In less than one year, Affordable Insurance Exchanges ("Exchanges") authorized by the Affordable Care Act ("ACA") are scheduled to be operational, providing a marketplace for the purchase of Qualified Health Plans ("QHPs") in the individual and small group markets. The Obama Administration has recently accelerated rulemaking and subregulatory guidance associated with the new Exchange/QHP framework, with many of the key details only now being finalized.

This Client Alert focuses upon some of the most significant features of QHPs and related issues, with a particular emphasis on prescription drugs. This includes a summary of ACA subsidies and associated potential fraud and abuse implications, including the potential for QHPs to be considered federal health care programs subject to the federal anti-kickback statute.

Exchanges and Types of Plans To Be Offered Through Exchanges

Exchanges and SHOPs; Individual and Small Group Coverage. "Exchanges" are governmental agencies or non-profit entities which meet a series of regulatory requirements and make QHPs available for both "qualified individuals" to purchase in the individual market, and for "qualified employees" of "qualified employers" to purchase in the small group market. The Exchanges will make the QHPs available to qualified employees/employers in the small group market through a "SHOP" (abbreviation of "Small Business Health Options Program").

Federally-Facilitated Exchange ("FFE"). The Department of Health and Human Services ("HHS") will establish and operate a FFEfor each state that does not elect to create an Exchange. Because 26 states will default to FFEs, the decisions that HHS makes with respect to the operation of FFEs (and FF-SHOPs) will be particularly important.

State-Federal Partnership Exchanges. In the State-Federal Partnership model, the state and federal government split responsibility for various Exchange functions. Seven states have proposed to enter into these types of Exchanges.

State-Based Exchanges. Seventeen states plus DC have proposed to establish their own Exchanges and have received conditional approval from HHS.

Qualified Health Plans. The plans to be offered through Exchanges and SHOPs are defined as "Qualified Health Plans" or "QHPs."2

"Metal Level" and Catastrophic QHP Coverage. QHPs will be categorized based upon their "level of coverage," or "actuarial value" ("AV," defined as percentage paid by the QHP of the allowed cost of benefits under the plan), to a standard population, as follows:

Bronze level - AV of 60%.3

Silver level - AV of 70%.

Gold level - AV of 80%.

Platinum level - AV of 90%.

"Silver plan variation" - Enrollees whose income falls within certain income ranges are entitled to elect a variation of the silver plan with reduced cost sharing, subsidized by the federal government. That is, these "silver plan variations" have a higher AV than the standard silver plan offered by the relevant QHP issuer (through the lower annual limit on enrollee cost-sharing described in next section, "Annual Limits on Cost-Sharing," and other reductions in copays, deductibles and other out-of-pocket amounts). The QHP issuer will determine what changes to deductibles or copays (if any) need to be made to achieve the higher AV; consequently, a silver plan variation will not necessarily have lower deductibles/copays for prescription drugs. There will be three categories of silver plan variations, based upon income (relative to the Federal Poverty Line ("FPL")), as follows:

Catastrophic plan - Except for coverage of three primary care visits and preventive care, these plans provide no coverage of Essential Health Benefits (defined below) until the beneficiary has incurred cost-sharing expenses equal to the annual out-of-pocket limit ($6,400 for 2014). Only individuals under 30 years of age or who are exempt from the mandate to purchase coverage may enroll in catastrophic plans.5

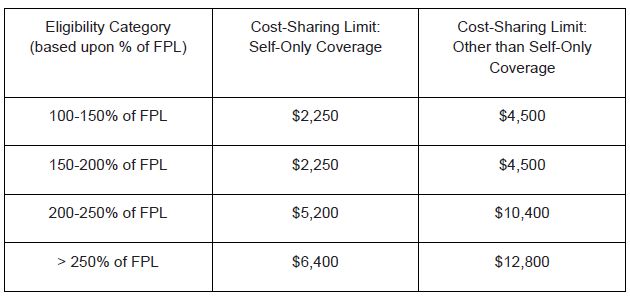

Annual Limits on Cost-Sharing. All QHPs are subject to annual limits on cost-sharing, which are reduced for low-income beneficiaries. For 2014, these limits are as follows:6

