INTRODUCTION

On Jan. 3, 2012, the IRS issued Notice 2012-9 to provide guidance on Form W-2 reporting to employees regarding the cost of their group health insurance coverage. You are required to start the reporting on the Forms W-2 that you issue to your employees for calendar year 2012.1

This new notice completely replaces Notice 2011-28, which the IRS previously issued to provide guidance on the Form W-2 reporting requirement.

Notice 2012-9 is not the final guidance the IRS intends to issue. The IRS plans to eventually issue regulations, but has not indicated its timing. The notice says the regulations will apply only prospectively and not to any calendar year beginning within six months of the date the regulations are issued. The guidance in the notice may continue to be used until the IRS issues additional guidance.2

Grant Thornton has prepared questions and answers to serve as your guide in complying with the requirements, and they are organized under the following major topics:

- Employers exempt from the reporting requirement

- Commencement of reporting

- Types of coverage to report

- Amount to report

- Reporting for terminated employees and other employee situations

- Special situations: Common paymasters, acquisitions during the year

- Procedural details: Where on Form W-2 to report the cost of group health insurance coverage, Form W-3 considerations

- Questions your employees may ask

QUESTIONS ADDRESSED IN THIS GUIDE

Employers exempt from the reporting requirement

1. Are any employers exempt from the Form W-2 reporting requirement?

Commencement of reporting

2. When are you required to start reporting the cost of group health insurance coverage on your employees' Forms W-2?

3. If an employee's employment is terminated before the end of a calendar year, and the employee requests that you furnish his or her Form W-2 before the end of the year in which he or she terminates employment, are you required to report the cost of group health insurance coverage on the Form W-2?

Types of coverage to report

4. What types of coverage are you required to take into account when calculating the cost of your employees' group health insurance coverage to report on their Forms W-2?

5. What amount must be reported for a health flexible spending arrangement (FSA)?

Amount to report

6. Do you report both the cost you pay and the cost paid by the employee?

7. If you maintain a plan for employees but make no contributions to it (i.e., it is entirely funded by employees), are you required to report the cost of the plan on your employees' Forms W-2?

8. Do you report the cost of taxable group health insurance coverage, such as coverage provided to an employee's domestic partner?

9. Do you include in the cost you report for a plan an amount that is taxable to a highly compensated individual under a self-insured discriminatory plan?

10. If you are an S corporation, do you report the amount related to the plan that a 2-percent shareholder is required to include in income?

11. How do you calculate the amount of cost to report on your employees' Forms W-2?

12. What is the cost of a plan under the COBRA applicable premium method?

13. What is the cost of a plan under the "modified COBRA premium method"?

14. What is the "premium charged method"?

15. How do you calculate the reportable cost for a plan if the plan charges employees the same amount of premium, regardless of the type of coverage elected by the employee?

16. How do you calculate the reportable cost for a plan if your COBRA premiums or your insurance premiums are not calculated on a calendar year basis?

17. How do you calculate the reportable cost for a plan if an employee's level of coverage changes during the calendar year?

18. How do you calculate the reportable cost for an employee if the employee's coverage changes during a period (for example, in the middle of a month)?

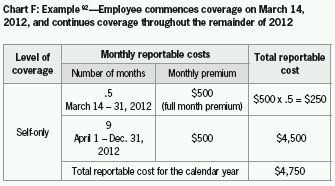

19. How do you calculate the reportable cost for an employee if the employee's coverage commences or terminates during a period (for example, in the middle of a month)?

20. How do you calculate the reportable cost for December of a year if the coverage period does not end on December 31?

21. How do you calculate the reportable cost under a program that provides health care benefits but also provides benefits that are not health care benefits, such as a long-term disability program that also provides certain health care benefits?

22. Are you required to adjust a Form W-2 that you have already issued for a calendar year to reflect an election or notification you receive after the end of the year that has a retroactive effect on coverage for the calendar year, such as notice of a divorce that occurred in the calendar year?

Reporting for terminated employees and other employee situations

23. If an employee leaves during the year and elects COBRA coverage, do you include the cost of the COBRA coverage in the cost of group health insurance coverage that you report on his or her Form W-2?

24. If an employee leaves during the year and requests to receive his or her Form W-2 before the end of the calendar year, are you required to report the cost of group health insurance coverage on the employee's Form W-2?

25. If you provide health care coverage during the year to a retiree or former employee to whom you paid no other compensation during the year, are you required to issue a Form W-2 to the individual to report the cost of group health insurance?

Special situations: Common paymasters, acquisitions during the year

26. If you use a common paymaster to pay an employee (i.e., you and one or more related entities concurrently employ the employee, and you have chosen to pay the employee through a single entity), who is responsible for reporting the cost of group health insurance coverage on the employee's Form W-2?

27. If you do not use a common paymaster to pay an employee who works for you and also works for other entities that are related to you, who is responsible for reporting the cost of group health insurance coverage on the employee's Form W-2?

28. Who has the reporting responsibility when an employee's employer changes during the calendar year as a result of the acquisition of his or her employer by another employer?

