Operators will likely refrac more oil and gas wells this year and further accelerate such activity in 2016. The reason is simple: substantial bang for CAPEX bucks. A recent study by engineers from SPE and Baker Hughes estimates that Bakken oil wells can be refraced for $1.8 million apiece – roughly ¼ of what it currently costs a top operator to drill and complete a new well. Yet the Bakken refracs in the study increased recoverable reserves by an estimated 69 percent and boosted production by 7.55 times relative to the pre-refrac level. Meanwhile, Eagle Ford wells can be refraced for $2.8 million apiece – about ½ a top operator's average completed well cost. The Eagle Ford refracs reviewed in the study boosted production by an average factor of 7.26 relative to the pre-refrac production level and increased estimated recoverable oil reserves by 53 percent.

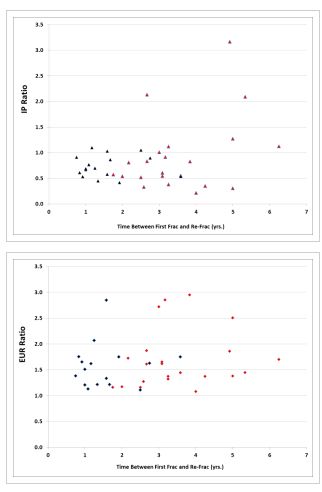

Equally profound, the study showed "no discernible correlation" between the amount of time a well has produced and the post-refrac performance metrics: In essence, even "young" wells may in fact be prime refrac candidates. Exhibit 1 shows the performance of refraced Bakken and Eagle Ford wells relative to well age. The performance metrics shown are the ratio of initial production ("IP") post-refrac to initial production after the initial fracturing job, and the increase in estimated ultimate recovery ("EUR").

Exhibit 1: Even "Young" Wells Can Make Excellent Refrac Candidates

Red marker=Bakken wells, Black marker=Eagle Ford wells

Source: SPE-173340-MS, Author's Analysis

Readers will notice a relatively narrow horizontal band in which the majority of results fall virtually regardless of the well's age when refraced: the average Eagle Ford well was 19 months old and the average Bakken well 42 months old. The fact that relatively new wells can still be economically viable refrac targets is important. Most analysts to date have viewed the Bakken and Eagle Ford as the primary locations for refrac potential because those plays are more mature – "older," if you will – than the Permian horizontal, Niobrara, South-Central Oklahoma Oil Province ("SCOOP"), and others that have come online more recently. Yet Eagle Ford wells that had been on production for as little as nine months still showed solid refrac performance – for instance, one well showed a recoverable reserves increase of 39 percent and production jump of 520 percent from pre-refrac levels. [6] This suggests that the pool of viable refrac candidates may be much larger, and span more basins, than previously thought. The study authors acknowledge that their work has some significant limitations – among them the fact that their search algorithm only captures success stories. Yet the trends amply reflected in the SPE study's data point to a much more positive outlook for the growth potential of refracing than the market consensus at present would suggest.

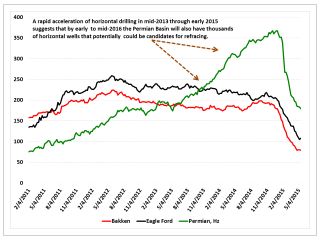

Oilfield services providers perceive this upside and are moving to embrace refracing. Schlumberger CEO Paal Kibsgaard noted on the company's 1Q2015 earnings call that "there are thousands of wells in North American land that are candidates for refracturing and this is both shale liquids and shale gas...this is quite a significant market opportunity."

Exhibit 2: Refracability of Newer Wells Suggests Significant Permian Basin Upside

Horizontal rig count, by selected basin

Source: Baker Hughes, Author's Analysis

Refracs Will Likely Become More Common as More Operators Perceive the Economic Benefits

To date, a number of key producers have expressed ambivalence about refracs. For instance, one large independent with strong positions in the Eagle Ford, the Bakken, and the Marcellus stated in its 1Q2015 earnings call that regarding refracs:

"We've looked at it and talked about it internally and we've not tried any refracs. Our outlook on that is that it really – technically, we believe that just drilling a new well and kind of starting fresh and making sure your lateral is in the very best target and making sure that you can redistribute the frac very evenly along the wellbore with the new well is probably the preferred way to go."[7]

Pioneer Natural Resources says it is conducting limited refracing in the Eagle Ford but that in its view there is presently "just not a lot of opportunity that we see that comes to mind where this is a no-brainer."[8] In essence, these operators appear to hesitate due to the potential opportunity cost of shifting capital and engineering focus from new well drilling and completions programs that have been very successful.

