Healthcare not-for-profit corporations, or NFPs, and other organizations typically own significant real estate assets, the value of which often cannot be efficiently realized through monetization, particularly if the properties' values continue to appreciate.

Real estate investment trusts, or REITs, have been used by companies as a preferred vehicle to monetize real estate assets and access the capital markets. In this article we discuss why healthcare NFPs in particular may benefit from using the REIT structure, and further discuss other potential viable structures including master limited partnerships, or MLPs.

About REITs

A REIT is a corporation, trust or association that primarily

invests and holds real estate assets.

The primary benefit of the REIT structure is that it is not subject

to U.S. federal corporate income taxes, and in most cases, state

corporate income taxes, provided it distributes at least 90% of its

taxable income annually to shareholders. Because of this benefit,

public REITs create an attractive opportunity for the investment

community.

Why use a REIT structure for not-for-profit organizations?

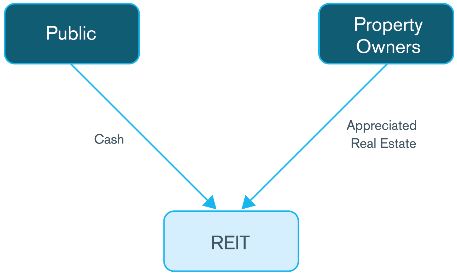

Although NFPs would not gain any additional tax benefits from using a REIT structure, it could be used as a method to tap into markets to which the NFPs may not otherwise have had access, thereby receiving a public multiple on the real estate assets without losing their non-profit status. Furthermore, the portion of the REIT that is public (as 100% of a REIT's stock need not be publicly-traded), the fair market value of the REIT's property portfolio is updated every day the shares are traded. Because of the restrictions imposed by state laws governing NFPs, NFPs are generally restricted from raising funds on the capital markets, denying them the public company multiple and excluding them from the potential proceeds that can be received by offering securities for sale to the public. Forming a REIT that will offer and sell its equity securities to the public and then using the proceeds of that offering to purchase the NFP's real property assets could allow the NFP to realize the value of its real estate holdings and create liquidity for those investments without losing its NFP status.

Certain considerations of using a REIT

REITs are subject to myriad tax rules which will need to be considered in the context of each NFP's particular circumstances. For example, in order to comply with the REIT tax rules, healthcare REITs' operating hospitals and other health care facilities must lease the property to a taxable corporate subsidiary known as a "taxable REIT subsidiary" (TRS) in exchange for rent provided that the TRS hires an unrelated eligible independent contractor to manage the operations for a management fee. The rental income derived by the REIT can be structured to be qualifying income for REIT tax purposes. As a result of the REIT structure, NFPs will relinquish significant control over their real property assets.

There also are parameters around the ownership structure for REITs such as closely held ownership rules. However, IRS guidance indicates that a REIT may be owned primarily by a Section 501(c)(3) tax-exempt organization such that the sponsoring NFP would be able to retain control over management.

MLP formation as a viable alternative

An alternative to REIT formation is an MLP, which is a similar structure whereby assets can be owned in an entity with publicly traded securities that are treated as a flow-through entity for tax purposes and therefore pays no taxes at the partnership level. According to IRS regulations, 90% of the gross income of an MLP must be "qualifying." Qualifying income includes many activities related to the extraction of natural resources such as development, mining, production, refining and transportation. Real property rents (and income from the sale of real property) also qualify.

An MLP is typically formed by a sponsor (e.g. a health system) who becomes the General Partner ("GP"). Securities called "units" are sold publicly to Limited Partners ("LPs") (e.g. hospitals, foundations, physicians, investors, etc.). The GP makes all decisions about the operation of the business as defined by the Partnership Agreement. This gives the GP effective control over the assets with potentially little ownership. The simplified structure looks like this:

The partnership agreement serves as the mechanism to contractually define the relationship between the GP and LPs.

There are several key characteristics of MLPs that may make the structure worth consideration:

- Control. Because of the GP/LP structure, a sponsor can effectively maintain operational control of the assets while still monetizing them.

- Distribution of Cash. Unlike a REIT, the requirement to distribute dividends is governed by the partnership agreement and not by regulation. Typically MLP partnership agreements are drafted to maintain some flexibility to fund contingency or other reserves.

- Stable Cash Flows. The typical MLP investor is interested in the income characteristics of the MLP distributions with the most stable businesses commanding premium valuations.

- Growth. In addition to a stable distribution, most MLPs also have attractive growth characteristics. Many sponsors hold back a significant amount of assets when forming an MLP so that they can fuel future growth at the MLP via accretive acquisitions from the sponsor. A large "dropdown" backlog is viewed very positively by investors.

- Unrelated Business Taxable Income (UBTI). UBTI is a concept in the tax rules that make UBTI over $1,000 taxable to a tax-exempt organization. Because the MLP's income "flows through" to its GP and LP owners, an NFP could end up paying taxes that it otherwise wouldn't. The overall MLP structure can address this issue but needs to be considered upfront.

Comparing sale/leasebacks

NFPs and health systems historically have opted for sale/leaseback transactions to monetize their non-core real estate portfolio, taking advantage of attractive capital markets conditions. A real estate investor will typically require a long-term lease, with fixed or inflation-pegged annual increases in the lease rate to generate an investor's required rate of return. However, post-transaction, some executives feel trapped as rising rents are often hard to sustain in an era of declining reimbursements. Moreover, once the properties are sold, the former owner no longer partakes in the rising market value of the properties, losing potential upside. A recent example of this dynamic involves a large and reputable owner-operator of nursing homes across the US. They sold the properties to a leading health care REIT and signed a long-term lease that included aggressive rent escalations, in exchange for an attractive purchase price. A few years into the lease, amidst a challenging operating environment, the operator's net income no longer covered the contractual rent payments. Luckily, the REIT was willing to revise the lease rates in exchange for other conditions, but not all situations have an amicable ending. This potential lack of flexibility in revising lease terms, the clash between cultures of the property management firm and their physician tenants, or even altering once-limited capital maintenance and expansion rights are drivers behind the NFP's "seller's remorse". REIT or MLP formation allows organizations to retain control over their property leases and management, and captures any increases in market value over time through the constant update in fair market value either of these vehicles allow.

One option is to structure a REIT or MLP either as an affiliate of the NFP organization, or as a partnership with other NFPs with a similar mission (e.g. two regional health systems can form a multi-billion dollar REIT). From this standpoint, the real estate value will be updated to fair market at point of REIT or MLP formation, with the former owners dictating lease rates and terms. Moreover, unlike a sale/leaseback, the publicly-traded portion of a REIT or MLP (e.g. REIT can list 10% of its shares on a public exchange) can access capital from a variety of sources – including retail investors, institutional funds or foreign entities – and use this capital for new acquisitions, development or routine maintenance. These capital raises can even be periodic, fueling the the organization's need for facilities growth over time. A REIT or MLP can employ a property management/maintenance team, acquisitions and development team, and/or finance department that are dedicated to the operations of the REIT or MLP, thereby retaining control over quality of staff and outcomes. The separation of a real estate portfolio and its management from corporate operations typically advances efficiency and best practices.

Conclusion

Forming a REIT or MLP to hold an NFP's real property is a potential way for an NFP to raise funds in the capital markets and enjoy a potential public company multiple without risking its non-profit status or losing control over its real estate assets. While there are potential risks and structuring considerations to take into account, boards and management of NFPs should at least consider the viability of a REIT or MLP structure when considering long-term real estate management and financing strategies.

Previously published by Becker's Hospital Review

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.