The Federal Trade Commission (FTC) has issued an administrative complaint challenging the proposed combination of Advocate Health Care Network (Advocate) and NorthShore University Health System (NorthShore) in the Chicago area as a violation of both FTC Act Section 5, which prohibits unfair methods of competition, and Clayton Act Section 7, which prohibits mergers that may substantially lessen competition. The FTC, joined by the Illinois Attorney General, also filed a complaint in federal district court in Chicago seeking a temporary restraining order and preliminary injunction to prevent Advocate and NorthShore from consummating their merger pending completion of the FTC's administrative trial on the merits of the transaction. The FTC alleges that the transaction would combine two close competitors to create the largest hospital system in northern Cook County and southern Lake County, Illinois, with control of 55 percent of the general acute care inpatient hospital admissions in that area.

This is the third hospital merger complaint filed by the FTC in six weeks, which is likely a function of the timing of the transactions and the FTC's completion of its investigations rather than a signal of a more aggressive enforcement environment, since the FTC has only formally challenged three hospital mergers in 2015. The complaint against Advocate and NorthShore generally follows the FTC's playbook from prior complaints, but the parties' alleged combined market share and the post-merger market concentration are the lowest of the hospital merger challenges brought by the FTC in recent years.

Summary of Administrative Complaint

Parties and Transaction

Advocate owns and operates 11 general acute care and a two-campus children's hospital in Illinois. Five of these hospitals are located in Cook County and two are located in Lake County. Advocate employs approximately 1,375 physicians and contracts with an additional 3,825 independent physicians through Advocate Physician Partners, a clinically integrated managed care contracting network. NorthShore owns and operates four general acute care hospitals—three of which are located in northern Cook County and one of which is located in southern Lake County. NorthShore employs approximately 900 physicians and participates with an additional 1,200 independent physicians in a program of clinical integration.

The parties entered into a definitive agreement in September 2014 for the Advocate parent corporation to become the sole member of Northshore and change its name to Advocate NorthShore Health Partners. The Advocate parent corporation is already the sole member of the Advocate hospital corporation, so the parent would be the sole member of both the Advocate hospital corporation and NorthShore.

Relevant Markets

The complaint asserts that the relevant product market is general acute care inpatient services sold and provided to commercial payors and their insured members. Inpatient services are alleged to include the cluster of general medical and surgical diagnostic and treatment services offered by general acute care hospitals, and exclude complex and specialized tertiary and quaternary services (e.g., some major surgeries and organ transplants).

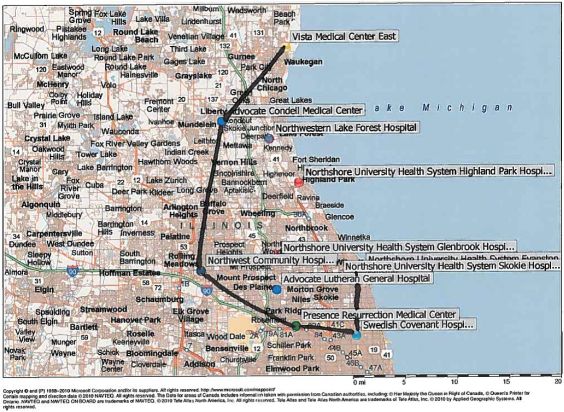

The FTC alleges that the relevant geographic market in which to assess competitive effects of the combination of Advocate and NorthShore is an area in northern Cook County and southern Lake County bounded by six hospitals—NorthShore Evanston Hospital in Evanston in Cook County to the east, Swedish Covenant Hospital in Chicago in Cook County to the southeast, Presence Resurrection Medical Center in Chicago in Cook County to the south, Northwest Community Hospital in Arlington Heights to the southwest, Advocate Condell Medical Center in Libertyville in Lake County to the northeast and Vista Medical Center East in Waukegan in Lake County to the northeast (North Shore Area). The complaint states that five other hospitals are located in the North Shore Area—NorthShore's three other hospitals, Advocate Lutheran General Hospital and Northwestern Lake Forest Hospital. The FTC claims that the North Shore Area substantially overlaps with the area that NorthShore's ordinary course documents identify as NorthShore's primary service area, comprised of 51 ZIP codes.

