Introduction

On December 2, 2013, the State Council issued the Circular Concerning Catalogue of Investment Projects Requiring Government Approval (2013 Version) (国务院关于发布政府核准的投资项目目录(2013年本)的通知 (the "2013 Catalogue") and introduced new changes1 to governmental approvals falling under the jurisdictions of the two approving authorities, the National Development and Reform Commission ("NDRC") and the Ministry of Commerce ("MOFCOM"). The objective is to overhaul China's decades-old, approval-based cross-border investment regulatory system that has restricted growth. The liberating effects from less approval requirements are deemed to bring a new boom in outbound investment to both private investors and Central SOEs (state-owned enterprises managed by the central government), covering a wider range of industries apart from natural resources related industries traditionally favored by Central SOEs.

Shortly after that, both NDRC and MOFCOM released detailed measures to implement the 2013 Catalogue and amended their former approval requirements.

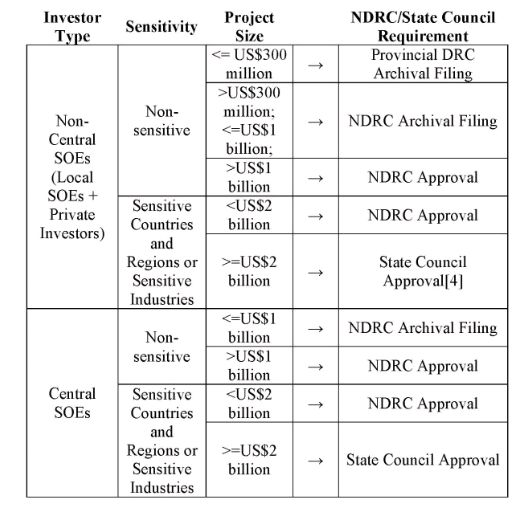

NDRC's Approval for Outbound Investment Projects

On April 8, 2014, NDRC issued Measures for the Administration of Approval and Archival Filing of Overseas Investment Projects (境外投资项目核准和备案管理办法);(the "Measures"), which have recently taken effect on May 8, 2014. Generally, the Measures provide that only archival filing with NDRC and provincial DRC should be required for outbound investment projects that are below US$1 billion and do not involve sensitive countries and regions and sensitive industries2. For outbound investment projects that either reach US$1 billion or involve sensitive countries and regions and sensitive industries, NDRC approval is required.

Superseding the Interim Measures for the Administration of Examination and Approval of the Overseas Investment Projects (境外投资项目核准暂行管理办法) (the "Interim Measures") effective on October 9, 2004, the Measures to a large extent reduce the approval requirements for outbound investment projects and introduce an archival filing oriented system. For instance, only when the size of the investment reaches US$1 billion, NDRC approval should be required regardless of industry sector; however, previously, this threshold was as low as US$100 million for general transactions, and US$300 million for natural resources related transactions.

NDRC's approval and archival filing requirements are summarized in the following table3.

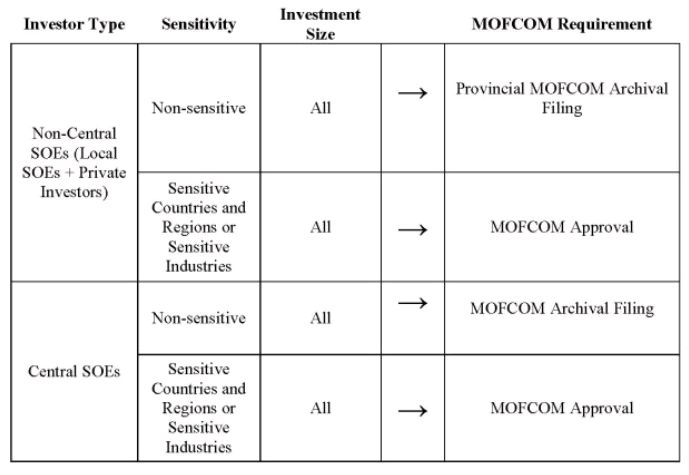

MOFCOM's Approval for Establishing an Offshore Non-Financial Enterprise with or without Investment Projects5

