In the late 60s and early 70s at Bing Nursery School on Stanford's campus, Walter Mischel conducted the famous "Marshmallow Experiment" on delayed gratification. Preschoolers were offered a choice between one marshmallow or cookie right away, or two if they waited about 15 minutes.

When researchers tracked down study participants as adults, they found that the children who had waited for the larger reward tended to have better life outcomes, including higher test scores and educational attainment, and lower rates of obesity and addiction.

By offering a choice between Traditional and Roth IRAs (but probably without intending to) the Federal government has created a vastly scaled-up version of the Marshmallow Experiment.

Traditional IRA and 401(k) contributions offer current year income tax deductions as an immediate reward. In contrast, Roth IRAs offer a promise of long-term income tax savings as delayed gratification.

In contrast to Mischel's willpower-virtue-success narrative, however, it's not straightforward that choosing the Roth will necessarily produce better outcomes – that depends on the relationship between many factors. We explore some of those issues below.

To set the stage, a brief recap of some of the rules on Roths is helpful.

- Contributions to a Roth IRA are not deductible.

- Qualified distributions from Roth IRAs are tax-free.

- If your income isn't too high, you can contribute to a Roth IRA at any age.

- Roth IRAs do not have required minimum distributions.

- If you are single, and your modified adjusted gross income is below $116,000, you can contribute up to the limit.

- If you are married and file a joint return, and your modified adjusted gross income is below $183,000, you can likewise contribute up to the limit.

- The limit is $5,500 per year (or $6,500 per year, if you are over age 50).

Especially when discussing IRAs (whether Traditional or Roth), there is always a tradeoff between being clear, and being comprehensive. For the full nuances behind the summary above, you can consult the IRS material here.

If you reduce your tax-deductible contributions to a Traditional IRA or your 401(k), and contribute to a Roth instead, that decision has an opportunity cost: the income tax deduction you don't get.

What's the size of that opportunity cost? The answer tends to vary on a case by case basis for any given family, for reasons lurking within Form 1040.

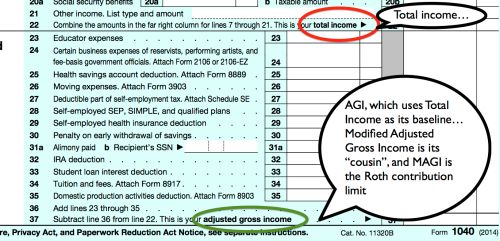

The annotated clip from Form 1040 below shows how income limits on Roth contributions are expressed in terms of modified adjusted gross income, which is defined with reference adjusted gross income, which in turn is defined with reference to total income.

In contrast, taxable income is what determines your marginal income tax rate, which determines the opportunity cost of a Roth IRA contribution.

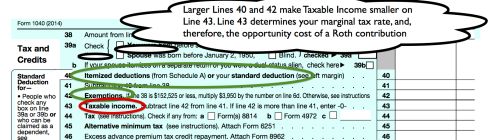

Taxable income relates to your modified adjusted gross income, but it will be smaller. How much smaller? That depends on your exemptions (i.e., whether you're married, and your number of dependents), and whether you take the standard deduction, or itemize deductions.

If you itemize deductions, taxable income shrinks as items like your mortgage interest, property taxes, state income taxes, and charitable contributions increase. The second clip below from Form 1040 illustrates the point.

For instance, suppose you're 40, and married with a modified adjusted gross income of $183,000. If you take the standard deduction of $12,400, your taxable income is $170,600, so you're in the 28% tax bracket. If you live in Kentucky, your state income tax rate is 6%, producing a combined state + federal marginal tax rate of 34%.

If you put $5,500 in a Roth rather than your 401(k) or a Traditional IRA (e.g., for a non-working spouse), the opportunity cost of the current income taxes you could avoid (but choose not to) is $1,870.

In return, the Federal government promises that it will never tax your Roth IRA withdrawals. If it keeps this promise, then what will the results look like in the future, when you're retired?

