On May 12, 2023, the Internal Revenue Service (IRS) issued initial guidance (Notice 2023-38, the Notice) outlining how taxpayers can qualify for the domestic content bonus credit amounts in the clean energy production and investment tax credits (PTC and ITC) at Tax Code Sections 45, 45Y, 48 and 48E, as added or amended by the Inflation Reduction Act of 2022 (IRA) (P.L. 117-169).

Owners of facilities or projects that may be eligible for the credits (such as wind, solar and energy storage projects) have been anxiously awaiting guidance on how to satisfy the "Domestic Content Requirement,"1 making them eligible for a tax credit boost of as much as 10% (in the case of Sections 45 and 45Y) or 10 percentage points (in the case of Sections 48 and 48E).2

The guidance has surprised many in the industry. While it was relatively widely known that the Treasury was seeking to create a framework that looked at the components/subcomponents of various equipment (e.g., looking at the wafers, glass and junction boxes for solar modules), the proposed framework creates some unexpected incentives.

On the one hand, products such as solar modules that are manufactured abroad may nevertheless still contain U.S.-made components that count towards the domestic content thresholds under the proposed framework.

On the other hand, there are aspects of the proposed framework that remove incentives to bring module manufacturing as a whole to the United States. Another unanticipated aspect of the guidance is how much sensitive information is required to be shared in order to allow taxpayers to perform accurate calculations.

The guidance effectively requires manufacturers to go open-book with project developers and share specific cost details that would allow customers to get a good sense of a supplier's profit margins. This could act as a chilling disincentive to use the domestic content bonus.

The guidance puts taxpayers on notice that the IRS and the Treasury Department intend to issue proposed regulations consistent with Notice 2023-38 that will be effective for taxable years ending after May 12, 2023 (although taxpayers may rely on the domestic content guidance in the Notice as long as construction of the "Applicable Project"3 begins before the date that is 90 days after the forthcoming proposed regulations are published).

Finally, the Notice contains a safe harbor that will make it easier for taxpayers to determine whether certain components of an Applicable Project will be classified by the IRS as either subject to the "Steel or Iron Requirement"4 or the "Manufactured Products Requirement."5

Upon its issuance, the Notice was met with criticism from a key lawmaker, because the domestic content requirements are lenient enough to allow projects with significant amounts of non-U.S.-sourced components to qualify for the bonus credit.

"I wrote the Inflation Reduction Act to make an historic investment in rebuilding domestic solar manufacturing, but the rules the Biden administration put forward today do not go far enough to make the most of that opportunity," said Senate Finance Committee Chair Ron Wyden (D-OR) in a statement.6 "I'm going to look for any opportunity to push these domestic content requirements further than the Biden administration has today."

Background and Scope

Given that the IRA added or amended numerous clean energy tax credits, it bears mentioning that this domestic content bonus guidance only applies to four of them:

- The Section 45 PTC for renewable electricity generation from certain technologies7, which the IRA amended and extended for projects that begin construction through 2024,8 when it is replaced with a technology-neutral version of the credit (see #2);

- The Section 45Y clean electricity PTC (which is designed to be technology neutral9 and only available projects that begin construction from 2025 through as early as 2032);

- The Section 48 ITC for renewable energy generation property10 as well as energy storage property, which the IRA amended and extended for projects that begin construction through 2024,11 when it is replaced with a technology-neutral version of the credit (see #4); and

- The Section 48E clean electricity ITC (which is designed to be technology neutral12 and only available for projects that begin construction from 2025 through as early as 2032).

Further, the PTC and ITC domestic content requirements are limited to steel, iron and "Manufactured Products"13 (all of which generally must be manufactured or produced in the U.S. in order to qualify).

We have received a fair number of questions regarding whether these rules are the same as or otherwise applicable to content sourcing requirements in other credits such as the $7,500 electric vehicle tax credit.

The answer is that the domestic content rules set forth in Notice 2023-38 do not apply to the electric vehicle credit. The PTC and ITC generally and the domestic content requirements specifically are very different from the electric vehicle tax credit under Section 30D.

The Section 30D credit amount is based, in part, on whether the vehicle's battery contains minerals extracted or processed in the U.S. (or in any country with which the U.S. has a free trade agreement in effect) and whether the battery components were substantially manufactured or assembled in North America. This is just something to keep in mind as we detail the domestic content rules applicable to the PTC and ITC.

