexed for inflation in the future. The maximum estate tax rate is 40 percent.

It is important to remember that the proceeds of life insurance policies and employee benefit plans owned by you at your death, along with the family home, vacation home, investments and the like, are counted in determining the size of your taxable estate.

Marital Deduction. The estate tax laws also provide an unlimited marital deduction for transfers between spouses who are U.S. citizens, either by lifetime gift or at death. Thus, because of this unlimited deduction, all property can pass between spouses without estate or gift tax at the time of transfer, and estate tax becomes payable only when the surviving spouse dies. The marital deduction is available for outright gifts or bequests and may also be available for transfers in trust for the benefit of the spouse, provided that the trust complies with certain requirements and that the spouse is the sole income beneficiary for life. The trust can provide for principal to be available as well. Transfers to spouses who are not United States citizens are subject to certain limitations. For example, outright gifts to non-U.S. citizen spouses are capped at $148,000 in 2016 and indexed for inflation in future years. Transfers to a surviving spouse who is not a U.S. citizen require compliance with certain tax rules in order to qualify for the marital deduction.

Gift Tax Exclusions. You may give up to $14,000 each year (indexed for inflation) to as many individuals as you wish without any gift tax liability and without using any of your gift tax exemption. If your spouse joins in making the gift, the gift can be increased to $28,000. For the gift tax annual exclusion to apply, the recipient of the gift must have the ability to enjoy the gift presently, as in a direct gift of money. However, gifts in trust containing special language can also qualify. In addition to the $14,000 annual exclusion, payment of certain educational or medical expenses on behalf of someone else, when made directly to the institution providing the educational or medical services, is eligible for an unlimited exclusion from gift tax. Gifts that exceed the annual exclusion and otherwise do not qualify for the educational or medical exclusions are taxable gifts that will count against your $5,450,000 exemption.

TAX PLANNING FOR THE MARRIED COUPLE

Because of the unlimited marital deduction, you can leave all of your property to your spouse (or in a qualifying trust for your spouse) and postpone all federal estate tax until your spouse's death. At your spouse's death, however, all of the spouse's property in excess of his or her estate tax exemption amount will be subject to tax, meaning that the marital deduction does not eliminate, but only defers, the tax. If the combined estates of you and your spouse exceed the estate tax exemption amount, therefore, leaving all of your property to your spouse may result in unnecessary taxes that will reduce your children's ultimate inheritance. (As discussed below, any unused federal exemption from the estate of the first of a married couple to die can be used at the time of the survivor's death in many cases. For a variety of reasons, however, this "portability" is not as effective as ensuring that the first spouse to die makes full use of the available exemption, however.)

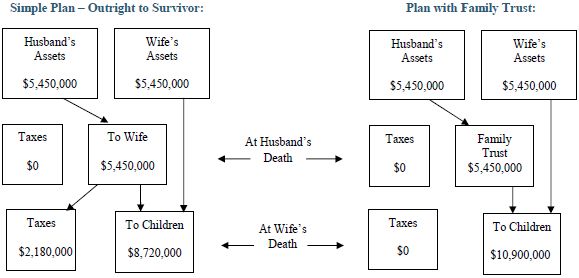

Example. Assume that each of you and your spouse has $5,450,000 in assets. Let's further assume that both you and your spouse die in 2016 (when the exemption amount is $5,450,000 per person). If you predecease your spouse and your will leaves your entire estate to your spouse, the marital deduction will shelter the distribution to your spouse from federal estate tax at your death. However, at your spouse's death, your spouse will have $10,900,000 (ignoring appreciation in the assets) and will only be able to shelter $5,450,000 from tax, leaving an estate of $5,450,000 subject to tax. The tax on that $5,430,000 will be $2,180,000, and $8,720,000 will ultimately be available for the children. (This example ignores the effect of state estate taxes and so-called "portability, both of which are discussed further below.)

