© (2011) Investment Management Consultants Association Inc. Reprinted with permission.

The mid-term elections brought meaningful change to the makeup of Congress and the lame-duck session had some equally meaningful issues to resolve with respect to taxation. Although a truce and a compromise have been reached, changes still may occur up until the 2012 presidential election and we should expect a flurry of new tax proposals over the next several years. Effectively, the major components of the Bush tax cuts (enacted through the Economic Growth and Tax Relief Reconciliation Act of 2001 [EGTRRA]) set to expire at the end of 2010 now are set to expire at the end of 2012, resulting in an increase in income tax rates in 2013.

The loss of these tax cuts, coupled with tax increases in the Health Care and Education Reconciliation Act of 2010, means that taxes are going up, and they are going up substantially for high-net-worth individuals. Undoubtedly numerous investment strategies are being developed in response and, as in the past, many will include mechanisms that attempt to convert ordinary income to capital gains or to defer taxation of investment earnings. And while some of these plans may work, they only mitigate the applicable tax. For the past 15-plus years, however, a strategy has existed that has the ability to eliminate taxes on a portion of investment portfolio earnings. The strategy is private placement life insurance (PPLI). While it is bona fide life insurance (which has ancillary benefits, discussed below), the tax benefit to investors lies in the advantageous treatment afforded variable life insurance under long-standing and unquestioned tax law. With the pending tax increases, PPLI is a necessary discussion topic for every investment advisor who hopes to provide value-added and comprehensive investment advice within the high-net-worth community.

TAXES ARE GOING UP

In 2013 there will be a major increase in income tax rates. Before the midterm election, taxes were expected to increase in two stages: first, as part of the expiring Bush tax cuts beginning January 1, 2011, and then in 2013 as a result of the Health Care and Education Reconciliation Act of 2010.

The tax increases in the Health Care and Education Reconciliation Act of 2010 impose (i) a 3.8-percent surcharge on net investment income and (ii) a Medicare payroll tax increase from 1.45 percent to 2.35 percent.

Under EGTRRA the highest applicable income tax rate is currently 35 percent for ordinary investment income and 15 percent for long-term capital gains and qualified dividends. Th e expiring Bush tax cuts coupled with the Health Care and Education Reconciliation Act of 2010 tax increases results in the following beginning in 2013:

- capital gains tax rates will increase from 15 percent to 23.8 percent

- ordinary investment income tax rates will increase from 35 percent to 43.4 percent

- income tax on qualified dividends will increase from 15 percent to 43.4 percent

Further, many state income tax rates will increase, potentially resulting in a total effective income tax rate well in excess of 50 percent.

INVESTMENT ADVISORS ARE DEVELOPING INVESTMENT THEMES

Investment advisors are developing investment themes and strategies in response to the changing economic landscape and future tax increases, including but not limited to:

- selling low-basis holdings before tax increases become effective (yet this still leaves unanswered the question of how to handle the investment proceeds)

- analyzing and recalculating after-tax yields on fixed income holdings, including a closer look at the benefits of municipal bonds given the wider tax spread between corporate and municipal bonds (yet it will be important to consider the associated risk of the potentially higher yield of municipal debt, which stems from the financial stress that city and state governments are feeling due to lower tax receipts, economic weakness, and funding employee and post-retirement benefits)

- considering investment strategies that postpone the realization of ordinary income

- utilizing more-liquid strategies within a broad and strategic framework that allows for tactical positioning as economic developments warrant

A MACRO VIEW OF THE CLIENT'S BALANCE SHEET

Many investment advisors (and investment product developers) are discussing (and developing) new tax mitigation and tax-efficient portfolio strategies. This activity is an excellent and necessary exercise, but too often it is done within a vacuum with respect to an investment portfolio. An investment advisor could do the client (and his own practice) a serious disservice by not reviewing the client's entire balance sheet on a macro basis and implementing tax mitigation strategies as well as— and more importantly—tax elimination strategies.

