In response to the rising tide of strike suits challenging mergers and acquisitions and the adequacy of executive compensation disclosures, more companies are adopting or considering adopting exclusive forum bylaws. These bylaws, which are largely a Delaware phenomenon, require that derivative actions, stockholder class actions, and other intra-corporate disputes be litigated exclusively in designated courts. This article examines the increase in the adoption of such bylaws following a June 2013 Delaware Court of Chancery decision upholding their validity. It also examines the language companies are including in such bylaws, their enforceability in litigation, and issues for boards to consider before adopting them.

For Delaware corporations facing a rising tide of strike suits (litigation brought for the primary purpose of obtaining a settlement), the June 25, 2013, decision by the Delaware Court of Chancery in Boilermakers Local 154 Retirement Fund v. Chevron Corporation,1 which upheld the validity of "exclusive forum" bylaws adopted by Chevron Corporation and FedEx Corporation, marked an important milestone.2 Exclusive forum bylaws require derivative actions, stockholder class actions, and other intra-corporate disputes to be litigated exclusively in a specified forum. Prior to Boilermakers, that forum was almost always the Delaware Court of Chancery. Such provisions are intended to address plaintiff forum shopping and the related phenomenon of plaintiffs' attorneys filing lawsuits arising out of the same facts in multiple jurisdictions to obtain attorneys' fees. In particular, these provisions seek to avoid the cost and uncertainty of parallel litigation, the risk of inconsistent outcomes, and the potential for Delaware law, which governs these disputes, to be misinterpreted by other courts. Additionally, they are intended to allow Delaware corporations to have intra-corporate disputes resolved by the courts most familiar with the state's corporate law.3 As suggested in Boilermakers, there is a benefit in having cases "decided in the courts whose Supreme Court has the authoritative final say as to what the governing law means."4

Multiforum litigation is most well-known in the context of mergers and acquisitions. For example, in 2012, 93 percent of merger and acquisition transactions valued at more than $100 million resulted in litigation, with an average of 4.8 lawsuits per transaction.5 For transactions with Delaware incorporated targets, 65 percent resulted in multiforum litigation in Delaware and other jurisdictions, 19 percent were challenged outside of Delaware only, and 16 percent were challenged solely in the Delaware Court of Chancery.6 The most common outcome of such lawsuits was a settlement that provided for the payment of attorneys' fees and additional disclosure, or, in some cases, changes in deal protections, but no increase in purchase consideration for stockholders.7 The entrepreneurial plaintiffs' bar has also been pursuing lawsuits modeled on merger litigation that allege fiduciary breaches by boards of directors in connection with executive compensation matters. The current generation of such lawsuits often seeks to enjoin annual meetings where stockholders are being asked to approve equity compensation plans. Such litigation tends to be brought outside of a company's state of incorporation.

History of Exclusive Forum Bylaws

Public companies began adopting exclusive forum bylaws in 2010 through unilateral board action, while companies not yet publicly traded (e.g., those going public, being spun off, or emerging from bankruptcy) overwhelmingly included such provisions in their charters.8 Unlike bylaws, charter amendments must be approved by both the board and stockholders. Thus, as a practical matter, bylaws are easier to adopt, and they may be easily amended by the board to take into account case law developments and refinements. However, stockholders retain the right to amend or repeal bylaws, including exclusive forum bylaws, and bylaws are generally easier to attack than stockholder-approved charter amendments.

Since 2010, charter adoptions have continued unabated and become an accepted norm in initial public offerings (IPOs). However, bylaw adoptions ground to a halt in early 2012 after plaintiffs' firms filed 12 virtually identical lawsuits in the Delaware Court of Chancery challenging the validity of exclusive forum provisions adopted by large, public corporations.9 Among other things, the complaints asserted that, under Delaware law, the boards of these companies lacked the power to adopt such bylaws without stockholder approval. While 10 of the 12 companies repealed their bylaws, and nine of those companies paid attorneys' fees as a result, Chevron and FedEx opted to litigate. In Boilermakers, Chancellor Strine unambiguously found that their exclusive forum bylaws were both statutorily and contractually valid.10

The plaintiffs appealed the decision to the Delaware Supreme Court. It appeared likely that the Boilermakers opinion would be upheld. However, on October 15, 2013, the plaintiffs unexpectedly withdrew the appeal, having seemingly concluded that the Delaware Supreme Court would affirm, creating a binding precedent from a higher level court. Compared to the opinion from the Court of Chancery, such a precedent would make it more difficult to successfully mount an "as applied" challenge to the enforcement of a forum selection bylaw in a non-Delaware court. While the plaintiffs in Boilermakers asserted a number of other claims, including breaches of fiduciary duty, the opinion only addressed the facial validity of the bylaws.11 On October 28, 2013, the plaintiffs moved for an order voluntarily dismissing all remaining claims without prejudice, an option that was not attractive to either defendant. Ultimately, the lawsuit against FedEx was dismissed with prejudice on November 1, 2013.12 The case against Chevron, which is in a different position as a result of a parallel case in the United States District Court for the Northern District of California, remains pending.13 According to the Delaware plaintiffs' October 28 motion, Chevron wanted to "certify a class and litigate all of the remaining claims."14 Chevron may also be considering whether there are other mechanisms to obtain a binding precedent. However, the Chevron case may simply end with a dismissal with prejudice, like the FedEx case.

Company Responses to Boilermakers

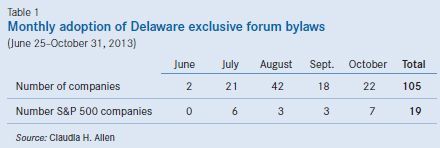

Rate of bylaw adoptions The plaintiffs' appeal to the Delaware Supreme Court raised the question of whether corporations interested in adopting an exclusive forum bylaw would await a determination from the Delaware Supreme Court or view Boilermakers as a sufficient basis for stepping off the sidelines. Based on the rate of bylaw adoptions from June 25 to October 31, 2013, many companies were comfortable acting (Table 1).

