Courts often face many challenges when assessing the solvency of a company whether public or privately held. Examples of difficult valuation questions include: would a company with a market capitalization of several hundred million dollars possibly be insolvent? Or, would publicly-traded debt at or near par be conclusive evidence that the issuer is solvent at the time? Or, would a company's inability to raise funds or maintain its investment grade rating at a given time be sufficient to rule on solvency?

It is common in valuation and solvency disputes to have qualified experts with very different opinions on the fair market value of a company, often using the same standard approaches of discounted cash flows and comparables. How would the courts or the arbitrators decide and what is the role of contemporaneous market evidence in such disputes? In this article, we discuss the role of market evidence and possible misinterpretations of such evidence and highlight recent court decisions in the United States.

We start with a few basic definitions. The fair market value is defined as the price at which an asset would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts. The three standard valuation approaches are the discounted cash flow approach, the market comparables approach, and the asset approach. The discounted cash flow approach estimates the value of the business based on the present value of expected future cash flows. A market comparable approach estimates the value of a business using performance metrics of comparable companies such as earnings. The asset approach estimates the business value as the sum of the values of its tangible and intangible assets less any liabilities. There are three common measures of solvency. A company is deemed solvent at a given point in time if: 1) the fair market value of its assets exceeds the value of its liabilities; 2) it was adequately capitalized; and 3) it had the ability to pay its debts. Finally, market evidence can take various forms including equity prices, prices of debt and derivatives, ratings, contemporaneous projections of revenues, management projections, and analysts' recommendations, among others.

In the 2005 Campbell decision, the lower court ruled (and the appeals court later affirmed) that a spin-off entity was solvent as of the spin-off date based on the market capitalization of the subsidiary after the market has learned the truth about a set of business problems, principally allegations of trade loading (VFB LLC v. Campbell Soup Co., 336 B.R. 81 (D. Del. 2005) and VFB v. Campbell Soup Co., 482 F.3d 624, 633 (3d Cir. 2007).) This was the first time we are aware of that a bankruptcy court used equity prices as a substitute, not as a complement, to the traditional valuation approaches such as the discounted cash flow method. A court similarly ruled in the Iridium litigation that the company was solvent, citing its market capitalization, bond market evidence, and contemporaneous valuations by various market participants among other market evidence (In re Iridium Operating LLC, 373 B.R. 283 (Bankr. S.D.N.Y. 2007).) Bankruptcy courts have ruled on many solvency disputes since then, but there has not been a consensus on the weight and relevance of market evidence to the question of solvency.

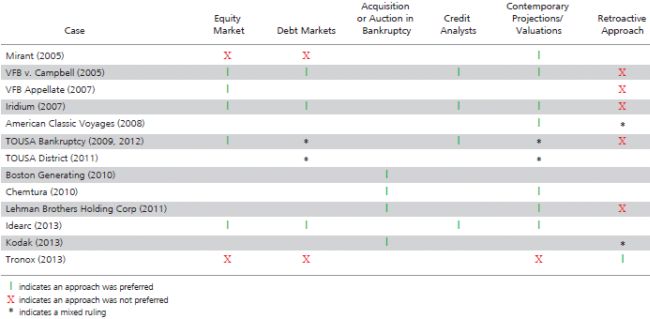

The table below provides a summary of recent cases where the courts have ruled on solvency issues and preferred either the market evidence or traditional valuation methods and gave more weight to one approach versus the other in determining valuation and solvency.

As presented in the table above, "equity markets" refers to the use of common stock prices as a basis for the valuation of equity at a given point in time. "Debt markets" refers to the reliance on debt prices or yields and/or issuance of debt or other fixed income instruments as a measure of market's perception of the value and credit worthiness of an issuer. "Acquisition or auction" refers to the use of the value of a sale of a company or assets via an auction or other process while a company is in bankruptcy as an indication of its value. "Credit analysts" refers to the reliance on contemporaneous views of rating agencies and analysts as an indicator of the value and credit worthiness of an issuer. "Contemporary projections" refers to the use of contemporaneous valuations by various market participants including management, equity analysts, and investment advisors. Finally a "retroactive approach" is the use of traditional valuation techniques such as DCF and market comparables that were developed during litigation.

