This article was originally published in Political Activity Law Bulletin, Winter 2009.

New Federal Election Commission ("FEC") rules will soon require federal candidates, leadership PACs, and party committees to disclose contributions that are "bundled" by individuals or entities required to register under the Lobbying Disclosure Act ("LDA").1 The rules will take effect in the next few months, after the FEC fully completes its formal rulemaking process. Four simple things should be remembered about these new rules:

- "Bundling" by registered lobbyists is not prohibited; it is only subject to new disclosure requirements.

- Lobbyists themselves have no obligation to disclose fundraising activity under the new FEC rules. Only federal candidates, leadership PACs, and party committees must disclose "bundled" contributions.

- The new disclosure rules only apply when a registered lobbyist "bundles" multiple contributions totaling over $15,000 for a particular candidate or committee during a 6-month, 3-month, or 1-month period.

- Federal candidates and committees will likely request notification of LDAregistered status before authorizing individuals to fundraise. This will relieve the candidates and/or committees of searching public records to determine lobbyist status—a potentially laborious task.

The remainder of this article describes the FEC's new bundling disclosure regulations in more detail.

FEC Definition of "Bundled"

Under the FEC's new regulations, a contribution received by a candidate, leadership PAC, or party committee is "bundled" when it is either:

- Forwarded by a registered lobbyist; or

- Credited to a registered lobbyist "through records, designations, or other means of recogni[tion]" such as titles, fundraiser tracking numbers, access to events or activities, and mementos.

Thus, a contribution is "bundled"—and possibly subject to disclosure requirements—if a candidate or committee notes in its records that it was solicited by a registered lobbyist. A contribution is also "bundled" if a registered lobbyist is rewarded for soliciting a contribution with an invitation to a fundraising event, a candidate photograph, or a fundraising title (e.g., "Pioneer" or "National Finance Committee Member").

"Bundling" Disclosure Reports

Reporting obligations are triggered once a candidate or committee receives during a 6-month, 3-month, or 1-month period over $15,000 from multiple contributions that were "bundled" by a particular registered lobbyist. A candidate or committee must disclose on new FEC Form 3L the name, address, employer, and amount "bundled" of each registered lobbyist whose fundraising activities exceed the $15,000 threshold.

Amending Lobbyist PAC Registrations

The FEC's new rules require any political committee that a registered lobbyist "established or controls" to amend its FEC registration form to reflect its relationship with a registered lobbyist.

Recent Developments in State Pay-to-Play Law

"Pay-to-play" rules that impose disclosure requirements and political-contribution prohibitions on government contractors are increasingly numerous and complex. This trend is expected to accelerate in the wake of high-profile scandals such as those surrounding Illinois Governor Rod Blagojevich. The article below reviews important and recent pay-to-play developments in Colorado, Illinois, New Jersey, and South Dakota.

Colorado

On November 4, 2008, Colorado voters approved Amendment 54, an amendment to Colorado's constitution that places restrictions on political contributions by certain government contractors. Amendment 54 became effective on December 31, 2008, and the Colorado Department of Personnel and Administration advises that the Amendment is applicable to all "sole source government contracts," including modifications to existing contracts, entered into on or after December 31, 2008.

The law requires "sole source government contracts" to include a clause that would prevent contract holders from making, causing or inducing contributions to any state or local political party or candidate during the term of the contract and for two years thereafter. In addition, persons who make or cause to be made any contribution to influence a ballot issue are prohibited from entering into a sole source government contract relating to that ballot issue.

To aid in the measure's enforcement, every holder of a sole source government contract must promptly prepare and deliver a Government Contract Summary to the Executive Director of the Colorado Department of Personnel and Administration.

Illinois

In 2008, the Illinois Governor and General Assembly enacted separate "pay-to-play" requirements. The Governor's Executive Order Number 3 established new restrictions on campaign contributions and solicitations by Illinois State contractors, bidders, and their affiliates.

The Executive Order went into effect on January 1, 2009. Also effective January 1, 2009, the General Assembly's Public Act 095-0971 which contains new registration and reporting requirements for state vendors and bidders, as well as additional contribution and solicitation restrictions on Illinois contractors, bidders, and affiliates. Executive Order 3 prohibits a business entity with more than $50,000 in contracts and/or bids with a state agency (including the state retirement systems) from soliciting or making contributions to certain state officers, candidates for state office, and political parties.

The prohibition lasts during the bid period and/or the term of the contract, and for two years thereafter. It applies to the business entity itself and to all "affiliated" persons and entities. Penalties for violation of the Order entitle the state to terminate the contract without additional compensation. Three or more violations within a 36 month period results in a ban on contracting with the state agencies for a period of three years.

Public Act 095-0971 requires any business entity whose aggregate bids, proposals and/or contracts with the state total more than $50,000 to electronically register with the Illinois State Board of Elections and submit a copy of its certificate of registration to the applicable chief procurement officer. On these registration forms, a business entity must disclose contact information for "affiliated" persons and entities, including executive employees and their families.

Business entities with state contracts or bids of more than $50,000 in the aggregate as of January 1, 2009, must register with the Board by February 2, 2009.

New Jersey

New Jersey has a robust pay-to-play regime which was found constitutional in a State Supreme Court case decided January 15, 2009. Specifically, the Court upheld the strict contribution limits and disclosure requirements imposed on state vendors.