Additionally, five companies planning to go public and two corporations seeking to reincorporate in Delaware announced plans to adopt exclusive forum bylaws during this period. In total, 112 Delaware corporations (listed on page 9) adopted or announced plans to adopt exclusive forum bylaws from June 25, 2013, through October 31, 2013, and the pace of adoptions has not slowed since then.15 To put these numbers in perspective, only one company adopted an exclusive forum bylaw during the comparable period in 2012.16

Corporations in other states also appear to be responding to Boilermakers, although to a lesser degree. During the same period in 2013, 18 Maryland corporations or real estate investment trusts adopted (or announced plans to adopt) exclusive forum bylaws, along with four corporations in Pennsylvania, two each in Nevada and Oregon, and one each in Florida, South Carolina, Texas, and Virginia.17 Three of these 30 corporations are S&P 500 constituents.18 (For a list of these companies, see page 9.)

Circumstances of adoption Largely consistent with past patterns, 85 percent of the exclusive forum bylaws analyzed were adopted or proposed by corporations that were already public. In addition, 11 percent of the bylaws analyzed were (or were being) adopted in connection with IPOs, 2 percent were being adopted in connection with reincorporation in Delaware, 1 percent were (or were being) adopted in connection with a spin-off, and 1 percent were adopted during emergence from bankruptcy. The percentage of bylaws adopted in connection with IPOs reflects an increase from 6.6 percent as of January 1, 2012.19

It is unclear whether more IPO companies are opting for an exclusive forum bylaw rather than a charter provision to appear more stockholder-friendly (since stockholders generally have the power to repeal or amend bylaws), to provide the board with the unilateral ability to effect future amendments, or for other reasons. Of the 12 IPO companies analyzed, four included (or planned to include) exclusive forum provisions in both their charters and bylaws, thereby lessening the significance of their exclusive forum bylaws for purposes of this analysis. Additionally, one company that adopted an exclusive forum bylaw announced that it will present the bylaw for approval at its next annual stockholders meeting. The ratification approach is reminiscent of the approach many companies take when adopting poison pills in response to the policies of Institutional Shareholder Services, Inc. (ISS), the influential proxy advisor. ISS will generally recommend voting against or withholding votes from the entire board if the board adopts a poison pill with a term of more than 12 months, or renews any existing pill, without stockholder approval.20

Consenting to an alternate forum In Boilermakers, the court noted that the boards of directors of Chevron and FedEx may consent to being sued in another jurisdiction under their exclusive forum bylaws. Bylaws that permit such optionality are viewed as "elective" and generally begin with the language: "Unless the Corporation consents in writing to the selection of an alternative forum ..." The court in Boilermakers stated that the elective consent language allows boards "to meet their obligation to use their power only for proper corporate purposes."21 In other words, whenever a lawsuit otherwise covered by an exclusive forum bylaw is brought outside the specified forum, the board must make a determination as to whether it is in the best interests of the corporation for the lawsuit to proceed in that alternate forum.22 In some cases, a board might determine that the other forum serves the best interests of the corporation.

While some academics and practitioners had questioned whether the elective language inequitably allows only the board to select among fora, from the point of view of corporations, that issue was effectively eliminated by Chancellor Strine's endorsement. Of the Delaware exclusive forum bylaws adopted after Boilermakers, 97 percent provide that the board may consent to an alternate forum. The remaining companies adopted "mandatory" forum selection provisions, which do not provide flexibility. As of January 2012, only 64 percent of exclusive forum bylaws included elective language.23

In connection with future as-applied challenges, plaintiffs may argue that a board has breached its fiduciary duty by seeking to enforce an exclusive forum bylaw rather than consenting to litigation in the forum chosen by the plaintiffs. In that regard, clearly documenting the board's rationale for not proceeding in a foreign jurisdiction should be helpful if the issue is raised.

Forum and jurisdiction Prior to the wave of lawsuits that began in February 2012, 96 percent of exclusive forum bylaws adopted by Delaware corporations specified the Delaware Court of Chancery as the exclusive forum.24 After the lawsuits challenging exclusive forum bylaws were filed, and, seemingly in response to some of the arguments advanced in the complaint, Chevron amended its bylaw to specify that intra-corporate claims may be brought in any state or federal court in Delaware and include a carve-out for situations in which the court does not have jurisdiction over the indispensable parties. Although FedEx chose not to amend its bylaw, the chancellor upheld the validity of both companies' bylaws.

Of the 112 post-Boilermakers bylaws, only 43 percent provide that the Delaware Court of Chancery is the exclusive forum; 34 percent provide that if the specified court (usually the Delaware Court of Chancery or a "state court" in Delaware) lacks subject matter jurisdiction, jurisdiction will vest in another Delaware state or federal court; and 23 percent take the Chevron approach of specifying the state and federal courts in Delaware. The alternatives highlight a potential downside of only specifying the Court of Chancery—the court may not have jurisdiction. For example, the federal courts or a different Delaware state court, such as the superior court, might have jurisdiction. If the federal courts have jurisdiction, plaintiffs could elect to sue the corporation in the federal district court where it is headquartered or otherwise has sufficient contacts. Those federal courts might not have as deep an understanding of Delaware law as the United States District Court for the District of Delaware. In view of these issues, companies should consider describing the exclusive forum as:

the Court of Chancery of the State of Delaware (or, if the Court of Chancery does not have jurisdiction, another state court located within the State of Delaware or, if no state court located within the State of Delaware has jurisdiction, the federal district court for the District of Delaware).

As to potential personal jurisdiction issues, 35 percent of the exclusive forum bylaws adopted after Boilermakers require that the court have "personal jurisdiction over the indispensable parties named as defendants."25 The comparable percentage in January 2012 was 19 percent.26 Similarly, 13 percent of post-Boilermakers bylaws state that the specified court or courts shall have exclusive jurisdiction "to the fullest extent permitted by law," in contrast to less than 1 percent in January 2012.27 Both of these increases reflect heightened sensitivity to jurisdictional arguments made by the plaintiffs.