Using the Estate Tax Exemption of Both Spouses. Rather than leave all property directly to your spouse, you can provide that property in an amount equal to your available estate tax exemption be held in a so-called "Family Trust," of which your spouse is a beneficiary. The Family Trust is not subject to estate tax at your spouse's death.

Example. Using the same assumptions as above, assume your estate plan provides for a Family Trust. At your death, the Family Trust is funded with $5,450,000 and your exemption from estate tax shelters the property. At your spouse's death, your spouse's taxable estate will be $5,450,000, which will be fully sheltered from estate tax.

A sound estate plan for a married couple with combined assets in excess of their respective estate tax exemptions will involve planning with a Family Trust. In this way, you can ensure that your property is available to your spouse (and children) during the spouse's lifetime. Moreover, the assets of the Family Trust will be distributed on the spouse's death as specified in the trust instrument, which could include continuing trusts for your children if appropriate. If outright distributions to the children (or partial distributions at certain ages) are desired, the trust agreement can so provide. In addition, the trust may permit the surviving spouse to control the disposition of the trust assets through the exercise of a power to direct the disposition of the trust property. This is called a "power of appointment" and can provide desirable flexibility.

The following chart compares the distribution and tax implications of leaving your estate directly to your spouse with the tax-efficient use of a trust to shelter your estate tax exemption amount (only federal estate taxes are reflected).

Using the Marital Deduction. If, at the time of your death, your assets exceed the estate tax exemption allocated to the Family Trust, the excess must qualify for the marital deduction if tax is to be avoided entirely at your death. In order to qualify the excess for the marital deduction, you must leave the excess either outright to your spouse or in a qualifying marital trust. There may be reasons why a trust would be preferable. For example, if you have children of a prior marriage, you may want to be able to direct where the marital deduction property will pass on your spouse's death. A marital trust may also be appropriate as a vehicle to assist your spouse with the investment and management of the trust property. A marital trust may be necessary to avoid estate tax at your death if your spouse is not a U.S. citizen.

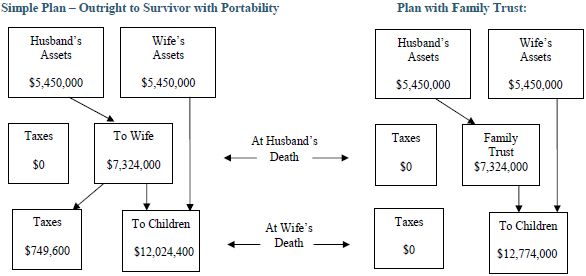

Portability. Beginning in 2011, if the estate of a married decedent does not use all available federal estate tax exemption, the unused federal exemption can be made available to the surviving spouse to be used for either lifetime gifts or as additional estate tax exemption. Thus, if each spouse has $5,450,000 in assets and a simple will leaving all property to the survivor, the survivor's estate will have the full $10,900,000 in federal exemption available and no federal estate tax will be due. However, this so-called "portability" of the federal estate tax exemption is not a substitute for proper planning for a number of reasons.

First, portability does not include any allowance for asset appreciation between the time of the first death and the time of the survivor's death. Using the example above, if the property transferred from the first to die to the survivor appreciated at an annual rate of 3% for the ten years between the first death and the survivor's death, the value of that property would have increased to $7,324,000 by the time of the survivor's death but the additional unused exemption available to the survivor would be only $5,450,000. This means that the $1,874,000 of property appreciation would be taxed at the survivor's death. However, if the first to die's estate plan caused a trust to be funded with that $5,450,000, that property plus all appreciation during the survivor's lifetime would escape estate tax at the survivor's death.

The following chart compares the distribution and federal estate tax implications of leaving your estate directly to your spouse with portability to the tax-efficient use of a trust to shelter your estate tax exemption amount.

In addition, portability only applies to the federal estate tax exemption and not to any applicable state estate tax exemption or to the generation-skipping transfer (GST) exemption, as explained in more detail below.

Finally, portability is only available for the unused exemption of a decedent's most recently deceased spouse. If a surviving spouse remarries and is widowed a second time, only the second spouse's unused exemption is available to the survivor's estate and the first spouse's exemption is lost.

