The scope of the European Market Infrastructure Regulation

The European Market Infrastructure Regulation ("EMIR") is the European Union's implementation of the G20 commitment to reduce systemic risk and increase transparency in the OTC derivatives market. In order to achieve these aims EMIR imposes three sets of obligations upon market participants: (i) clearing; (ii) reporting; and (iii) risk mitigation.

Whilst many non-bank entities might assume they are not affected by EMIR, they should note that it has very broad application. In particular, real estate funds and managers, corporate and trading entities ought to be cognisant of the application of EMIR to their OTC derivative activities.

Scope of market participants captured

EMIR distinguishes between types of market participant and has two broad categories of counterparties:

a) Financial counterparties ("FCs"), which are: investment undertakings; banks; insurance, assurance and reinsurance undertakings; undertakings which operate collective investment schemes and their managers; institutions for the provision of occupational retirement benefits; and alternative investment funds managed by alternative investment fund managers, which are authorised by the relevant EU directive.

b) Non-financial counterparties

("NFCs"), are any entities incorporated

or established in the European Union that are not FCs. NFCs are

further divided depending on the scale of their OTC derivatives

trading activity: those NFCs that engage in OTC derivatives

transactions which exceed certain notional value thresholds[1]

("NFC+");and those NFCs whose OTC

derivatives transactions do not exceed a threshold

("NFC-").

Classification as a FC, NFC+ or NFC- impacts upon the extent to which a market participant must comply with EMIR. However, all OTC derivatives market participants (except individuals) will be required to comply with EMIR to some extent (there is no de minimis exception).

Scope of OTC derivatives contracts captured

Every type of OTC derivative contract is captured by EMIR. EMIR applies to both standard and non-standard OTC derivatives contracts and does not distinguish between speculative OTC derivatives contracts and those made for commercial purposes.

Territorial scope

EMIR has wide territorial reach and does not simply apply where both market participants are based in the EU.

If a FC or a NFC enters into a OTC derivatives transactions with a counterparty based outside the EU then the transaction will be caught (subject to various agreements between the EU and other countries on equivalent regulatory regimes). As well, transactions between counterparties where neither counterparty is based in the EU will be captured by EMIR if the OTC derivatives transaction has "a direct, substantial and foreseeable effect" within the EU.

The scope of EMIR is broad, significantly broader than that of Title VII of Dodd-Frank, and will raise issues of compliance for all market participants. The obligations that must be complied with are below, for each obligation also detailed is the date when that obligation has or will enter into force.

The Clearing Obligation

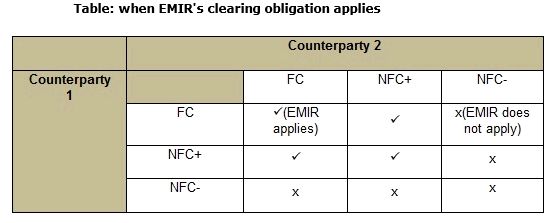

The clearing obligation only applies to FCs and NFCs+ who enter into OTC derivatives contracts where the derivative is standardised and liquid. The table below shows when EMIR's clearing obligation will apply.

The clearing obligation requires all eligible OTC derivatives contracts to be cleared through a central counterparty that has been authorised or recognised by the European Securities and Markets Authority ("ESMA").

Entry into force: expected to enter into force in July 2014, but this is dependent on central counterparties being authorised or recognised by ESMA.

The Reporting Obligation

The reporting obligation is broader than the clearing obligation in that it applies to all derivatives contracts (not simply those that are standardised and liquid) and all counterparty types (including NFCs-). The reporting obligation will apply to both counterparties to a transaction whenever negotiations of an OTC derivative contract are concluded or the contract is modified or terminated. The report must be made to a trade repository which has been authorised or recognised by ESMA.

A market participant can delegate its reporting obligation to its counterparty or an agent/third-party service provider. However, liability for failure to make a report will remain with the market participant even if it has delegated reporting.

Entry into force: expected to enter into force in February 2014, but this is dependent on trade repositories being authorised or recognised by ESMA 90 days in advance of that date. The Risk Mitigation Obligations

These risk mitigation obligations apply to those OTC derivatives contracts that are not subject to the clearing obligation.

(i)Record keeping obligation

All market participants are to maintain records of their OTC derivatives trading activities and retain these records for a period of 5 years following termination of the relevant OTC derivatives contract.

Entered into force: 16 August 2012

(ii) Timely confirmation obligation

Requires counterparties to an OTC derivatives contract to confirm the details of that contract by electronic means and within a "timely manner". What "timely" means varies depending on the type of OTC derivatives contract and when it was entered into.

Entered into force: 15 March 2013

(iii) Valuation obligation

FCs and NFCs+ must, on a daily basis, value their outstanding OTC derivatives contracts using either a mark-to-market or mark-to-model valuation process.

Marking-to-market entails tracking the current market value of an OTC derivative contract so that losses or gains on a position can be calculated.

Marking-to-model is where a financial model is used to price a position instead of using market prices to calculate values (mark-to-market).

Entered into force: 15 March 2013

(iv) Portfolio reconciliation obligation

Where market participants have multiple OTC derivatives contracts

with the same counterparty then a portfolio reconciliation process

will have be conducted (at a varying frequency depending on whether

the counterparties are FCs, NFCs+ or NFC-). Portfolio

reconciliation is the process by which counterparties check that

they have a consistent record of the terms of their transactions

with each other by comparing descriptions of their

portfolios.

Entered into force: 15 September 2013

(v) Portfolio compression obligation

All market participants with 500 or more uncleared OTC derivatives contracts with the same counterparty must have procedures in place to regularly (at least twice a year) determine whether to conduct a portfolio compression exercise. Portfolio compression entails terminating equal and offsetting trades with the same counterparty. It reduces the gross notional size and number of trades in a market participant's portfolio without changing the overall risk profile or value of the portfolio.

Entered into force: 15 September 2013

(vi) Dispute resolution obligation

Market participants must agree with their counterparties procedures and processes to identify, record and monitor disputes relating to the OTC derivatives contracts between them.

Entered into force: 15 September 2013

Conclusion

EMIR imposes substantial obligations on all market participants, including those not ordinarily subject to financial services regulation. In addition to market participants putting systems and controls in place in order to comply with EMIR, market participants will also need to completely review their existing derivatives documentation. Amending existing documentation can be accomplished either through adhering to the relevant ISDA Protocols or through the drafting of bespoke bilateral agreements.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.