- within Insolvency/Bankruptcy/Re-Structuring and Family and Matrimonial topic(s)

- with Finance and Tax Executives

With global merger activity and enforcement on the rise, the current regulatory environment presents complex challenges to transacting parties. In this client alert, we summarize recent developments in jurisdictions that may affect your next deal.

CHINA: STREAMLINING THE MERGER REVIEW PROCESS

Recent reforms to remove the mandatory pre-notification consultation process, coupled with the new simplified filing procedure, signal that China's Ministry of Commerce ("MOFCOM") is focused on improving the efficiency of its merger review process. Since China's Anti-Monopoly Law took effect in August 2008, MOFCOM's Anti-Monopoly Bureau has reviewed over 1,100 transactions (almost 250 cases in 2014 alone), has cleared the vast majority of these transactions without any conditions, and has intervened in a small number of deals:

- Requiring remedies in only 24 deals

- Blocking only 2 deals

However, MOFCOM's review process has been criticized for being unduly long, burdensome and inefficient. As an example, MOFCOM approved Glencore International's acquisition of Xstrata with conditions in late April 2013, more than a year after the parties notified the deal to MOFCOM, nine months after the deal received antitrust clearance from regulators in the U.S. and Australia, and five months after the European Commission approved the deal subject to conditions.

Elimination of Mandatory Pre-Notification Consultation Process: On September 15, 2015, in an effort to shorten the duration of merger reviews, MOFCOM eliminated its Consultation Division, along with its formal pre-notification consultation period. The Consultation Division had been responsible for reviewing notifications for completeness prior to MOFCOM's official acceptance of a case. The pre-notification review created two significant inefficiencies that extended the merger review process. First, there was no statutory time limit for this stage. The back-and-forth consultation between the parties and MOFCOM could take two months or more. Second, once MOFCOM accepted a filing, the case would pass from the Consultation Division to a different review team, who had had no prior involvement in the case.

New Case Review Teams: In place of the Consultation Division, MOFCOM has created three case teams who will review transactions from filing through the end of the review period. Like the U.S. merger review process, each case team will focus on specific industries, enabling the staff to gain industry expertise.

Simplified Review Process for Non-Complex Deals: The simplified procedure, announced in February 2014, sets forth a streamlined review process for transactions that are unlikely to raise competitive concerns. Most notified cases should fall into this category. The agency's stated goal is to clear simple cases during Phase I review, i.e., within 30 days. This would be a substantial improvement, as MOFCOM's data shows that only a minority of merger cases are completed during the initial 30-day Phase I review and it is not uncommon for MOFCOM to extend Phase II review (already 90 days) of foreign deals by an additional 60 days—meaning that even uncomplicated deals can take up to six months from filing to clearance.

Transactions Qualifying for Simplified Procedure:

- Off-shore joint ventures with no activities in China;

- Changes from joint to sole control of a joint venture (except where sole parent and JV compete in same market); or

- Transactions where the parties:

-

- Have a combined market share of less than 15%; and

- Each has market shares of less than 25% if they are active in any vertically related or neighboring markets.

Bottom Line: These procedural changes are welcome, but MOFCOM's Anti-Monopoly Bureau continues to be severely understaffed—it has only 30 officials, 15 of which are engaged in case review. Even with pre-notification consultation out of the picture, it still can take four to six weeks for MOFCOM to formally accept a merger filing. While parties may see some benefits from these procedural reforms, they may not see a significant reduction in the review timeline anytime soon.

EUROPE: INCREASE IN MERGER NOTIFICATIONS AND PHASE II CASES

As the European Competition Commissioner, Margrethe Vestager observed, there has been an "M&A boom" since November 2014.1 As of September 30, 2015, 247 mergers have been notified to the Commission in 2015 and an additional 18 cases from the member states have been referred to the Commission by the notifying parties or a national competition authority.

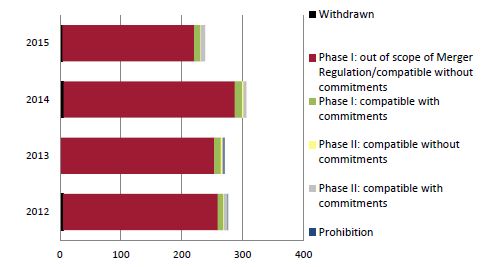

The chart on the following page summarizes EC merger activity over the past four years:2

Some notable trends:

- In 2014 and 2015, approximately 70% of the cases handled in Phase I have been subject to the simplified notification procedure, in which parties submit a reduced notification because the transaction is unlikely to raise competition concerns.

- More cases have been subject to extended Phase II reviews:

- Eight cases in 2014 (about 2.6% of notified cases in 2014) and nine cases in 2015 (as of September 30, 2015) (about 3.6% of notified cases in 2015).

- In 2014, the Commission cleared 17 cases with remedies (about 5.6% of notified cases in 2014); 12 such cases during Phase I (about 4% of notified cases in 2014) and the other 5 cases during Phase II (about 1.7% of notified cases in 2014).

- As of September 30, 2015, the Commission had requested commitments in 17 cases (about 6.9% of notified cases in 2015); ten such cases during Phase I (about 4% of notified cases in 2015) and the other seven cases during Phase II (about 2.8% of notified cases in 2015).

- No mergers were prohibited during 2014 and 2015, and only ten cases were withdrawn by the merging parties during this timeframe.

