Introduction

A common issue that arises when structuring a corporate acquisition of a public company is that a tax-sensitive shareholder of the target corporation (T) requires tax-free treatment while the remaining shareholders do not. For example, assume that an acquiring corporation (P) seeks to purchase T (which has fair market value of $100), that 60 percent of the T stock is widely held by the public and that 40 percent of T is owned by a single family or individual (Individual). P would prefer to acquire all of T for cash, and the public shareholders may generally be indifferent to tax considerations (e.g., where T stock is held primarily by tax-exempt pension funds), but Individual demands tax-free rollover treatment of his/her T shares. This article addresses four methods for structuring P's acquisition of T to achieve taxable treatment for the public and tax-free treatment for Individual. In the discussion below, P and T are domestic corporations, but a similar analysis frequently applies when P and T are foreign.

Reorganization Under Section 368(a)(1)(A)

The simplest structure from a U.S. federal tax perspective for providing Individual with tax-free rollover treatment under the scenario presented above is a reorganization under section 368(a)(1)(A) (an "A" reorganization) of the Internal Revenue Code. The A reorganization can be accomplished through a direct statutory merger of T into P or a merger of T into a disregarded entity or subsidiary of P. In order for the reorganization to be tax-free, at least 40 percent of the value of the total consideration paid to T shareholders must be in the form of P stock (the "continuity of interest" requirement). Thus, T can merge directly into P, with the T shareholders collectively receiving a total of $40 of P stock and $60 of cash.

In the example above, all tax objectives will be achieved if the $40 of P stock can be directed to Individual (who will receive tax-free rollover treatment on the exchange of T stock for P stock) and the $60 cash can be directed to the public T shareholders. Depending on the jurisdiction, securities and corporate law may or may not prevent P from effectively ensuring that the public receives solely cash and Individual receives solely the P stock. For example, certain states permit the P stock to be offered to shareholders that tender the most T stock (i.e., Individual). Other jurisdictions impose stricter protections for public shareholders, which may necessitate P offering potentially costly financial incentives to obtain the necessary cooperation from the T shareholders.

Meeting the 40 percent continuity of interest requirement can also pose practical issues. The parties will typically want to negotiate the major economic terms of the reorganization, but fluctuations in the value of T or P before closing can impact whether the amount of P stock and cash intended to be delivered at closing will actually meet the 40/60 ratio on that date. Treasury regulations provide a helpful "signing date" rule for measuring continuity of interest that allows the parties to agree to an exchange ratio that satisfies the 40/60 test when the original merger agreement is signed (so that subsequent value fluctuations do not disqualify the merger on the closing date). However, the signing date rule can prove difficult to satisfy, particularly where disparate consideration must be offered to different groups of T shareholders (as described above).

The 'Double Dummy' Structure

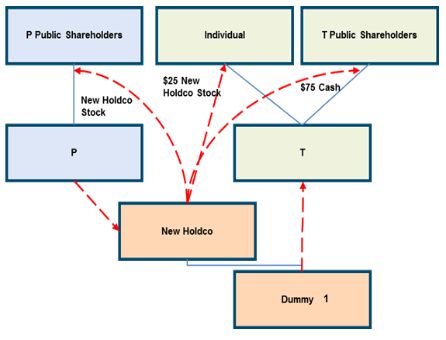

A second structure for combining P and T with tax-free rollover treatment is known as the "double dummy" structure. In a double dummy structure, P may acquire T using a larger percentage of cash consideration than 60 percent because the transaction is not geared to satisfy the requirements of an A reorganization, but rather the more flexible requirements for a tax-free section 351 exchange. Note that section 351(a) provides that a transfer of property (including stock) to a corporation in exchange for stock will be tax-free if one or more transferors own at least 80 percent of the stock (within the meaning of section 368(c) of the transferee corporation immediately after the exchange (the "control" requirement). The double dummy structure thus commonly is used when P seeks to issue more than 60 percent cash in the exchange (e.g., where Individual owns only 25 percent of T and P wants to purchase the remaining 75 percent of T for cash).

