Introduction

Many believe that excessive executive compensation and flawed incentive compensation practices can be at least partially blamed for the imprudent risk-taking that helped spark the economic crisis. Financial institutions face more scrutiny from regulators and the general public than ever before particularly when it comes to executive and incentive pay. In response, the president signed the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) into law on July 21, 2010. Among the Dodd-Frank Act's many provisions are new rules for incentive compensation. On Feb. 7, 2011, the Federal Deposit Insurance Corporation (FDIC) proposed a number of regulations for implementing compensation provisions in the Dodd-Frank Act. The FDIC's proposed regulations reach beyond banks and will affect a range of financial services firms, including broker-dealers and investment advisers. The purpose of this white paper is to review the historical background leading up to the FDIC's recent proposals, as well as to provide insight and analysis both from a compliance perspective and in light of the trends and issues surrounding executive compensation in the financial services industry.

The risk of rewards: How did we get here?

Most of the principles and plan design features (e.g., mandatory deferrals, risk-adjusted awards and longer-term performance periods) outlined in recent reports and statements in the United Kingdom have been incorporated in newly proposed and released incentive-based compensation rules in the United States. For instance, a recent history of incentive compensation policies and practices in the financial services industry can be found in A review of corporate governance in UK banks and other financial industry entities.1 This report, prepared by Sir David Walker and published on July 16, 2009, was commissioned by then-Prime Minister Gordon Brown in response to the economic crisis. In August 2009, the UK's Financial Services Authority published Policy Statement 09/15, Reforming remuneration practices in financial services.2 This exhaustive policy statement presented new principles and a complex structure for designing, implementing and controlling compensation (remuneration) arrangements.

The events, laws, regulations and related documents listed below serve as milestones marking the increases in regulatory scrutiny of executive and incentive-based compensation in the U.S. and global banking system. This process began with the financial crisis in the fall of 2008 and continued as follows:

The FDIC's proposed regulations

Overview

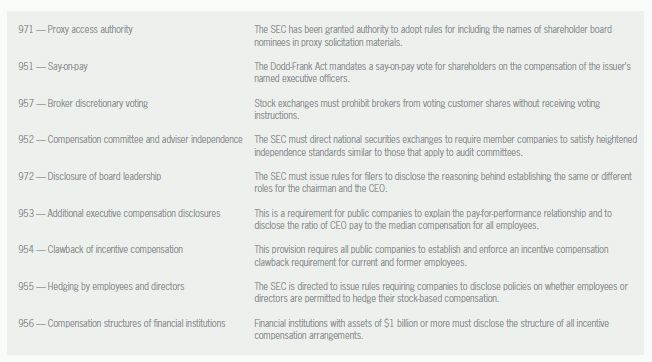

A number of the provisions in the Dodd-Frank Act address corporate governance and executive compensation issues.

We'll focus specifically on Section 956, which requires that agencies issue regulations or guidelines with respect to incentive-based compensation practices at covered financial institutions.

Other relevant sections include:

Key implementation dates

The notice of proposed regulation called for a comment period of 45 days beginning Feb. 7, 2011. Following the comment period, the final regulations will be published in the Federal Register. The final regulations will become effective six months following publication in the Federal Register.

Definitions

The following definitions were used to clarify the new rules:

Compensation — Defined as all direct and indirect payments, fees or benefits, both cash and noncash, awarded to, granted to, or earned by or for the benefit of any covered person in exchange for services rendered to the covered financial institution. This would include payments or benefits pursuant to an employment contract, compensation or benefit agreements, fee arrangements, perquisites, stock option plans, postemployment benefits, or other compensatory arrangements. For credit unions, the definition of compensation specifically excludes reimbursement for reasonable and proper costs incurred by covered persons in carrying out official credit union business; provision of reasonable health, accident and related types of personal insurance protection; and indemnification.

