- within Litigation, Mediation & Arbitration, Criminal Law and Technology topic(s)

- with Inhouse Counsel

- with readers working within the Retail & Leisure and Securities & Investment industries

SELECT COMPLIANCE DEADLINES AND REMINDERS

Summary Annual Report ("SAR") Deadline for Calendar Year Defined Contribution Plans

Plan administrators must distribute SARs to participants and beneficiaries within nine months of the plan's year end. For plan years that end December 31, the SAR is due September 30, 2015. If the plan received an extension for filing Form 5500, the deadline for providing SARs is extended by two months.

Summary Report for Multiemployer Defined Benefit Plans

Multiemployer defined benefit plans must provide a summary report to participating unions and contributing employers within 30 days of the deadline for filing the Form 5500. The summary report must contain information such as benefit formulas and other financial information.

Form 5500 Filing Deadline for Calendar Year Plans with Extensions

For plan administrators of calendar year plans that filed Form 5558 to obtain an extension for filing Form 5500, Form 5500 must be filed by October 15, 2015.

GENERAL BENEFIT PLAN DEVELOPMENTS

Department of Labor ("DOL") Guidance Regarding Classification of Workers as Employees

The Administrator of the DOL Wage and Hour Division issued Administrator's Interpretation No. 2015-1, providing guidance regarding the classification of workers as employees vs. independent contractors. The Administrator's Interpretation confirms that the term "employee" is broad and includes most workers under the Fair Labor Standards Act. Thus, employers should exercise caution in classifying workers to ensure that their independent contractors are not classified erroneously. In the event that employees are misclassified as independent contractors, the employer may need to reevaluate whether newly classified employees affect various requirements that apply to its benefit plans.

RETIREMENT PLAN DEVELOPMENTS

Securities and Exchange Commission ("SEC") Proposed Regulations Regarding Compensation Clawback

On July 1, 2015, the SEC issued a proposed rule that would require public companies to implement clawback policies to recover incentive-based executive compensation that was paid in error. The proposed rule would require a company that must prepare an accounting restatement to correct a material error that affected a financial statement, to recoup the erroneous compensation received in the three-year lookback period prior to the due date of the accounting restatement.

Required Minimum Distribution Lump-Sum Payments

On July 9, 2015, the Internal Revenue Service ("IRS") issued Notice 2015-49, advising that the IRS plans to amend the required minimum distribution regulations so that qualified defined benefit plans generally may not replace annuities of retirees in pay status with a lump sum or other accelerated payment. Generally, qualified plans must begin paying a required minimum distribution by April 1 of the calendar year following the later of the year in which the employee turns 70-1/2 and the year in which the employee retires. Some defined benefit plan sponsors have conducted lump sum payment windows to allow retirees who are in pay status to convert their annuity to a lump sum. The amendments to the required minimum distribution regulations would generally prohibit future plan amendments that allow acceleration of current annuity payments. Notice 2015-49 provides that the amended regulations will apply as of July 9, 2015, but will not apply to amendments allowing retirees in pay status to elect to convert their benefit to a lump sum if those amendments were adopted before July 9, 2015. Notice 2015-49 also carves out other circumstances in which such a lump-sum option may be acceptable, such as if it was approved by the IRS or was communicated to participants prior to July 9, 2015.

Reduced Determination Letter Program

On July 21, 2015, the IRS announced substantial changes to the determination letter program for qualified retirement plans due to limited resources. Previously, plan sponsors were able to apply for determination letters every five years to confirm that the plan complied with the requirements in the Internal Revenue Code. Effective January 1, 2017, the determination letter program will eliminate the five-year remedial amendment cycles for individually designed plans and will be limited to initial qualification and qualification at termination. However, plan sponsors of Cycle A plans will be able to apply for determination letters from February 1, 2016 through January 31, 2017. The IRS and the Department of the Treasury will determine other limited circumstances in which a plan sponsor may apply for a determination letter.

The announcement also provides that, as of July 21, 2015, the IRS will not accept off-cycle applications for determination letters unless they are for new plans or terminating plans. Although the determination letter program will be limited, the IRS is looking at ways to help plan sponsors meet qualification requirements, which may include providing model amendments.

Defined Contribution Annuity Selection Safe Harbor

The DOL issued Field Assistance Bulletin 2015-02 ("FAB") to provide guidance to defined contribution plan fiduciaries regarding compliance with the annuity selection safe harbor. Generally, the safe harbor for annuity selection requires that fiduciaries thoroughly and objectively search for providers, consider sufficient information to assess the provider's ability to make payments, appropriately assess the cost, appropriately determine at the time of selection that the annuity provider is financially capable of making payments, and discuss the decision with an expert if necessary. The FAB clarifies that "the prudence of a fiduciary decision is evaluated with respect to the information available at the time the decision was made—and not based on facts that come to light only with the benefit of hindsight." The DOL confirmed that it will assess a plan fiduciary's decision regarding annuity providers based on the information available when the selection was made and at all periodic reviews. Periodic review of the annuity provider may be required if the fiduciary knows of a "red flag" regarding the provider, but the DOL advised that a plan fiduciary is not required to review the provider every time a participant elects an annuity.

HEALTH AND WELFARE PLAN DEVELOPMENTS

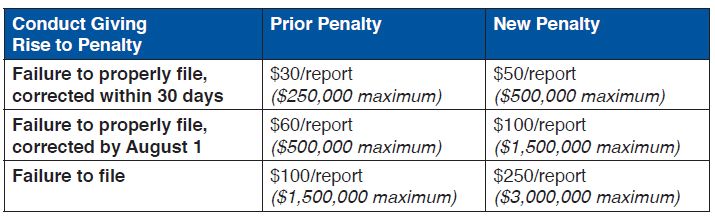

Increased ACA Reporting Penalties

The new Trade Preferences Extension Act of 2015 increases the penalties for failing to file ACA reporting forms with the IRS or failing to provide the forms to employees. To avoid penalties for errors, employers must demonstrate that they acted in good faith to comply with reporting requirements. The chart below compares some of the new penalties to the prior penalties.

Final Rules on Contraception Services

The Department of Health and Human Services ("HHS"), DOL and the Department of the Treasury published final rules regarding the requirement to provide certain preventative services. Religious employers and nonprofit organizations that hold themselves out as religious organizations, oppose providing contraceptive services based on religious objections and provide self-certification that they meet the regulatory requirements to their third-party administrator ("TPA") or HHS may be exempt from the requirement to provide contraception services.

In addition to religious organizations and nonprofits, certain closely held for-profit entities may also be exempt from the contraception services requirement if they meet several requirements regarding ownership and objections to contraceptive coverage. The for-profit entity must not be publicly traded and must have an ownership structure in which five individuals or less own more than 50% of its value or must have a substantially similar ownership structure. The for-profit entity's highest governing body must adopt a resolution stating that it objects to covering contraceptive services because of the owner's "sincerely held religious beliefs," and the organization must provide self-certification that it meets the regulatory requirements to HHS or its TPA. A for-profit entity may, but is not required to, send a letter to describe its ownership structure to HHS to confirm that it qualifies as an eligible organization.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.