Qualifying for Domestic Content Bonus Credit

The IRA states that taxpayers seeking to avail themselves of the domestic content bonus tax credit must certify that "any steel, iron, or manufactured product which is a component of [the Applicable Project] (upon completion of construction) was produced in the U.S. (as determined under section [sic] 661 of title 49, Code of Federal Regulations)." Section 661 of the Code of Federal Regulations are the domestic content (known as "Buy America") requirements applicable to government entities that receive funding from the Federal Transit Administration (FTA) (typically public transit agencies).

The IRA further establishes different domestic content requirements for steel and iron versus Manufactured Products. For steel or iron, the IRA states that the domestic requirement should be applied in a manner consistent with 49 C.F.R. 661.5, which requires that "all steel and iron manufacturing processes must take place in the U.S., except metallurgical processes involving refinement of steel additives."

For Manufactured Products, the domestic content requirement is met if not less than the adjusted percentage specified in the IRA of the total costs of all of the Manufactured Products which are components of a qualified facility upon completion of construction are attributable to Manufactured Products (including components) which are mined, produced or manufactured in the U.S.

The relevant tax credit statutes (i.e., 45, 45Y, 48 and 48E) include cross-references to the Buy America regulations promulgated by the FTA. It is important to keep in mind and realize that the rules set forth in Notice 2023-38 deviate significantly from the analysis that would have been applicable under the Buy America regulations with respect to manufactured products.

Steel or Iron v. Manufactured Products

One of the main features of the PTC and ITC Domestic Content Requirement is that the test varies depending on whether the project component in question is steel or iron as compared to a Manufactured Product.

Steel or Iron

The guidance provides that only those project components that are "construction materials made primary of steel or iron and are structural in function" are subject to the Steel or Iron Requirement.

Thus, items such as nuts, bolts, screws, clamps and fittings that might be made primary of steel or iron but are not structural in function are not subject to the requirement and can be manufactured outside of the U.S. The inclusion of the requirement that the components be structural in function may seem like a departure from Buy America regulations, but is actually with how FTA interprets the steel or iron requirement in 49 C.F.R. 661.5.

For example, in the case of a land-based wind turbine project, the steel tower that would hold the turbine and blades would be a component that would have to satisfy the Steel or Iron Requirement. According to the Notice, such a tower would only satisfy the Domestic Content Requirement if "all manufacturing processes with respect to [such tower] take place in the U.S., except metallurgical processes involving refinement of steel additives."

Note that the Domestic Content Requirement is not focused on where the raw materials used to produce the iron or steel came from (so they can be sourced from outside of the U.S.—the ore can be imported). Instead, it looks to the location of the manufacturing processes, and defines "manufacturing process" in a way that would, as applied to iron or steel, likely include processes such as melting, refining, forming, rolling, drawing, finishing, fabricating and coating (with an exception for metallurgical processes involving refinement of steel additives, which is consistent with other Buy America requirements).14

Manufactured Products15

While the guidance regarding steel or iron is generally consistent with 49 C.F.R. 661.5 as required under the IRA, the guidance regarding Manufactured Products appears to depart from the Buy America regulations more significantly.

A reasonable analysis of the Buy America standards for manufactured products would have resulted in the qualified facility or energy project being treated as the end product. One would then check to see if the components of that end product (e.g., solar modules, inverters, wind turbines, etc.) were manufactured in the U.S. Importantly, one would not need to look at the subcomponents thereof (e.g., wafers, glass, junction boxes, etc.) and determine the place of manufacture of those subcomponents.

The Notice, however, bases most of the critical calculations on the cost of subcomponents rather than of components of an energy project. This can be helpful for components that are not manufactured in the U.S. since the project can still count subcomponents towards the domestic content threshold.

However, the details of how the calculation works perversely removes some incentive to manufacture components in the U.S. This is because if a component such as a solar module, inverter or wind turbine contains a single subcomponent that is not manufactured in the U.S., then the value-add created by manufacturing the component in the U.S. is lost.

This can be illustrated with a single example of a $100 component that is comprised of two subcomponents that each cost $40. If both subcomponents are manufactured in the U.S., then the entire component is a U.S. Manufactured Product and the full $100 counts towards the threshold.

However, if one of the two subcomponents is not manufactured in the U.S., then only the $40 attributable to the cost of the other subcomponent that is manufactured in the U.S. counts towards the threshold. Thus, the $20 value-add from taking both subcomponents that cost $40 each and manufacturing them into a $100 component is lost. Said another way, there's no incentive to manufacture the component in the U.S. since only $40 will count towards the threshold once a single foreign subcomponent is in the mix.

Cost Accounting

As one can see from the example above, the cost of the various parts that make up manufactured product components is very important. Equally as surprising is the very specific and unique cost accounting required by Notice 2023-38.