In connection with the facial challenge in Boilermakers, Chancellor Strine quickly dispensed with plaintiffs' arguments as to defects in subject matter or personal jurisdiction:28

it bears repeating that in the main, and as the plaintiffs themselves concede, the kind of cases in which claims covered by the forum selection clause predominate are already overwhelmingly likely to be resolved by a state, not federal, court. And as with the issue of personal jurisdiction, the plaintiffs ignore a number of factors that suggest that their hypothetical concern that the forum selection clause will operate unreasonably is overstated.

However, in the context of future "as-applied" challenges to the enforceability of exclusive forum bylaws, any defects in jurisdiction will not be "hypothetical." While including additional language addressing potential defects in personal or subject matter jurisdiction may not make a difference in the majority of cases, it could in others. Accordingly, it is important to consider these issues when crafting an exclusive forum provision.

Deemed consent Sixty-five percent of the exclusive forum bylaws analyzed specify that any person or entity owning, purchasing, or otherwise acquiring any interest in shares of the corporation's stock "shall be deemed to have notice of and consented to the provisions of this bylaw." In January 2012, 33 percent of exclusive forum bylaws included such language.29 Under Delaware law, each of the charter and bylaws is deemed a contract that binds all stockholders.30 Thus, the language appears to be a "belt and suspenders" effort to ensure that stockholders are bound by the bylaw and that non-Delaware courts where the corporation may be sued are on notice of such consent. This language, however, raises potential contract interpretation questions.31 For example, other important process-oriented bylaw provisions, such as those relating to advance notice of stockholder nominations and business, do not include "deemed consent" language.32 Accordingly, stockholders could argue that they are not bound by bylaws that do not include "deemed consent" language. Such an argument would, however, conflict with the precept that all stockholders are bound by all bylaws, regardless of when the bylaws are adopted. Arguably, a better solution would be to include a deemed consent clause that covers the bylaws in their entirety.

Lennar Incorporated adopted an exclusive forum bylaw with deemed consent language that goes a step further.33 The company's bylaw states that stockholders will be deemed to have consented to personal jurisdiction in the Delaware Court of Chancery (and other specified Delaware courts) "in any proceeding brought to enjoin any action by that person or entity that is inconsistent with the exclusive jurisdiction provided for" in the bylaw.34 Thus, the Lennar language contemplates that, in the event a stockholder sues outside Delaware, the corporation may also seek an anti-suit injunction against the stockholder in the specified Delaware court. The underlying theory is that any such injunction should be respected in the non-Delaware court. However, whether or not the exclusive forum provision explicitly provides for consent to personal jurisdiction in the specified court, the strategy of seeking an anti suit injunction in Delaware may not always work, as exemplified by the recent proceedings in a merger lawsuit against Edgen Corporation discussed below.

The additional language employed by Lennar raises the question of whether the standard "deemed consent" language in most exclusive forum provisions is sufficient to confer personal jurisdiction. The Delaware Supreme Court has held that where "the parties to the forum selection clause have consented freely and knowingly to the court's exercise of jurisdiction, the clause is sufficient to confer personal jurisdiction on a court."35 However, it is not clear whether the standard language reflects the type of free and knowing submission to jurisdiction contemplated by the Delaware Supreme Court, as evidenced in the Edgen merger litigation.

Sole bylaw amendment Of the 112 companies that adopted (or indicated an intention to adopt) an exclusive forum bylaw subsequent to Boilermakers, 54 percent amended their bylaws for the sole purpose of adopting an exclusive forum provision. By contrast, in January 2012, only 8 percent of the companies that adopted exclusive forum bylaws did so on a stand-alone basis—generally preferring to bundle exclusive forum amendments with other bylaw amendments.36 The current percentage appears to be another indicator of the relative comfort of public corporations in adopting exclusive forum bylaws.

Adoption prior to significant event Some companies continue to adopt exclusive forum bylaws in advance of or concurrently with public announcements of a merger or other event that could result in litigation. For example, on August 26, 2013, HiTech Pharmacal Co., Inc. agreed to be acquired.37 On the same day, the board amended the company's bylaws to include a forum selection provision, likely in anticipation of the lawsuits that follow such announcements.38 Air Products and Chemicals, Inc. adopted an exclusive forum bylaw on July 18, 2013.39 On July 31, the hedge fund Pershing Square Capital Management, L.P. and affiliated entities announced that they had acquired a 9.8 percent beneficial interest in the company.40 Notably, Air Products was one of the 10 companies that had repealed a forum selection bylaw after being sued in 2012. Illustrating the changes in practice, Air Products' new bylaw, unlike the original, specifies that if the Delaware Court of Chancery lacks subject matter jurisdiction, the Superior Court of Delaware, followed by the United States District Court for the District of Delaware, will have exclusive jurisdiction. In addition, the bylaw specifies that the board may consent to being sued in another jurisdiction.

Experimentation As companies continue to experiment with exclusive forum provisions, a number of other clauses have appeared. For example, 4 percent of the exclusive forum bylaws analyzed specify that a company shall be entitled to injunctive relief and specific enforcement; 4 percent include severability language, likely with a view toward as-applied challenges; one provision specifies that the forum provision is solely procedural in nature, seemingly in anticipation of arguments that the bylaw deprives stockholders of substantive rights; and, as previously discussed, one company has stated that it will present its exclusive forum bylaw to its stockholders for ratification at the next annual meeting.

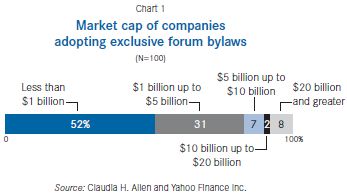

Market capitalization The market capitalization of the companies adopting exclusive forum bylaws ranges from less than $100 million to more than $85 billion, indicating interest from both the smallest and largest public companies. Market capitalizations for 100 of the 112 companies analyzed are available on Yahoo Finance. As shown in Chart 1, the bulk of those companies have market capitalizations below $5 billion.

