IN THIS ISSUE:

- Will Tax Reform Hurt the Municipal Bond Market

- Bankruptcy Court Protects California Bondholders from Chapter 9

- Tierney Bill Favors BABs Over Tax-Exempt Debt

- Bond Market Snapshot

Will Tax Reform Hurt the Municipal Bond Market?

The U.S. House of Representatives recently approved Representative Paul Ryan's 2012 budget proposal. Ryan's proposal, dubbed "The Path to Prosperity," is the latest in a string of Republican proposals that emphasize tax reform as a path to recovery. The various reform proposals typically include a reduction in marginal tax rates and the elimination of various tax preferences, each of which poses a challenge to the traditional tax-exempt bond market.

The following are some features of several budget and tax initiatives that have been proposed:

Representative Ryan's Fiscal 2012 Budget Proposal

- Reduce top tax rate to 25%

- Eliminate or limit tax expenditures to broaden tax base

National Commission on Fiscal Responsibility and Reform

- Remove tax exemption for new municipal bonds

- Reduce top tax rate to 25%; tax capital gains and dividends as ordinary income

Representative Schakowsky's Deficit Reduction Plan

- Raise wage cap on social security taxes

- Tax capital gains and dividends as ordinary income

Domenici-Rivlin Debt Reduction Task Force

- Retain tax exemption for public purpose municipal securities

- Reduce top tax rate to 27%; eliminate most tax expenditures to broaden tax base

- Impose new 6.5% debt reduction sales tax

- Tax capital gains and dividends as ordinary income

Stiglitz-Roosevelt Institute

- Eliminate tax preferences and reduce tax rates

- Devise a more efficient mechanism than municipal bonds to aid state and local governments

Representative Tierney's Tax Reform Bill

- Require all new municipal debt to be issued as taxable direct-pay bonds with a 25% federal subsidy rate. (See also "Tierney Bill Favors BABs Over Tax-Exempt Debt" in this issue.)

Bankruptcy Court Protects California Bondholders from Chapter 9

Despite increasing "chatter" in the investment community concerning the municipal bankruptcy option, Chapter 9 bankruptcy filings are likely to remain a costly last resort for most municipalities. Nevertheless, municipal bond investors breathed a collective sigh when the U.S. Bankruptcy Court, Eastern District of California, recently upheld bondholder protections in a municipal bankruptcy proceeding.

In 2009, the Sierra Kings Health Care District (the "District"), located in the County of Fresno, California, filed a voluntary Chapter 9 bankruptcy petition (Case No. 2009-19728), but remained current on its debt obligations. In March 2011, the court ruled that the District's pledge of ad valorem taxes to secure its general obligation bonds qualifies as both a special revenue pledge and a statutory lien, and therefore cannot be interrupted due to the Chapter 9 bankruptcy filing.

More information about the District's bankruptcy proceedings can be found here.

Tierney Bill Favors BABs Over Tax-Exempt Debt

Representative John Tierney (D-MA) plans to introduce a bill next month as part of Congress's tax reform efforts. Tierney's bill, dubbed the "Tax Equity and Middle Class Fairness Act of 2011," would require all new municipal debt to be issued in the form of taxable direct-pay bonds with a 25% federal subsidy rate.

Proponents claim the bill will save the federal government $60 billion by eliminating tax expenditures or preferences. Tierney asserts that the direct-pay bond provision alone will create a savings of approximately $92 million in one year.

Market participants have advocated for the reinstatement of the Build America Bonds program since its termination in 2009. However, issuers and underwriters have questioned Tierney's approach, arguing that a 25% subsidy rate is too low, and that the elimination of tax-exempt bonds would damage an already weakened municipal bond market.

Lew Feldman, Los Angeles Chair of Goodwin Procter LLP and head of its Public Finance Practice, favors the reinstatement of a BABs program, but thinks Tierney's idea swings the pendulum too far. "Build America Bonds provided a successful adjunct to the ailing tax-exempt market," says Feldman. "But to eliminate tax exemption entirely, especially during a fragile recovery, would jeopardize the foundation of municipal finance."

See also " Will Tax Reform Hurt the Municipal Bond Market?" in this issue

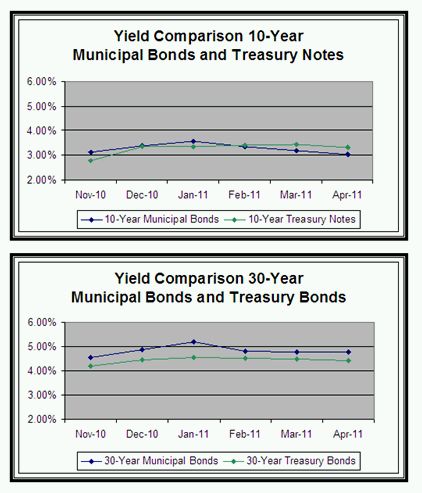

Bond Market Snapshot

Trading in the municipal securities market remained strong in April 2011, despite Standard & Poor's announcement of a "negative" outlook for U.S. Treasuries.

The yield on the 10-year U.S. Treasury note continued to outpace the 10-year municipal bond – 3.33% versus 3.05% – while the yield on 30-year municipal bonds increased slightly to 4.78%, but remained higher than the yield on 30-year Treasuries, which dropped slightly to 4.41%.

Source: Bloomberg (www.bloomberg.com)

Goodwin Procter LLP is one of the nation's leading law firms, with a team of 700 attorneys and offices in Boston, Los Angeles, New York, San Diego, San Francisco and Washington, D.C. The firm combines in-depth legal knowledge with practical business experience to deliver innovative solutions to complex legal problems. We provide litigation, corporate law and real estate services to clients ranging from start-up companies to Fortune 500 multinationals, with a focus on matters involving private equity, technology companies, real estate capital markets, financial services, intellectual property and products liability.

This article, which may be considered advertising under the ethical rules of certain jurisdictions, is provided with the understanding that it does not constitute the rendering of legal advice or other professional advice by Goodwin Procter LLP or its attorneys. © 2011 Goodwin Procter LLP. All rights reserved.