Procedural details: Where on Form W-2 to report the cost of group health insurance coverage, Form W-3 considerations

29. Where on Form W-2 is the cost of group health insurance coverage reported?

30. Do you report the total of the cost of group health insurance coverage provided to all of your employees on Form W-3 for the year?

Questions your employees may ask

31. Why is the IRS requiring that you report the cost of my group health insurance coverage on my Form W-2?

32. Does your reporting the cost of my group health insurance coverage on my Form W-2 cause the coverage to be taxable to me?

EMPLOYERS EXEMPT FROM THE REPORTING REQUIREMENT

1. Are any employers exempt from the Form W-2 reporting requirement?

Yes. You are exempt if you were required to file fewer than 250 Forms W-2 for the preceding calendar year.3 For example, if you filed fewer than 250 Forms W-2 for 2011, you are exempt from the reporting requirement for 2012. The notice states that this exemption remains in effect "until further guidance is issued." This means the IRS reserves the right to eliminate the exemption. If the IRS does so, the elimination of the exemption will apply for only future years.

When you count the number of Forms W-2 you issued, you must count any Forms W-2 issued to your employees by any agents.4 For example, if you have employees who are issued Forms W-2 by a professional employer organization (PEO), you must count those Forms W-2 in determining whether you issued fewer than 250 of them. If the count is 250 or more, you must comply with the reporting requirement for all Forms W-2 issued to your employees, including the Forms W-2 issued to your employees by the PEO.

In addition to the exemption for employers who filed fewer than 250 Forms W-2 for the preceding calendar year, the law exempts you from the reporting requirement if you are a federally recognized Indian tribal government. In addition, you are exempt if you are a tribally chartered corporation wholly owned by a federally recognized Indian tribal government.5

There are no other exemptions from the reporting requirements. The notice states that "all employers that provide... employer-sponsored coverage... during a calendar year are subject to the reporting requirement. ..."6 The notice lists several types of employers that are subject to the reporting requirement, as follows:7

- Federal, state and local government entities (but note that self-insured governmental plans that are not subject to any federal continuation coverage requirements, such as COBRA, are not subject to the reporting requirement8)

- Churches and other religious organizations (but note that self-insured church plans that are not subject to any federal continuation coverage requirements, such as COBRA, are not subject to the reporting requirement9)

- Employers that are not subject to the COBRA continuation coverage requirements

COMMENCEMENT OF REPORTING

2. When are you required to start reporting the cost of group health insurance coverage on your employees' Forms W-2?

You are required to start the reporting for calendar year 2012.10 You are required to issue Forms W-2 for calendar year 2012 to your employees no later than Jan. 31, 2013.

You are allowed to voluntarily report the cost of group health insurance coverage on your employees' Forms W-2 for 2011. If you choose to do so, you may use the guidance in Notice 2012-9 (i.e., the notice summarized in this Grant Thornton guide) for purposes of the 2011 reporting.11

3. If an employee's employment is terminated before the end of a calendar year and the employee requests that you furnish his or her Form W-2 before the end of the year in which he or she terminates employment, are you required to report the cost of group health insurance coverage on the Form W-2?

No.12 If an employee's employment is terminated before the end of a calendar year, the employee can request his or her Form W-2 for the year, and you must then furnish the Form W-2 to the employee on or before the 30th day after the written request or the 30th day after the final payment of wages to the employee, whichever is later.13 You are not required to report the cost of group health insurance coverage on the Form W-2 of an employee who requests to receive a Form W-2 before the end of the calendar year during which he or she terminated employment.

TYPES OF COVERAGE TO REPORT

4. What types of coverage are you required to take into account when calculating the cost of your employees' group health insurance coverage to report on their Forms W-2?

You are required to report the total cost of all group health plans. The notice defines the term "group health plan" as "a plan (including a self-insured plan), of, or contributed to by, an employer (including a self-employed person) or employee organization to provide health care (directly or otherwise) to the employees, former employees, the employer, others associated or formerly associated with the employer in a business relationship, or their families."14

The notice states that employers may rely on the definition of a group health plan in the COBRA regulations in order to identify group health plans for Form W-2 reporting.15 Under those regulations, a group health plan is generally defined as a group insurance policy or one or more individual insurance policies in any arrangement that involves the provision of health care to two or more employees.16

The regulations define health care as "the diagnosis, cure, mitigation, treatment or prevention of disease, and any other undertaking for the purpose of affecting any structure or function of the body."17 The regulation states that "a program that furthers general good health, but... does not relate to the relief or alleviation of health or medical problems and is generally accessible to and used by employees without regard to their physical condition or state of health... is not a group health plan."18

You are required to report the cost of employer-sponsored coverage.19 Thus, if you do not sponsor the coverage, you do not report the cost of the coverage on your employees' Forms W-2. The term "employer-sponsored coverage" means coverage under any group health plan that you make available to an employee and that is excludable from the employee's gross income or that would be excludable from the employee's gross income if you provided the coverage.20 You are required to report the cost of employer-sponsored coverage even if you make no contributions to the plan. See question 7 for further details.