Multi-State Plans. The ACA requires the Office of Personnel Management ("OPM") to contract with health insurance issuers to offer at least two multi-state plans ("MSPs") in each Exchange. At least one such contract must be with a non-profit entity. OPM is to administer the MSP program "in a manner similar to the manner" in which OPM administers the Federal Employees Health Benefits Program ("FEHBP"), including through negotiating a medical loss ratio, a profit margin, premiums and other terms and conditions of coverage. OPM's approval will be required for each MSP's benefits package, including the prescription drug list (which would be judged against the applicable benchmark plan, in accordance with the standard for all QHPs described in the "Prescription Drug Requirement" section below).

Exchange Certification. QHPs must be certified by the Exchange on which they will be offered. There are a variety of federal requirements, including state licensure, and states are also allowed to establish state-specific requirements for the QHPs to be offered through their Exchanges, subject to various limitations.

Essential Health Benefits

All QHPs must cover the following ten categories of Essential Health Benefits ("EHBs"): ambulatory patient services; emergency services; hospitalization; maternity and newborn care; mental health and substance-abuse disorder services, including behavioral health treatment; prescription drugs; rehabilitative and habilitative services and devices; laboratory services; preventive and wellness services and chronic disease management; and pediatric services, including oral and vision care.

Benchmark Plans. While the ACA provided that CMS was to further define Essential Health Benefits, CMS has instead provided that EHBs will be defined in each state by reference to a benchmark plan for that state; the state can choose the benchmark plan, from several alternatives,7 and if a state does not make a selection, the default benchmark plan will be the largest plan by enrollment in the largest product in the state's small-group market. The benchmark plan for each state is set forth in Appendix A to CMS's final rule on Essential Health Benefits.8 For multi-state plans, multi-state plan issuers would have the additional option of selecting any of the three largest FEHBP plan options as the benchmark plan for purposes of defining EHBs.

Prescription Drug Requirements. With respect to prescription drugs, the final rule released by CMS provides that, in order to provide Essential Health Benefits, a plan must cover at least the same number of drugs in each United States Pharmacopeia ("USP") category and class as are covered by the benchmark plan for the given state, but in no event less than one drug in every USP category and class. The QHP issuer must submit its drug list to the Exchange, the state or OPM (as applicable), and must have procedures in place that allow an enrollee to request and gain access to clinically appropriate drugs not otherwise covered by the QHP.

"Medical Management Techniques" - The preamble to the final rule states that QHP issuers "may continue to use reasonable medical management techniques that are evidence-based" subject to the regulation prohibiting discrimination based upon factors such as age or health condition. This may permit drugs to be counted toward the minimum number in the class if on formulary9 but subject to prior authorization or step edits. Relative to determining what prior authorization, etc. would be deemed impermissibly discriminatory, CMS indicates that the states and the Exchanges will be "responsible for monitoring drug lists for such compliance as part of their enforcement and certification responsibilities."

Formulary Cost-Sharing Tiers - HHS states that the requirement to place a drug on formulary "does not require that drugs be covered on a particular tier" of the formulary; accordingly, certain drugs could be put on copay tiers requiring very high copays. Notably, the Actuarial Value Calculator that HHS has released for calculation of AVs10 provides for four formulary tiers - generic, preferred brand, non-preferred brand, and specialty drugs.

Premiums

Variation in Premiums. Unlike under Medicare Part D,11 but consistent with most individual health insurance policies today, the beneficiary premium payable for a given QHP can vary from one beneficiary to the next. However, the bases for and amount of variation are limited. Specifically, rates may vary based upon age, but the maximum variation on that basis is 3 to 1; rates may vary based upon tobacco use, but not by more than 1.5 to 1; and rates may vary upon geographic rating areas, including by state for MSPs. Premiums may also vary based upon whether coverage is for an individual or family.