Covered financial institution (CFI) — Defined to include any of the following types of institutions that have $1 billion or more in assets:

- A depository institution or depository institution holding company, as such terms are defined in Section 3 of the Federal Deposit Insurance Act (FDIA)

- A broker-dealer registered under Section 15 of the Securities Exchange Act of 1934

- A credit union, as described in Section 19(b)(1)(A)(iv) of the Federal Reserve Act

- An investment adviser, as such term is defined in Section 202(a)(11) of the Investment Advisers Act of 1940

- The Federal National Mortgage Association (Fannie Mae)

- The Federal Home Loan Mortgage Corporation (Freddie Mac)

- Any other financial institution that the appropriate federal regulators, jointly, by rule, determine should be treated as a CFI for these purposes

As the last item above implies, these rules are designed to cover a broad range of financial institutions, as well as to address compensation arrangements that extend beyond those included in the Dodd-Frank Act. The uninsured branches and agencies of a foreign bank, as well as the other U.S. operations of foreign banking organizations that are treated as bank holding companies pursuant to Section 8(a) of the International Banking Act of 1978, will be considered CFIs. The Federal Home Loan Banks with assets of more than $1 billion and the FHLBanks Office of Finance will also be subject to the proposed rules.

Covered person — A covered person is any executive officer, employee, director or principal shareholder of a CFI. No specific categories of employees are excluded from the scope of the proposed rules. Certain prohibitions apply only to a subset of covered persons. For federal credit unions, only one director, if any, may be considered a covered person, since under Federal Credit Union Act and National Credit Union Administration (NCUA) regulations, only one director may be compensated as an officer of the board.

Incentive-based compensation — Defined as any variable compensation that serves as an incentive for performance. The form of payment, whether it is cash, an equity award, or other property, does not affect whether the compensation meets the definition of incentive-based compensation. There are several types of compensation that do not fall within the scope of this definition, including:

- compensation that is awarded solely for, and the payment of which is solely tied to, continued employment (e.g., salary);

- compensation arrangements that provide rewards solely for activities or behaviors that do not involve risk-taking (e.g., payments made solely for achieving a higher level of education or maintaining a professional certification);

- compensation arrangements that are determined based solely on the employee's level of fixed compensation and do not vary based on one or more performance metrics (e.g., employer contributions to a 401(k) retirement savings plan computed using a fixed percentage of an employee's salary); and

- dividends paid and appreciation realized on stock or other equity instruments that are owned outright by a covered person. However, stock or other equity instruments awarded to a covered employee under a contract, arrangement, plan or benefit would not be considered owned outright while subject to any vesting or deferral arrangement (irrespective of whether such deferral is mandatory).

Executive officer — Defined as any person who holds the title or performs the function (regardless of title, salary or compensation) of one or more of the following positions: president, CEO, executive chairman, chief operating officer, CFO, chief investment officer, chief lending officer, chief legal officer, chief risk officer, or head of a major business line.

In addition, directors and boards of directors are defined as board members or boards performing a similar function. A principal shareholder owns at least 10 percent of the voting securities of the financial institution. Total consolidated assets must generally be $1 billion or more for the institution to qualify as a CFI under the proposed rules.

Prohibitions

The proposed rules specify two prohibitions for covered persons at CFIs:

- establishing or maintaining any incentive-based compensation arrangements that encourage covered persons to expose the institution to inappropriate risks by providing excessive compensation, and

- establishing or maintaining any incentive-based compensation arrangements that encourage inappropriate risks that could lead to a material financial loss.

In addressing whether an institution provides excessive compensation, the proposed rules refer to compensation standards established under Section 39 of the FDIA and expand upon them. Under the proposed rules, compensation for a covered person is considered excessive when amounts paid are unreasonable or disproportionate to, among other things, the amount, nature, quality or scope of services performed by the covered person. In making this determination, the agencies will consider:

- the combined value of all cash and noncash benefits provided to the covered person;

- " the compensation history of the covered person and other individuals with comparable expertise at the CFI;

- the financial condition of the CFI;

- comparable compensation practices in comparable institutions based on such factors as asset size, geographic location, and complexity of the institution's operations and assets;

- the projected total costs and benefits to the CFI of the covered person's postemployment benefits;

- any connection between the individual and any fraudulent act or omission, breach of trust or fiduciary duty, or insider abuse with regard to the CFI; and

- any other factors the agencies determine to be relevant.

Inappropriate risks that may lead to a material financial loss

The proposed rules prohibit any CFI from establishing or maintaining any incentive-based compensation arrangement or any feature of any arrangement that encourages a covered person to expose the financial institution to inappropriate risks that could lead to a material financial loss. The provision acknowledges the requirement in Section 956 of the Dodd-Frank Act mandating such prohibition. Further, the proposed rules clarify that Section 39 of the FDIA does not include standards to determine whether compensation arrangements may encourage inappropriate risks that could lead to a material financial loss. However, these rules point to existing supervisory guidance that addresses incentive-based compensation, such as the Principles for Sound Incentive Compensation Practices and, as mentioned earlier, the related principles adopted by the Financial Stability Board.