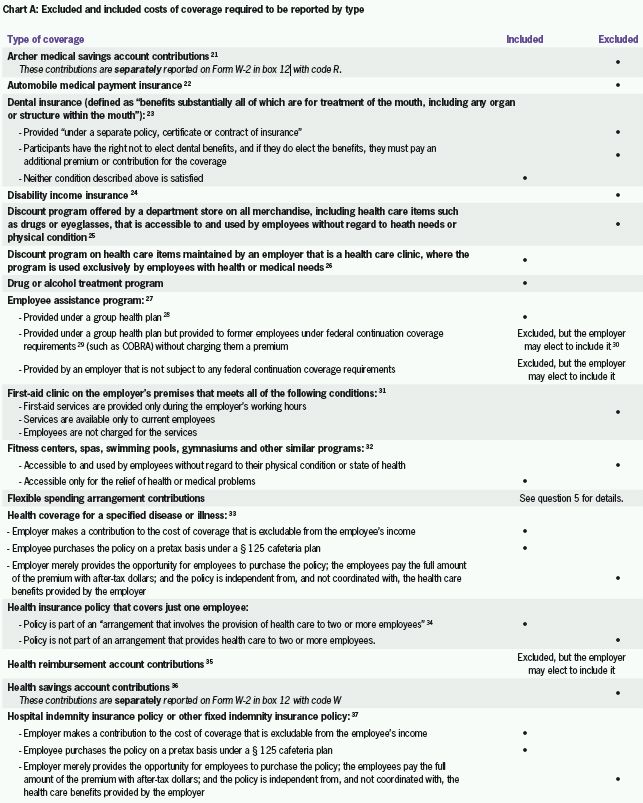

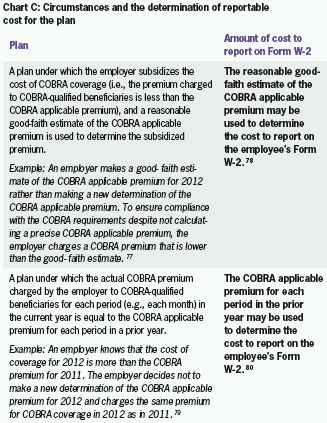

Chart A on Page 7 lists specific types of coverage and indicates whether the cost of the coverage is included or excluded in the amount you are required to report on your employees' Forms W-2. Each type of coverage is either addressed specifically in the notice or is addressed in other IRS guidance referenced in the notice.

5. What amount must be reported for a health flexible spending arrangement (FSA)?

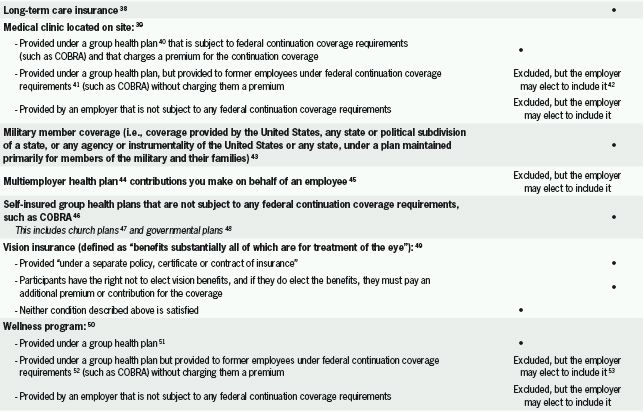

You do not report the amount of the employee's salary reduction contributions to the FSA.54 You report only the amount of any employer flex credits that the employee elects to apply to the FSA.55 However, you do not report the employer flex credits if the amount of salary reduction contributions elected by the employee for all qualified benefits under the plan (i.e., both salary reduction contributions for the FSA and salary reduction contributions for other benefits, such as dependent care and adoption assistance) exceeds the total contributions to the FSA (i.e., both the employee's salary reduction contributions to the FSA and the employer flex credits applied to the FSA).56,57 Chart B summarizes three examples that appear in the notice:58

AMOUNT TO REPORT

6. Do you report both the cost you pay and the cost paid by the employee?

Yes. You report the total cost including both the employer-funded cost and the employee-funded cost. You report the employee-funded cost regardless of whether the employee paid it through pretax or after-tax contributions.59

7. If you maintain a plan for employees but make no contributions to it (i.e., it is entirely funded by employees), are you required to report the cost of the plan on your employees' Forms W-2?

You are required to report the cost if coverage under the plan would not be available at the same cost to your employees except for their employment-related connection to you.60

8. Do you report the cost of taxable group health insurance coverage, such as coverage provided to an employee's domestic partner?

Yes.61 Generally, the value of group health insurance coverage that is provided for the employee, the employee's spouse and dependents, and a child of the employee who is under age 27 at the end of the calendar year is not included in the employee's gross income. The value of coverage of other individuals, such as a nondependent domestic partner or a child who is 27 or older as of the end of the calendar year, is included in the employee's gross income. The value of this taxable coverage must be included in the amount reported on the employee's Form W-2.

9. Do you include in the cost you report for a plan an amount that is taxable to a highly compensated individual under a self-insured discriminatory plan?

