A newly-released study by well-respected University of Alabama at Birmingham ("UAB") Marketing Professor Robert A. Robicheaux and his research staff provides statistical evidence of the substantial amount of sales and use tax revenue that the State of Alabama and its localities lose each year to e-commerce. The study also describes the ripple effect caused when instate retailers lose those sales. Dr. Robert A. Robicheaux, Estimates of Alabama Losses Due to E-Commerce (Feb. 21, 2012) (Available here). The study shows that a significant amount of sales and use tax revenue owed by consumers to the State of Alabama and its local governments is lost due to a lack of compliance by consumers and the government's inability to force remote sellers to charge and remit sales tax.

According to the landmark study, this results not only in substantial sums of lost sales and use tax revenue, but it also lowers Alabama's economic output, which in turn costs Alabama residents jobs and reduces their household income, thereby reducing the State's income tax revenue. The study concludes that the loss of sales/use tax revenue from online purchases alone will cost the State and local governments more than $1 billion over the next five years, unless federal laws are enacted to prevent it.

As the well-documented study confirms, e-commerce and online purchasing have become a significant part of the U.S. economy, as well as the Alabama economy. In 2009, the U.S. Bureau of Census estimated that national e-commerce sales amounted to approximately $3.4 trillion. Those sales can be divided into two categories: business-to-business ("B2B") and business-to-consumer ("B2C"). While B2C e-commerce in 2009 only accounted for about $145 billion, or 4 percent of total retail sales, it has been growing at double digit rates in recent years.

The study goes on to estimate that e-commerce sales by remote sellers to Alabama consumers exceeded $34 billion in 2011. Of that amount, approximately $2.3 billion of the sales were B2C sales and the remaining sales were B2B sales, which have a compliance rate that the study estimates to be between 75-80 percent. Not surprisingly, and perhaps too conservatively, the study reports that only about half of the consumers in B2C sales remitted any sales or use tax on their purchases. Because of this compliance failure, the study concludes that Alabama and its local governments are losing millions of dollars in sales and use tax revenue annually. According to Dr. Robicheaux, "There is an urban myth that if you buy something on the Internet, then you don't have to pay [sales] taxes. That is false, and it hurts everyone in Alabama."

The study highlights two reasons for the lost revenue. First, Quill Corp. v. North Dakota (1992) and its predecessor, National Bellas Hess v. Illinois (1967), prevent states from requiring remote, nonnexus sellers to collect and remit sales tax owed by Alabama buyers on their purchases. Second, the study concludes that some remote sellers purposefully avoid creating nexus in order to avoid having to collect applicable sales taxes, which not only reduces their administrative costs, but, more importantly, gives them a competitive price advantage over sellers with nexus in the state.

In addition, the study also notes that few retail purchasers voluntarily comply and pay the consumer use tax they owe, either because they don't understand their compliance obligation or they specifically avoid payment of the tax by purchasing products through remote sellers. State legislators, the Alabama Retail Association (ARA), and even law review commentators have recently noted that the lack of compliance and resulting revenue losses has become a major fiscal problem for Alabama, and will continue to negatively affect state and local governments and funding for public education as e-commerce continues to grow.

E-commerce sales will continue to expand and, as the study predicts, will soon outpace the growth of traditional retail and B2B sales. Using a conservative estimated growth rate of only 2 to 2.5 percent, the study predicts lost tax revenue will rise from $263 million in 2011 to $299 million in 2016. (See Table 1 below). Using a more likely growth rate of 6 to 7.5 percent, the study predicts total tax revenue losses growing from $309 million in 2011 to $398 million in 2016. (See Table 2 below).

At either growth rate, the amount of lost revenue is staggering. Moreover, these estimates may be too conservative because the report employed an average combined sales tax rate of just 8.33%, even though the average, population-weighted combined sales tax rate in Alabama is now approximately 9%. According to a recent Tax Foundation study, the combined state and local sales tax rate in Alabama ranks as the 6th highest in the country.

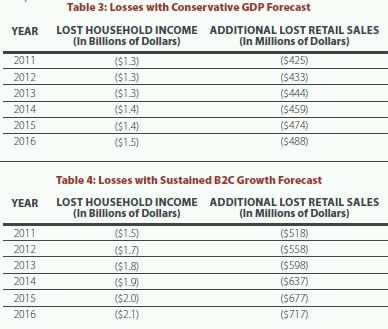

Another problem addressed by the new study is the effect of the "lost" retail sales on Alabama's economy. Every dollar of retail sales that is lost because a purchaser chooses to buy from a remote seller, rather than a local Alabama retailer, directly impacts Alabama's economy. Indeed, the study estimates a loss of $2 billion or more in traditional retail sales and a resulting loss of 3,500 to 4,000 jobs for Alabama workers each year. The study also estimates that in 2012, $1.3 billion in household income and $433 million in additional retail sales to in-state businesses will be lost. (See Table 3 below). If the growth rate of online retail sales is sustained through 2016, the study predicts that losses will increase to $2.1 billion of income and $717 million in local retail sales in 2016. (See Table 4 below).

The study argues that noncompliance should not be permitted because it gives remote sellers a competitive advantage over Alabama and its local governments. The study notes that when in-state sales are lost to e-commerce, it creates a ripple effect, adversely affecting commercial property owners and developers, banks, construction trades, advertising agencies, Alabama manufacturers, and other businesses in Alabama. Not surprisingly, Professor Robicheaux calls for marketplace fairness and for Alabama to join in that debate.

The Alabama Retail Association (ARA) applauded the release of Dr. Robicheaux's comprehensive study, with its President Rick Brown stating:

This report makes clear that for every $1 million in retail sales Alabama retailers lose to online sales that go untaxed, the state loses 22.5 jobs. Lost jobs, means lost income, which means even more lost retail sales, lost sales taxes and lost income taxes. Alabama can't afford to continue to lose billions in sales, millions in taxes, and thousands of jobs. It is time for Congress to quit picking winners and losers when it comes to which sellers must collect sales taxes. It is time for all retailers to be required to collect sales taxes, whether their stores are on Main Street or along the information highway.

For more information on Professor Robicheaux's study, please click here.

Note: The authors advise the Alabama Retail Association and other business associations on streamlined sales tax issues and related matters.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.