The CFTC has now implemented many of the requirements applicable to swaps under Title VII of the Dodd-Frank Act.1 In contrast, substantially all of the SEC's rules under Title VII regulatory security-based swaps are not yet effective. However, the SEC has issued various proposed and final (but not yet effective) rules and indicated its "anticipated" sequencing of the relevant compliance dates. In addition, the SEC has issued various proposed and final rules pertaining to the cross-border application of such rules. Set forth below is an overview of (i) the current status of the SEC's implementation of Title VII requirements applicable to security-based swaps and (ii) the SEC's cross-border framework, as it currently exists, for the regulation of security-based swaps.2

I. Status of SEC Implementation

On June 11, 2012, the SEC issued the "Statement of General Policy on the Sequencing of the Compliances Dates for Final Rules Applicable to Security-Based Swaps" (the "General Statement"), in which the SEC articulated its "anticipated" sequencing of the implementation of the Title VII requirements applicable to security-based swaps. The General Statement categorized the Title VII SEC requirements into the following five categories:

- Definitional Rules (i.e., the definitions of "security-based swap" and "security-based swap dealer") and Cross-Border Rules.

- Reporting Requirements (i.e., registration and regulation of swap data repositories, and reporting and public dissemination of security-based swap transaction data).

- Mandatory Clearing (i.e., the mandatory clearing of security-based swap transactions, clearing agency standards, and the end-user exception from mandatory clearing).

- Security-Based Swap Dealer Registration (i.e., the registration and regulation of security-based swap dealers).

- Trade Execution Requirement (i.e., the trade execution requirement for security-based swaps that are required to be cleared and the registration and regulation of security-based swap execution facilities).

The General Statement then addressed how the compliance dates of the foregoing requirements should be sequenced. Set forth below is a summary of (i) the sequence contemplated in the General Statement and (ii) relevant actions (summarized below in italicized text) that, subsequent to the General Statement, the SEC has taken to date.

First, the General Statement provided that the Definitional Rules should be the earliest Title VII rules adopted and effective. The relevant Definitional Rules were published in the Federal Register on May 23, 2012 and August 13, 2012.3

Second, the General Statement provided that the Cross-Border Rules should be proposed (but not necessarily finalized) after the adoption of the Definitional Rules but before any other Title VII rules are effective. The proposed Cross-Border Rules were published in the Federal Register on May 23, 2013.

Third, the General Statement provided that the Reporting Requirements should become effective following the issuance of the final Definitional Rules and the proposed Cross-Border Rules. Final rules applicable to (i) reporting and public dissemination of security based swaps (i.e., Regulation SBSR) and (ii) the registration and regulation of security-based swap data repositories were both published in in the Federal Register on May 19, 2015. Pursuant to such final rules, a security-based swap data repository must register with the SEC and comply with applicable requirements starting on March 18, 2016. The compliance schedule under Regulation SBSR has not yet been finalized; however, the proposed compliance schedule provides that reporting obligations and public dissemination requirements with respect to a particular asset class of a security-based swap will go into effect six months and nine months, respectively, after a security-based swap data repository commences operations for that asset class.

Fourth, the General Statement provided that each of (i) Mandatory Clearing, (ii) Security-Based Swap Dealer Registration, and (iii) the Trade Execution Requirement should become effective only after the final Reporting Requirements are in place.

- Regarding Mandatory Clearing, the General Statement provided that no "clearing determination" should be made by the SEC with respect to any asset class of security-based swap until the later of (i) the compliance date of certain rules applicable to "clearing agencies," (ii) the compliance date of the end-user exception from the clearing requirement, and (iii) certain SEC determinations generally regarding requirements applicable to broker-dealers involved in the clearing of security-based swaps.

- Regarding Security-Based Swap Dealer Registration, the General Statement provided that security-based swap dealers should be given an appropriate amount of time to determine whether registration is required and to come into compliance with the various related requirements. Final rules regarding the registration of security-based swap dealers were published in the Federal Register on August 14, 2015. However, the compliance date for registration will not take place until after certain fundamental rules applicable to security-based swap dealers (including business conduct standards and capital, margin, and segregation) are finalized. Swap dealing activity that occurs more than two months prior to such compliance date will not count toward an entity's de minimis threshold.

- Regarding the Trade Execution Requirement, the General Statement provided that such requirement, with respect to any security-based swap that is required to be cleared, should not be triggered until (A) the SEC finalizes standards for determining when a security-based swap has been "made available to trade" on an exchange or security-based swap execution facility, (B) the SEC has determined that the relevant security-based swap has been "made available to trade," and (C) such determination has become effective.