No.62 If a self-insured plan discriminates in favor of highly compensated individuals regarding eligibility to participate or the benefits provided under the plan, the amount of the "excess reimbursement" must be included in the individual's gross income.63 The excess reimbursement included in the individual's income is subtracted from the cost of coverage to determine the cost to report on the individual's Form W-2.64

A highly compensated individual is one of the five highest paid officers, a shareholder who owns more than 10 percent in value of the stock of the employer, or an individual who is among the highest paid 25 percent of all employees.65

10. If you are an S corporation, do you report the amount related to the plan that a 2 percent shareholder is required to include in income?

No.66 You do not include in the cost of the plan the amount that a 2 percent shareholder is required to include in income. A 2 percent shareholder is an employee who owns on any day during the S corporation's taxable year more than 2 percent of the outstanding stock or more than 2 percent of the total combined voting power of all stock of the S corporation.67 A 2 percent shareholder is required to include health insurance premiums paid by an S corporation in income.68

11. How do you calculate the amount of cost to report on your employees' Forms W-2?

It is helpful to begin by understanding the terminology the IRS uses in the notice. The notice refers to the cost of a plan as its "reportable cost," and it refers to the amount you report on each employee's Form W-2 as the "aggregate reportable cost." You calculate a reportable cost for each health plan in which an employee participates. The sum of the reportable costs for all the health plans in which the employee participates is the aggregate reportable cost for the employee.

The notice provides the following three permissible methods for computing the reportable cost:

- An employer may use the COBRA premiums that apply to the plan for the calendar year as the reportable cost.69 The notice refers to this as the "COBRA applicable premium method." It is important to note that while employers may charge COBRA beneficiaries 102 percent of the COBRA premium for COBRA coverage, the reportable cost does not include the 2 percent surcharge.

- For plans that do not calculate a precise COBRA premium, but instead charge COBRA beneficiaries an estimate of the COBRA premium or charge them the prior year's COBRA premium, the notice provides special rules for calculating the reportable cost for the plan.70 The notice refers to these special rules as the "modified COBRA premium method." As noted above, the reportable cost does not include the 2 percent surcharge.

- A plan that is insured may use the premium the insurer charges for the employee's coverage as the cost to report on the employee's Form W-2.71 The notice refers to this as the "premium charged method."

In summary, the notice provides three methods for calculating the reportable cost for a plan:

- COBRA applicable premium method

- Modified COBRA premium method

- Premium charged method (insured plans only)

When you calculate the reportable costs for your plans, you are not required to use the same method for every plan you maintain. However, a plan must use the same method for every employee covered under the same plan.72

12. What is the cost of a plan under the COBRA applicable premium method?

The notice borrows the word "applicable" from the COBRA rules, which refer to the COBRA premium as the "applicable premium." Thus, the term "applicable premium" simply means the COBRA premium.

Under the COBRA applicable premium method, you simply use the COBRA premiums that you already calculate for COBRA purposes to determine the reportable cost for the plan for the calendar year.

The rules for calculating the COBRA applicable premium are summarized as follows:

- The term "applicable premium" with respect to an employee means the cost for similarly situated employees.73

- The amount of the applicable premium applies for a period of 12 months (referred to as the "determination period") and must be determined before the beginning of the determination period.74

- For a self-insured plan, the applicable premium must be a reasonable estimate of the cost of providing coverage, determined on an actuarial basis (referred to as the "actuarial method").75

- Rather than using the actuarial method, a self-insured plan may use the actual cost for the same period during the preceding determination period, adjusted by the percentage increase or decrease in the implicit price deflator of the gross national product (referred to as the "past cost method").76

13. What is the cost of a plan under the "modified COBRA premium method"?

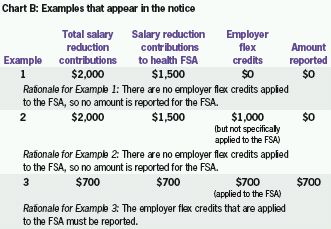

The modified COBRA premium method is used for plans that do not calculate an applicable COBRA premium under the rules discussed in the previous question, but instead charge COBRA beneficiaries an estimate of the COBRA premium or the prior year's COBRA premium. There are two specific circumstances in which the modified COBRA premium method may be used. Chart C describes the circumstances and the determination of reportable cost for the plan.

14. What is the "premium charged method"?

The premium charged method applies only to insured plans (i.e., not self-insured plans), and allows you to use the amount of the premium charged by your insurer for the employee's coverage as the reportable cost for the plan.81

15. How do you calculate the reportable cost for a plan if the plan charges employees the same amount of premium regardless of the type of coverage elected by the employee? Some plans maintain a simplified employee premium structure, whereby the

premium the employee is required to pay does not always vary based on the number of individuals covered by the plan. The notice refers to this type of premium structure as "composite rates" and provides the following two examples:82

- A plan charges employees the same premium for self-only coverage and all other types of coverage, such as family coverage

- A plan offers different types of coverage and charges employees the same premium within each type, such as when:

-

- the same premium is charged for both self-only coverage and self-plus-spouse coverage; and

- a different premium is charged for any other family coverage, regardless of the number of family members covered.