On the one hand, a court in the Southern District Court of New York ruled in 2011 that the fair market value for the Lehman broker-dealer is the transaction price that Lehman had agreed to with Barclays at the time. The court ruled that post market valuation methods do not address the relevant question of whether certain undisclosed facts and inaccurate estimates at the time of the transaction would have affected the judgment that the transaction price was fair (In re Lehman Brothers Holdings Inc., 445 B.R. 143 (Bankr. S.D.N.Y. 2011).) On the other hand, the US Bankruptcy Court for the Southern District of New York relied primarily in the Chemtura litigation on traditional valuation methods including the market comparables analysis and the discounted cash flow as compared to market evidence (In re Chemtura Corp., 439 B.R. 561, 586 n.106 (Bankr. S.D.N.Y. 2010).)

Notwithstanding the appeal of relying on the assessment of market participants at the relevant time and the absence of possible hindsight, market evidence has its own challenges, especially in the context of solvency litigation. Consider equity prices as an example. According to economic theory, equity prices reflect the present value of the future cash flow of a company in an efficient market. There are various forms of market efficiency, but the one most commonly used in this context means that the equity price would reflect all publicly available information. Thus, reliance on equity prices as a measure of the fair value in a case where there was rampant fraud (as in the case of Enron, for example) would not necessarily reflect the future cash flow of the company. The US courts have examined various factors to evaluate market efficiency, such as the level of trading volume and other measures of liquidity, the number of analysts following a stock, and the response of the stock price to news. And, the question of whether a market is efficient is determined on a case by case basis after conducting various economic and statistical analyses.

However, a positive market capitalization is not necessarily evidence of solvency without additional examination of the financial conditions of the company in question, among other factors. Equity can be thought of as an option to purchase the company for the value of the liabilities. Equity retains a positive value even if the market value of the assets falls below the value of the liabilities. This is similar to a call option having value even when the stock price is below the strike price, the price at which the option is to be exercised. Therefore, it is important to analyze the equity prices of a company in the context of all the other factors affecting the value of the company to avoid misinterpreting the market evidence.

In addition to evidence from the equity market, data from the bond markets — including pricing, spreads, credit ratings, and bond issuances — could inform the questions of solvency and creditworthiness. Again, in the Campbell litigation, for example, the court ruled that the company's ability to issue debt well after the spin-off was evidence of its credit-worthiness at the time of the spin-off. On the other hand, the bankruptcy court in the TOUSA decision found that the company's secured bond issuance was not indicative of solvency (In re TOUSA, Inc., 422 B.R. 783, 813–14 (Bankr. S.D. Fla. 2009).)

Once debt is issued, courts have also used debt prices to inform their decision on solvency. In support of its conclusion regarding Idearc's solvency, the US District Court, Northern District of Texas noted that Idearc debt traded at near par for six months following the spin-off (US Bank National Association vs. Verizon Communications, No. 10-1842, 2013 WL 230329 (N.D. Tex. 2013).) Also, the court in the TOUSA litigation explained that some TOUSA bonds were trading at $0.45 around the valuation date, consistent with its opinion that the company was insolvent or inadequately capitalized (TOUSA, pp. 20, 118). Debt could be trading below par for reasons that have to do with lack of liquidity or concerns about the industry as whole, for example, and not necessarily evidence of insolvency. Valuation experts would need to examine the market evidence of each case separately as there are no quick and fast rules about interpreting bond prices and spreads.

We provide a hypothetical example to illustrate the importance of fact-specific analysis when valuing a company. Consider an example where we need to value a company with a face value of $30 million of debt. For simplicity, let's assume that there were only two possible outcomes of a restructuring of this company at a given point in time. Therefore, there was a 50 percent chance the company was going to be a success after the restructuring and be worth $90 million; and a 50 percent chance the company was going to fail and be worth only $10 million after liquidation. In the case of success, the debt would be paid in full and worth its full $30 million, and the equity will be worth $60 million ($90-30 million). In the case of failure, the debt-holders will receive the $10 million, and the equity will be worthless. The following graphic illustrates the example.

In this example, the value of the company is $50 million (based on an equal weighting for scenarios in which it is worth $90 million or $10 million). The value of the debt is $20 million, a 33 percent discount to the face value, even though the value of the company is $50 million and the company is solvent. This example shows the importance of analyzing the market data including bond prices in context of the facts at issue. (Example is based on Investment Valuation, Aswath Damodaran (2002).)

The debate over the relevance of contemporaneous market evidence in solvency litigation continues as more data on the debt and equity become available. While reliance on market data varies in solvency disputes, it is important for experts to explain the reasons for not relying on market evidence when it is not consistent with their DCF estimates, for example. In addition, experts would also factor in various limitations including illiquidity and industry-wide events, among others, when interpreting market evidence.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.