Refundable Premium Tax Credits. Individuals enrolling in QHPs (other than catastrophic plans) through Exchanges whose "household income" (a defined term, based upon modified adjusted gross income) is between 100% and 400% of the FPL are entitled to refundable "premium tax credits" to reduce the premium amount they would otherwise pay for a QHP.12 The premium tax credit is computed based upon the individual's household income and the premium that the individual would pay for the second-lowest cost silver QHP available to the individual.

Formula for Calculation of Premium Tax Credits. Specifically, the individual receives a tax credit equal to the difference between (1) the premium for the second-lowest silver QHP, and (2) the product of (a) the "applicable percentage" for the beneficiary, based on that beneficiary's household income, and (b) the beneficiary's household income. Accordingly, if the beneficiary were to enroll in the second-lowest cost silver QHP, the premium tax credit would be in an amount sufficient to reduce their net premium cost to the given portion of their household income.

Applicable Percentage. The "applicable percentage" ranges from 2% of household income for beneficiaries with household income of 133% or less of the FPL, to 9.5% of household income for beneficiaries with household income of at least 300% but less than 400% of the FPL.

Variation in QHP Premiums. The premium tax credit is the same regardless of specific QHP selected by the individual, except that it can never exceed the amount of the premiums payable under the QHP in which the beneficiary actually enrolls. Consequently, an individual selecting a plan with a higher premium pays that added premium out of his/her own pocket, without an additional premium subsidy.

Advance Payments; Annual Reconciliation on Tax Return. Eligibility for the premium tax credit is calculated by Exchanges on a monthly basis, based upon information provided by the individual, and advance payments of the premium tax credit are paid to the QHP issuer based upon such submissions. Beneficiaries must submit an income tax return to claim the credit; subject to certain exceptions/limitations, if the credit to which the beneficiary is ultimately entitled based upon the tax return exceeds the advance payments of the credit received, the beneficiary owes the difference to the Internal Revenue Service.

Cost Sharing Reductions

As noted in the "silver plan variation" section above, beneficiaries whose income falls below certain levels are entitled to enroll in a "silver plan variation" with reduced cost-sharing. This reduced cost-sharing is subsidized by HHS.

Advance Payments of Estimated Cost-Sharing Reductions. CMS will make monthly advance payments to the QHP issuer equal to the estimated per member per month ("PMPM") dollar value of the cost-sharing reductions provided under the silver plan variation at issue.

Reporting of Actual Reductions. The cost-sharing subsidy ultimately paid to a QHP issuer will be based upon the actual amounts of the cost-sharing reductions provided to beneficiaries. For each calendar year and plan variation, the QHP issuer must submit to HHS the total allowed costs for EHBs, broken down by (1) the amount the issuer paid, (2) the amount the enrollees paid, and (3) the amount the enrollees would have paid under the standard plan without cost-sharing reductions. QHP issuers can calculate the amount the enrollees would have paid under the standard plan without cost-sharing reductions by applying the actual cost-sharing requirements under the standard plan to the allowed costs for EHB under the plan variation (the "standard methodology"). For drug claims, this would require applying the difference in deductible/copay for the given claim between the standard plan and the plan variation (e.g., $15 copay instead of $25 copay). Additionally, in response to complaints that this methodology would require substantial system changes, HHS has provided a "simplified methodology" alternative in an interim final rule; under this simplified methodology, QHP issuers would apply summary cost-sharing parameters for the standard plan to the total allowed costs paid for EHB under the plan with cost-sharing reductions..

Periodic Reconciliation. The actual reductions provided are reconciled against the advance payments, presumably on an annual basis. If the advance payments exceed the actual reductions, the QHP issuer must refund the difference, and if the advance payments are less, CMS pays the difference to the QHP issuer.