II. SEC Cross-Border Framework to Date

Enumerated below are certain significant proposed and final rules that the SEC has issued to date pertaining to the cross-border regulation of security-based swaps.

- May 23, 2013: Proposed cross-border security-based swap rules. This proposed rule addressed the SEC's cross-border application of Title VII holistically in a single proposing release, rather than in a piecemeal fashion. In finalizing these requirements, however, the SEC will issue (i) certain final cross-border rules and guidance in the adopting releases for the relevant substantive requirements and (ii) other final cross-border rules and guidance in separate rulemakings.

- August 12, 2014: Final security-based swap cross-border definitional rule. This final rule focused on: (i) the application of the de minimis exception to Security-Based Swap Dealer Registration in the cross-border context; and (ii) the procedure for submitting "substituted compliance" requests.4 Additionally, the final rule provided the definition of "U.S. person." It is expected, and the final rule suggests, that subsequent rulemakings generally will use this same "U.S. person" definition.

- March 19, 2015: Final reporting and public dissemination rule (Regulation SBSR). This final rule contains provisions generally governing the cross-border application of the substantive requirements set forth therein.

- May 13, 2015: Proposed rule relating to security-based swaps arranged, negotiated, or executed in the United States. This proposed rule focused on: (i) the application of the de minimis exception to the dealing activity of a non-U.S. person carried out, in relevant part, by personnel in the United States; (ii) the application of Regulation SBSR to such transactions; and (iii) the cross-border application of the external business conduct requirements to the foreign business and U.S. business of a registered security-based swap dealer.

- November 30, 2015: Prudential regulators' final margin rules. The prudential regulators' final margin rules contain provisions generally governing the cross-border application of the substantive requirements set forth therein.5

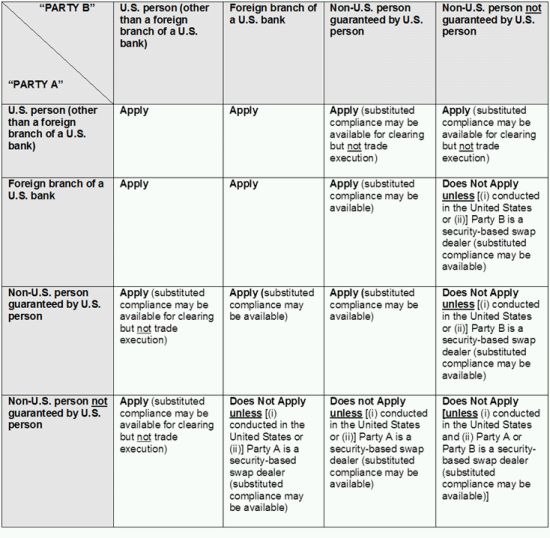

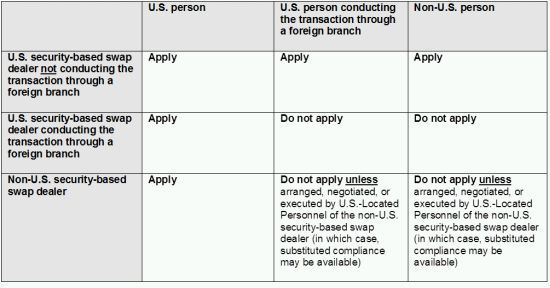

The proposed and final rules enumerated above, in combination, establish a cross-border framework, which is, in part, summarized by the following tables. Specifically, the tables below summarize, at a high, general level, the cross-border application of the following requirements: (i) mandatory clearing and trade execution; (ii) the external business conduct standards applicable to security-based swap dealers; (iii) security-based swap reporting and public dissemination; and (iv) the calculation of de minimis threshold from security-based swap dealer registration. Additionally, table (v) provides the SEC's "U.S. person" definition alongside, for comparison purposes, the CFTC's "U.S. person" definition. These summary tables are subject to change when, among other events, any of the proposed rules on which they are based become finalized.

(i) Mandatory clearing and trade execution requirements

The SEC's May 13, 2015 proposed rule relating to security-based swaps arranged, negotiated, or executed in the United States suggests that, under future rulemakings, the bracketed language in the table above may cease to apply.6

(ii) External business conduct standards

"Conducted through a foreign branch," as used in the table above, means that (A) the foreign branch is the counterparty to the transaction and (B) the transaction is arranged, negotiated, and executed on behalf of the foreign branch solely by persons located outside the United States.

(iii) Security-based swap reporting and public dissemination

Substituted compliance may be available if at least one of the counterparties is either a non-U.S. person or a foreign branch of a U.S. person.