Specifically, the prohibition will apply only to those incentive-based compensation arrangements for individual covered persons or groups of covered persons whose activities may expose the CFI to a material financial loss. These persons include:

- executive officers or other covered persons who are responsible for oversight of firmwide activities or material business lines;

- other individual covered persons, including non-executive employees, whose activities may expose the CFI to a material financial loss (for example, traders with large position limits relative to the CFI's overall risk tolerance); and

- groups of covered persons who are subject to the same or similar incentive-based compensation arrangements and who, in the aggregate, could expose the CFI to a material financial loss (for example, loan officers who, as a group, originate loans that account for a material amount of the CFI's credit risk).

Complying with the proposed rules

The proposed rules state that an incentive-based compensation arrangement established or maintained by a CFI for one or more covered persons does not comply unless it:

- balances risk with financial rewards (for example, by using deferral of payments, risk-based adjustment of awards, longer performance periods, or reduced sensitivity to short-term performance);

- is compatible with effective controls and risk management; and

- is supported by strong corporate governance.

The following provides additional details about these standards:

Balance of risk with financial rewards — The proposed rules identify four methods that are currently used to make compensation arrangements more sensitive to risk:

- Risk-based adjustment of awards — This method adjusts the size or amount of incentive-based compensation awards based on measures that take into account the risk the covered person's activity poses to the CFI. Such measures may be quantitative or based on managerial judgment subject to appropriate oversight.

- Deferral of payment — Under this method, the actual payout of an award is delayed significantly beyond the end of the performance period, and amounts paid are adjusted for actual losses or other aspects of performance that become clear during the deferral period.

- Longer performance periods — With this method, the time period of the performance measures is extended (e.g., from one year to two years). Longer performance periods and payment deferrals allow awards and payments to be made after some or all of the risk outcomes are realized or better-known.

- Reduced sensitivity to short-term performance — Under this method, the rate for which awards are increased for a covered person who achieves a higher performance level is reduced. Rather than offsetting the risk-taking incentives for short-term performance, this method reduces their magnitude.

The proposed rules note that these methods don't encompass the universe of risk-adjusting methodologies and that in the future, new methods will emerge as incentive compensation practices evolve. Additionally, each method has advantages and disadvantages that vary depending on the situation, and in some cases, applying two or more methods may be necessary to achieve an appropriate balance.

Compatibility with effective controls and risk management — The role of the board of directors and the board's compensation committee will be to provide broad oversight in the development of strong controls to govern the design and implementation of incentive compensation while ensuring an appropriate balance between rewards and associated risks. Under the proposed rules, the board (or a committee of the board) should actively oversee the development and operations of the incentive compensation system and related processes.

For example, the board should review and approve the overall purpose and goals of the system to ensure that they are consistent with the financial institution's risk tolerance. Additionally, the board has an affirmative requirement to receive relevant compensation and related performance data and to assess whether the incentive compensation plan design and performance are consistent with the requirements in Section 956 of the Dodd-Frank Act.

Larger financial institutions — The proposed rules provide special deferral arrangements for executive officers and a special review and approval requirement for other individuals at larger financial institutions (generally defined as those institutions with assets of $50 billion or greater) as described below.

Mandatory incentive compensation deferral — The deferral-of-compensation requirement states that at least 50 percent of the incentive-based compensation of an executive officer should be deferred over a period of at least three years. Regulators believe that incentive deferrals for executive officers at larger financial institutions are likely to improve the balance between risk and reward when a substantial portion of the executive's incentive compensation is deferred over a multiyear period. This belief is consistent with international standards and allows for additional time in which risk and performance can be evaluated, while acknowledging that ex-ante risk adjustments are difficult to measure and model.

The proposed rules allow institutions to use a cliff deferral when applying the deferral period. In a cliff deferral, the incentive compensation is deferred for a full three-year period. The proposed rules permit a ratable deferral (in which the compensation is paid in equal installments over the three-year deferral period) or a variable deferral (in which amounts deferred are paid in unequal amounts, but not less than amounts under the ratable deferral, over the three years). For example, if compensation totaling $300,000 is deferred, a variable deferral permits payment of $50,000 after the first year, $100,000 at the end of the second year, and the remaining $150,000 at the end of the third year.