Market Share and Anticompetitive Effects

The FTC argues that the merging parties are close, if not each other's closest, competitors. The merging parties would own six of the 11 hospitals in the geographic area alleged in the complaint. The FTC asserts that the merging parties are the two largest providers, by admissions, of general acute care inpatient hospital services in the North Shore Area and, combined, would control 55 percent of general acute care hospital inpatient admissions. The next closest competitor, Northwest Community, would draw only 15 percent of admissions and no other competitor would draw more than 9 percent of admissions, according to the FTC. The FTC characterizes the transaction as presumptively unlawful under their Horizontal Merger Guidelines, since the transaction will create a highly concentrated market with 3,517 points and an increase in 1,423 points.

The FTC cites the parties' ordinary course documents and "diversion analysis," which the FTC describes as a "standard economic tool to determine the extent to which hospitals are substitutes," to argue that the parties are close—if not each other's closest—competitors. The FTC states that health care consumers in the North Shore Area strongly prefer that their networks include at least one of the merging parties. The FTC asserts that the elimination of competition between the merging parties would result in increased bargaining leverage with payors and higher reimbursement rates. Further, the FTC alleges, the growth of narrow networks will increase the merged system's bargaining leverage as narrow networks marketed to North Shore Area consumers will need to include the combined system post-closing. The FTC also alleges that the parties have engaged in quality and service competition, and that the merger would eliminate the parties' incentive to continue to engage in that type of "non-price" competition.

Entry & Efficiencies

The FTC argues that hospital entry would not be likely, timely or sufficient to counteract the anticompetitive effects of the transaction. That allegation is buttressed by the fact that Illinois still has Certificate of Need laws that can prevent or delay entry by new hospital competitors or expansion by existing competitors in the market.

The complaint states that the parties argue that their transaction would generate sufficient cost savings to enable them to participate in a low-price, ultra-narrow network. The FTC rejects the parties' argument on grounds that the parties have neither substantiated the claimed cost efficiencies nor demonstrated that their willingness to participate in that network is merger-specific. The complaint alludes to other claimed efficiencies, but similarly dismisses them as speculative, not merger-specific, or insufficient to offset the transaction's likely competitive harm.

Key Implications

Relevance of the Prior Litigation

This is the second time the FTC has challenged a hospital transaction involving NorthShore (formerly Evanston Northwestern Healthcare Corporation). In 2004, the FTC filed an administrative complaint challenging NorthShore's acquisition of Highland Park Hospital in 2000. In that action, the administrative law judge (ALJ) ruled in favor of the FTC, and ordered NorthShore to divest Highland Park Hospital. The full Commission affirmed liability, but ordered an alternative remedy. Under the FTC's final order in that case, NorthShore is required to contract separately with payors for the services of Highland Park Hospital unless payors elect otherwise.

On the same day that the FTC filed the administrative complaint challenging the Advocate-NorthShore transaction, the merging parties issued a press release stating their intent to defend their proposed merger against the FTC allegations. NorthShore will do so as it continues to defend itself against a private action stemming from its earlier acquisition of Highland Park Hospital. In December 2013, a federal district court judge granted class action status to a group of plaintiffs alleging that NorthShore's acquisition of Highland Park Hospital enabled it to raise rates to anticompetitive levels in violation of federal antitrust laws (the underlying allegation in the FTC's post-consummation challenge to the Evanston Northwestern-Highland Park Hospital transaction). At stake are treble damages and attorneys' fees. Should the class prevail on its claim, the merged Advocate-North Shore would be responsible for that liability.

