Seyfarth Synopsis: The IRS has announced an increase to the applicable dollar amount for determining the Patient-Centered Outcomes Research Institute ("PCORI") Fee for 2024 as well as other health and welfare limits.

The Affordable Care Act (ACA) established the PCORI to support research on clinical effectiveness. The PCORI is funded (through the Patient-Centered Outcomes Research Trust Fund) in part by fees paid by certain health insurers and sponsors of self-insured health plans ("PCORI fees"). The PCORI fee is determined by multiplying the average number of covered lives for the plan year times the applicable dollar amount, and is reported and paid annually (by July 31) to the IRS using Form 720 (Instructions to Form 720 are available here). The applicable dollar amount as set by the IRS for plan years ending on or after October 1, 2022 and before October 1, 2023 was $3.00 per covered life.

The IRS has issued Notice 2023-70 announcing the applicable dollar amount that must be used to calculate the fee for plan years that end on or after October 1, 2023 and before October 1, 2024. This 2023-24 PCORI fee is $3.22 per covered life, an increase of $0.22 per covered life from 2023. The PCORI fee for a 2023 calendar year plan, calculated as $3.22 per covered life, is due by July 31, 2024.

For more information on paying the PCORI fee, see our prior posts here, here and here, and the IRS website here. Also refer to this IRS page for a helpful chart describing the applicability of the PCORI fee to various health arrangements.

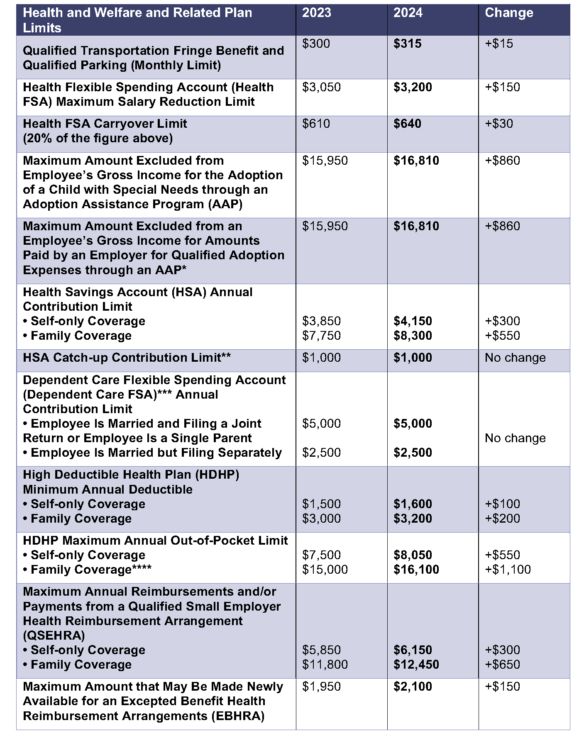

Additionally, the IRS has announced other 2024 cost-of-living adjustments for employer-sponsored health and welfare and related plans and programs (collectively, "plans"). The 2024 cost-of-living adjustments (and the changes from 2023) for these plans, from Rev. Proc. 2023-23 and Rev. Proc. 2023-34 are summarized in the table below:

* The amount excludable from an employee's gross income for amounts paid by an employer for qualified adoption expenses through an AAP begins to phase out in 2024 for taxpayers with modified adjusted gross income ("MAGI") in excess of $252,150 and is completely phased out in 2024 for taxpayers with MAGI of $292,150 or more.

** The HSA catch-up contribution limit is set by statute and does not adjust for inflation.

*** Dependent Care FSA limits are set by statute and do not adjust for inflation.

**** The HDHP out-of-pocket limit for family coverage also is subject to an "embedded" individual out-of-pocket limit of $9,450 (up from $9,100) on essential health benefits in a non-grandfathered HDHP, as required by the Affordable Care Act. The 2024 adjustment was announced by the U.S. Department of Health & Human Services here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.