Special review and approval requirements for other designated individuals — In the proposed rules, regulators acknowledge that certain non-executive officers potentially have the ability to expose the financial institution to losses that are substantial relative to the institution's size, capital, and overall risk tolerance. To strike an appropriate balance and discourage exposure to the risk of material financial losses, the board of directors or a committee of the board must identify any non-executives whose job responsibilities and impact on risk rise to a level that could expose the financial institution to potentially material financial losses.

Additionally, the board (or committee) may not approve any incentive compensation arrangement unless it determines that the arrangement, including the payment method, effectively balances the employee's reward with the range and time horizons of risks associated with the employee's activities. The board must evaluate the effectiveness of the risk-balancing methods that the financial institution uses to mitigate financial risk.

Policies and procedures — Under the proposed rules, CFIs will have to adopt policies and procedures governing incentive compensation arrangements in order to foster transparency and promote compliance and accountability. The scope of these policies and procedures should reflect the size and complexity of the financial institutions' business activity as well as the scope and nature of their compensation arrangements. The regulators noted that some lower-level employees, such as tellers, bookkeepers, couriers or data processing personnel, may be outside the scope of these regulations.

To ensure that risks are adequately understood, regulators believe that personnel involved in risk management, risk oversight and internal control monitoring should be involved in all phases of the design of incentive-based compensation arrangements. Additionally, to maintain adequate independence, the institution's risk management, risk oversight and internal control personnel must have a reporting relationship to senior management that is separate from their relationships to covered persons. The full-scope policies and procedures should be designed so that the board or committee receives sufficient data and analysis from management and other sources to assess whether the overall design and performance of the institution's incentive compensation arrangements are consistent with both Section 956 and the institution's overall risk management policies.

Preparation and documentation of incentive compensation policies and procedures should address the institution's processes for establishing, implementing, modifying and monitoring incentive compensation arrangements in enough detail for regulators to determine the extent of compliance with the Dodd-Frank Act and the proposed rules. Documentation maintained by a CFI should include but not be limited to:

- a copy of all incentive compensation arrangements and plans,

- the names and titles of individuals covered by such arrangements or plans,

- a record of the incentive-based compensation awards made under the arrangements or plans, and

- records reflecting the persons or units involved in approving and monitoring the arrangements or plans.

Where deferral in connection with an incentive-based compensation arrangement is used, the policies and procedures should reflect the amounts of any payments, the time period appropriate to the duties and responsibilities of the covered person, the risks associated with the person's duties and responsibilities, and the size and complexity of the CFI. Additionally, the policies and procedures should require that any deferred amounts paid be adjusted for actual losses or other measures of performance that are realized or become known during the deferral period.

In keeping with the need of every financial institution for safety and soundness, the proposed rules require policies and procedures under which any incentive compensation arrangement is subject to a strong corporate framework that includes active and ongoing board oversight.

Other topics — The proposed rules call for financial institutions to describe the extent to which they prohibit personal hedging strategies to lock in the value of their equity compensation that is vested over time. Finally, the anti-evasion provision prohibits a CFI from evading the restrictions of the proposed rules by any indirect act such as replacing substantial numbers of covered employees with independent contractors.

Understanding the proposed regulations in context

Largest institutions face biggest impact

Although the Dodd-Frank Act and U.S. federal agencies have addressed these proposed rules to a broad group of financial institutions, the focus of these rules is to restructure incentive compensation practices at larger financial institutions. Further, Policy Statement 09/15 as promulgated by the Financial Services Authority — along with the Walker report — targets larger UK and international financial institutions. One can conclude that these institutions contributed more to the financial crisis and thus helped spark the too-big-to-fail situation. The requirement of a deferral of one-half or more of all incentive compensation for executive officers sends a clear message that larger banks must implement more restrictive incentive compensation policies. These policies must provide a substantial means to adjust the awards after the completion of the performance period based on future losses or other changes that take place in performance metrics after the awards have been earned.

