- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit, Insurance and Healthcare industries

Adapted from an article first published in International Tax Review, September 2004.

Introduction

A new type of income security recently made its debut in U.S. capital markets: the Income Deposit Security, or "IDS" as it is commonly referred to. IDSs are high-yielding, fixed income-like instruments consisting of a subordinated debt security and a share of common stock "clipped" together to form an efficient delivery mechanism to distribute an issuer’s free cash flow to its investors.

This article is an introduction to the IDS structure, from its Canadian income trust derivation to its stage of evolution at the time of writing. It is worth noting that the IDS is still a very new security. As this market develops and more offerings close, it can be expected that the IDS structure will continue to evolve.

IDSs were initially conceived by CIBC World Markets as a derivation of the Canadian income trust. The intent was to replicate the economic attributes of the Canadian income trust structure, providing for steady, high-yield returns to U.S. and Canadian investors in U.S. companies.

As of mid-August 2004, only one IDS offering has been completed—the US$277 million initial public offering (IPO) by Volume Services America Holdings, Inc. in December 2003. Since that time, a number of structural changes have been made to address U.S. tax, accounting and regulatory points, and 19 other IDS offerings have been filed with the U.S. Securities and Exchange Commission and, where a Canadian tranche is contemplated, with Canadian securities regulators. A variation on the structure, which is better suited to a U.S. company offering only in Canada, has also been introduced with the successful closing in March 2004 of the Cdn$222 million issue of Income Participating Securities (IPS) by Medical Facilities Corporation in an offering that was co-led by BMO Nesbitt Burns and TD Securities. In Europe, a similar product to the IDS has also been tested. The Norwegian yellow pages group, Findexa, recently completed Europe’s first high-yield dividend share (HYDS) offering.

CIBC Capital Markets has led or co-led 12 of the IDS filings to date. A number of other underwriters are leading or co-leading IDS offerings as well, and some with their own nomenclature: the Enhanced Income Security (EIS) of RBC Capital Markets, the Enhanced Yield Security (EYS) of Lehman Brothers and the Income Unit (IU) of Banc of America. These offerings seek to raise more than US$11 billion in aggregate, and speculation is that offerings filed in 2004 could aggregate more than US$15 billion.

The types of companies best suited for an IDS structure are the same as those best suited for an income trust—that is, they tend to be in mature industries and to produce significant and stable cash flow with limited capital expenditure requirements. A wide diversity of industries is represented in the IDS filings to date with a concentration in rural telephone companies.

The Canadian Income Trust Context

The income trust structure is well accepted in the Canadian public markets. Since 2001, income trusts have accounted for nearly two-thirds of all new equity offerings in Canada, and there are now almost 150 publicly traded Canadian income trusts representing more than 7% of the market value of the Toronto Stock Exchange’s S&P/TSX Composite Index. Their popularity is primarily driven by demand for steady returns at higher yields, particularly in the current environment of relatively low interest rates and uncertain equity markets.

In a typical income trust IPO, a Canadian trust is formed to acquire a business from the selling sponsors. The trust raises cash for this purpose by selling its units to the public in Canada, and the units are listed on the Toronto Stock Exchange. The proceeds from the offering are used to finance an acquisition subsidiary with subordinated debt and common equity. In usual leveraged buyout fashion, additional leverage and cash are achieved through third-party senior debt borrowed by the subsidiary. The subsidiary then uses the aggregate cash to purchase the business.

The result is an efficient structure in which the business, after servicing the senior debt, pays available cash to the trust in the form of interest on the subordinated debt and dividends on the common equity. The trust then distributes this cash to its unitholders. The fact that the trust is a flow-through vehicle for Canadian tax purposes contributes to the efficiency of the structure, as does the interest expense on the subordinated debt, which is deductible by the subsidiary for Canadian tax purposes.

