Rapid Changes, Rapid Upheaval

The Media & Entertainment (M&E) industry is undergoing rapid changes in many different dimensions which are impacting all aspects of the video ecosystem, upending business models and affecting consumer consumption and technology delivery models.

From an economic perspective, the "free money era" is over. Lower interest rates helped to fuel Cable TV expansion with continued MVPD carriage fee increases, escalating sports rights fees, expanded film slates and funded the build-out of streaming platforms. Today, however, all of those drivers that fueled M&E growth are challenged. MVPD carriage fees for linear TV are in decline. The lucrative business of home video, comprised of rentals and purchases which subsidized the film industry, continues to dwindle. Higher interest rates challenge M&E firms in servicing the existing debt on their balance sheets and impact the ability to support growth driven by debt-fueled M&A. Macro-economic issues such as inflation and higher interest rates along with labor strikes, cord-cutting and intense competition among streaming video providers have resulted in significant structural changes to the entire M&E ecosystem.

The industry economics are eroding, consumers are changing their behavior and technology is advancing at a pace at which the industry has never experienced. In view of all of these factors, mergers and acquisitions to drive industry consolidation through cost optimization, the adoption of new target operating models and the execution of carve outs to divest non-core assets will define the M&E business operating agenda for the next 12-24 months.

What Corporation Transformation Initiatives Are Impacting the M&E Industry?

Almost every week, there are significant developments in the M&E industry involving corporate transformation. Large technology companies are purchasing broadcast rights to sporting events that heretofore were only available on major broadcast networks or Pay-TV channels. Streaming service providers are removing programming for lower performing shows and sophisticated algorithms are being used to provide information about how program budgets are sized, authorized and executed across the global marketplace.

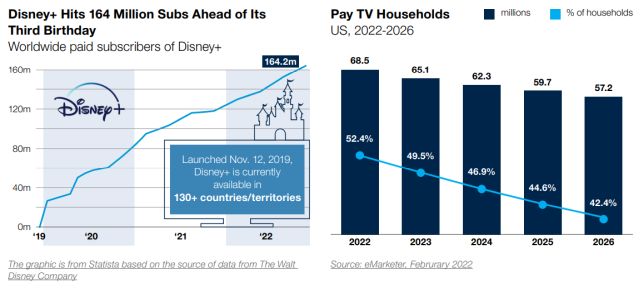

Relative to what they were five years ago, many balance sheets are now significantly more burdened. Acquiring long-term content rights, increasing original scripted production and a blank-check mentality for building out global streaming platforms appeared to be a logical strategy to drive growth. But viewers shifted, Pay-TV subscriptions decreased and viewers went shopping for selective streaming subscriptions. However, consumer churn rates on streaming services are significantly higher than historical MVPD churn rates, thus making commitments to long-term sports rights and increased original programing investments challenging to sustain.

The Macro Time Horizons in M&E

Ask anyone who has had a senior level position across any M&E segment—film, television, music, etc.—what the pace of change was over the course of 50 years (1960 to 2010) and the response would probably be the notion that while there were very significant changes during that period, they were also gradual and accretive. Today's changes are anything but that.

- In television, three broadcast channels per market grew to hundreds via Pay-TV services. Network television was joined by cable networks and the expansion of channels via the cable bundle, home video (VHS/DVD), electronic sell through (EST) and video on demand (VOD) all added new content windowing to drive incremental revenue.

- In Film, the box office expanded as theaters evolved into multiplexes which led to the globalization of content with new markets and territories as well as creating additional windows for monetization such as Pay-TV, home video, VOD, EST and Premium VOD for same day and date releases.

- Streaming platforms were assumed to be a further extension of monetizing the video ecosystem on a global basis, through direct-to-consumer, subscription and ad-supported services. However, the technology and the business models supporting streaming have proven to be more transitory than accretive.

