Introduction

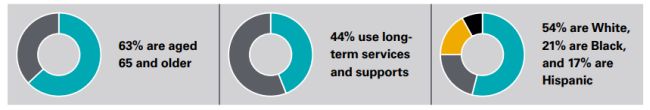

In the United States, individuals are eligible for Medicare because they are aged 65 or older or because of their long-term disability status, and they are typically eligible for Medicaid because they have low income and few assets. Over 12 million Americans are eligible for both Medicare and Medicaid (i.e., dual-eligible individuals), and many are aged 65 or older, have complex health needs, and are racially diverse.1

Dual-eligible individuals also account for a disproportionate share of spending in both programs: 19% of Medicare and 14% of Medicaid enrollees are dual-eligible, but they contribute to about one-third of spending in each program.2 Medicare and Medicaid are governed by different rules across a range of areas, such as eligibility and enrollment, provider networks, and covered benefits, and have separate financing mechanisms. This can result in fragmented coverage, uncoordinated care, and misaligned financial incentives for dualeligible individuals, despite the level of complexity and high cost of this population.

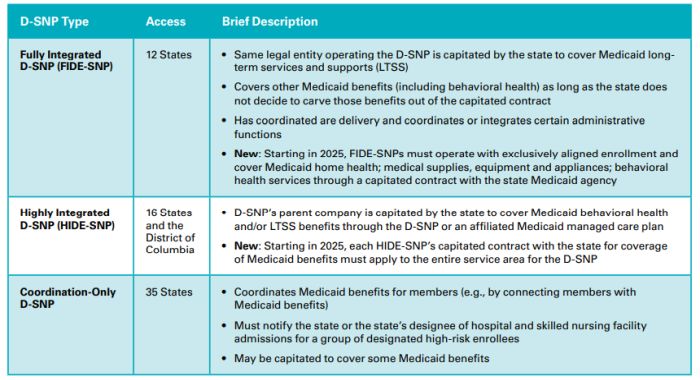

To address challenges created by the disconnected systems, federal and state policymakers have implemented a number of approaches to better coordinate and integrate care and financing across Medicare and Medicaid, including through Medicare Advantage (MA) dual-eligible special needs plans (D-SNPs). Specifically, all D-SNPs must have contracts with state Medicaid agencies (i.e., State Medicaid Agency Contracts, or SMACs) that meet specific federal requirements, including Medicare-Medicaid integration to improve coordination across the two programs. States can include additional requirements in the SMAC beyond the federal requirements, such as additional care management or data-sharing mandates.

Today, there is growing interest from Congress in advancing integrated care models.3 The Centers for Medicare & Medicaid Services (CMS), in the CY 2023 Medicare Advantage and Part D Final Rule, also signaled its preference for states to use fully integrated dual-eligible special needs plans (FIDE-SNPs) or highly integrated dual-eligible special needs plans (HIDE-SNPs) as the primary vehicles for integrating care for dualeligible individuals.4 (See Figure for a description of the types of MA D-SNPs.)

Figure: Types of Dual-Eligible Special Needs Plans (D-SNPs)

Source: Adapted from Kolber, M., et al. What Health Plans Should Know About Federal Changes for Dual Eligibles. December 2022. Available at https://www.manatt. com/Manatt/media/Documents/Articles/What-Health-Plans-Should-Know-About-Federal-Changes-for-Dual%c2%a0Eligibles-12-15-22_v4.pdf; MACPAC, Chapter 5: Raising the Bar: Requiring State Integrated Care Strategies, June 2022.

Despite the growth of the D-SNP market, D-SNP access and integration levels vary across the country. There is opportunity for states to pursue more integrated care models (particularly FIDE-SNPs or HIDE-SNPs) that promote financial integration and lead to improved access, care delivery and health outcomes for dualeligible individuals.5

In the January 2023 report supported by Arnold Ventures, Manatt Health highlighted the following two complementary strategies that state policymakers may deploy to improve financial integration of Medicare and Medicaid:6

- Benefit Design: States may influence the design of the FIDE-SNP benefit to drive efficient resource allocation across Medicare and Medicaid and seamless, holistic, and equitable care for dual-eligible individuals. For example, states can leverage the D-SNP model of care (MOC) as a vehicle for aligning and integrating benefits and care coordination across Medicare and Medicaid services within FIDE-SNPs.

- Medicaid Rate Setting: Working with their actuaries, states may assess and incorporate more broadly in their Medicaid rate-setting processes expected savings to their Medicaid programs arising from their aligned benefit design and integrated care. Specifically, the preamble to the CY 2023 Medicare Advantage and Part D Final Rule (Final Rule), endorsing the approach outlined in the proposed rule, confirmed that Medicaid capitation rates can be actuarially sound if they consider "[t]he impact of MA supplemental benefits and any State-specific requirements in the State Medicaid agency contract, D-SNP MOC, or Medicare-Medicaid plan (MMP) contract on the costs and utilization of the Medicaid benefits covered by the Medicaid managed care capitation rates." This reaffirms the ability of state Medicaid agencies to consider MA spending and requirements in Medicaid capitation rates, including potential savings that may accrue from integration.