Another message to the larger financial institutions is that the risk of material losses extends to employees outside the executive suite. The recent controversy over large bonus payments to employees of banks in major money centers is a prime example of what regulators are aiming to rectify. In the future, after these rules are final, the practice of paying large bonus payments will likely be prohibited. Violating these proposed rules — especially those concerning bonus payments — will pose a huge reputational risk.

Proposed methodology for compliance

A reasoned approach to complying with the proposed regulations and ensuring consistency with the Guidance on Sound Incentive Compensation Policies (the Guidance) requires a three-pronged methodology that is intended to address:

- incentive plan design that appropriately balances risks with rewards,

- integrated internal controls and risk management, and

- strong corporate governance.

The history of this tripartite methodology goes back to the Walker report, which concluded that boards of directors had been neglecting their oversight responsibility of addressing the risks implicit in incentive compensation, especially the compensation of individuals whose roles and behavior exposed certain large financial institutions to significant risks and material financial losses. As a consequence, the FSA's remuneration policy focused on methods of sound incentive plan design, implementation of meaningful internal control policies, and heightened scrutiny of remuneration policies by independent board members. These themes continued to surface within the principles established by the Financial Stability Board. As regulators and legislators in the United States sought direction on how to respond to the financial crisis, policymakers relied upon these global precedents to formulate the U.S. approach that led to the federal banking regulators' guidance.

The first method requires that incentive plans and arrangements be carefully and judiciously designed to ensure that the potential reward or financial gain is balanced against the broad range of risks that may be associated with the reward or gain. Incentive plan design has traditionally been management's role and not an area where banking and securities regulators have set policy — until recently. The SEC has broadened the scope of required proxy disclosures to include the Compensation Discussion and Analysis, or CD&A, which expands on the link between compensation and company/shareholder performance. The American Recovery and Reinvestment Act of 2009 (ARRA) and Troubled Asset Relief Program (TARP) provided for restrictions on incentive pay and prohibitions on excessive risk-taking and other practices such as golden parachute payments. The Guidance further addresses this topic by noting that "an unbalanced arrangement can be moved toward balance by adding or modifying features that cause the amounts ultimately to be received by employees to appropriately reflect risk and risk outcomes."2 The proposed regulations establish guidelines for all CFIs and mandatory requirements for large CFIs (generally those with assets above $50 billion). When incentive compensation potentially exposes the CFI to a significant risk, the institution must adjust (lower) the reward to mitigate the risk of a material financial loss. For large CFIs, this means establishing a mandatory 50 percent deferral of incentive compensation for at least three years. However, the regulators are unclear as to the best approach to risk mitigation. They ultimately conclude that for the present, risk mitigation is best accomplished by the deferral of incentive compensation for an appropriate time period that allows adjustment for any material financial loss incurred. Because many decisions about the time and magnitude of extending credit will have a long-term impact (sometimes as long as 30 years), this approach seeks to mitigate losses and recapture inappropriate incentive payments. Other design features include using performance measures that span longer time periods, such as a three-year average ROI versus annual net income. Finally, this approach requires the CFI to lessen its emphasis on short-term performance.

Establishing effective internal controls and risk management represents the second method suggested in the federal regulators' approach. Developing a robust set of internal controls over incentive plan design and implementation and over the monitoring of incentive pay is the desired outcome. For most CFIs, this will require an expanded role for internal audit personnel, who will need to work closely with management and/or HR staff so that the organization can integrate the process of applying sound internal controls and risk management practices to incentive compensation plans and arrangements. The proposed regulations and the Guidance express concern about potential conflicts of interest and have suggested that internal audit staff not report directly to management personnel who participate in incentive compensation plans that are reviewed by internal audit staff. In fact, the Guidance — echoing FSA Policy Statement 09/15 — specifies that compensation for internal audit and risk management staff should be based on performance measures other than those used by management personnel participating in incentive compensation arrangements reviewed by internal audit or risk management personnel. This is clearly a new role for most internal audit departments and represents a departure in policymaking for many CFIs.