The guidance states that only direct labor and direct materials costs can be included and cross-references regulations under Section 263A and Section 461. While not stated explicitly, we suspect this approach is an attempt to exclude any "domestic content premium" a manufacturer may be able to command with respect to pricing.

In any event, developers cannot simply look to the price paid for various components. Instead, the manufacturers must share very detailed and perhaps very commercially sensitive cost accounting information on material and labor costs in order for the developer to be able to perform the required calculations.

We also emphasize that only direct manufacturing costs count. The cost of installing the equipment at the project site, for example, is not included.

Adjusted Percentage Rule for Manufactured Products

The domestic content percentage that must be met in order for a project's Manufactured Products to be deemed to satisfy the Domestic Content Requirement is:

- 40% (in the case of a facility for which construction begins before 2025)

- 45% (in the case of a facility for which construction begins in 2025)

- 50% (in the case of a facility for which construction begins in 2026)

- 55% (in the case of a facility for which construction begins after 2026).

(However, if the facility is an offshore wind facility, the adjusted percentage that applies starts at 20% and increases to 27.5% in 2025, 35% in 2026, 45% in 2027, and 55% thereafter.)

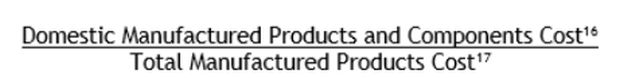

For Manufactured Products, the domestic cost percentage calculation used to apply the Adjusted Percentage Rule (to see if you meet the pre-2025 40% threshold and are deemed to satisfy the Domestic Content Requirement) is as follows:

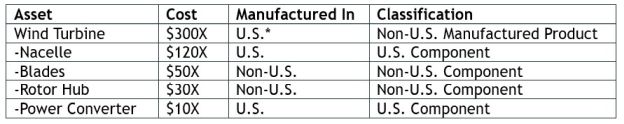

To understand how this works, let's walk through an example. Assume our Applicable Project is a land-based wind turbine that (for simplification purposes) only has two "Applicable Project Components"18: (1) the tower, which we discussed above under the separate Steel or Iron Requirement, and is not included in the calculation related to manufactured products, and (2) the wind turbine itself, which is a manufactured component made up of four components: nacelle, blades, rotor hub and power converter. In this example, the wind turbine is considered a Manufactured Product and each of its four components constitutes a Manufactured Product Component.

In order to run the calculation above, we need to determine the cost of:

- Each Applicable Project Component that is a U.S. Manufactured Product; and

- Any Manufactured Product Components that are incorporated into a Non-U.S. Manufactured Product that is an Applicable Project Component (but only if such Manufactured Product Components are mined, produced or manufactured in the U.S. and therefore constitute a "U.S. Component"19).

*In our example, the wind turbine as a whole will be considered a "Non-U.S. Manufactured Product"20 regardless of where it was manufactured, because it contains components that were manufactured outside of the U.S. (the blades and rotor hub). This means that only the costs of its U.S. Components—the $120X nacelle and $10X power converter—are included in the numerator. If, however, the wind turbine instead only contained components of U.S. origin and was itself manufactured in the U.S., then it would be a U.S. Manufactured Product and its $300X cost (not those of its U.S. components) would be included in the numerator.

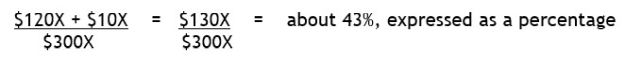

Now to the calculation in our example:

Because, in this case, 43% exceeds the adjusted percentage of 40%, the Adjusted Percentage Rule is satisfied and the wind turbine is deemed to have been produced in the U.S. notwithstanding that the final manufacture thereof may have occurred outside the U.S. and it is defined in the guidance as a Non-U.S. Manufactured Product.

Based on the foregoing calculation demonstrating satisfaction of the Adjusted Percentage Rule for the wind turbine and assuming the tower was manufactured in the U.S. in satisfaction of the Steel or Iron Requirement, the taxpayer should be able to certify that the Domestic Content Requirement has been satisfied.

Applicable Project Component Classification Safe Harbor

Underlying much of the analysis above is correctly determining which parts of a clean energy project should be categorized as an Applicable Project Component, and then whether such an Applicable Project Component is subject to the Steel or Iron Requirement or the Manufactured Products Requirement. If it's a Manufactured Product, it's also helpful to understand what some common Manufactured Product Components might be.