Currently, the CMS Medicaid Managed Care Rate Development Guide (Guide) contemplates dual-eligible members enrolled in D-SNPs in the Medicaid rate-setting process. However, CMS has not provided further guidance on how states and their actuaries can operationalize the approach endorsed in the Final Rule preamble. Having clear and specific guidance from CMS on how to reflect potential efficiencies accruing from integrated care in Medicaid rate setting, as well as specific examples of opportunities that state Medicaid agencies and their actuaries may pursue, could encourage more states to expand access to integrated care programs that can better coordinate whole-person care and connect people with necessary long-term services and supports (LTSS) and social support services.7 This may lead to higher beneficiary satisfaction, a better care experience, and ultimately, improved health outcomes and health equity for dual-eligible individuals, who are racially diverse and have more complex health needs.8

To address the gaps in care for dual-eligible individuals, this report, also supported by Arnold Ventures, outlines:

- Federal opportunities, including potential CMS rulemaking and guidance, that can support states in implementing financial integration approaches: States may be hesitant to adopt approaches to financial integration without additional guidance from CMS. Thus, this report includes potential avenues and proposed programmatic guidance for CMS to consider, including sample language for sub-regulatory guidance (e.g., Medicaid rate-setting instructions), to provide guidelines and clarifications for how states can adopt and implement the approach endorsed in the Final Rule.

- State opportunities to achieve financial integration: This report also explores the Medicaid ratesetting strategy in more detail than the previous report, with a focus on policy, actuarial, and regulatory considerations for states and their actuaries. The report provides concrete examples of ways in which state policies related to integrated care models involving D-SNPs may be reflected in Medicaid rate setting. For each example, this report includes an overview and a discussion of key policy, actuarial, and practical implementation considerations.

In developing this report, the authors identified and interviewed key stakeholders familiar with D-SNPs, Medicaid rate setting, and federal and state Medicaid policy for dual-eligible individuals. Interviewees included state Medicaid policymakers, Medicaid actuaries, D-SNP health plan leaders and actuaries, thought leaders, and consumer representatives. Interviews were conducted with groups of stakeholders to understand their views on the federal and state opportunities and barriers to further financial integration in ways that impact Medicaid rate setting. This report synthesizes the discussions with interviewees, additional research, the Manatt authors' Medicaid program and policy expertise, and the Milliman authors' actuarial experience working with state Medicaid agencies and health plans on Medicaid rate setting and MA bid development.

To view the full article, click here.

Footnotes

1. Medicare Payment Advisory Commission (MedPAC) and the Medicaid and CHIP Payment and Access Commission (MACPAC), Data Book: Beneficiaries Dually Eligible for Medicare and Medicaid, February 2023, https://www.macpac.gov/wp-content/uploads/2023/02/ Feb23_MedPAC_MACPAC_DualsDataBook-WEB-508.pdf.

2. Ibid.

3. In November 2022, a bipartisan group of senators released a request for information (RFI) seeking comments on ways to improve care integration for dual-eligible individuals and "to build a lasting, effective legislative solution." In May 2023, based on the RFI comments, Senator Cassidy released draft legislation for targeted stakeholder feedback that would provide states with support to establish integrated care programs for dual-eligible individuals.

4. CY 2023 Medicare Advantage and Part D Final Rule, May 2022, https://www.federalregister.gov/documents/2022/05/09/2022-09375/ medicare-program-contract-year-2023-policy-and-technical-changes-to-the-medicare-advantage-and.

5. MACPAC, Evaluations of Integrated Care Models for Dually Eligible Beneficiaries: Key Findings and Research Gaps, August 2020, https://www.macpac.gov/wp-content/uploads/2019/07/Evaluations-of-Integrated-Care-Models-for-Dually-Eligible-Beneficiaries-KeyFindings-and-Research-Gaps.pdf.

6. S. Anthony, A. Fiori, A. Traube, Opportunities to Promote Financial Integration for Dual-Eligible Individuals, Manatt Health, January 2023,https://www.manatt.com/Manatt/media/Documents/Articles/AV-Duals-Financial-Integration-Manatt-Final-Report_c.pdf.

7. RTI International, Addressing Social Determinants of Health in Demonstrations Under the Financial Alignment Initiative, June 2020, https://innovation.cms.gov/data-and-reports/2021/fai-sdoh-issue-brief.

8. Center for Health Care Strategies/MLTSS Institute, The Value of Pursuing Medicare-Medicaid Integration for Medicaid Agencies, November 2019, https://www.chcs.org/media/ADvancing-States-Value-of-Integration-Report-1119_4.pdf.

Additional authors include Annie Hallum and Nicholas Johnson of Milliman

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.