The macro balance sheet approach requires an understanding and recognition (and management on occasion) of the other assets and liabilities within the client's estate such as cash balances, real estate, equities and fixed income, hedge funds, private equity, and other alternative asset classes (whether through 401(k)s, individual retirement accounts [IRA], brokerage accounts, etc.). Furthermore, an advisor must be cognizant of the client's cash requirements for any emerging liabilities including mortgages, capital calls, asset maintenance, and major capital expenditures.

REVIEW INVESTMENT RETURNS NET OF FEES AND FEDERAL AND STATE TAXES

All too often investment returns are presented, discussed, and evaluated net of investment management fees, but without regard to the impact of taxation. Investment returns must be reviewed in light of taxation, and this will be even more important with the pending tax increases. An investment manager can generate an investment return of 10 percent (net of investment management fees), but the real after-tax return to the client may only be 5.66 percent (assuming a 43.4-percent federal tax rate and ignoring any applicable state tax). It is possible, therefore, that more than 50 percent of the return could be absorbed by federal and state taxes and investment management fees.

LOST OPPORTUNITIES FOR INVESTMENT ADVISORS

A manager or investment advisor may argue that rarely are the client's tax liabilities satisfied by way of redemptions and liquidations of the managed assets, but the money must come from somewhere (the client's cash accounts, traditional brokerage accounts, etc). The manager or investment advisor must recognize that while assets under management may not be specifically depleted, the client's other assets are being depleted, thus depriving the investment advisor of potentially new allocations from the client (and, therefore, new income sources and an increase in assets under management), perhaps only stalling a future redemption request.

PPLI: A TAX-ELIMINATION STRATEGY

This raises the question of what can be done to off set these significant tax burdens on portfolio earnings. As mentioned previously, the tax planning community will create and market various investment strategies and structured vehicles that attempt to mitigate the tax liability on an investment portfolio. However, PPLI can eliminate the tax liability on a portion of an investment portfolio.

Traditional Insurance is Off-Balance-Sheet

PPLI is not traditional insurance such as universal life, guaranteed universal life, whole life, etc., nor is it term insurance. While some of these traditional types of life insurance have asset accumulation features, they tend to be limited in scope and investment return. Traditional insurance functions primarily to pay a death benefit after the insured (the client) has died. Certainly this can provide a valuable benefit to the client's estate, but the policy, its death benefit, and the payment of the applicable premium are off -balance-sheet items. For example, assume a client has a net worth of $50 million and minimal liabilities. Th is client may secure $50 million of death benefit coverage by paying $3 million for a traditional insurance product, liquidating $3 million in investable assets to do so. The traditional insurance product has limited asset accumulation features, so the majority of the $3-million premium may go toward insurance carrier and brokerage fees (which may be up to 120 percent of the first-year premium). Th e client's real net worth decreased by $3 million to $47 million, yet a $50-million "receivable" exists off -balance-sheet until the death of the insured.

PPLI is On-Balance-Sheet

In contrast, PPLI is an on-balance-sheet solution. Continuing the example from above, the same $3 million buys $50 million of death benefit in a PPLI policy, and investable assets are liquidated to pay the premium, but more than 95 percent of that $3 million premium is reinvested immediately, at the policy owner's discretion. Th is amount is invested among an array of strategies (within limits) underneath the policy, and the assets enjoy tax-free accumulation during the life of the insured. Immediately after the purchase, the client's net worth effectively remains $50 million (with $3 million now growing in a tax-free investment environment). As with the traditional insurance purchase, a $50-million death benefit receivable exists off -balance-sheet until the death of the insured. However, the underlying assets of the insurance are accreting tax-free on the client's balance sheet.

The benefits of PPLI effectively mandate that its use be part of any discussion between an investment advisor or fund manager and a high-net- worth client. The primary benefits include the investment benefit, the living benefit, and the death benefit. PPLI offers numerous estate planning applications and asset protection opportunities as well.

Investment and Tax Benefit

One of the primary attractions of PPLI is the tax advantages afforded life insurance. At its simplest level, and when structured properly, the PPLI premiums invested accrete free of federal income tax during the life of the insured and the death benefit passes to the beneficiary free of any federal income tax (and is potentially estate-tax free if structured properly). A favorable investment structure develops when PPLI is coupled with underlying actively managed investments that typically would generate investment returns that are taxed as ordinary income or short-term capital gain (e.g., hedge funds, commodity funds, and high-yield taxable bonds); these are expected to be taxed at rates as high as 43.4 percent.