In the first example, the employer may use the same reportable cost for all employees, regardless of the type of coverage they elect. The employer must use one of the methods discussed in the previous questions to calculate the reportable cost (i.e., the COBRA applicable premium method, the modified COBRA premium method or the premium charged method).

In a situation like the second example, the employer may use the same reportable cost for all the different types of coverage for which the same premium is charged to employees. Thus, in the example, the employer may use one reportable cost for all employees who have self-only coverage and self-plus-spouse coverage, and a different reportable cost for all the employees who have any other family coverage. An employer who chooses this approach must use it for all the types of coverage under the plan. Thus, in this example, the employer cannot use a single reportable cost for all the employees who have self-only coverage and self-plus-spouse coverage, but then not use a single reportable cost for all the employees who have other family coverage. Regardless of the approach chosen, the employer must use one of the methods discussed in the previous questions to calculate the reportable cost (i.e., the COBRA applicable premium method, the modified COBRA premium method or the premium charged method).

If an employer uses composite rates for active employees but does not use composite rates to determine the premium to charge COBRA beneficiaries (i.e., individuals who are continuing their coverage under COBRA), the employer may use either the composite rate or the COBRA premium as the reportable cost.

16. How do you calculate the reportable cost for a plan if your COBRA premiums or your insurance premiums are not calculated on a calendar year basis?

Your employees' Forms W-2 are prepared on a calendar year basis. However, not all health plans are operated on a calendar year basis. If your health plan is not operated on a calendar year basis, your COBRA premiums and insurance premiums (for an insured plan) are probably not calculated on a calendar year basis.

The notice requires you to calculate the reportable cost for a plan strictly on a calendar year basis.83 It states that you must determine the reportable cost for each "period" during the calendar year and add the reportable costs for each period to determine the total reportable cost for the year. The notice uses a month as an example of a period, probably because many plans charge premiums on a monthly basis.84 A change in the COBRA premium or insurance premium during the calendar year must be figured into an employee's reportable cost for the year.85

The notice provides two examples of a plan's reportable cost for the year, using monthly premiums. Chart D summarizes the examples.

17. How do you calculate the reportable cost for a plan if an employee's level of coverage changes during the calendar year?

The change in the employee's level of coverage during the calendar year must be figured into the employee's reportable cost for the year.88 The notice provides an example of a plan's reportable cost for the year when an employee's level of coverage changes during the year. Chart E summarizes the example.

18. How do you calculate the reportable cost for an employee if the employee's coverage changes during a period (for example, in the middle of a month)?

You may use any reasonable method to determine the reportable cost for the period.90 Since the most common period used by employers is a month, the remainder of the answer to this question will use a month as the period.

The notice gives the following examples of reasonable methods:

- The reportable cost in effect at the beginning of the month

- The reportable cost in effect at the end of the month

- An average of reportable costs in effect during the month

- A proration of the reportable costs in effect during the month (i.e., a weighted average)

You must use the same method for all employees with coverage under the plan.

19. How do you calculate the reportable cost for an employee if the employee's coverage commences or terminates during a period (for example, in the middle of a month)?

The same rules as discussed previously also apply when an employee commences or terminates coverage during a period, such as in the middle of a month.91 The notice provides an example of a plan's reportable cost for the year when an employee commences coverage in the middle of a month, using a proration approach. Chart F summarizes the example.

20. How do you calculate the reportable cost for December of a year if the coverage period does not end on Dec. 31?

Most plans establish premiums on a monthly basis. In that case, the coverage period for the month of December will end on Dec. 31. However, if the coverage period does not end on Dec. 31 and instead crosses over into the next calendar year, you can assign the cost for the coverage period using any of the following methods:93

- Treat the cost for the period as a reportable cost for the calendar year that includes Dec. 31 (i.e., the current year)

- Treat the cost for the period as a reportable cost for the calendar year immediately subsequent to the calendar year that includes Dec. 31 (i.e., the following year)

- Allocate the cost for the period between the current year and the following year using any reasonable allocation method, which generally must relate to the number of days in the period of coverage that fall within each of the two calendar years

You must use the same method for all employees.

21. How do you calculate the reportable cost under a program that provides health care benefits but also provides benefits that are not health care benefits, such as a long-term disability program that also provides certain health care benefits?

You may use any reasonable allocation method to determine the cost of the portion of the program providing health care benefits.94 If the portion of the program that provides health care benefits is only incidental compared with the portion of the program that provides other benefits, you are not required to report any cost for the program. In contrast, if the portion of the program that provides other benefits is incidental compared with the portion of the program that provides health care benefits, you may elect to report the entire cost of the program, rather than allocating the costs between the two portions of the program.

22. Are you required to adjust a Form W-2 that you have already issued for a calendar year to reflect an election or notification you receive after the end of the year that has a retroactive effect on coverage for the calendar year, such as notice of a divorce that occurred in the calendar year?

No.95 You calculate the amount to report on an employee's Form W-2 for the calendar year based on the information available to you on Dec. 31 of the year. Thus, you are not required to take into account any election or notification made or provided after the end of the year, even if the election or notification retroactively affects coverage for the calendar year.