Notwithstanding the above table, reporting and public dissemination requirements will apply to a security-based swap, regardless of the counterparties, if the transaction is:

- accepted for clearing by a clearing agency having its principal place of business in the United States;

- executed on a platform having its principal place of business in the United States;

- effected by or through a registered broker-dealer; or

- connected with a non-U.S. person's security-based swap dealing activity that is arranged, negotiated or executed by U.S.-Located Personnel.

(iv) Calculation of de minimis threshold

In applying the de minimis threshold, a counting entity (whether a U.S. person or a non-U.S. person) must aggregate its swap dealing transactions with the swap dealing transactions of any of its affiliates (in each case applying the cross-border framework set forth in the table above) that are not registered security-based swap dealers.

(v) "U.S. person" definition

Footnotes

[1] "Security-based swap" generally means a derivative the payments of which are based on variables that are closely tied to the major categories of securities that are regulated by the SEC under Title VII of the Dodd-Frank Act, including swaps based on a single equity or debt security, single name credit default swaps (CDS), or swaps based on narrow-based security (i.e., nine or fewer) indexes. Title VII provides, as additional examples: total return swaps referencing a single security or loan; total return swaps referencing a narrow-based index of securities; OTC options for the purchase or sale of a single loan, including any interest therein or based on the value thereof; equity variance or dividend swaps referencing a single security or narrow-based index of securities; single-name CDS; and CDS referencing a narrow-based index of securities.

[2] For purposes of simplicity, this overview will not address "major security-based swap participants" and the Title VII requirements applicable thereto, which are similar to, and in many cases identical to, the Title VII requirements applicable to security-based swap dealers.

[3] Further Definition of "Swap Dealer," "Security-Based Swap Dealer," "Major Swap Participant," "Major Security-Based Swap Participant" and "Eligible Contract Participant", 77 Fed. Reg. 30,596 (May 23, 2012); Further Definition of "Swap," "Security-Based Swap," and "Security-Based Swap Agreement"; Mixed Swaps; Security-Based Swap Agreement Recordkeeping, 77 Fed. Reg. 48,208 (August 13, 2012).

[4] Specifically, a security-based swap dealer that engages in a "de minimis" quantity of swap dealing activity qualifies for an exception from registration as a security-based swap dealer. Under current "phase in" levels: (i) for credit default swaps, only those entities and individuals who transact $8 billion or more worth of credit default swap dealing transactions over the prior 12 months initially have to register as security-based swap dealers; and (ii) for other types of security-based swaps, the level is $400 million.

[5] These margin rules apply to a security-based swap dealer only if it is governed by at last one of the prudential regulators (i.e., a security-based swap dealer that is a bank); the SEC's margin rules, which apply to non-bank security-based swap dealers, have not yet been finalized. The prudential regulators' final margin rules are summarized in a posting in the current Derivatives in Review (available here).

[6] Application of Certain Title VII Requirements to Security-Based Swap Transactions Connected With a Non-U.S. Person's Dealing Activity That Are Arranged, Negotiated, or Executed by Personnel Located in a U.S. Branch or Office or in a U.S. Branch or Office of an Agent, 80 Fed. Reg. 27,445 (May 13, 2015) ("[W]e are not proposing to subject transactions between two non-U.S. persons to the clearing requirement (and, by extension, to the trade execution requirement) on the basis of dealing activity in the United States, including transactions that are arranged, negotiated, or executed by personnel located in a U.S. branch or office. . . . [W]e now preliminarily believe that we should not impose the clearing requirement on a security-based swap transaction between two non-U.S. persons where neither counterparty's obligations under the security-based swap are guaranteed by a U.S. person, even if the transaction involves one or more registered foreign security-based swap dealers.").

[7] "Conduit affiliate" is defined as "a person, other than a U.S. person, that: (A) Is directly or indirectly majority-owned by one or more U.S. persons; and (B) In the regular course of business enters into security-based swaps with one or more other non-U.S. persons, or with foreign branches of U.S. banks that are registered as security-based swap dealers, for the purpose of hedging or mitigating risks faced by, or otherwise taking positions on behalf of, one or more U.S. persons (other than U.S. persons that are registered as security-based swap dealers or major security-based swap participants) who are controlling, controlled by, or under common control with the person, and enters into offsetting security-based swaps or other arrangements with such U.S. persons to transfer risks and benefits of those security-based swaps." Application of "Security-Based Swap Dealer" and "Major Security-Based Swap Participant" Definitions to Cross-Border Security-Based Swap Activities, 79 Fed. Reg. 47,278 (August 12, 2014).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.