Principal place of business The largest percentage of the 112 companies are headquartered in California (26 percent), followed by Texas (12 percent), New York (10 percent), and Arkansas, Illinois, Massachusetts, and New Jersey (each, 4 percent). Corporations headquartered in 21 other states have adopted exclusive forum bylaws since June 25, 2013. The high percentage of corporations headquartered in California is consistent with the high percentage identified in previous analyses of exclusive forum provisions.41 The extent to which these percentages correlate with perceived litigation climates is unclear.42

Enforcement and "As-Applied" Challenges

Although the Delaware Court of Chancery found that the Chevron and FedEx exclusive forum bylaws were valid, future skirmishes between plaintiffs and corporations are likely to take place in courts outside of Delaware, when defendants seek to dismiss or stay cases based on exclusive forum provisions and plaintiffs then challenge the enforceability of such provisions.43 Enforcement disputes could also spill over into Delaware, as was the case in the Edgen merger litigation described below. Delaware forum selection bylaws, like other forum selection clauses, should be "construed like any other contractual forum selection clause and [be] considered presumptively, but not necessarily situationally, enforceable," according to Boilermakers.44 Plaintiffs may rebut this presumption by showing that enforcement is unreasonable or unjust.45 Plaintiffs may also allege that the board breached its fiduciary duties in enforcing or adopting a bylaw.46 Accordingly, exclusive forum provisions are not self enforcing, a point often overlooked by opponents. Courts in jurisdictions outside of Delaware where lawsuits are filed will undertake situational reviews.

The existing case law concerning the enforceability of exclusive forum provisions in bylaws (or charters) is scant and inconsistent. This is not surprising, given that such provisions are relatively new. In Galaviz v. Berg, the first litigated as-applied challenge to a forum selection bylaw, the United States District Court for the Northern District of California declined to dismiss a stockholder derivative action against Oracle on the basis of its mandatory forum selection clause.47 The court, in this 2011 case, focused upon the fact that the bylaw was unilaterally adopted by the board after the majority of the alleged wrongdoing occurred and without the consent of stockholders who had purchased shares before the amendment. On the basis of federal common law, the court found that the bylaw did not bind stockholders because it had been adopted without stockholder consent.48 The court did not address whether the provision was valid as a matter of Delaware corporate law. Many practitioners and academics believe that this case of first impression was incorrectly decided, in particular, because bylaws customarily provide that they may be amended by the board. In Boilermakers, Chancellor Strine sharply criticized Galaviz as resting "on a failure to appreciate the contractual framework established by the [Delaware General Corporation Law] for Delaware corporations and their stockholders."49

Another litigated as-applied challenge involved an exclusive forum provision in a certificate of incorporation that arose in the context of Facebook's IPO. In a February 2013 ruling, Judge Sweet of the United States District Court for the Southern District of New York denied a motion to dismiss four IPO derivative actions against Facebook on the basis of the exclusive forum provision in its charter.50 The court denied the forum selection motion on the narrow technical grounds that the amended charter containing the forum clause was not filed with the Delaware Secretary of State until four days after the IPO. Thus, the provision was not in effect when shares were purchased in the offering. Moreover, since the court dismissed the cases on other grounds, it did not need to wade into a controversial area:51

The Court recognizes the considerable debate on the efficacy, enforceability and desirability of the use of exclusive forum provisions and declines to advance any position here.

On February 15, 2013, in Daugherty v. Ahn, a derivative action brought in Texas against Furmanite Corporation, the Texas court granted a motion to dismiss on the basis of Furmanite's mandatory exclusive forum bylaw, adopted in 2006.52 That bylaw, which predates the current generation of provisions, is much like Oracle's, and only addresses derivative actions:53 Venue for Derivative Suits.

Any derivative action or proceeding by or in the name of the Corporation shall be brought only in the Chancery Court of the State of Delaware.

The case involved allegations of inadequate internal controls and violations of the Foreign Corrupt Practices Act, thus highlighting that exclusive forum provisions are relevant beyond the merger and acquisition context.

On October 1, 2013, Edgen entered into a definitive agree-ment to be acquired by Sumitomo Corporation. On October 11, the company was sued in Louisiana, the state where it is headquartered.54 Edgen filed a motion to dismiss in Louisiana based on the mandatory forum clause in its charter. Concerned about its ability to close the transaction on a timely basis, Edgen also filed a complaint against the Louisiana plaintiff in the Delaware Court of Chancery based upon its exclusive forum provision. Edgen sought an anti-suit injunction that would enjoin the plaintiff from prosecuting his claims in the Louisiana action.55 Edgen appears to be the first company to employ this strategy. The case was assigned to Vice Chancellor Laster, who, during a November 5, 2013 hearing, characterized the plaintiffs' claims as "an exceedingly weak challenge to a deal."56

The vice chancellor found that Edgen had stated a colorable claim since the claims in the Louisiana case were within the scope of the exclusive forum provision and the stockholder had facially violated the forum provision. He also found irreparable harm sufficient to support an injunction, since violating a forum selection clause constitutes irreparable harm under Delaware precedent. However, in balancing the equities, he declined to issue an injunction for two primary reasons: (a) potential questions about personal jurisdiction over the plaintiff, and (b) concerns over the "aggressive" means by which the company was pursuing enforcement and related concerns regarding respect for other courts. As to personal jurisdiction, Vice Chancellor Laster stated that the absence of an explicit reference to personal jurisdiction created a "litigable issue."57 With respect to deferring to the court in which litigation was commenced, Vice Chancellor Laster emphasized that Boilermakers contemplated that the enforceability of an exclusive forum clause "would be considered in the first instance by the other court, by the court where the breaching party filed its litigation, not through an anti-suit injunction in the contractually specified court."58 Moreover, he noted that proceedings in Louisiana scheduled for the next day lessened the need for immediate action. Although he declined to issue an injunction, Vice Chancellor Laster stated: "It may be that in the right case an anti-suit injunction is appropriate."59 The Louisiana court held a hearing on Edgen's motion to dismiss on December 13, and granted the motion in January 2014.60