REPORTING FOR TERMINATED EMPLOYEES AND OTHER EMPLOYEE SITUATIONS

23. If an employee leaves during the year and elects COBRA coverage, do you include the cost of the COBRA coverage in the cost of group health insurance coverage that you report on his or her Form W-2?

You are allowed to choose whether to include the cost of COBRA coverage in the cost of group health insurance coverage that you report. You must use a consistent approach with all employees who terminate employment during the same plan year.96 For example, if you have a calendar plan year and you choose to report the cost of COBRA coverage for one employee for 2012, you must do so for all employees for 2012. You could change your mind for 2013 or any subsequent year and choose not to report the cost of COBRA coverage for any employees.

The decision you make regarding whether to report the cost of COBRA coverage elected by an employee also applies to any post-employment coverage you provide to an employee during the plan year in which he or she terminates employment. For example, if you fund postemployment coverage for an employee and you have decided to report the cost of COBRA coverage elected by employees, you must also report the cost of the employer-funded postemployment coverage.

24. If an employee leaves during the year and requests to receive his or her Form W-2 before the end of the calendar year, are you required to report the cost of group health insurance coverage on the employee's Form W-2?

No.97 See question 3 for further details.

25. If you provide health care coverage during the year to a retiree or former employee to whom you paid no other compensation during the year, are you required to issue a Form W-2 to the individual to report the cost of group health insurance?

No.98 You are not required to issue a Form W-2 to report the cost of group health insurance coverage to an individual if you are not otherwise required to issue a Form W-2 to the individual.

SPECIAL SITUATIONS: COMMON PAYMASTERS, ACQUISITIONS DURING THE YEAR

26. If you use a common paymaster to pay an employee (i.e., you and one or more related entities concurrently employ the employee and you have chosen to pay the employee through a single entity), who is responsible for reporting the cost of group health insurance coverage on the employee's Form W-2?

The notice requires the common paymaster to report the cost of the coverage.99

27. If you do not use a common paymaster to pay an employee who works for you and also works for other entities that are related to you, who is responsible for reporting the cost of group health insurance coverage on the employee's Form W-2?

If you and one or more related entities (within the meaning of § 3121(s)) concurrently employ the same individual but do not use a common paymaster, you have a choice: You can have only one of the employers report the total cost of all the group health coverage on the employee's Form W-2, or you can have each employer report an allocated portion of the total cost. If you choose the latter, you can use any reasonable method to allocate the cost.100

28. Who has the reporting responsibility when an employee's employer changes during the calendar year as a result of the acquisition of his or her employer by another employer?

Under a general rule, both the predecessor employer and the successor employer are required to report the cost of the group health insurance coverage they each provided on the respective Forms W-2 issued to the employee.101

An exception applies when the predecessor and successor employers elect to have the successor employer prepare a single Form W-2 for the employee for the entire calendar year, covering the wages paid for the calendar year by both the predecessor and successor employers. This election is available when the successor employer acquires substantially all the property used in a trade or business of the predecessor employer, or used in a separate unit of a trade or business of the predecessor employer, and in connection with or immediately after the acquisition, the successor employer employs individuals who immediately prior to the acquisition were employed in the trade or business of the predecessor employer.102 If the election is made, the successor employer reports the aggregate cost of the group health insurance coverage provided by both the predecessor and successor employers.103

PROCEDURAL DETAILS: WHERE ON FORM W-2 TO REPORT THE COST OF GROUP HEALTH INSURANCE COVERAGE, FORM W-3 CONSIDERATIONS

29. Where on Form W-2 is the cost of group health insurance coverage reported?

The cost is reported in box 12, using code DD.104 Box 12 is used for various reporting purposes. Accordingly, it is not labeled for a specific purpose. Instead, the label simply states, "See instructions for box 12."

30. Do you report the total of the cost of group health insurance coverage provided to all of your employees on Form W-3 for the year?

No.105 You do not report the total cost of group health insurance coverage on Form W-3. You file Form W-3, "Transmittal of Wage and Tax Statements," only when you file a paper Copy A of Forms W-2. There is no box on Form W-3 to report the total cost of group health insurance coverage provided to all of your employees, and the IRS has not indicated any intention to add a box for this purpose.

QUESTIONS YOUR EMPLOYEES MAY ASK

The questions in this section are stated from an employee's perspective.

31. Why is the IRS requiring that you report the cost of my group health insurance coverage on my Form W-2?

The reporting is required under a section of the Internal Revenue Code that was added to the law by the Patient Protection and Affordable Care Act of 2010 (i.e., the health care reform law). According to the IRS, the reporting provides "useful and comparable consumer information to employees on the cost of their health care coverage."106

32. Does your reporting the cost of my group health insurance coverage on my Form W-2 cause the coverage to be taxable to me?