The growth of the underlying policy assets free of federal income tax turns an otherwise 8-percent after-tax return into a 14.1-percent net return (or a 10-percent return into 17.7-percent net return) assuming a 43.4-percent tax bracket. Even for investment managers who successfully use passive investment strategies and generate returns taxed at capital gains rates of only 23.8 percent, PPLI turns an otherwise 10-percent after-tax return on the underlying PPLI policy assets into a 13.1-percent net return.

PPLI insurance fees are generally lower than retail insurance products. Most policies have low front-end loads on premium payments (3 percent or less), annual charges against policy cash values that are a fraction of the annual tax cost associated with similar investments in a taxable environment, and no surrender charges. As a general rule, total policy fees are less than 1.25 percent of the cash value over the investment horizon.

An Example

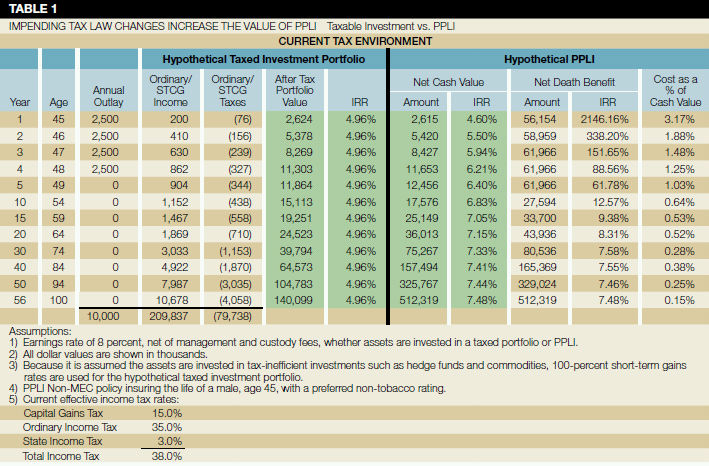

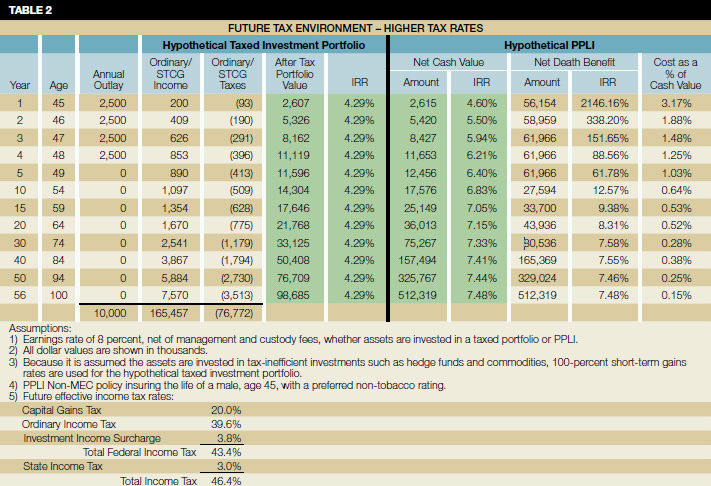

Table 1 (see below) presents a comparison of a series of hypothetical investments in the current tax environment with and without PPLI. Table 2 presents a comparison of a series of hypothetical investments in the expected higher-tax environment with and without PPLI.

In both scenarios, PPLI generates the higher net investment return over any reasonable investment horizon. Assuming four annual investment deposits (or premium payments into the PPLI policy) of $2.5 million under current tax assumptions (table 1), after 20 years a taxable investment portfolio will have a value of $24.5 million versus a value of $36 million within the PPLI policy. As a result of the power of compounding, after 40 years a taxable investment portfolio will have a value of $64.6 million versus a value of $157.5 million within the PPLI policy. Under the future tax assumptions (table 2) the differences are even more amplified.