UNITED STATES: RECENT FINES FOR HSR VIOLATIONS UNDERSCORE AGGRESSIVE FEDERAL ENFORCEMENT

Within the past two months, the U.S. Federal Trade Commission ("FTC") has brought three enforcement actions for violations of the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the "HSR Act") and has imposed fines totaling almost $1 million. Each of these violations involved the acquisition of a minority interest in a business. Two of the cases involved the improper application of HSR exemptions and the third case involved a second inadvertent failure to notify.

Improper Use of Passive Investor Exemption: On August 24, 2015, the FTC announced it had reached a settlement with Third Point LLC and its three managed hedge funds (collectively, "Third Point"), for failure to file notification under the HSR Act for multiple acquisitions of Yahoo! voting stock in 2011. Third Point asserted it was a "passive investor"; therefore, its acquisitions were exempt from HSR reporting.

The "passive investor" exemption provides that a person may acquire up to 10% of the voting stock of a company without triggering an HSR reporting requirement, provided that the acquirer does not intend to influence the basic business decisions of the company or to participate in its management.

The FTC deems the following actions to be inconsistent with "passive investor" status:

- nominating a candidate to the board;

- proposing corporate action requiring shareholder approval;

- soliciting proxies;

- having a controlling shareholder, director, officer, or employee serving simultaneously as an officer or director of the target;

- being a competitor of the target; or

- doing any of the foregoing with respect to any entity that directly or indirectly controls the target.

The FTC alleged that Third Point could not claim "passive investor" status because of conduct that was inconsistent with the exemption, including:

- Contacting individuals to gauge their interest in becoming the CEO or board member of Yahoo!;

- Taking steps to assemble an alternate slate of board of directors;

- Writing to Yahoo! to inform that Third Point was prepared to join the board;

- Internally deliberating the possible launch of a proxy battle for directors of Yahoo!; and

- Making public statements that Third Point was prepared to propose a slate of directors at Yahoo!'s next annual meeting.

The settlement imposes a five-year injunction on Third Point's use of the passive investor exemption. Consistent with its "one free pass" policy, the FTC declined to impose a monetary fine on the basis that the violation was inadvertent and short-lived and Third Point had not previously violated the Act.

Improper Use of Institutional Investor Exemption: On September 22, 2015, the FTC settled with Leucadia National Corporation ("Leucadia") for its failure to file HSR notification in connection with the conversion of its interest in Knight Capital Group (held by its subsidiary, Jeffries, LLC) into approximately 13.5% of the voting stock of KCG Holdings, Inc. ("KCG"), with a value of approximately $173 million. Leucadia relied on the "institutional investor" exemption, which states that acquisitions by institutional investors are exempt from HSR reporting if:

- the acquisition is made in the ordinary course of business for the purpose of investment;

- the acquirer will not hold more than 15% of the outstanding voting shares; and

- the target is not an institutional investor of the "same type" as the buyer.

Leucadia asserted that Jeffries and KCG were not the same type of institutional investors, alleging that Jeffries was a "broker-dealer," whereas KCG was not. The FTC disagreed and imposed a fine of $240,000 on Leucadia for its failure to file in violation of the Act. In its press release, the FTC acknowledged that Leucadia had relied upon the advice of counsel, but imposed a fine because this was Leucadia's second HSR violation.

Second Violation for Failure to Notify Results in Fine: On October 6, 2015, the FTC reached a settlement with investor Len Blavatnick to pay $656,000 in penalties for failure to notify his acquisition of shares of TangoMe. In August 2014, Mr. Blavatnick, through his company, Access Industries, had purchased approximately 29.1% of the voting stock of TangoMe, valued at $228 million. Four months later, he submitted a corrective filing to notify the acquisition of TangoMe stock. In imposing the fine, the FTC noted that Blavatnick had failed to consult HSR counsel, notwithstanding his prior commitment after a previous HSR violation, to institute effective HSR compliance procedures.

BRAZIL REQUIRES NOTIFICATION OF "ASSOCIATIVE AGREEMENTS"?

Companies doing business in Brazil should be aware that Brazil's mandatory pre-merger control regime may require notification of exclusive distribution agreements and other non-merger transactions that do not trigger reporting obligations in the U.S., the EU or any other pre-merger control regimes.

In November 2014, Brazil's Council for Economic Defence ("CADE") issued new rules (effective January 5, 2015) clarifying that an "associative agreement" between parties that meet the turnover thresholds must be reported and approved under the Brazilian merger control law prior to implementation where:

- The parties meet the requisite financial thresholds (one party having annual gross sales of 750 million reais or higher, and another having annual gross sales of 75 million reais or higher);

- The agreement is for a period of more than two years; and

- The parties are horizontally related and their combined share of the relevant market is at least 20 percent; or

- The parties are vertically related, and one of the parties holds market share of at least 30 percent in the relevant market, and the agreement contains exclusivity obligations or profit-sharing clauses.

To date, CADE has reviewed very few associative agreements:

- In at least five instances, CADE found that the notified transaction did not meet the criteria for merger control review.

- Several notified associative agreements have been approved without conditions (e.g., a distribution agreement for pesticides, and an exclusive bottling, distribution, and marketing agreement for soft drinks).

Recognizing that it is highly unusual to require notification of non-merger agreements prior to implementation, CADE has indicated that it is open to discussing its interpretation of "associative agreements" and to consult with practitioners to determine whether a filing is required.

Footnotes

1 Speech of March 12, 2015, published on the website of the European Commission – http://ec.europa.eu/commission/2014-2019/vestager/announcements/thoughts-merger-reform-and-market-definition_en.

2 Statistics on merger cases, published on the website of the European Commission – http://ec.europa.eu/competition/mergers/statistics.pdf.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.