Historically, income trust transactions have generally been domestic Canadian transactions. More recently, the Canadian income trust IPO has been used to finance the acquisition of U.S.-based businesses. The first of this new wave of transactions was completed in May 2002 when Heating Oil Partners Income Fund closed its IPO unit offering and acquired a residential heating-oil distributor with operations in the United States. Since the Heating Oil Partners Income Fund transaction, six additional cross-border (U.S.–Canadian) income fund IPOs have been completed for aggregate proceeds of over Cdn$1 billion. The latest trend is for established Canadian income funds to make acquisitions of U.S.-based businesses typically funded through an offering of trust units. An example of such a transaction would be the recent US$385 million acquisition of an approximately 70% interest in the operating businesses of Bumble Bee Holdings, L.P., a California-based manufacturer and distributor of canned tuna, salmon and specialty seafood by Connors Bros. Income Fund, creating North America’s largest branded seafood company and Canada’s largest consumer products income fund with a market capitalization of approximately Cdn$700 million. The acquisition was financed, in part, by a Canadian public offering of trust units by the Fund.

What Is an Income Deposit Security?

The IDS structure is essentially an income trust structure without the trust. In the IDS structure, rather than holding units of a trust, the investor holds the underlying securities—subordinated notes and common shares of the company—directly. These two securities are clipped together to form an IDS. Holders of IDSs receive interest at a fixed rate on the subordinated notes and dividends on the common shares to produce a blended yield. The distribution policies of IDS issuers are similar to those of income trusts, real estate investment trusts (REITs) and master limited partnerships (MPLs), which distribute a significant portion of their free cash flow, although, in the case of IDSs, as opposed to Canadian and U.S. REITS, there is no regulatory requirement to do so.

As with an income trust, the deductibility for Canadian and U.S. tax purposes of the interest expense on the subordinated debt makes the IDS structure efficient because it transfers the tax liability from the trust to the investor, and the resulting high yields with low volatility are expected to be attractive to U.S. investors. In addition, as IDSs include a common share component, investors also participate in the growth of the company. The result is a traditional leveraged buyout financing structure now available to public investors.

Another aspect of the IDS structure that is expected to be attractive to investors is the distributable cash model. Given the earnings restatements that are now all too common, the transparency of valuations based on distributable cash is appealing. As has been said, "You can’t restate cash in your pocket."

Suitability for the IDS Structure and Valuation

From an issuer’s perspective, the IDS structure provides a capital-raising opportunity at attractive pricing. In the case of a sponsor seller, the result can be higher enterprise valuation and multiple than in a private sale or traditional stock IPO. This is particularly so in the case of a low-growth company that may not be able to access the traditional stock IPO market even in strong market times.

Companies best suited for IDS offerings have the following characteristics: (i) a history of predictable and stable cash flow; (ii) long-life assets requiring limited and minimal capital expenditure; and (iii) strong market position with modest growth potential, operating in a mature industry. A diverse range of businesses are reflected in IDS filings to date, including food services, laundry equipment services, fast food restaurants and children’s care services, with a concentration in rural telephone companies, which represent more than a quarter of the filings to mid-August 2004.

Cash flow is the key element because these offerings are to be priced on a yield relative to expected distributable cash. Distributable cash is calculated by reference to a company’s EBITDA less maintenance capital expenditure, senior debt interest expense, cash taxes and the additional administrative expense of being a public company. The basic valuation model is as follows:

Value = Distributable Cash Required Yield

The valuation calculus is affected by a number of additional factors, including any provision for cash holdback and the size and nature of the selling sponsors’ retained interest in the company. Typically, the form of the retained interest is common stock of a different class and with different dividend rights (both as to yield and priority) from that which is a component of the IDSs. Some offerings provide that the rights of the retained interest to cash distributions are subordinate to, and therefore available to support, expected cash distributions on the IDSs for a certain period of time. The release of the subordination feature may be triggered upon achieving EBITDA and cash distribution targets. Regarding the size of the retained interest, as discussed earlier, it is generally at least 10% of the company’s equity.

The Typical IDS Structure

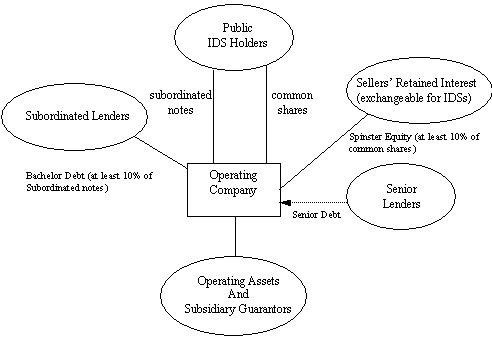

The IDS structure is flexible enough to accommodate a company’s specific needs regarding the amount of capital to be raised, the allocation between debt and equity, and the ownership percentage that will be retained by the sellers. The diagram below illustrates the typical IDS structure:

The IDS structure is imposed on an existing operating business and as a result, unlike income trusts, there is no need to transfer the business into a new structure. The company issues subordinated notes and common shares clipped together to form IDSs. Where applicable, the subordinated notes are guaranteed by the issuer’s operating subsidiaries. IDS filings to date contemplate that the IDSs can be unclipped or separated 45 days after the closing of the offering. A holder of subordinated notes and common shares can also recombine them to form IDSs. In all the offerings, it is contemplated that the IDSs will be listed on a stock exchange (most issuers are submitting applications for listing on the AMEX). Most issuers have also undertaken to list the common shares on the same stock exchange as the IDSs if a sufficient number of IDSs are separated into their component parts and the listing requirements of the stock exchange can be fulfilled. No IDS offerings to date contemplate a similar listing of the subordinated notes.

As discussed below, to support the desired tax and accounting treatment of the subordinated notes, 10% of the equity of the issuer (the so-called spinster equity) must be held separately by parties that do not hold any subordinated notes (generally as a retained interest held by the selling sponsors) for two years, and 10% of the subordinated notes (the so-called bachelor debt) is required to be placed with third parties that do not hold IDSs or other equity of the issuer and have no intention of doing so. It is usually necessary to refinance the senior debt of the company in conjunction with an IDS offering to accommodate the issuance of the subordinated notes and the interest payments thereon and the dividend payments on the common shares (as components of the IDSs). The interaction of the senior debt with the subordinated notes is an important and often challenging aspect of structuring these transactions particularly since most of the issuer’s free cash flow after debt service is to be distributed in the form of dividends on its common shares.

Management incentives in IDS companies are generally taking the form of long-term incentive plans that pay out differing percentages of increased distributable cash above various thresholds. Consequently, management is more focused on cash flow generation than on the more traditional quarterly earnings per share. Incentive payments are usually in the form of cash or IDSs.

Characterization of the Subordinated Notes for U.S. Tax and Accounting Purposes

A critical structuring point for IDS transactions is to ensure that the subordinated notes are indeed characterized as debt for U.S. federal income tax and accounting purposes. If the subordinated notes are characterized as equity rather than debt, the interest paid to the holders of the subordinated notes will be treated as dividends and will therefore not be tax-deductible by the company. This could materially increase the tax liability of the company and correspondingly reduce distributable cash. The characterization of the subordinated notes as debt rather than equity is primarily a U.S. income tax concept since the intent is to obtain an interest deduction for U.S. federal income tax purposes for a U.S. taxpayer. Canada does not have a history of jurisprudence on the characterization of debt as debt or equity.

The U.S.–Canadian Cross-Border Income Fund Experience

The characterization of the subordinated notes as debt is relevant in the cross-border income fund context. The subordinated notes issued in those transactions were structured to achieve the desired debt characterization, and tax opinions were issued by U.S. counsel to the company and to the underwriters to the effect that, on the basis of certain factors derived from case law, the subordinated notes "should" be treated as debt, and the interest paid on the subordinated notes "should" be deductible for U.S. federal income tax purposes. Unfortunately, no ruling from the IRS can be obtained as to the characterization of the debt as debt since such an issue is a question of fact.

Some of the factors relevant to determining the characterization of the subordinated notes as debt for U.S. federal income tax purposes are as follows, although no one factor is determinative:

- the notes are not convertible into equity of the issuer;

- there is a lack of ownership proportionality between debt and equity holders;

- the initial capitalization of the issuer is commercially reasonable;

- there is a lack of subordination of the notes to trade creditors;

- the notes have no voting rights and no participation rights;

- the interest on the notes is paid on a set date at a fixed rate;

- the obligation to pay interest on, and to repay the principal of, the notes is unconditional;

- the income trust and the retained interest holder would have normal creditor remedies on default of payment of interest or principal;

- the initial debt-to-equity ratio (by value) is approximately 3 to 1 and commercially reasonable; and

- the term, interest rate and other provisions of the notes and any subsidiary guarantee of the notes are commercially reasonable.