Fraud & Abuse/Reporting Issues

Importance of Appropriate Reporting of Rebates and Other Discounts. While the regulations do not expressly state this, this reconciliation is presumably based upon QHP costs, net of discounts; consequently, if a QHP fails to appropriately take into account manufacturer rebates or other discounts in reporting drug claim costs, there would presumably be an overpayment by the federal government. Consequently, this is one example of an area where requiring QHPs to appropriately report rebates and other discounts will be important Are Silver Plan Variation QHPs Federal Health Care Programs? This direct federal funding of silver plan variation QHPs may make such QHPs "federal health care programs" subject to the federal anti-kickback statute.13 The statutory definition of that term, at 42 U.S.C. § 1320a-7b(f), includes "any plan or program that provides health benefits, whether directly, through insurance, or otherwise, which is funded directly, in whole or in part, by the United States Government...." Notably, since cost-sharing reductions apply only for silver plan variations, this basis for QHPs to potentially constitute federal health care programs would not apply for bronze, gold, platinum or catastrophic plans (but other bases might apply - see the section on "Premium Stabilization Programs" below). To the extent that QHPs are deemed federal health care programs, due to cost-sharing subsidies or other features of QHPs, there may be various potential regulatory implications to be considered, e.g., for patient assistance programs providing manufacturer copay or other support for beneficiary cost-sharing.

Premium Stabilization Programs, a/k/a, the "3 Rs"

QHPs may make payments or receive funds under the ACA risk adjustment, reinsurance and risk corridor programs, also known as the "3 Rs." These programs are intended to reduce the risk borne by individual QHPs, and thereby permit them to be offered for lower premiums.

Risk Adjustment. QHPs (and most plans in the individual and small group markets offered outside of Exchanges) are subject to risk adjustment. Risk adjustment calculates a risk score for each enrollee, based upon age, sex and recorded diagnoses. This is used to calculate the plan average risk score. If the plan average risk score is higher than the average risk score for the state, the QHP issuer will receive a payment reflecting the expected additional cost, based upon the average premium for the state. Payments from and to QHP issuers will be made following the end of the plan year.

Prescription Drug Use Not a Factor in Risk Score Calculation. CMS has determined that prescription drug use will not be used as a predictor of health costs or in calculation of risk scores at this time, since "we believe that inclusion of prescription drug information could create adverse incentives to modify discretionary prescribing." It appears that CMS may be concerned that including prescription drug use in the concurrent risk adjustment methodology could give QHPs a financial incentive to have certain drugs prescribed because of the financial benefit to the QHP from an improvement in its risk score.

Similar to Medicare Advantage/Part D Risk Adjustment. The risk adjustment model will operate similar to the manner in which risk adjustment currently operates for Medicare Advantage and Medicare Part D plans, except that it will be based upon same-year (concurrent) diagnoses, rather than prior-year diagnoses as under Medicare Advantage/Part D risk adjustment, and a modified set of health condition codes are used for scoring. States can operate a risk adjustment methodology instead of having CMS do it, however, for 2014, only Massachusetts has proposed to operate its own risk adjustment methodology.

Reinsurance. Under the reinsurance program, most commercial health insurers and self-insured plans must pay $5.25 PMPM to HHS. Out of these funds, HHS will make reinsurance payments to QHPs in the individual market for beneficiaries whose claims costs exceed $60,000 per year. Specifically, HHS will pay a QHP issuer 80% of an enrollee's claims costs between $60,000 and $250,000 per year; provided that CMS may reduce the payment if amounts collected for a year (based upon the $5.25 PMPM amount, or other national contribution rate established by HHS) are less than the requests for reinsurance payments.

Claims Costs Net of Discounts. While HHS does not state specifically that claims costs are net of discounts, this will almost certainly be the case; consequently, this is another feature of QHPs for which appropriate reporting of manufacturer rebates and other types of discounts will be important, to avoid overpayment of reinsurance subsidies.

