Software companies are facing a transition to comply with the major accounting changes contained in the new revenue recognition guidance, Accounting Standards Update (ASU) 2014-09, Revenue from Contracts with Customers. But there is another important issue to consider: how these accounting changes will affect software company valuations.

How are valuations currently performed?

Accounting Standards Codification (ASC) 820, formerly Financial Accounting Standards (FAS) No. 157, provides valuation guidance. There are three approaches: market, income and cost. We will briefly discuss market and income approaches here because they are widely considered to be the most relevant in relation to the economic factors that determine value.

Market approach

Market approach techniques typically involve developing valuation multiples derived from an analysis of comparable companies and include the following:

- MVIC1/revenue

- MVIC/EBITDA

- MVIC/EBIT

- Equity/net income

Income approach

Income approach techniques convert an expected stream of future benefits to a present value and include:

- Discounted future cash flows/earnings

- Capitalized cash flows/earnings

- Discounted royalties avoided

- Option pricing models

- Monte Carlo simulations

Monte Carlo simulations are performed using specialized software, generating thousands of potential scenarios related to a "base case" and may be applied to a wide variety of models and techniques.

What do software companies need?

For software companies, the most frequently encountered valuation needs are as follows:

1. Share-based compensation. Closely held firms issue both common stock and options exercisable into common stock to their employees. Valuing the company's equity is a critical step in this process, often followed by the allocation of this value to different classes of equity to arrive at a value of the common stock for compensation purposes.

2. Assets acquired in a business combination. Companies that have grown via acquisitions need to assign values to acquired assets and assumed liabilities.

3. Earnouts. Companies that have grown via acquisitions also need to assign values to earnouts.

4. Impairment testing. Software companies that have grown via business combinations often have material goodwill that may require an annual valuation analysis.

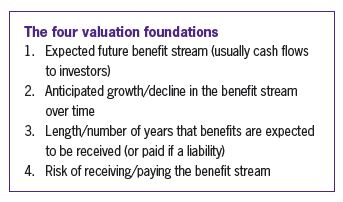

Economic factors driving business valuation

Although numerous valuation techniques are used to determine the value of a business, business segment, asset or liability, most of them are based upon the same four foundations.

It is important to note that tax rule changes can directly impact economic value because changes in tax rates, deductions and credits can affect expected cash flows. Accounting changes, on the other hand, generally do not have an impact on expected cash flows.

How are valuations affected by the new guidance?

The prospective changes in revenue recognition should not have any impact on the value of software companies. However, the new guidance may have a significant impact on valuation techniques. It is critical that management, auditors and third-party specialists prepare for these issues. A number of examples follow:

Example A: Value of a reporting unit for goodwill impairment testing purposes — revenue/EBITDA multiples

Assume the following, if there were no changes to revenue recognition standard ASC 606:

- The median (and most relevant) comparable company multiples are 1.5x for revenue and 8.0x for EBITDA

- The reporting unit metrics are $70 million for revenue and $12 million for EBITDA

- The resulting values are $105 million based on the revenue multiple and $96 million for EBITDA

A qualified appraiser might conclude that the value of the reporting unit (before any further adjustments) is approximately $100 million based on these two indications.

Now, assume that the new rules have had the following impact:

- The median comparable company multiples are 1.2x for revenue and 7.0x for EBITDA

- The reporting unit metrics are $75 million for revenue and $13 million for EBITDA

- The resulting values are $90 million based on the revenue multiple and $91 million for EBITDA

In this case, the appraiser might conclude that the company's value is $90 million. Given our expectation that accounting changes should not impact the value of a firm, then what happened to the other $10 million of value? The answer is likely the following:

- The new revenue recognition guidance had a beneficial impact on comparable companies' revenues and EBITDA

- The accounting-driven increases in reported revenue and EBITDA produced an equal and opposite decrease in the observed multiples

- The new guidance also had a beneficial impact on the subject reporting unit's revenues and EBITDA, but to a lesser extent than observed for the comparable companies

The end result

The economic value should not have changed, but failure to identify and adjust for the impact of the new guidance results in a 10% loss of value. This could represent the difference between passing and failing a Step 1 goodwill impairment test.

Example B: Value of a revenue-based earnout using a discounted cash flow technique

Whether the valuation technique used is a probabilityweighted multiscenario analysis, a Monte Carlo simulation or some other methodology, the impact of the new guidance is easily illustrated and understood.

For a hypothetical earnout, assume that if revenues for the year following the acquisition are:

- Less than $10 million, then no payments are due

- Between $10 million–$20 million, then 10% of the excess over $10 million is to be paid

- Over $20 million (10% of the excess over $10 million and 20% of the excess over $20 million)

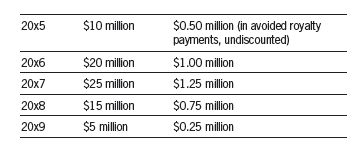

Further, assume the following scenarios and related probabilities for next year's GAAP-based revenue:

These scenarios, when weighted, imply a future, prediscount earnout obligation of $350,000.

Now, we assume that the new guidance results in an increase in GAAP revenue as follows:

These scenarios, when weighted, now imply a prediscount obligation of $900,000, almost three times the original amount calculated. The key takeaway from this example is for management to exercise care in establishing criteria for earnouts based on GAAP revenue, EBITDA or other metrics that may be significantly affected by the new revenue recognition guidance.

Example C: Value of a patent using an avoided royalty technique

Patents, trademarks and other types of intellectual property are often valued-based on a technique known as a relief-from-royalty method. The rationale for this technique is that by owning this asset the company avoids the cost of paying a royalty to a third party to license it. These avoided royalties are usually expressed as a percentage of revenues generated by products or services that rely on the underlying intellectual property. A simple patent example follows.

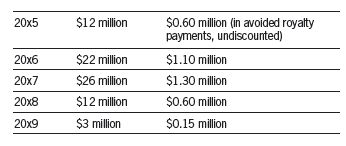

Assume that a patent with a five-year useful life, if licensed from a third party, would require the licensee to pay a royalty equal to 5% of gross revenue.

Further, assume that this patent supports a product with the following expected GAAP-based revenues:

Now, assume that under the new guidance, the applicable expected revenue stream is adjusted as follows:

Two observations are important. First, the impact of the new rules across time may or may not be significant. In the example above, total revenues over the five-year life are assumed to be equal. Second, however, when discount rates are applied, the present values will not be equal. This raises the issue discussed in the impairment test example — the asset (in this case, a patent) should have the same value regardless of the particular GAAP rules in effect. If so, then management and its auditors should be alert to situations in which the values are themselves being impacted by the new rules.

Our recommendation

Any discussion of revenue recognition guidance must be extended to include potential effects on important valuation issues. The examples provided are not intended to be exhaustive, but rather illustrative of potential problems that software companies may encounter in future periods. Other examples could have been developed, such as:

- Acquired IPR&D and other intangibles

- Impairment testing of trademarks

- Company valuations for share-based compensation purposes

In every case, these issues deserve the focus of senior management, its auditors and its independent thirdparty specialists to ensure that noncash changes such as revenue recognition rules do not inappropriately affect valuation results for financial reporting purposes. license it.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.