Additionally, an October 2012 stockholder class and derivative action against MetroPCS Communication, Inc., which has an exclusive forum bylaw, remains pending in Texas.61 The litigation arose from a business combination involving MetroPCS, Deutsche Telekom, and T-Mobile USA, Inc. The Texas trial court granted a temporary restraining order with respect to certain aspects of the transaction without first considering the defendants' motion to stay or dismiss the litigation on the basis of its exclusive forum bylaw. However, the Texas Court of Appeals found that "the trial court abused its discretion by granting injunctive relief without first ruling on ... motions respecting the forum selection clause in question."62 The court of appeals also noted precedent stating that forcing a party to litigate in a forum different from that provided for in a forum selection clause, and requiring an appeal to enforce the rights granted in that clause is "clear harassment."63 The defendants' motion to dismiss or stay is scheduled for hearing in March 2014.

Finally, on November 4, 2013, in HEMG Inc. v. Aspen Univ.,64 the Supreme Court of New York County, a trial court, dismissed derivative claims against Aspen Group Inc. for breach of fiduciary duty, waste of assets, and dilution of stockholder equity on the basis of the exclusive forum provisions in the company's charter and bylaws adopted prior to a reverse merger. The claims related to the disputed existence of loan receivables from the plaintiffs reflected on Aspen's balance sheet. Citing Boilermakers, the court rejected assertions that the exclusive forum provisions were invalidly adopted without stockholder consent and concluded that the derivative claims must be brought in the Delaware Court of Chancery.

Adoption Considerations

For corporations that have been involved in multiforum litigation, the appeal of an exclusive forum bylaw is obvious. For others contemplating adoption of an exclusive forum bylaw, the statistics concerning the incidence of intra-corporate litigation brought outside a corporation's state of incorporation serve as a powerful incentive to act.

Nonetheless, consistent with their fiduciary duties, boards must thoughtfully evaluate whether a forum selection bylaw would be in the best interests of the corporation and its stockholders. In Boilermakers, the plaintiffs alleged that board adoption of an exclusive forum bylaw was self interested, so it is important to create a record establishing an independent, informed, and balanced consideration of whether to adopt an exclusive forum bylaw. As part of its analysis, the board should evaluate whether there are reasons to favor litigating in a company's headquarters state and whether the status quo may be a superior option. For corporations formed outside Delaware, the board's analysis should also include an assessment of the quality of the state courts that would be specified.

As a practical matter, boards should analyze stockholder views on exclusive forum provisions. Some institutional investors support exclusive forum bylaws; others object on the theory that such provisions deprive investors of an important right. Notably, over time, some institutional investors, such as T. Rowe Price, that originally opposed exclusive forum provisions have changed or softened their views, recognizing that strike suits are effectively a tax on their investments. Companies should review the proxy voting guidelines of their institutional investors, Forms N-PX to determine how registered management investment companies voted in the prior proxy season, and the extent to which their institutional investors follow the voting recommendations of ISS and/or Glass Lewis & Co.

Both proxy advisors generally oppose company proposals to adopt exclusive forum provisions, although they technically make case-by-case determinations.65 Glass Lewis takes its opposition one step further by recommending against the election of the governance committee chair if, during the past year, the board adopted a forum selection clause without stockholder approval.66

The reaction of stockholders to proposals seeking the repeal of exclusive forum bylaws provides evidence that stockholders are listening to what well-run corporations have to say about the costs of multiforum litigation. In 2012, Amalgamated Bank Longview Funds submitted four nonbinding repeal proposals. Amalgamated Bank describes itself as "America's Labor Bank." In response, two of the targeted companies repealed their bylaws, while Chevron and United Rentals, Inc. took the proposals to their stockholders and defeated the proposals by almost a two-to-one margin.67 It is unclear whether there will be any repeal proposals this season, but the Chevron and United Rentals vote results indicate that providing stockholders a balanced, thoughtful explanation of a company's reasoning can be persuasive.

Additionally, boards should be aware that exclusive forum bylaws are relatively new and case law is only beginning to develop. When corporations seek to enforce such provisions in non-Delaware courts, the provisions will be subject to situational reasonableness review and, likely, to challenges from plaintiffs. Although arguments in favor of enforcement are strong, there can be no guarantee that a non-Delaware court will enforce a bylaw providing that the exclusive forum will be in Delaware, and courts in different jurisdictions may reach inconsistent conclusions.

Conclusion

Companies should carefully consider whether to adopt an exclusive forum bylaw, taking into account the issues discussed above, as well as the timing of adoption. For companies that are already public, exclusive forum bylaws represent the best tool currently available to address the phenomenon of strike suits. Boilermakers serves as an important endorsement of the underlying soundness of exclusive forum bylaws. Action has begun moving to courts in other states as plaintiffs challenge the enforcement of these provisions. The reaction of non-Delaware courts to these provisions, particularly in states such as California, will be a critical determinant of their success.

Originally published in The Conference Board

Footnotes

1 Boilermakers Local 154 Ret. Fund v. Chevron Corp.,73 A.3d 934 (Del. Ch. 2013), judgment entered sub nom. Boilermakers Local 154 Ret. Fund & Key W. Police & Fire Pension Fund v. Chevron Corp., 7220-CS, 2013 WL3810127 (Del. Ch. June 25, 2013) [hereinafter Boilermakers].

2 The Chevron bylaw is representative of the current generation of provisions, and provides as follows:

Unless the Corporation consents in writing to the selection of an alter-native forum, the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the Corporation, (ii) any action asserting a claim of breach of a fiduciary duty owed by any director, officer or other employee of the Corporation to the Corporation or the Corporation's stockholders, (iii) any action asserting a claim arising pursuant to any provision of the Delaware General Corporation Law, or (iv) any action asserting a claim governed by the internal affairs doctrine shall be a state or federal court located within the state of Delaware, in all cases subject to the court's having personal jurisdic-tion over the indispensable parties named as defendants. Any person or entity purchasing or otherwise acquiring any interest in shares of capital stock of the Corporation shall be deemed to have notice of and consented to the provisions of this Article VII.

