Yesterday the Federal Energy Regulatory Commission ("FERC") issued four orders, each of which directs a participant in New England's prior Day-Ahead Load Response Program ("DALR Program") to show cause why it should not be found to have violated Federal Power Act and FERC prohibitions against energy market manipulation and, as a result, to disgorge payments received and be assessed substantial civil penalties (totaling nearly $26.5 million in the aggregate). The four participants include two end-users, Rumford Paper Company ("Rumford") and Lincoln Paper and Tissue ("Lincoln"); a consulting firm, Competitive Energy Services ("CES"); and an individual, Richard Silkman, a principal of CES (collectively, "DR Participants"). The orders are based on allegations, contained in reports by the FERC's Office of Enforcement ("OE"), that DR Participants fraudulently inflated the day-to-day energy consumption values used to set a baseline from which payments for load reductions would be measured. OE alleges that the conduct of the participants named resulted in unjustified payments by all New England rate payers that should be disgorged, in addition to the proposed penalties for the DR Participants' conduct. The orders present compelling reminders and valuable lessons for all participants in FERC-regulated energy markets, and particularly the demand response markets, to ensure they have in place programs and controls carefully designed to ensure effective compliance with both the letter and the spirit of FERC rules and regulations. Failure to do so puts participants, both companies and individuals, at risk of substantial liability.

Background

During the period covered by the orders (July 2007 to February 2008), ISO New England Inc. ("ISO-NE") administered a demand response program designed to reduce demand (and prices) for electricity in New England during the hours of the day when demand for electricity was heaviest (and electricity prices highest). These demand times were defined to be between 7 a.m. and 6 p.m. on business days, and Rumford and Lincoln were to be paid for reducing demand (and thereby energy prices) in New England during those peak hours. Payments under the DALR Program were based on the amount of reduction bid and accepted into the day-ahead energy market and actually reduced during the peak periods. "Actual" reduction was measured as the difference between the amount of energy Rumford and Lincoln would have used absent participation in the program, which is referred to as their baseline, and the amount that was actually used during the periods when the DR Participant committed to reduce.

The Orders

The orders allege that during the 2007-08 period, Lincoln and Rumford (at the suggestion and with the assistance of CES and Silkman) adopted and implemented plans to intentionally inflate the baselines submitted to ISO-NE, and to maintain those inflated baselines in order to maximize payments for reductions from their usual load (which in fact were not reductions at all). Pursuant to those plans, OE alleges Lincoln and Rumford participated in the DALR Program, operated normally, yet claimed to be reducing load from their inflated baselines, and were compensated for such claimed (but alleged to be phantom) energy reductions. As a result of this participation in the DALR Program, Lincoln, Rumford and CES (by way of commissions) received payments totaling nearly $3.4 million.

Proposed Penalties & Disgorgement

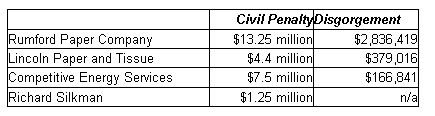

The orders direct DR Participants to demonstrate why their alleged violations should not result in the following civil penalties and disgorgements (plus interest), as applicable:

Investigative and Administrative

Processes

The orders were preceded by lengthy investigative and

administrative processes. Following a nonpublic preliminary

investigation of DR Participants' activities, OE issued on

January 25, 2011, notices of alleged violation ("NoV")

identifying its preliminary determinations that each of the DR

Participants had violated the FERC's prohibition against

electric energy market manipulation. The NoVs were issued pursuant

to an earlier FERC order intended to increase the transparency of

OE staff's investigations.1 That order requires NoVs

be issued only after the subject of an enforcement investigation

has either responded or had the opportunity to respond to a

preliminary findings letter detailing OE staff's conclusions

regarding the subject's conduct.

The DR Participants' NoVs were among the first issued by the

FERC under that new procedure. OE reported that it engaged DR

Participants in settlement discussions following the NoVs but was

unable to reach a settlement with any of them. Subsequent to

issuing the NoVs and continuing its investigations, on April 17,

2012, almost 15 months after issuing the NoVs, OE submitted to the

Commission OE's reports and recommendations (a copy of which

was included as an appendix to the order issued in each case). The

Commission responded three months later with these orders.

DR Participants have until August 16, 2012, to file their

respective answers to the show cause orders. In their answers, DR

Participants must choose to either (i) have the case heard before a

FERC-appointed administrative law judge, or (ii) be assessed an

immediate penalty by the FERC.

Lessons

The orders are among the first in which the FERC applies its

penalty guidelines in a show cause order, and they contain an

informative discussion about the application of those guidelines.

Commissioner Cheryl A. LaFleur's concurrences in the Rumford,

Lincoln and CES orders take exception to the specific application

of those guidelines, explaining her view that the DR Participants

were being double penalized by adders designed to account for

duration of the alleged manipulation. Commissioner LaFleur would

have preferred that the majority exercise its discretion in its

application of the guidelines so as not to double count for the

particularly long duration of the alleged misconduct.

It is instructive to note that OE investigated and FERC affirmed

the plans to hold all persons and organizations involved in

FERC-jurisdictional transaction(s), including the ultimate

consumers themselves, responsible for compliance with FERC

anti-market manipulation requirements, on the view that all such

conduct and manipulation is "in connection with" a

FERC-jurisdictional transaction.

It is worth noting also that, in each of the Rumford, Lincoln and

CES orders, OE found the lack of an effective compliance program at

the time of the violations. Specifically, there were no procedures

in place to detect compliance violations, no training of employees

regarding the regulatory requirements governing DALR Program

participation, and no individual ultimately responsible for

ensuring compliance with regulatory requirements. Even smaller

companies, OE noted, should have basic policies in place to ensure

employees act in a manner consistent with FERC regulatory

requirements.

These orders provide another reminder that all market participants

would be well-served to ensure their compliance programs are

structured to minimize the risk of market conduct that regulators

might reasonably view as manipulation. OE has indicated it is

placing a priority on addressing market manipulation concerns, and

our own experiences working with clients on compliance matters

reinforce this fact. Strong compliance programs reduce not only the

risk of missteps but also the possible penalties if missteps

occur.

Our attorneys have significant experience advising clients on

designing, assessing, and implementing compliance programs that

mitigate and ameliorate energy market compliance risks, as well as

on the specific operation and requirements of the New England

markets in general and on demand response markets in particular. If

you have any questions concerning the orders specifically or energy

market compliance issues generally, please contact any of the

attorneys listed in this alert.

Footnotes

1 Enforcement of Statutes, Regulations, and Orders, 129 FERC ¶ 61,247 (2009), order on reh'g, 134 FERC ¶ 61,054 (2011).

www.daypitney.comThe content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.