Another Potential Basis for Individual Market QHPs to Constitute Federal Health Care Programs? Because HHS will disburse funds for reinsurance payments to QHP issuers with respect to QHPs in the individual market, there is the potential for such QHPs to be deemed "federal health care programs" subject to the anti-kickback statute on the basis that it is "funded directly, in whole or in part, by the United States Government." On the other hand, if a QHP did not receive any reinsurance payments in a given year, such a basis may not apply.

Risk Corridors. Under the risk corridor program, QHP issuers whose "allowable costs" vary from their "target amount" by 3% or more, are entitled to receive, or must pay, amounts to HHS. The program essentially helps to limit QHP issuers' risk from having claims costs significantly greater than expected in establishing the premium. The program operates in a manner similar to the Medicare Part D risk corridors.

Allowable Costs Greater Than 103% of Target Amount: If allowable costs are greater than 103% but less than 108% of the target amount, HHS pays the QHP issuer 50% of the allowable costs in excess of 103%. For allowable costs greater than 108% of the target amount, HHS pays an additional 80% of the amount in excess of 108%.

Allowable Costs Less Than 97% of Target Amount: If Allowable Costs are less than 97% but greater than 92% of the target amount, the QHP issuer must pay 50% of the difference between the allowable costs and the 97% to HHS. For allowable costs less than 92% of the target amount, the QHP issuer must pay an additional 80% of the amount below 92% to HHS.

Claims Costs Net of Discounts. Again, allowable costs for purposes of risk corridor calculations will presumably be determined net of manufacturer rebates and other forms of discounts received by a QHP issuer; accordingly, this is another feature of QHPs for which appropriate reporting of rebates and other forms of discounts will be important, to avoid overpayment (or inappropriately avoided payment) of risk corridor adjustment amounts.

Potential Basis for QHPs to Constitute Federal Health Care Programs? Because HHS will disburse funds for risk corridor adjustments to QHP issuers with respect to QHPs, there is the potential for such QHPs to be deemed "federal health care programs" subject to the anti-kickback statute on the basis that such QHPs would be "funded directly, in whole or in part, by the United States Government." On the other hand, if a QHP did not receive any risk corridor adjustments in a given year, such a basis may not apply.

Other Issues

Fees vs. Discounts. The rules do not clearly indicate whether or how various amounts paid as fees, but which could also be characterized as discounts, should be handled. For example, under Medicare Part D, administrative fees paid by manufacturers to PBMs are required to be characterized as discounts (rebates) unless they constitute "bona fide service fees," for which one requirement is satisfaction of a fair market value test. Further guidance may be forthcoming on these issues.

Reporting of Data via "Edge Servers."

Reporting of Data via "Edge Servers." CMS has stated that it intends to use a "distributed data processing tool," referred to as an "edge server," which would reside on health insurance issuers' systems to make de-identified claims data available to CMS on a remote basis for risk adjustment and reinsurance calculations. In the final Notice of Benefit and Payment Parameters released at the beginning of March 2013, HHS stated that the data formats, definitions and technical standards will be made available in future guidance, and the system must be implemented and tested by QHP issuers for QHPs no later than September 30, 2013. Significantly, the operation of such tool (and its interaction with different health insurers' own computer systems) may effectively drive the manner in which data is reported on different issues. It is unclear what impact this novel reporting/data collection strategy may have, relative to requirements for appropriate reporting of rebates, other types of discounts, and various types of fees.

Footnotes

* This high-level summary omits numerous details/exceptions relating to the matters discussed herein and is not intended to constitute legal advice as to any matter.

2 The specific definition (at 45 C.F.R. § 155.20) is: "Qualified health plan or QHP means a health plan that has in effect a certification that it meets the standards described in subpart C of part 156 issued or recognized by each Exchange through which such plan is offered in accordance with the process described in subpart K of part 155."