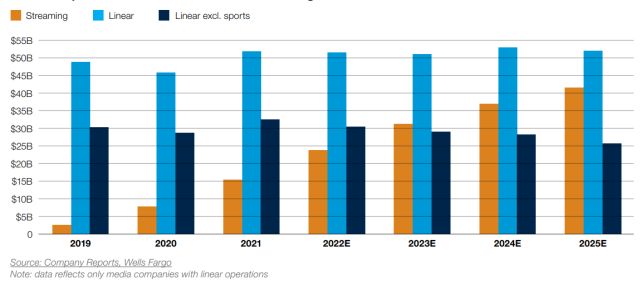

Streaming shifts audiences from traditional "cash cow" businesses such as linear television but it is a lower margin, higher churn and highly competitive offering. Streaming does not currently provide the accretive revenue and margin pathways that prior evolutions in the video ecosystem provided.

The evolution of those accretive windows and technologies for incremental distribution played out over decades. But change is accelerating and M&E is now competing with hyperscaler technology platforms, their significant balance sheets and cash reserves, as well as traditional M&E competitors.

It took Netflix 10 years to reach 100 million subscribers. It took Disney+ 16 months to reach 100 million subscribers. After decades of growth, cable service providers will continue to experience losses in Pay-TV subscribers. According to audience measurement firm Nielsen, U.S. TV-viewing time as of November 2023 was led by Streaming at 36.1 percent followed by Cable at 28.3 percent and Broadcast at 24.9 percent.

Driven by Wall Street's mandate to measure media success via digital platforms and a growth at all cost mentality, there has been an incessant march to create streaming video services and to establish direct-to-consumer relationships. Consumers struggle with having to subscribe to multiple streaming services to watch desired content. The challenge of content discovery is considerable. The onus is now on the consumer to find content as opposed to the traditional television viewing experience where content is programmed and delivered for a passive viewing experience. Over time, recommendation algorithms driven by artificial intelligence (AI) and machine learning (ML) will assist in solving some of these problems. Content providers at first enjoyed the revenue gained by licensing content to streaming providers but then decided to discontinue those licensing deals as they sought to keep their content exclusively on their own streaming platforms to drive subscriber growth. Original content creation and acquisition budgets measured in the billions of dollars, increasing in double digit percentages Year-over-Year (YoY).

The objective was clear: Gain as many subscribers as fast as possible. The result? Hundreds of millions of subscribers worldwide. But the "grow subscribers at any cost" approach resulted in billions of dollars spent on creating original content and building streaming platforms to support global direct-to-consumer services at scale. The lost revenue from no longer licensing their content to third parties has also contributed to billions of dollars of losses in operating these streaming services. The strategy for content exclusivity on owned and operated streaming platforms eroded a proven and necessary content monetization window.

Content Spend Forecast: Linear TV vs. Streaming

And then, a sensibility switch was turned on by Wall Street and suddenly the new dictum is now profitability over subscriber growth. The industry has come almost full circle in that it:

- Initially licensed content to streaming services to drive incremental distribution revenue.

- Recognized that content shouldn't be on a competing service to assist in driving a competitor's growth and should be used to drive subscriber growth on their owned and operated streaming service platform.

- Re-established third party licensing and the associated revenue as they are important aspects of content monetization and profitability.

- Evolved their content windowing strategy to address when content should be made available on their own streaming services as well as licensed to other platforms to maximize distribution revenue and audience reach.

According to The Hollywood Reporter, original content spend by streaming providers grew 45% from 2021-2022 but only grew by 14% in 2023 as a result of the renewed focus on the profitability of streaming services.

To be sure, there are companies in the M&E industry that have healthy balance sheets and robust cash flow. There are also numerous companies that are severely leveraged and have flat or decreasing revenue along with high fixed overhead costs. This creates significant challenges to generate free cash flow (FCF) to service the debt, especially in relation to increased interest rates. And, in many cases, EBITDA of these organizations is still predominantly driven by their linear networks' businesses. They may have technical operations that may be better suited for a cloud or streaming provider and are facing challenges from a crop of competitors leveraging the newest technologies and scale to reinvent current operations at far more advantageous operational run rates.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.