Adopting a strong corporate governance program to ensure sound incentive compensation policies is the final method suggested in the approach to adopting the proposed regulations. A strong corporate governance program should include meaningful and regular oversight by the board of directors (or the compensation committee of the board). The board should provide broad oversight and policymaking guidance regarding the design, implementation, monitoring and approval process for all incentive arrangements for senior executives — including payments and the sensitivity of those payments to risk outcomes. Additionally, this oversight should be expanded to encompass all individuals whose responsibilities and actions potentially expose the CFI to material financial losses. The board should receive regular reports, which should include data and analysis regarding incentive compensation plans and arrangements sufficient to allow a determination of whether the outcomes are consistent with the organization's safety and soundness requirements. Finally, the board should have sufficient resources, which should include possessing, or having access to, a level of expertise and experience in risk management and compensation practices in the financial services industry that is appropriate given the nature, scope and complexity of the organization's activities.

As noted in the Guidance, many believe that excessive executive compensation and flawed incentive compensation practices can be at least partially blamed for the imprudent risk-taking that helped spark the economic crisis. The proposed regulations identify specific restrictions on incentive compensation as described above and further state that incentive compensation arrangements are not compliant unless they balance financial risks with rewards,3 are compatible with effective controls,4 and are supported by strong corporate governance.5 We conclude that implementing the three risk mitigation methods proposed in the Guidance and establishing enhanced process improvements are not simple tasks. Inventorying current plans for balancing risks with rewards and addressing new and expanded roles for internal audit and risk management personnel will require a substantial time investment, especially for CFIs whose use of incentive compensation is substantial and far-reaching. Finally, the proposed regulations raise the bar for the board, requiring it to become more closely involved than ever before with incentive plan design and oversight. These new requirements were not unexpected; however, their adoption will make dramatic changes to incentive compensation at CFIs.

Action steps: Top 10 tips

Compliance with these new and proposed compensation rules can be overwhelming. Here are 10 steps your institution can take now.

1. Determine if you are a CFI under the proposed rules and, if so, determine if you qualify as a large CFI.

2. Complete a thorough inventory of all the current compensation arrangements by accumulating all written and other documentation describing, among other things:

- who is eligible and participating in each plan,

- the key provisions for each plan and arrangement,

- how the plans are designed and how the performance targets are established,

- how awards levels are determined and how plans are approved for implementation,

- what compensation is excluded from consideration (such as broad-based plans and 401(k)s),

- when and how frequently payments are made to participants, and

- the risk that the current incentive compensation plan may expose the CFI to excessive or inappropriate risks.

3. Assess the scope of each incentive plan and arrangement (i.e., the number of named executive officers or NEOs and employees covered by all plans and arrangements, including individuals whose position and compensation may expose the institution to excessive risk). Assess the magnitude of the current target and maximum annual total compensation for all plans and arrangements, and identify the time horizons (annual, monthly, multi-year, etc.) of the payment scheme and the risk exposure for each compensation arrangement.

4. Conduct a review of all compensation and internal audit policies and procedures that govern the design, implementation and payment for all incentive compensation.

5. Evaluate the corporate risk factors affecting the current plans and arrangements, assessing their impact on inappropriate risk-taking for the plan participants.

6. Determine the current role of internal audit in the design, implementation and monitoring of compensation plans and arrangements. Evaluate that role against the current and proposed regulatory guidance.

7. Adjust your current incentive plans to incorporate the FRB's Guidance on Sound Incentive Compensation Policies and the proposed rule's guidance. Add a deferral period for risk adjustment and a clawback feature, implement longer performance periods and place less emphasis on short-term results.

8. Engage the board and compensation committee in a continuing education process on the proposed rule and related guidance. Confirm their expanded role in incentive plan design and approvals, and gain their support for the expanded role of internal audit/risk management personnel.

9. Implement an ongoing monitoring and review process for all incentive compensation arrangements to include management, internal audit and the compensation committee.

10. Prepare for annual regulatory reporting requirements on incentive compensation plans and arrangements by accumulating relevant documentation and plan data, as well as obtaining appropriate management and internal audit staff input.

Footnotes

1 Walker, Sir David. A review of corporate governance in UK banks and other financial industry entities. Originally published July 16, 2009. http://webarchive.nationalarchives.gov.uk/+/http://www.hm-treasury.gov.uk/d/walker_review_261109.pdf .

2 Financial Services Authority. Policy Statement 09/15, Reforming remuneration practices in financial services, August 2009, www.fsa.gov.uk/pubs/policy/ps09_15.pdf .

3 Compensation Discussion and Analysis.

4 Guidance on Sound Incentive Compensation Policies, p. 30.

5 Ibid.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.