On April 16, 2014, MOFCOM started to solicit public comments over the draft of Measures for Overseas Investment Management (Amended)(境外投资管理办法修订)(the "Amended Measures") and the deadline has just came on May 15, 2014

The Amended Measures reduce the five circumstances subject to MOFCOM's approval to a single one. Previously, MOFCOM's approval should be required when: 1) making overseas investment in a country which has not established a diplomatic relationship with China; 2) making overseas investment in a specific country or region (such a country or region shall be determined by MOFCOM in conjunction with the Ministry of Foreign Affairs and other relevant departments); 3) making overseas investment with the amount of investment of the Chinese party being US$100 million or more; 4) making overseas investment which involves the interests of multiple countries or regions; or 5) setting up a special-purpose company overseas. However, under the Amended Measures, regardless of the investment size, only when sensitive countries and regions or sensitive industries6 are involved in establishing an offshore non-financial enterprise should MOFCOM's approval be required. Otherwise, investors are only subject to an archival filing with MOFCOM (Central SOEs for MOFCOM and other investors for provincial MOFCOM).

MOFCOM's approval and archival filing requirements are summarized in the following table.

Looking Ahead

With both detailed measures from NDRC and MOFCOM becoming effective in the next few months, outbound investment activities, offshore acquisitions are expected to increase as the regulatory hurdle is removed for PRC investors including private investors as well as Central and non-Central SOEs. For private Chinese entrepreneurs and domestic PE funds who tend to invest less than US$300 million, only archival filing with provincial DRC and provincial MOFCOM would be enough to clear their way to go global.

Footnotes

1 The 2013 Catalogue provides that only those investments of US$1 billion or more and those involving sensitive countries and regions or sensitive industries are subject to NDRC's approval; other investments made by Central SOEs and investments of US$300 million or more made by local enterprises are subject to archival filing with NDRC. The 2013 Catalogue also provides that only establishing enterprises through outbound investment involving sensitive countries and regions or sensitive industries is subject to MOFCOM's approval; otherwise, Central SOEs are subject to archival filing with MOFCOM and local enterprises are subject to archival filing with provincial governments (provincial MOFCOM). The 2013 Catalogue defines neither "sensitive countries and regions" nor "sensitive industries".

2 The Measures define "sensitive countries and regions" as countries and regions without a formal diplomatic relationship with China or under international sanctions, at war, or in a state of unrest; and defines "sensitive industries" as basic telecommunication operations, cross-border water resources development and utilization, large-scale land development, main electrical grids, and news media. MOFCOM gives a similar definition of sensitive countries and regions; but gives a different definition of sensitive industries. See footnote 6.

3 For investments over US$300 million through offshore acquisitions or competitive biddings, the Measures require Chinese bidders to submit a "project information report" to NDRC applying for a confirmation letter before they are permitted to undertake any "substantive work". Such substantive work includes signing binding documentation, proposing binding fee quotes, and commencing foreign investment review process in the relevant jurisdictions of acquisitions (in offshore acquisitions); and making official bids (in competitive biddings). The purpose of this preliminary project information report regime is to avoid Chinese investors from competing against each other for the same assets at the ultimate cost to the State. In practice, NDRC will only issue one conformation letter, which is commonly dubbed as a "road pass", at a time for any given deal. Previously, this threshold was US$100 million.

4 The Measures further provide that when the size of outbound investment projects reaches US$2 billion in sensitive countries and regions or sensitive industries, NDRC should submit its review opinions to the State Council for approval.

5 NDRC is the approving authority for outbound investment projects; MOFCOM is the approving authority for establishing an offshore enterprise. When a PRC investor establishes an offshore enterprise without a specific investment project, only MOFCOM's approval is required; when a PRC investor establishes an offshore enterprise with a specific investment project, both NDRC and MOFCOM's approval are required. On the latter occasion, NDRC's approval is a pre-requisite to obtain MOFCOM's approval in practice.

6 The Amended Measures define "sensitive countries and regions" as countries and regions without a formal diplomatic relationship with China or under the United Nations' sanctions, at war, or in a state of unrest; and defines "sensitive industries" as using products and techniques that are restricted for export by China, and involving multi-national/regional interests. NDRC has a different definition for "sensitive industries". See footnote 2.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.