3 A QHP's AV can deviate from the 60%/70%/80%/90% level by +/- 2%, and still be offered as having the applicable level of coverage; e.g., a QHP with an AV of 58% could be offered as a bronze plan.

4 Silver plan variations may vary from these AV levels by +/- 1%, except that the AVs of the standard silver plan and of the silver plan variation for individuals within income at 100%-150% of the FPL must also differ by at least 2%.

5 In addition to the QHP types detailed here, QHP issuers must offer two plan variations for Indians, one of which has all cost-sharing eliminated, and the other of which has no cost sharing for items furnished by the Indian Health Service.

6 Pursuant to the ACA, these limits on cost-sharing apply to all benefits under the QHP - i.e., a combined annual limit on cost-sharing for medical benefits, prescription drugs and other benefits. In response to comments from industry indicating that plans are incapable of administering a combined limit on all benefits, HHS has released an FAQ which appears to permit, for 2014 only, certain health plans that administer their drug benefits through a separate pharmacy benefit manager ("PBM") to apply separate out-of-pocket maximums for "major medical" and prescription drug benefits, so long as each out-of-pocket maximum is less than the limits identified here. It is unclear whether this "enforcement safe harbor" is intended to apply to QHPs, but if it does, a QHP could establish separate out-of-pocket maximums for major medical and prescription drug benefits, which add up to twice the limits shown in the table above. We expect further guidance on this issue.

Alternatives are: (1) the largest health plan by enrollment in any of the three largest small group insurance products in the state's small group market; (2) any of the largest three employee health benefit plan options by enrollment offered and generally available to state employees in the state; (3) any of the largest three FEHBP plan options by aggregate enrollment that is offered to all health benefits-eligible federal employees; or (4) the coverage plan with the largest insured commercial non-Medicaid enrollment offered by an HMO operating in the state.

8 78 Fed.Reg. 12834 (Feb. 25, 2013). Additionally, to the extent a benchmark plan does not cover all EHBs, that benchmark plan is deemed supplemented by a supplementary plan, also listed in Appendix A to this final rule.

9 Note that the final HHS rules for QHPs/Exchanges do not define or use the term "formulary," unlike the CMS Medicare Part D rules; instead, they refer to what drugs are "covered" by the QHP, and state that a QHP must submit "its drug list" to the Exchange, state or OPM. Nevertheless, the "list" of drugs "covered" by the QHP appears to be what is generally referred to in the industry as a "formulary," so we use that term herein.

10 Available at cciio.cms.gov/resources/files/av-calculator-final-2-20-2013.xlsm. QHPs are not required to conform to these tiers; for different formulary designs, they can submit an AV analysis by a qualified actuary.

11 Individual premiums for a given Part D plan do vary under Part D, but not based upon age, etc.; the variation is based on the enrollee's income exceeding certain levels, at which point federal subsidies are reduced, and the beneficiary's premium increases accordingly.

12 There are various requirements for premium tax credits not detailed here; most notably, they are not available to individuals who are eligible for "minimum essential coverage" through certain government-sponsored programs, grandfathered health plans, or employer coverage which is "affordable" (based upon income and plan coverage tests).

13 To our knowledge, HHS has not to date directly addressed the potential applicability of the anti-kickback statute to QHPs. However, we note that the ACA includes a provision which expressly makes the False Claims Act applicable to payments "made by, through, or in connection with an Exchange...if those payments include any Federal funds." That section further states that "[c]ompliance with the requirements of this Act concerning eligibility for a health insurance issuer to participate in the Exchange shall be a material condition of an issuer's entitlement to receive payments, including payments of premium tax credits and cost-sharing reductions, through an Exchange." ACA section 1313(a)(6). Query whether advance payment of a premium tax credit would make a QHP a federal health care program; if this is only advance payment of a tax credit, arguably these represent only the enrollee's funds, rather than federal "funding" of QHPs.

This article is presented for informational purposes only and is not intended to constitute legal advice.