A double dummy structure involves P or T forming a new holding corporation (New Holdco), which in turn forms two wholly owned merger subsidiaries (the "double dummy" corporations). Dummy One merges into P (the P merger) and Dummy Two merges into T (the T merger), with P and T each surviving the merger as wholly owned subsidiaries of New Holdco. In the P merger, the P shareholders receive solely New Holdco stock in exchange for their P stock; in the T merger, Individual receives $25 of New Holdco stock and the T public shareholders receive $75 cash in exchange for their T stock.

Because T and P survive the reverse mergers, the transitory existence of the dummy corporations is disregarded for federal tax purposes and the transaction is treated as if the P and T shareholders transferred their stock to New Holdco in exchange for New Holdco stock (or $75 cash in the case of the T public). Treating the reverse mergers as stock transfers ensures that there is no risk of a corporate level tax on the assets of P and T. In addition, the P and T stock exchanges are designed to qualify for tax-free treatment at the shareholder level under section 351. That is, the shareholders of P and Individual constitute a section 351 "control group" who own in the aggregate 100 percent of the stock of New Holdco following the exchanges. Thus, the P shareholders and Individual should each obtain tax-free treatment under section 351(a).

As stated above, this structure is frequently useful for a merger of equals where Individual owns less than 40 percent of T or the continuity of interest requirement is otherwise difficult to satisfy. Drawbacks of this structure include the fact that the P shareholders generally must participate in and vote for the exchanges (although under Delaware law, the vote by P shareholders can sometimes be avoided) and that P, which may be a much larger publicly traded company than T, will end up as a subsidiary of a new public holding company. If it is undesirable for P to become a subsidiary of New Holdco, the "single dummy" structure (discussed below) is a viable alternative.

The 'Single Dummy' Structure

A single dummy structure is a variation of the double dummy structure where P merges directly into New Holdco rather than becoming a subsidiary of New Holdco, thus enabling P's business to continue in the top-tier public company. In a single dummy structure, P forms New Holdco and New Holdco, in turn, forms a single new subsidiary (Dummy One). Dummy One then merges into T, with T surviving as a wholly owned subsidiary of New Holdco. Here, the T public receives $75 of cash and Individual receives $25 of New Holdco stock. Immediately after T's merger, P merges into New Holdco, with New Holdco surviving and the P shareholders receiving New Holdco stock. Once again, the combination of T and P into New Holdco is designed to qualify as an overall section 351 exchange, so that Individual can obtain rollover treatment, but the technical tax analysis differs slightly. Specifically, Individual and P will be considered co-transferors in a section 351 exchange, with Individual obtaining section 351 treatment and the P shareholders obtaining tax-free reorganization treatment under section 354.

To reach a good comfort level for a single dummy acquisition, it is important that (i) the transaction be structured so that the merger of P into New Holdco cannot qualify as a reorganization under section 368(a)(1)(F) (which is achieved by completing the T merger before the P merger), and (ii) the incorporation of New Holdco or the P merger achieves some business objective beyond satisfying section 351 (which is usually the case).

Convertible Stock

A fourth alternative is for P to form a new subsidiary (S) with cash and cause S to acquire the T stock. In this alternative, S buys out the T public shareholders with the cash and acquires Individual's T stock in exchange for S stock; P and Individual are treated as co-transferors in the section 351 exchanges with S, with Individual obtaining tax-free treatment. Although Individual will initially hold a less liquid minority interest in S stock, Individual will also be given a conversion right so that he/she can exchange the S stock for a more liquid interest in P's publicly traded common stock after a period of time (e.g., one year after the acquisition).

Due to the issues presented by the conversion feature, this structure is less desirable, but it has been used when the alternatives listed above are not workable (for example, News Corporation acquired all of the shares of Dow Jones & Company using this structure in 2007). Crucially, the subsequent conversion of S stock into P stock will be a taxable exchange for Individual. Other planning considerations also should be kept in mind when structuring the transaction (e.g., the S stock should participate to some extent in corporate growth to avoid potential concerns under section 351(g)) in order to successfully defer the recognition of Individual's gain until the time of conversion.

Thus, while this structure has the advantage that P does not have to merge or be contributed to a holding company, the additional tax complexities of the conversion arrangement mean that the tax treatment is somewhat less assured.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.