Chevron Corporation, Bylaws, as amended March 28, 2012. Filed as Exhibit 3.1 to Current Report on Form 8-K, filed March 28, 2012 (www.sec.gov/Archives/edgar/data/93410/000119312512139980/d326116dex31.htm). The FedEx bylaw differs from the Chevron bylaw in that (a) the exclusive forum specified is limited to the Delaware Court of Chancery, and (b) it does not include a carve-out for situations in which the court lacks personal jurisdiction over indispensable parties. Both features were added to Chevron's bylaw after it was sued in the Court of Chancery.

3 See John Armour, Bernard Black, and Brian Cheffins, "Delaware's Balancing Act," Indiana Law Journal, 87, issue 4, October 1, 2012, pp. 1345, 1347 ("An extensive body of precedent, developed by expert judges, has been a key part of Delaware's 'value-added' for firms, which has helped to sustain its high share in the market for corporate law, despite premium pricing in the form of sizeable 'franchise taxes' levied on firms that incorporate there.").

4 Boilermakers at 953.

5 Robert M. Daines and Olga Koumrian, "Shareholder Litigation Involving Mergers and Acquisitions," Cornerstone Research, February 2013, pp. 1–3, available at (www.cornerstone.com/getattachment/199b1351-aba0-4f6d-92f0-24b50f4a4b29/Shareholder-Litigation-Involving-Mergers-and-Acqui.aspx). See also Matthew D. Cain and Steven M. Davidoff, "Takeover Litigation in 2012," February 1, 2013, pp. 1–3 (http://ssrn.com/abstract=2216727)). Similar to Daines and Koumrian, Cain and Davidoff found that 91.7 percent of 2012 deals resulted in litigation, and the average number of lawsuits per transaction was five.

6 Daines and Koumrian, "Shareholder Litigation Involving Mergers and Acquisitions," p. 3.

7 Daines and Koumrian, "Shareholder Litigation Involving Mergers and Acquisitions," p. 6 (indicating that in 81 percent of settlements, stockholders received only supplemental disclosures "and the parties in only one settlement acknowledged that litigation contributed to an increase in the merger price").

8 Claudia H. Allen, "Exclusive Forum Provisions: Putting on the Brakes," Bloomberg BNA Corporate Accountability Report, December 14, 2012 [hereinafter "Putting on the Brakes"] (//65.17.213.81/Files/45101_BNA_121412_Exclusive_Forum_Provisions.pdf). In order to adopt a bylaw, the board must be granted authority to do so under the charter. Such a grant is customary. Only a small number of public companies have put exclusive forum charter amendment proposals to a stockholder vote. Institutional Shareholder Services, Inc. and Glass Lewis & Co., Inc., the influential proxy advisory firms, have generally recommended against approval of such management proposals. See Note 65.

9 Allen, "Putting on the Brakes."

10 Boilermakers at 954 and 958.

11 The opinion in Boilermakers noted that Chevron and FedEx had argued that multiforum litigation "imposes high costs on the corporations and hurts investors by causing needless costs that are ultimately borne by stockholders, and that these costs are not justified by rational benefits for stockholders from multiforum filings." Boilermakers at 944. Essentially, both companies argued that adopting such a bylaw was a rational response to a known problem, and their boards should be protected by the deferential business judgment rule.

12 Stipulation and Order of Dismissal, IClub Partnership v. FedEx Corporation, C.A. No. 7238-CS (Del. Ch. November 1, 2013).

13 The parallel suit, largely copied from the Delaware complaint, was filed in March 2012. Bushansky v. Armacost, No. CV 12 1597 (N.D. Cal. 2012). This is the same court that refused to dismiss the case against Oracle Corporation (763 F. Supp. 2d 1170 (N.D. Cal. 2011)) discussed below. On August 9, 2012, the United States District Court for the Northern District of California stayed the Bushansky case until August 8, 2013, pending the outcome of the litigation in the Delaware Court of Chancery. Order Granting in Part and Denying in Part Defendants' Motion to Abstain or Stay and Setting Case Management Conference, Bushansky v. Armacost, No. CV 12 1597 (N.D. Cal. Aug. 9, 2012). On August 20, 2013, the action was stayed "until the Supreme Court of Delaware decides the likely appeal of the Delaware Decision." Stipulation and Order to Continue Stay, Bushansky v. Armacost, No. CV 12 1597 (N.D. Cal. Aug. 20, 2013). The case remains pending.

14 Motion for Dismissal Without Prejudice, Boilermakers Local 154 Ret. Fund v Chevron Corp., C.A. No. 7220-CS (Del. Ch. Oct. 28, 2013).

15 The total does not include THL Credit Senior Loan Fund, a Delaware statutory trust, which adopted an exclusive forum bylaw in August 2013 designating the state or federal courts in Delaware. By December 31, 2013, 155 Delaware corporations, of which 30 are S&P 500 constituents, adopted or announced plans to adopt exclusive forum bylaws, according to the author's research.

16 Allen, "Putting on the Brakes."

17 The provisions of the Maryland General Corporation law relating to the permissible scope of a bylaw are similar to the parallel provisions in the Delaware General Corporation Law, and Maryland courts "have historically found Delaware law in matters involving business law highly persuasive." "Exclusive Forum Selection Bylaws in Maryland," Venable LLP, July 9, 2013 (citing In re Nationwide Health Properties, Inc. Shareholder Litigation, No 24- C-11-001476, slip op. at 16 (Md. Cir. Ct. May 27, 2011)).

18 The total does not include Genco Shipping & Trading Limited, a Marshall Islands corporation, which adopted an exclusive forum bylaw in October 2013, designating the state or federal courts in the state of New York.