State Estate Tax Consideration for the Married Couple. Most states traditionally patterned their estate taxation scheme on the federal estate tax. Today, many states, including Florida, no longer have a state estate tax. Some states, including Connecticut, New York, Massachusetts and New Jersey, among others, have changed their estate tax laws so that the exemption from state estate tax is less than (and, in some cases, considerably less than) the federal exemption (although New York's exemption will match the federal exemption beginning January 1, 2019). For a resident of such a state (or a resident of any state who owns real property in such a state) with a traditional estate plan designed to avoid estate tax at the death of the first spouse by optimizing use of the federal marital deduction, there will be no federal tax due at the death of the first spouse, but there could be state tax due if the federal and state estate tax exemptions are different at the time of the first death. For example, a New Jersey resident dying in 2016 with a taxable estate of $5,450,000 would owe $444,800 in New Jersey estate tax at his death.

As noted earlier, portability does not apply to state estate taxes. Thus, a married couple from New Jersey who chooses to leave all property outright to each will have effectively "wasted" the first-to-die's $675,000 New Jersey estate tax exemption.

By using a plan that maximizes use of federal and state exemption amounts, it may be possible to defer both state and federal tax until the survivor's death. For residents of states like Massachusetts (and Connecticut in certain circumstances) that recognize independent state-only marital deductions, this permits deferral of all estate taxes until the survivor's death. For residents of other states, it may make sense to pay state estate tax at the first death to avoid paying substantially more federal tax at the second death. In some cases, it may be possible to use portability to capture unused federal exemption while deferring state taxes.

Having a plan that affords maximum flexibility to respond to a variety of competing tax considerations is important. In addition to the estate tax considerations described above, another factor to consider is how sheltering property in trust may affect income taxes. When a surviving spouse dies, property subject to federal estate tax in the survivor's estate receives a step-up in basis to the property value as of the survivor's date of death, meaning that previous appreciation will escape capital gains tax. This step-up does not apply, however, to property that has been sheltered from federal estate tax in a trust. Sheltered property may therefore escape estate tax but any appreciation on that property from the time of the first death to the death of the survivor will be subject to capital gains tax when the property is sold. As the difference between the estate tax rates and capital gains tax rates narrows, this consideration becomes increasingly relevant.

LIFETIME GIVING

In addition to planning for the disposition of property at death, estate planning can include consideration of lifetime giving to remove assets from your estate. If your estate exceeds the estate tax exemption and estate tax will likely be due on your death (or on the death of you and your spouse), lifetime gifts may substantially reduce that tax. As noted above, you are entitled to give so-called "annual exclusion" gifts up to $14,000 each year to as many persons as you like without gift tax implications. You and your spouse may together give up to $28,000 to as many persons as you like. A gift program that operates over a number of years may produce significant transfer tax savings by removing both the gifted property from your taxable estate as well as the appreciation on that property after the gift. To the extent your gifts exceed the annual exclusion, however, such gifts will be taxable and will reduce your gift tax exemption (although no federal gift tax will need to be paid until you have exhausted your gift tax exemption). You should also be aware Connecticut (but not New York, New Jersey or Massachusetts), imposes its own gift tax on lifetime transfers in excess of the annual exclusion. The Connecticut gift tax permits a $2,000,000 exemption for lifetime gifts but, like the federal tax, any such gifts will reduce the amount that can pass free of estate tax at death.

Children and grandchildren are frequent recipients of gifts. When they are minors, care must be taken in structuring the gifts. You may wish to make such gifts to an adult acting as custodian for the minor under the state's Uniform Transfers to Minors Act. Typically, the custodian may retain the gift for the minor's benefit until such person reaches age 21, when it must then be turned over. It is also possible to use trusts for minors that are designed to facilitate giving to minors and to postpone the complete distribution of the gifted assets until the recipient reaches a later age.

To read this Guide in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.