In our prior post, we discussed what might be a reasonable forecast for future investment returns. Markets have moved around a bit since that time, so the current future nominal return forecast is about 7.3%. At age 65, your $5,500 Roth contribution will have grown to approximately $32,015 (an amount you can draw tax-free to help pay yourself your personal pension).

If, instead, you had directed the $5,500 to your 401(k) or a Traditional IRA, and invested your related $1,870 income tax savings in a taxable account, at age 65 you'd have $32,015 in the 401(k) or Traditional IRA, all of it taxable as ordinary income upon withdrawal.

In addition, you'd have about $10,885 in the taxable account, about $9,015 of which would be taxable as long-term capital gains at a 26% combined state + federal rate when the assets were sold, leaving you about $8,541 net of tax.

So, if you're keeping score, here's where things stand:

- If you chose the Roth, you have $32,015 in there, tax-free.

- If you chose the 401(k) or Traditional IRA instead, your taxable side account leaves you with about $8,541 net of tax, and your 401(k) or Traditional IRA has $32,015 in it, all taxable as ordinary income.

- Obviously, to leave you at break-even versus the Roth alternative, your marginal state + federal income tax rate on the $32,015 401(k) or Traditional IRA needs to be less than 26.7% (i.e., $8,541/$32,015).

Let's restate that, to help keep things "clear":

If the government keeps its promise to never tax Roth IRA withdrawals, and you contribute to a Roth IRA as a 28% marginal Federal rate payer, and if your state income tax rate is the same at the times you contribute to and withdraw from the Roth, then if your marginal Federal rate is higher than 20.7%, the Roth was a good deal.

In contrast, if your marginal Federal rate in retirement is lower than 20.7%, by choosing the Roth, you paid more taxes than you needed to.

Under the current bracket schedule for married-filing-jointly taxable income:

- The Roth will be a bad deal at taxable income levels below $74,900.

- The Roth will be a good deal at taxable income levels above $74,900.

To make this insight more useful, we should consider how your taxable income might change when retired, even if your total income remains unchanged.

If you move to Florida, your effective marginal income tax rate will decline by 6%, because you won't pay Kentucky income tax any longer. With no state income taxes to deduct, your itemized deductions are likely to decline, increasing your taxable income.

Likewise, your dependents will have left home, and you'll likely be paying much less mortgage interest (if any) — this will also reduce itemized deductions, increasing taxable income.

You can see it's likely that your taxable income will be higher in retirement, expressed as a fraction of your total income.

Whether your total income (and, by extension, your taxable income) will increase or fall in retirement (and, therefore, whether the Roth is a good or bad deal for you) depends on a number of variables.

Factors supporting a decline in total and taxable income in retirement are obvious:

- First, employment income is likely to be much less, or zero.

- Second, you'll have control over the way taxable accounts are invested and harvested, limiting the amount of capital gains and dividends hitting your tax return.

On the other hand, some factors support an increase in total and taxable income in retirement:

- Once you hit your early 70s, required minimum distributions from IRAs and 401(k) accounts will increase your total income.

- Further, it's likely that up to 85% of your Social Security benefits will be includible in your income.

To make a nuanced decision about whether contributing to a Roth while you're in the workforce will increase your net-of-tax wealth when retired, you should also do a realistic assessment of your likely earnings trajectory.

As we noted earlier, many people underestimate risks of an unplanned early retirement or impaired earning power in their 50s and 60s. In light of these risks, the flexibility offered by taxable (non-qualified) savings outside a Roth, a Traditional IRA, or a 401(k) increases.

This post has explored whether Roth contributions make sense during your working years, in the context of your retirement planning. The discussion has assumed the Federal government will keep its promise not to ever tax Roth withdrawals. The reliability of that promise presents meaningful counterparty risks, ones that are hard to quantify, but probably pretty real.

In a future post, we'll evaluate those risks, and how they relate to using Roth IRA conversions to reduce estate taxes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.