19 This percentage is derived from data gathered in connection with preparing Claudia H. Allen, "Study of Delaware Forum Selection in Charters and Bylaws," January 25, 2012, which covers the period March 2010-December 2011 [hereinafter, Study of Delaware Forum Selection] (http://65.17.213.81/Files/45103_Jan_%202012_Forum_Study.pdf).

20 See, e.g., 2014 U.S. Proxy Voting Summary Guidelines, ISS, December 19, 2013 (www.issgovernance.com/files/ISSUSSummaryGuidelines2014.pdf), p. 11.

21 Boilermakers at 954.

22 If the defendant corporation asserts that the lawsuit should be dismissed or stayed on the basis of its exclusive forum bylaw, the foreign court must make a determination as to whether to enforce that bylaw. That determination involves a three-part analysis under which the foreign court: (a) applies the laws of the state of incorporation to evaluate the validity of adoption, (b) applies the foreign jurisdiction's laws to determine whether the motion should be granted, and (c) applies the laws of the state of incorporation to determine whether enforcing the bylaw would lead to a breach of the board's fiduciary duty or an inequitable result. See Joseph A. Grundfest and Kristen A. Savelle, "The Brouhaha Over Intra Corporate Forum Selection Provisions: a Legal, Economic, and Political Analysis," The Business Lawyer, 68, no. 2, February 2013, pp. 325, 330.

23 Derived from data gathered in connection with Allen, "Study of Delaware Forum Selection." The first generation of exclusive forum provisions was largely mandatory, unlike the current generation. See Allen, "Study of Delaware Forum Selection," pp. 7-8.

24 Derived from data gathered in connection with Allen, "Study of Delaware Forum Selection." According to the data, the remaining 4 percent specified a court of competent jurisdiction in Delaware or the state and federal courts in Delaware. Note that the latter formulation is the same as Chevron's amended formulation. The data also indicate that as of December 31, 2011, 13 percent of companies with exclusive forum bylaws included language recognizing the potential for federal courts to have exclusive jurisdiction.

25 Chancellor Strine suggested a practical solution to ensuring that the court would have jurisdiction over officers, employees, and affiliates not subject to 10 Del. C. § 3114, concerning service of process on nonresidents—namely, conditioning advancement and indemnification on assent to jurisdiction in Delaware over the categories of claims covered by an exclusive forum bylaw, or including consent to jurisdiction provisions in employment agreements.

26 Derived from data gathered in connection with Allen, "Study of Delaware Forum Selection."

27 Derived from data gathered in connection with Allen, "Study of Delaware Forum Selection."

28 Boilermakers at 961 (citations omitted).

29 Derived from data gathered in connection with Allen, "Study of Delaware Forum Selection."

30 See Airgas, Inc. v. Air Prods. & Chems., Inc., 8 A.3d 1182, 1188 (Del. 2010) ("Corporate charters and bylaws are contracts among a corporation's shareholders."); Centaur Partners, IV v. Nat'l Intergroup, Inc., 582 A.2d 923, 938 (Del. 1990) ("Corporate charters and by-laws are contracts among the shareholders of a corporation and the general rules of contract interpretation are held to apply."); Boilermakers at 955. ("In an unbroken line of decisions dating back several generations, [the Delaware] Supreme Court has made clear that bylaws constitute a binding part of the contract between a Delaware corporation and its shareholders.").

31 See Allen, "Study of Delaware Forum Selection,"p.7.

32 Moreover, the Delaware courts have rejected the notion that stockholders have "vested rights" that may not be changed through board-adopted bylaw amendments. Boilermakers at 940; Kidsco v. Dinsmore, 953 A.2d 227, 234 (Del. 2008).

33 Lennar Corporation, Bylaws as amended as of October 3, 2013. Filed as Exhibit 3.6 to Current Report on Form 8-K filed October 4, 2013 (www.sec.gov/Archives/edgar/data/920760/000119312513391695/d607840dex36.htm).

34 Explicitly providing that investors are deemed to have submitted to the exclusive jurisdiction of a specified court has been more common in the context of publicly traded limited partnerships and limited liability companies. See e.g., LRR Energy, L.P., Section 16.9 of First Amended and Restated Agreement of Limited Partnership Agreement, dated as of November 16, 2011. Filed as Exhibit 3.1 to Current Report on Form 8-K filed November 22, 2011 (www.sec.gov/Archives/edgar/data/1519632/000110465911065590/a11-30123_1ex3d1.htm); Vanguard Natural Resources, LLC., Section 15.8 of Amendment No. 1 to Third Amended and Restated Limited Liability Company Agreement. Filed as Exhibit 3.1 to Current Report on Form 8-K filed August 5, 2013 (www.sec.gov./Archives/edgar/data/1384072/000138407213000075/vnr-amendmentno1tollcagree.htm).

35 Nat'l Indus. Grp. (Holding) v. Carlyle Inv. Mgmt. L.L.C., 67 A.3d 373, 381 (Del. 2013).

36 Derived from the data gathered in connection with Allen, "Study of Delaware Forum Selection."

37 See Items 1.01 and 5.03 of Current Report on Form 8-K filed August 27, 2013 (www.sec.gov/Archives/edgar/data/887497/000114420413047928/v353808_8k.htm).

38 Ibid.

39 Air Products and Chemicals, Inc., Amended and Restated Bylaws. Filed as Exhibit 3.1 to Current Report on Form 8-K filed July 23, 2012 (www.sec.gov/Archives/edgar/data/2969/000119312513298998/d571094dex31.htm).

40 Schedule 13D filed July 31, 2013 (www.sec.gov/Archives/edgar/data/2969/000119312513311732/d576548dsc13d.htm).

41 Allen, "Study of Delaware Forum Selection," p. 8; Joseph A. Grundfest, "The History and Evolution of Intra-Corporate Forum Selection Clauses: An Empirical Analysis," Delaware Journal of Corporate Law, 37, no. 2, 2012, pp. 333, 354, 368-369 (noting that Delaware chartered corporations headquartered in California were over-represented in the group of entities that had adopted exclusive forum provisions, and that previous research indicated approximately 23.8 percent of Delaware corporations are headquartered in California). Since the cited statistic is from 2003, and the pool of companies analyzed in this article is modest, it is unclear whether California remains over-represented.

