Although class is discussed frequently and openly in Britain, it makes many of us on this side of the Pond uncomfortable. Even so, class in America has been covered humorously by Paul Fussell, and with great color and insight by the New York Times.

Because I am a trust and estates lawyer, my practice offers a fascinating perspective on a particular aspect of class: how inheritance affects adult children.

To quantify and explore representative effects of inheritance, I built a model illustrating how the balance sheet of a relatively high-earning professional can be expected to change over the professional's working and retirement years.

Let's call our professional Henry, for lack of something more fun. Assume that Henry is a likeable, industrious guy, and graduated as a superstar from "school" (i.e., high school!) in Louisville, from one of the usual suspects. Assume further that Henry studied finance at Notre Dame as an undergraduate, worked for two years in asset management in Chicago, and went to Kellogg for his MBA.

In the real world, Henry might be a spectacularly successful founder of a hedge fund, but that creates "noise" in the model, so let's assume that Henry instead works as a well paid mutual fund manager in progressively more responsible positions over the course of a stable and successful career, earning a solid income that allows him to pay his student loans (for the model runs in which those apply) and "max-out" his 401(k) contributions.

The model assumes a realistic current rate and repayment terms for student loans, and what I believe is a realistic long-term projection of investment returns under current market conditions. (If you play around with the model, you can easily modify the student loan interest rate and investment return parameters, if you'd like to.)

Although it's a simple model that ignores period-to-period volatility in investment returns, I think that's not a material drawback for its purposes, which are to illustrate the substantial life cycle planning effects of inheritance events on adult children.

The model shows different life cycle outcomes for Henry, the same guy with the same career, depending on his being part of three different classes: upper middle, lower upper, and upper.

No class taxonomy is necessarily accurate, and all run distinct risks of being obnoxious.

With that caveat, for our discussion, I sort among the classes by one independent variable only: the amount of parental provision for children (whether by education funding or inheritance).

- In the Upper Middle Class model run, Henry doesn't get much of a tail wind on his financial life cycle, except for his considerable human capital. This model run assumes that Henry funds most or all of his undergraduate and graduate school costs with student loans. It also assumes he receives a $5,000 specific bequest at age 30 from his grandmother, and $200,000 at age 60 when his widowed mother passes away.

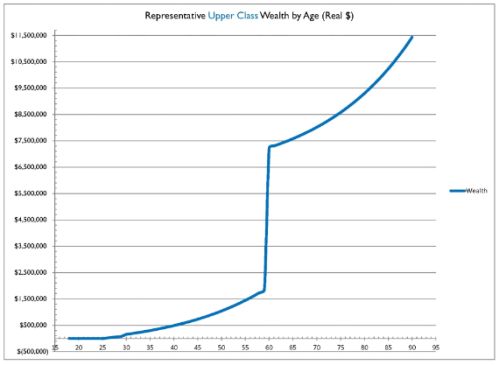

The chart below illustrates model results for Upper Middle Class Henry.

We see that, burdened by student loans, Henry doesn't have a positive net worth until he's 33. He works to age 66, and spends $190,000 per year in retirement, living to age 90. Because his inheritance has been modest, his 401(k) fuels most of his retirement spending, and his assets are substantially depleted by the end of his life.

- In the Lower Upper Class model run, Henry has a much larger head start, and more meaningful inheritance events. His parents can pay his college costs, so he takes on loans only for graduate school. His grandmother was richer, so at 30 he inherits $50,000, and at age 60 when his mother dies, his inheritance is $1 million.

The chart below illustrates model results for Lower Upper Class Henry.

In this model run, we see that Henry's net worth is negative only until he's 29. Henry works to age 65, and spends $200,000 per year in retirement. His inheritance can be tapped to delay the need to take 401(k) distributions, and his larger capital base can support his retirement lifestyle without being depleted to any material degree.

In this Lower Upper Class model run, Henry's receipt of an inheritance will make it possible for him to provide an inheritance, making a "virtuous cycle" of multi-generational wealth and cumulative advantage more likely.

If Henry's children don't (or can't) earn as much as he does, they and their children will have a wider array of life options: Lower Upper Class Henry's capital (both inherited and accumulated through work) provides a safety net.

- In the Upper Class model run, Henry has an even larger head start, and a rather giant inheritance event from his parents. Henry takes no undergraduate or graduate school loans, and his net worth is never negative. Although he inherits the same $50,000 at age 30 as his Lower Upper Class version. When he's 60, however, he and his two other siblings each receive $5 million from their mother. As shown in the chart below, this large inheritance transforms Upper Class Henry's outcomes.

In the Upper Class model run, Henry's realizes it's unnecessary to continue working for money after he inherits, so he retires early to his homes on Lake Michigan and Sarasota, dodging Northern winters and Southern summers.

Although he's left the workforce rather early, his capital base is so large that even though he spends $300,000 per year, his capital keeps on compounding.

Upper Class Henry has the options to leave large inheritances for his descendants, explore philanthropic options, and focus on delightfully high class problems of estate tax minimization.

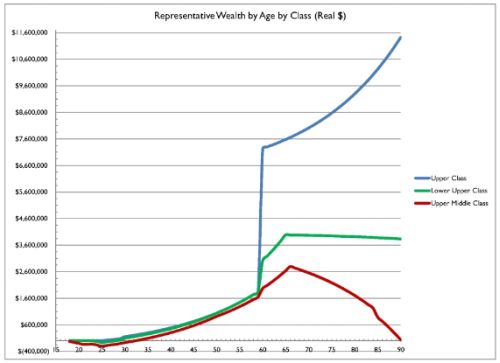

I think that the right pictures can be tremendous tools in focusing on the key issues: the differences that actually make a difference.

To that end, consider the summary chart below.

It shows wildly different outcomes for the same person who had the same career and the same earnings, and made the same investment choices that turn on only one variable: how much education funding and inheritance he received.

One of the chart's most interesting aspects is the similar wealth accumulation trajectory for Henry during his working years, no matter what his class.

In our case study, the presence or absence of multi-generational capital transmission through education funding and/or inheritance changed Henry's retired life substantially, and the lives of his children and grandchildren even more substantially.

The blue line in the chart above for Upper Class Henry bears further consideration and challenge.

Was it the right use of capital for Upper Class Henry to have the same career (and long commute, and stress, etc.) as Upper Middle and Lower Upper Class Henry? Possibly not.

It might have made more sense for Upper Class Henry's parents to shift more of the family's capital and spending power to him through lifetime gifts, than to reserve substantially all of it for his inheritance.

A future post will explore this issue – smoothing life cycle consumption opportunities in families with multigenerational wealth – in greater depth.

If you are a hardworking mid-career professional, the model and its case studies are substantially relevant to your own financial and estate planning.

Likewise, if you are evaluating the best way to structure inheritance for your adult children, the model will help you visualize the financial effects of inheritance much more clearly.

It's another example of how an integrated life cycle approach to financial and estate planning produces better decisions and better outcomes for clients and their advisors.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.