Change in Geographic Market Definition

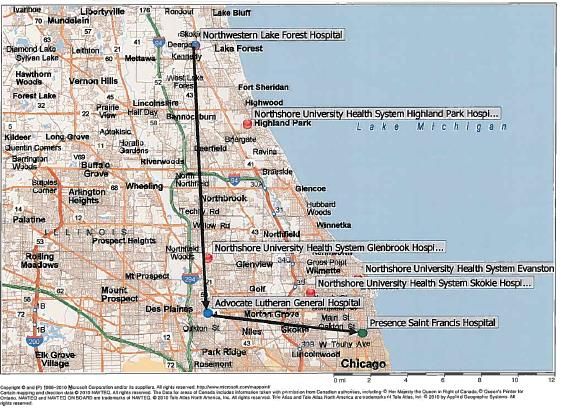

The FTC's alleged geographic market differs somewhat from the geographic market in the FTC's prior successful challenge of NorthShore's acquisition of Highland Park Hospital. In the earlier litigation, the FTC defined the geographic market for purposes of analyzing the competitive effects of NorthShore's acquisition of Highland Park Hospital as the triangle formed by NorthShore's then-three hospitals (NorthShore subsequently acquired Rush North Shore Hospital in Skokie in Cook County, a transaction the FTC did not formally challenge). As a result, in addition to NorthShore's now four hospitals, the FTC found that the geographic market included Lake Forest Hospital in Lake Forest in Lake County (now part of Northwestern Medicine), Advocate Lutheran General in Park Ridge in Cook County and Presence St. Francis Hospital in Evanston in Cook County. The following is a map showing the geographic area in the prior FTC challenge:

In contrast, the relevant geographic market alleged in the FTC's current complaint includes Advocate Condell Medical Center (to the northwest), Northwest Community Healthcare Hospital, Swedish Covenant Hospital, and Presence Resurrection Medical Center (all on the southern end of the geographic market), but excludes Presence St. Francis Hospital (which is located in-between Northshore Evanston Hospital and Swedish Covenant Hospital). The following map shows the alleged geographic area in the current FTC challenge:

This case is noteworthy because it is the first case in recent years to challenge a hospital merger in a major metropolitan area; most challenges have occurred in non-urban markets characterized by four or fewer competing hospitals or systems (e.g., Toledo, Ohio; Rockford, Illinois; Harrisburg, Pennsylvania; Huntington, West Virginia; Reading, Pennsylvania). Moreover, there are no "natural barriers" (such as a river, mountain range, major expressway) that impact the relevant geographic market definition in this case. That said, the FTC's alleged geographic market in this case is consistent with its long-standing policy of defining markets as narrowly as possible, which has the tendency to increase the potential anticompetitive effects likely to result from a transaction.

Efficiencies

The FTC's continued challenge of hospital merger transactions involving close competitors—and the FTC's categorical rejection of efficiencies claimed by the merging parties—remains an obstacle to health care providers seeking to adapt to the changing health care financing environment. While the FTC points to examples of alternative arrangements among collaborators to undercut the argument that competitors need to merger in order to achieve the benefits of collaboration, the underlying business reality for many health systems simultaneously seeking to remove costs and improve quality is that the most efficient and cost-effective way to achieve that result is by a merger, not a limited-purpose joint venture. Because the burden of proving that claim shifts to the parties in transactions that violate the FTC's Horizontal Merger Guidelines, which all recent hospital merger challenges have, it is difficult for the parties to disprove the FTC's theory.

The FTC's Failure to Challenge the Transaction's Combination of Physicians

Interestingly, the FTC did not challenge the transaction's combination of employed physician groups. Although the complaint cites the number of Advocate and NorthShore's employed and contracted physicians, it does not break those numbers down by physician specialty or estimate the parties' post-merger share of any market for physician services. In light of the FTC's intervention in the litigation in Boise, Idaho, involving St. Luke's acquisition of a large multi-specialty physician group, that is an interesting omission from its complaint in this case.

FTC Challenges Chicago-Area Health System Combination

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.