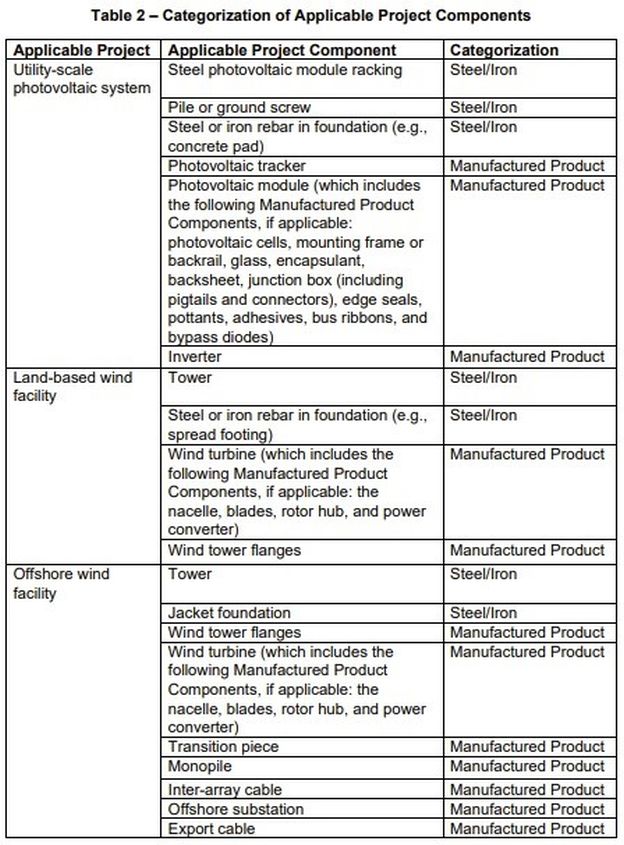

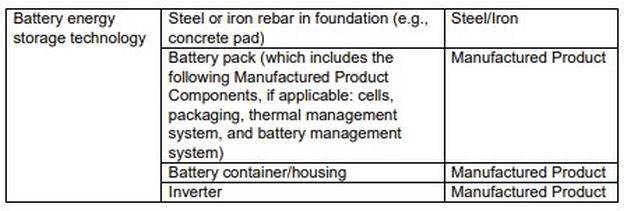

The Notice very helpfully includes a table containing safe harbor classifications for a few common clean energy projects—commercial solar, land and offshore wind, and battery storage. While the Notice makes clear that such classifications will be accepted by the IRS, the Notice indicates that no inference should be extended from the Notice's classifications and applied to the Buy America statute and regulations administered by the FTA.21

The safe harbor in the Notice cautions that the table "may not be an exhaustive set of all Applicable Project Components for those types of Applicable Projects." We have copied the table below for your reference:

Retrofitted Projects

The Notice provides that used property can be included in the Applicable Project without jeopardizing the project's ability to satisfy the PTC and ITC "originally placed in service" requirement as long as "the fair market value of the used property is not more than 20% of the Applicable Project's total value calculated by adding the cost of the new property to the value of the used property"—this is the "80/20 Rule."

This is a reiteration of a long-standing approach taken by the IRS with respect to incorporating used equipment into new projects. If an Applicable Project placed in service after December 31, 2022 meets the 80/20 Rule, then it can get a domestic content bonus credit amount as long as the new property in the project meets the Domestic Content Requirement (and the taxpayer otherwise complies with applicable requirements).

Certification Requirements

Once a taxpayer has established that all of a project's Applicable Project Components satisfy either the Steel or Iron Requirement or the Manufactured Products Requirement, making the project eligible for a domestic content bonus credit amount, the taxpayer must then certify that its project meets the Domestic Content Requirement.

This certification is done by way of a statement, a "Domestic Content Certification Statement,"22 submitted to the IRS certifying that, upon completion of construction:

- All of the Applicable Project's steel or iron items subject to the Steel or Iron Requirement; and

- All Manufactured Products that are components of the Applicable Project

satisfy the Domestic Content Requirement. The certification is made at the time the project is placed in service23 and should be attached to Form 8835, "Renewable Electricity Product Credit"; Form 3468, "Investment Credit"; or other applicable form for reporting domestic content bonus credit amounts and filed with the taxpayer's annual return submitted to the IRS for the first taxable year in which the taxpayer reports a domestic content bonus credit amount for such Applicable Project.24

Note that the taxpayer is required to maintain records sufficient to substantiate any claimed domestic content bonus credit amount, including detailed records sufficient to establish that the Steel or Iron Requirement and the Manufactured Products Requirement were satisfied for the Applicable Project. Such documentation must adhere to the general recordkeeping requirements under Code Section 6001 and Treas. Reg. Section 1.6001-1, et seq.