No. The reporting on your Form W-2 is for your information only. The reporting is intended to inform you of the cost of your health care coverage and does not cause the health care coverage we provide to you to become taxable.107

Footnotes

1 Notice 2012-9, Section I, Section III.

2 Notice 2012-9, Section I, Section III, Section IV.

3 Notice 2012-9, Section III, Q&A-3.

4 Notice 2012-9, Section III, Q&A-3.

5 Notice 2012-9, Section III, Q&A-3.

6 Notice 2012-9, Section III, Q&A-3.

7 Notice 2012-9, Section III, Q&A-3.

8 Notice 2012-9, Section III, Q&A-21.

9 Notice 2012-9, Section III, Q&A-21.

10 Notice 2012-9, Section I and Section III.

11 Notice 2012-9, Section I and Section III.

12 Notice 2012-9, Section III, Q&A-6.

13 Section 6051(a); Treas. Reg. § 31.6051- 1(d)(1)(i); Notice 2012-9, Section II.

14 Notice 2012-9, Section III, Q&A-13.

15 Notice 2012-9, Section III, Q&A-13.

16 Treas. Reg. § 54.4980B-2, Q&A-1(a).

17 Treas. Reg. § 54.4980B-2, Q&A-1(b).

18 Treas. Reg. § 54.4980B-1, Q&A-1(b).

19 § 6051(a)(14), Notice 2012-9, Section II.

20 § 4980I(d)(1)(A); Notice 2012-9, Section II and Section III, Q&A-12.

21 § 6051(a)(11) and (a)(14)(A); Notice 2012-9, Section II and Section III, Q&A-16; Treas. Reg. § 54.4980B-2, Q&A-1(f).

22 Notice 2012-9, Section III, Q&A-12; § 9832(c)(1)(E).

23 Notice 2012-9, Section III, Q&A-12 and Q&A-20; Treas. Reg. § 54.9831-1(c)(3).

24 Notice 2012-9, Section III, Q&A-12; § 9832(c)(1)(a).

25 Treas. Reg. § 54.4980B-2, Q&A-1(c).

26 Treas. Reg. § 54.4980B-2, Q&A-1(c).

27 Notice 2012-9, Section III, Q&A-32 and Q&A-33.

28 For this purpose, "group health plan" is defined under § 5000(b)(1), where it is defined as "a plan (including a self-insured plan) of, or contributed by, an employer (including a self-employed person) or employee organization to provide health care (directly or otherwise) to the employees, former employees, the employer, others associated or formerly associated with the employer in a business relationship, or their families."

29 Federal continuation coverage requirements include the COBRA requirements under the Internal Revenue Code, the Employee Retirement Income Security Act of 1974, or the Public Health Service Act and the temporary continuation coverage requirements under the Federal Employee Health Benefits Program. Notice 2012-9, Section III, Q&A- 32.

30 The cost is not reported for either active employees or for continuation coverage beneficiaries who receive Forms W-2.

31 Treas. Reg. § 54.4980B-2, Q&A-1(d).

32 Treas. Reg. § 54.4980B-2, Q&A-1(b).

33 Notice 2012-9, Section III, Q&A-37 and Q&A-38.

34 Treas. Reg. § 54.4980B-2, Q&A-1(a).

35 Notice 2012-9, Section III, Q&A-18 and Q&A-33.

36 § 6051(a)(12) and (14)(A); Notice 2012-9, Section II and Section III, Q&A-16.

37 Notice 2012-9, Section III, Q&A-37and Q&A-38.

38 Notice 2012-9, Section III, Q&A-12; Treas. Reg. § 54.4980B-2, Q&A-1(e); § 7702B(c).

39 Notice 2012-9, Section III, Q&A-32 and Q&A-12; Treas. Reg. § 54.4980B-2, Q&A- 1(b).

40 For this purpose, "group health plan" is defined under § 5000(b)(1), where it is defined as "a plan (including a self-insured plan) of, or contributed by, an employer (including a self-employed person) or employee organization to provide health care (directly or otherwise) to the employees, former employees, the employer, others associated or formerly associated with the employer in a business relationship, or their families."

41 Federal continuation coverage requirements include the COBRA requirements under the Internal Revenue Code, the Employee Retirement Income Security Act of 1974, or the Public Health Service Act and the temporary continuation coverage requirements under the Federal Employees Health Benefits Program. Notice 2012-9, Section III, Q&A- 32.

42 The cost is not reported for either active employees or for continuation coverage beneficiaries who receive Forms W-2.

43 Notice 2012-9, Section III, Q&A-22.

44 A multiemployer plan is defined in Treas. Reg. § 54.4980B-2, Q&A-3, as a plan to which more than one employer is required to contribute and that is maintained pursuant to one or more collective bargaining agreements between one or more employee organizations and more than one employer.

45 Notice 2012-9, Section III, Q&A-17 and Q&A-33.

46 Notice 2012-9, Section III, Q&A-21. This includes plans not subject to federal continuation coverage requirements under the Internal Revenue Code, the Employee Retirement Income Security Act of 1974, the Public Health Service Act and the temporary continuation coverage requirement under the Federal Employees Health Benefits Program.

47 A church plan is defined under § 414(e) as "a plan established and maintained... for its employees (or their beneficiaries) by a church or by a convention or association of churches which is exempt from tax under Section 501." See § 414(e) for further details.