42 For example, "2012 State Liability Systems Survey: Lawsuit Climate, Ranking the States," conducted by Harris Interactive Inc. for the U.S. Chamber Institute for Legal Reform, September 2012 (www.instituteforlegalreform.com/uploads/sites/1/Lawsuit_Climate_Report_2012.pdf) ranked California-47, Texas-36, New York-18, Arkansas-35, Illinois-46, Massachusetts-19 and New Jersey-32.

43 Exclusive forum bylaws and charter provisions can be analyzed in largely the same light as stockholder rights plans (poison pills). The validity of these provisions has been established, but they are subject to situational challenge.

44 Boilermakers at 957.

45 M/S Bremen v. Zapata Off-Shore Co., 407 U.S. 1, 10 (1972) (United States Supreme Court held that a forum selection clause should be enforced unless the resisting party can meet the heavy burden of showing that enforcement would be "'unreasonable' under the circumstances."); Ingres Corp. v. CA, Inc., 8 A.3d 1143, 1445, 1147 (Del. 2010) (Delaware Supreme Court held that "where contracting parties have expressly agreed upon a legally enforceable forum selection clause, a court should honor the parties' contract and enforce the clause" unless the resisting party can show that the "clause was unreasonable, unjust, or otherwise invalid."); Boilermakers at 958.

46 Plaintiffs might argue that the bylaw is being used for inequitable purposes. See Schnell v. Chris-Craft Indus., Inc., 285 A. 2d 437 (Del. 1971).

47 763 F. Supp. 2d 1170 (N.D. Cal. 2011).

48 The court suggested that if the provision had been approved by stock-holders and in the company's charter, the argument for enforceability would be stronger. Ibid. at 1175. It is possible that other courts might share this view.

49 Boilermakers at 956.

50 In re Facebook, Inc., IPO Sec. & Derivative Litig, 922 F. Supp. 2d 445, 463 (S.D.N.Y. 2013).

51 Ibid. at 462, note 16 (citations omitted).

52 Order Granting Defendants' Motion to Dismiss Because of Mandatory Forum Selection Clause, Daugherty v. Ahn, Cause No. CC-11-06211 (Cnty. Ct. at Law No. 3, Dallas Cnty. Tex., February 15, 2013).

53 Furmanite Corporation (f/k/a Xanser Corporation), Art VIII, Section 6 of Amended and Restated Bylaws as of September 14, 2006. Filed as Exhibit 3.1 to Quarterly Report on Form 10-Q filed November 14, 2006 (www.sec.gov/Archives/edgar/data/54441/000095013406021554/ d41284exv3w1.htm).

54 Amended Petition for Breach of Fiduciary Duty, Genoud v. Edgen Grp., Inc., No. 625244 (La. 19th Jud. Dist. Ct. filed October 22, 2013).

55 Verified Complaint for Injunctive Relief, Edgen Grp., Inc. v. Genoud, No. 9055-VCL (Del. Ch. filed October 31, 2013).

56 Telephonic Hearing on Plaintiffs' Motions for Expedited Proceedings and For Temporary Restraining Order and Rulings of the Court at 22, Edgen Grp., Inc. v. Genoud, No. 9055-VCL (Del. Ch. November 5, 2013).

57 Ibid. at 36. The Vice Chancellor also stated: "Now, I am not making a ruling today that I do not have personal jurisdiction."

58 Ibid. at 39.

59 Ibid. at 41.

60 See November 8, 2013, letter from P. Clarkson Collins, Jr., counsel for Edgen Group Inc., to Vice Chancellor Laster, describing the November 6, 2013 status conference in Genoud v. Edgen Group Inc., No. 625244 (La. Dist. Ct.) at which the December 13, 2013 hearing was scheduled.

61 Golovoy v. Deutsche Telekom, Cause No. CC-12-06144-A (Cnty. Ct. at Law No. 1, Dallas Cnty., Tex., October 10, 2012). In April 2013, in connection with the consummation of the business combination described below, stockholders also approved an exclusive forum charter amendment and the company changed its name to T-Mobile US, Inc.

62 In Re MetroPCS Communications, Inc., 391 S.W.3d 329, 340 (Tex. App. 2013).

63 Ibid. at 339 (citing In re AutoNation, 228 S.W.3d 663, 667-68 (Tex. 2007)).

64 HEMG Inc. v. Aspen Univ., No. 650457/13 (N.Y. Sup. Ct. November. 4, 2013).

65 See 2014 U.S. Proxy Voting Summary Guidelines, ISS, December 19, 2013 (www.issgovernance.com/files/ISSUSSummaryGuidelines2014.pdf), p. 24 and Proxy Paper Guidelines: 2014 Proxy Season, Glass Lewis & Co. LLC . See also Allen, "Study of Delaware Forum Selection," p.6. ISS' case-by case policy takes into account whether a company has been "materially harmed" by stockholder litigation outside its state of incorporation. As a practical matter, ISS has yet to identify a company it believes has suffered such harm. See Allen, "Putting on the Brakes." Similarly, Glass Lewis has not recommended in favor of any management proposals under its case-by case policy. Note that these policies do not apply to board-adopted bylaws, but it is nonetheless important to take these positions into account.

66 Proxy Paper Guidelines: 2014 Proxy Season, Glass Lewis, & Co. LLC.

67 Allen, "Putting on the Brakes."

68 THL Credit Senior Loan Fund, a Delaware statutory trust, adopted an exclusive forum bylaw in August 2013. 69 Genco Shipping & Trading Limited, a Marshall Islands corporation, adopted an exclusive forum bylaw in October, 2013 designating the state or federal courts in the State of New York.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.