Footnotes

1. The Domestic Content Requirement can be found in Tax Code Section 45(b)(9)(B)(i) (incorporated by cross-reference in Section 48(a)(12), which is incorporated by cross-reference in Section 48E(a)(3)(B)) and in Section 45Y(g)(11)(B)(i).

2. Note that the increased credit amounts discussed mandated that the project meet certain prevailing wage and apprenticeship requirements (see initial guidance regarding the prevailing wage and apprenticeship requirements in IRS Notice 2022–61) and/or is located in an energy community, however Notice 2023-38's guidance is limited to credit boosts associated with the domestic content requirements.

3. "Applicable Project" is defined in Notice 2023-38 as "(i) a qualified facility under §§ 45 or 45Y; (ii) an energy project under § 48, which may include qualified property for which a valid irrevocable election under § 48(a)(5) has been made to treat such qualified property as energy property under § 48; or (iii) a qualified investment with respect to a qualified facility or energy storage technology under § 48E."

4. See Section 3.02 of Notice 2023-38.

5. See Section 3.03 of Notice 2023-38.

6.See https://www.finance.senate.gov/chairmans-news/wyden-statement-on-new-solar-domestic-content-rules.

7. Note that facilities generating electricity from wind, biomass, geothermal, solar, small irrigation, landfill and trash, hydropower and marine and hydrokinetic renewable energy may all be eligible.

8. Construction must begin before January 1, 2025.

9. But limited to qualifying solar and wind facilities with a maximum net output of less than five megawatts, including associated energy storage technology.

10. Note that eligible projects may include fuel cell, solar, geothermal, small wind, energy storage, biogas, microgrid controllers and combined heat and power properties.

11. Construction must begin before January 1, 2025.

12. But limited to facilities that generate electricity with a greenhouse gas emissions rate that is not greater than zero and qualified energy storage technologies.

13. The Notice defines "Manufactured Product" as "an item produced as a result of the manufacturing process." The Notice defines "Manufacturing Process" as "the application of processes to alter the form or function of materials or of elements of a product in a manner adding value and transforming those materials or elements so that they represent a new item functionally different from that which would result from mere assembly of the elements or materials." This definition is the same as the Buy America regulations in 49 CFR 661.3.

14. 49 CFR 661.5

15.We use the term "subcomponents" in this client alert but note that Notice 2023-38 defines these as "Manufactured Product Components". This distinction is important because the term "subcomponent" has a specific meaning in the Buy America regulations under the FTA where the country of origin of subcomponents is not considered.

16. According to Notice 2023-38, "[t]he Domestic Manufactured Products and Components Cost is the sum of the costs of an Applicable Project's (1) U.S. Manufactured Products that are Applicable Project Components and (2) Manufactured Product Components of Non-U.S. Manufactured Products that are Applicable Project Components if the Manufactured Product Components are mined, produced, or manufactured in the United States (U.S. Component)."

17. According to Notice 2023-38, "[t]he Total Manufactured Products Cost for an Applicable Project is the sum of the costs of each Applicable Project Component that is a Manufactured Product."

18. Notice 2023-38 defines "Applicable Project Component" as "any article, material, or supply, whether manufactured or unmanufactured, that is directly incorporated into an Applicable Project. An Applicable Project Component may qualify as steel, iron, or a Manufactured Product."

19. Recall that the origin of a U.S. Component's subcomponents doesn't matter for this purpose.

20. Recall that a Manufactured Product is produced in the U.S. if (1) all of the manufacturing processes take place in the United States, and (2) all of the components of the Manufactured Product are of U.S. origin. In this case, because the nacelle and the blades are not of U.S. origin, then the wind turbine is a Non-U.S. Manufactured Product under Notice 2023-38.

21. Specifically, the Notice states that "conclusions about how the items described in Table 2 are classified under the IRA do not constitute precedent for future the FTA implementation of its Buy America requirements to federally funded public transportation projects."

22. According to the Notice, among other things, the statement needs to include: (i) whether the Applicable Project is a qualified facility, energy project or energy storage technology; (ii) the specific type of Applicable Project; (iii) the geographic coordinates and address of the Applicable Project; (iv) the date the Applicable Project was placed in service; and (v) the total domestic content bonus credit amount with respect to the Applicable Project.

23. According to Notice 2023-38, "[t]he date an Applicable Project is considered placed in service . . . is the date on which such property is placed in a condition or state of readiness and availability for a specifically assigned function, whether in a trade or business or in the production of income."

24. A copy of the initial "Domestic Content Certification Statement" should then be attached to the annual return in subsequent years.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.