48 A governmental plan is defined under § 414(d) as "a plan established and maintained for its employees by the government of the United States, by the government of any state or political subdivision thereof, or by any agency or instrumentality of any of the foregoing." See § 414(d) for further details.

49 Notice 2012-9, Section III, Q&A-12 and Q&A-20; Treas. Reg. § 54.9831-1(c)(3). 50 Notice 2012-9, Section III, Q&A-32 and Q&A-33.

51 For this purpose, "group health plan" is defined under § 5000(b)(1), where it is defined as "a plan (including a self-insured plan) of, or contributed by, an employer (including a self-employed person) or employee organization to provide health care (directly or otherwise) to the employees, former employees, the employer, others associated or formerly associated with the employer in a business relationship, or their families."

52 Federal continuation coverage requirements include the COBRA requirements under the Internal Revenue Code, the Employee Retirement Income Security Act of 1974, or the Public Health Service Act and the temporary continuation coverage requirements under the Federal Employees Health Benefits Program. Notice 2012-9, Section III, Q&A- 32.

53 The cost is not reported for either active employees or for continuation coverage beneficiaries who receive Forms W-2.

54 § 6051(a)(14)(B); Notice 2012-9, Section II and Section III, Q&A-16.

55 Notice 2012-9, Section III, Q&A-19; Prop. Treas. Reg. § 1.125-5(b).

56 Notice 2012-9, Section III, Q&A-19.

57 Presumably, the rationale for this rule is that no amount should be reported for an FSA when the salary reduction contributions made by the employee to the plan as a whole would have covered the total amount in the FSA if the contributions had been applied to the FSA.

58 Notice 2012-9, Section III, Q&A-19.

59 § 4980I(d)(1)(C); Notice 2012-9, Section III, Q&A-14.

60 Treas. Reg. § 54.4980B-2, Q&A-1.

61 Notice 2012-9, Section III, Q&A-15.

62 Notice 2012-9, Section III, Q&A-23. Under § 105(h), if a self-insured medical plan discriminates in favor of a highly compensated individual, an "excess reimbursement" amount must be calculated and included in the individual's income. This excess reimbursement amount must be subtracted from the cost of coverage in calculating the cost of coverage to report on the individual's Form W-2.

63 § 105(h).

64 Notice 2012-9, Section III, Q&A-23.

65 § 105(h)(5).

66 Notice 2012-9, Section III, Q&A-23; § 1372(b). A 2-percent shareholder-employee of an S corporation must include in his or her income the cost of employer-sponsored health coverage.

67 § 1372(b).

68 Notice 2008-1.

69 Notice 2012-9, Section III, Q&A-24 and Q&A-25.

70 Notice 2012-9, Section III, Q&A-24 and Q&A-27.

71 Notice 2012-9, Section III, Q&A-24 and Q&A-26.

72 Notice 2012-9, Section III, Q&A-24.

73 § 4980B(f)(4)(A).

74 § 4980B(f)(4)(C).

75 § 4980B(f)(4)(B)(i); Notice 2012-9, Section II.

76 § 4980B(f)(4)(B)(ii); Notice 2012-9, Section II.

77 Notice 2012-9, Section III, Q&A-27, Example 3.

78 Notice 2012-9, Section III, Q&A-27.

79 Notice 2012-9, Section III, Q&A-27, Example 2.

80 Notice 2012-9, Section III, Q&A-27.

81 Notice 2012-9, Section III, Q&A-26.

82 Notice 2012-9, Section III, Q&A-28.

83 Notice 2012-9, Section III, Q&A-31.

84 Notice 2012-9, Section III, Q&A-24.

85 Notice 2012-9, Section III, Q&A-29.

86 Notice 2012-9, Section III, Q&A-30, Example 1.

87 Notice 2012-9, Section III, Q&A-30, Example 2.

88 Notice 2012-9, Section III, Q&A-30.

89 Notice 2012-9, Section III, Q&A-30, Example 3.

90 Notice 2012-9, Section III, Q&A-30.

91 Notice 2012-9, Section III, Q&A-30.

92 Notice 2012-9, Section III, Q&A-30, Example 4.

93 Notice 2012-9, Section III, Q&A-36.

94 Notice 2012-9, Section III, Q&A-34.

95 Notice 2012-9, Section III, Q&A-35.

96 Notice 2012-9, Section III, Q&A-6.

97 Notice 2012-9, Section III, Q&A-6.

98 Notice 2012-9, Section III, Q&A-9.

99 Notice 2012-9, Section III, Q&A-7.

100 Notice 2012-9, Section III, Q&A-7.

101 Notice 2012-9, Section III, Q&A-8.

102 Rev. Proc. 2004-53, Section 1.01.

103 Notice 2012-9, Section III, Q&A-8.

104 Notice 2012-9, Section III, Q&A-5.

105 Notice 2012-9, Section III, Q&A-10.

106 Notice 2012-9, Section I and Section III, Q&A-2.

107 Notice 2012-9, Section I and Section III, Q&A-2.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.