In addition to the U.S. tax analysis, an accounting analysis is required by the company’s auditors to determine the correct financial statement presentation of the subordinated notes. If the auditors are not satisfied, they may require that the company take a reserve against earnings equal to the value of the deduction of interest expense on the subordinated notes. In the face of such a reserve, the company’s board of directors would likely feel compelled to reduce correspondingly dividends on the company’s common shares.

The IDS Context

Although IDSs have certain structural elements in common with cross-border income funds and therefore face the same subordinated debt-characterization challenge, IDS structures generally have some additional features that support the characterization of the subordinated notes as debt for U.S. federal income tax purposes.

Most important, the IDS structure does not involve a trust. Investors hold the components of the IDSs directly and can separate them more easily into their component subordinated notes and common shares. It is believed that the easier separation of the subordinated notes from the common shares in the IDS structure relative to the cross-border income fund structure provides support for the desired tax and accounting treatment in IDS offerings. As with the cross-border income funds, tax opinions at the "should" level are being obtained in connection with IDS offerings.

Typical Subordinated Note Terms

The desired tax and accounting treatment is also supported by having subordinated note terms that are in line with conventional high-yield debt. The ratio of total outstanding debt to EBITDA and the ratio of anticipated cash flow to debt service payments from IDS issuers are typically consistent with ratios for issuers of public high-yield subordinated debt instruments. The maturity of the subordinated notes is now in the range of 10 to 15 years. The interest rate on the subordinated notes will depend on the market conditions at the time of offering. IDS issuers are also obtaining opinions from independent financial advisers relating to the market terms of their subordinated notes.

As IDS filings have evolved, the covenant pattern applicable to the subordinated notes now more closely resembles that of high-yield debt. Initially, some of the IDS transactions, such as the Volume Services offering, had an interest deferral mechanism whereby interest on the subordinated notes was to be deferred for a certain period of time if certain financial ratios were not met. This requirement was imposed by the senior lender. In some of the more recent filings, interest deferral has been converted into a permissible feature, at the option of the issuer, rather than mandated, or shortened or eliminated all together.

Lastly, most of the IDS filings contemplate a payment blockage period whereby interest payments on the subordinated notes can be blocked for so long as a payment default under the senior credit facility exists or for 179 days in the event of a default (other than a payment default) under the senior credit facility.

Requirements of the Big Four Accounting Firms

In March 2004, the big four accounting firms communicated certain requirements for IDS offerings, many of which had already been structured into these offerings to strengthen the characterization of the subordinated notes as debt for accounting purposes. These requirements are as follows:

- that the bachelor debt requirement be met: at least 10% of the subordinated notes must be held separately by third parties that do not hold any IDSs or other equity of the issuer;

- that the spinster equity requirement be met: at least 10% of the equity of the issuer (not in the form of IDSs) must be held separately by parties that do not hold any subordinated notes and this equity must not be exchangeable for IDSs for at least two years;

- that the indenture governing the subordinated notes prohibit the payment of dividends on the common share component of the IDSs if interest is not being paid on the subordinated debt;

- that the underwriters undertake to use their best efforts to make a market for the bachelor debt;

- that the subordinated notes rank parri passu with trade debt; and

- that counsel to the issuer deliver a legal memorandum analyzing the treatment of the subordinated notes and related subsidiary guarantees as debt in a bankruptcy context and a "should" level tax opinion that the subordinated notes should be treated as debt for U.S. federal income tax purposes.

Conclusion

The IDS structure continues to evolve as the offerings now filed with the U.S. States Securities and Exchange Commission respond to comments and seek to clear their registration statements. For example, in some recent IDS filings, the exchangeability feature of the common shares to be held as a retained interest by the selling sponsors (which is not in the form of IDSs) has been eliminated. Assuming these offerings clear the regulatory process and find favour with investors, we can expect to see more of the IDS structure, whether in the form of IDS (in the United States), IPS (in Canada) or HYDS (in Europe).

Richard Willoughby is a partner and Alexandra A. Kau a senior associate in the Corporate Department of the New York office of Torys LLP. Their practices include advising on IDS offerings in the United States. Gary J. Gartner is a partner and chair of the Tax Department of Torys in New York, and Corrado Cardarelli, a partner in the Tax Department of Torys’ Toronto office.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.