Nevertheless, the North American shale liquids production leaders may soon find their large inventories of potentially refracable wells an irresistible opportunity. CAPEX budgets have been slashed due to persistently low commodity prices, and further reductions could be coming if WTI crude prices do not recover to the $65 per barrel threshold. In addition, nontraditional incentives such as service company pilot programs, where the pressure pumper shares more risk with the producers and essentially gets paid out of the well's post-completion production – akin to a recovery-based contingent fee – may accelerate refracing activity.[9]

Gas Refrac Potential

Comstock Resources, a gas producer, announced in March that it plans to spend $23 million to refrac 14 wells in the Haynesville Shale.[10] Comstock reports that its first Haynesville refrac – the Pace #33 – cost $2 million and boosted the well's flowrate by a factor of eight and its flowing pressure by a factor of three. The company believes it can reduce costs of future refrac projects by 10 percent to 15 percent below the costs for the Pace #33 (i.e., $1.7 to $1.8 million per refrac). For comparison, drilling and fracing new wells in the Haynesville can cost from $6.3 million at the low end up to as much as $11 million for a well with a 10,000-foot lateral.[11]

Comstock estimates that with natural gas prices between $3.00 and $3.50 per thousand cubic feet, the refracs could yield internal rates of return as high as 40 percent to 69 percent. For reference, on May 11 natural gas traded for $2.85 per thousand cubic feet at the Henry Hub, the closest pricing location for Haynesville gas selling into the Gulf Coast market.[12] So even at today's prices, Comstock's Haynesville gas refracs are almost certainly robustly profitable.

Refracs Offer Substantial Medium-Term Oil and Gas Production Potential and May Also Increase M&A Valuations

There are four key takeaways from this analysis:

- Slowing the capital treadmill. Refracs offer shale drillers a way to slow down the "capital treadmill" on which they are currently running. Slowing the treadmill has been a priority for the industry as low commodity prices persist. A good refrac in the Bakken can bring a well's production back to 75 percent or more of the initial production rate while costing as little as 25 percent of the price of drilling and completing a new wellbore. As the dataset grows and operators learn more about how to identify the best refrac candidates, such potential return ratios will likely stimulate higher levels of refrac activity.

- Boost short-term cash flow. Refracs also offer companies a quick and lower-cost way of boosting short-term cash flows, which expands operators' ability to service debt and prepare for renewal of financing packages in today's lower-price environment. Once drilled, a well can be fraced and brought into production within two weeks once a decision is made to frac.[13] Refracs could likely be performed on a similarly short timetable.

- Boost enterprise value via larger recoverable reserve numbers. Greater refracing activity and operational improvements have the potential to significantly increase well-positioned shale producers' reserve bases. This would, all things held equal, boost stock prices and potential acquisition costs to majors seeking to buy their way into shale plays.

- Further decoupling of rig counts and oil and gas production numbers. Refracs can bring oil onto the market quickly, and the growth of refracing also stands to further decouple U.S. rig count and oil and gas production numbers.

Footnotes

[1] Yagna Deepika Oruganti, Rohit Mittal, Cameron J. McBurney, Alberto Rodriguez, "Re-Fracturing in Eagle Ford and Bakken to Increase Reserves and Generate Incremental NPV-Field Study," SPE-173340-MS, 2015. (18)

[2] Id. at 13.

[3] Id. at 11.

[4] Id. at 5.

[5] Id. at 1.

[6] Id. at 5.

[7] Company, 1Q2015 Earnings Call Transcript.

[8] Pioneer Natural Resources, 1Q2015 Earnings Call Transcript.

[9] Schlumberger, 1Q2015 Earnings Call Transcript.

[10] "COMSTOCK RESOURCES, INC. ANNOUNCES REDUCED 2015 CAPITAL BUDGET AND PROVIDES UPDATE ON HAYNESVILLE SHALE PROGRAM," 23 March 2015, http://phx.corporate-ir.net/phoenix.zhtml?c=101568&p=irol-newsArticle&ID=2027804.

[11] Naureen Malik, "Haynesville Shale Gas Cost Cuts Lure Drillers From Marcellus," Bloomberg, 11 March 2015, http://www.bloomberg.com/news/articles/2015-03-11/haynesville-shale-gas-cost-cuts-lure-drillers-from-marcellus.

[12] Henry Hub Natural Gas Spot Price, Energy Information Administration, http://www.eia.gov/dnav/ng/hist/rngwhhdD.htm (accessed 13 May 2015).

[13] Telephone interview with experienced completions engineer, 3 April 2015.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.