Executive Order 117, signed by Governor Corzine earlier this year, prospectively expands the scope of the upheld state contract pay-to-play laws by increasing the number and type of covered contributions. The Executive Order took effect November 15, 2008 and applies to contributions made and contracts executed on or after that date.

When awarded a contract, state contractors must complete both a certification verifying compliance with the pay-to-play restrictions and a report listing all contributions made during the preceding four years to a New Jersey continuing political committee, or PAC. The New Jersey Division of Purchase and Property will soon release a permanent certification form, but has already issued an interim certification form to be used temporarily. Under a separate, pre-existing statute, state contractors may have additional disclosure requirements. For example, contractors may be required to report contributions made during the prior twelve months to certain state and local political candidates and committees as well as information about the various contracts they have with the state. Although not discussed here, the state pay-to-play restrictions also apply to partnerships, limited liability partnerships, limited liability companies, and persons affiliated with those entities.

South Dakota

On November 4, 2008, South Dakota voters rejected Initiated Measure 10. Among other provisions, the Measure would have prohibited holders of no-bid contracts and their employees from making political contributions or independent expenditures to candidates for elected office in the state or any of its political subdivisions. It also would have prevented officeholders responsible for awarding a contract from accepting political contributions from competitively bid contract holders.

Gift Rules Applicable to Members and Staff of the 111th Congress

The 111th United States Congress convened January 6, 2009. In one of its first items of business, the House of Representatives adopted the rules by which it will operate, including the ethics and gift rules. No changes were made to the gift rule, House Rule XXV. However, as summarized below, the House made a few changes to its standing ethics rules and continued several orders relating to ethics.

- Post-employment restrictions and disclosure. Current House Members who negotiate for outside employment must file disclosures with the Committee on Standards of Official Conduct within three business days of commencing negotiations. Previously, lame-duck House Members were exempt from the disclosure requirements.

- Use of exercise facilities by former members. Former Members, former Members' spouses, and former House officers who are registered as federal lobbyists are prohibited from using the Members gym. This order was first adopted in the 109th Congress.

- Office of Congressional Ethics. The Office of Congressional Ethics will continue in the 111th Congress.

- Investigative Ethics Subcommittee. The Committee on Standards of Official Conduct is directed to empanel a subcommittee to conduct an investigation within 30 days after a Member is indicated or charged with a crime. This order was first adopted in the 110th Congress.

Unlike the House, the Senate as a continuing body has a standing gift rule that need not be adopted with each new Congress. Accordingly, Senate Rule XXXV still establishes the rules under which Senators and Senate staff can or cannot accept gifts. No substantive changes have been made to the Senate gift rule since the passage of the Honest Leadership and Open Government Act of 2007. Thus, lobbyists, foreign agents, and organizations that employ or retain lobbyists and foreign agents ("lobbyist employers") may not provide gifts to any Members, officers, and staff of the 111th Congress, whether employed by the House or Senate, unless the gift qualifies for an exception.

Likewise, the various gift exceptions and exemptions also remain, the most common of which allow Congressional Members and staff to accept:

- Free attendance (including meals) at "widely-attended" events.

- Free attendance at charity fundraising events.

- Refreshments, a continental breakfast, and non-meal foods offered at a business meeting or reception.

- Items of nominal value such as t-shirts, baseball hats, and trinkets valued at less than $10.

- Informational materials.

In addition to the items listed above, persons who are not lobbyists and organizations that do not employ or retain lobbyists or foreign agents may provide gifts valued at $49.99 or less per occasion up to an aggregate annual limit of $99.99.

Finally, it is important to read and stay familiar with the gift rules. Lobbyists and lobbyist employers are required to certify on a semiannual basis that they have read the gift rules and have not made any gifts that are impermissible under the rules.

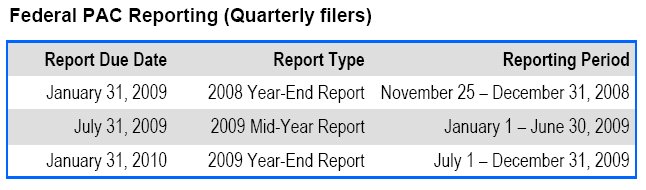

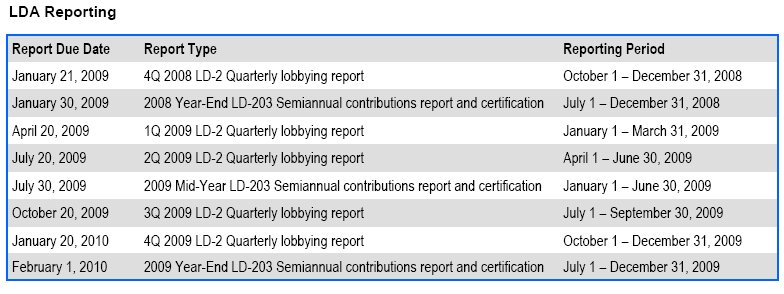

2009 PAC and LDA Reporting Calendar

Footnote

1. A recipient committee must also report contributions "bundled" by political committees that an LDA registrant or listed lobbyist "established or controls." The term "registered lobbyist," as used in this article, includes all of these lobbyist PACs.

This article is designed to give general information on the developments covered, not to serve as legal advice related to specific situations or as a legal opinion. Counsel should be consulted for legal advice.