Furthermore, with only a few modifications investment advisors can continue serving clients who utilize PPLI. The advisor can serve as the (registered) investment advisor to the client's policy ownership structure (in many cases a trust) and collect a fee from the client (or trustee) accordingly; or the advisor can create an investment structure underneath the insurance policy and manage the assets on a fully discretionary basis.

Living Benefit

In each scenario presented above, PPLI generates the highest account value over the investment horizon on a tax-adjusted basis. Moreover, during the life of the insured, the policy owner has income-tax-free access to the PPLI policy cash value by making withdrawals of basis (i.e., cumulative premiums paid) or policy loans (provided the policy does not lapse before the death of the insured). This benefit of PPLI provides another tax-preferential savings vehicle without the limitations of a 401(k) or IRA. However, unlike a 401(k) or IRA, there is unrestricted access to the cash value of the policy, typically up to 90 percent of the accumulated cash value. Th is amount may be borrowed tax-free, with net borrowing costs ranging from 0.25 percent to 1.0 percent. From a planning perspective, the living benefits can be used to fund lifestyle needs or capital expenditures, while remaining sensitive to the macro balance sheet approach to financial investing.

Death Benefit and Estate Planning Applications

The PPLI death benefit sometimes is overlooked, but it is actually an important part of the planning process. Th e death-benefit uses include estate-tax mitigation, philanthropy, and buy-sell agreement funding.

With the two-year continuation of the Bush tax cuts, an estate tax returns in 2011. Beneficiaries can use the liquidity created by the PPLI death benefit to help pay estate taxes and thus limit other liquidations of an investment portfolio, real estate, or a family business.

The death benefit also may be used to create a family philanthropic legacy. The beneficiary of the death benefit could be a charity, church, school, or family foundation, or still yet, used to create a private family foundation for future generations.

One rather advanced but effective planning technique is the split-dollar premium payment arrangement. Split-dollar planning is a flexible framework that facilitates transferring wealth to future generations in a transfer-tax-efficient manner. For example, a senior generation can pass assets in a leveraged manner to the next generation with minimal or no transfer-tax liability by creating an irrevocable life insurance trust and by funding the insurance purchase through an alternative premium-paying arrangement, such as an intrafamily loan structured as a split-dollar arrangement under the applicable tax regulations. When a client's net worth suggests the need for removing substantial assets from the estate tax base, PPLI, a traditional irrevocable life insurance trust, and an intrafamily split-dollar loan can be an effective combination.

Domestic and International Asset Protection

PPLI also can serve as a powerful asset protection tool. Prudent planning suggests that wealthy individuals should create structures that will prevent a devastating loss of part or all of their wealth due to a lawsuit judgment or other unanticipated liability. While a detailed discussion of asset protection planning is outside the scope of this article, ownership of investment assets through PPLI policies issued in certain jurisdictions outside of the United States can offer substantial statutory asset protection that might not otherwise be available to the policy owner under state law. In addition, policy ownership structures such as trusts and certain entities may have more favorable asset protection attributes when created outside the United States. In this context, it is also important to know that there are significant differences in pricing between domestic and international insurers; the primary difference is the application of state premium tax assessed against each premium paid to a domestic insurer, which can be as high as 4 percent.

CONCLUSION

PPLI is used most often as a simple, tax-elimination investment vehicle and PPLI likely should be a part of every high-net-worth individual's investment and estate plan. Investment advisors discussing the applications and investment benefits of PPLI will set themselves apart from their competitors by providing macro advice on the management of a client's balance sheet and being proactively cognizant of the impact of taxation, the greatest impairment to sustained investment growth.

Provided the policy remains in force, the benefits of tax-free accretion of investment earnings, tax-free access to the policy assets, and a tax-free death benefit presents an unparalleled tax planning tool advisors to the high-net-worth community cannot afford to ignore.

Bob Chesner is a director with the Austin, TX, law firm of Giordani, Swanger, Ripp & Phillips, LLP, where he assists high-net-worth clients with design and implementation of domestic and offshore life insurance and annuity structures and property and liability needs. He earned a BS in accounting from Providence College . Contact him at bchesner@gsrp.com.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.