The Adjuvancy, LLC.

Let’s admit it- we have a problem pricing goods and services. Most of us consider that we use sophisticated analyses- but, it is usually closer to the "back-of-the envelope" methodology. We add in our costs and then figure out how much we need to add on to cover those amounts.

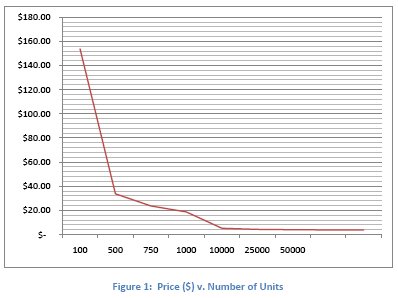

Some of us have used breakeven analysis based upon various assumptions of market capture; we may feel comfortable falling back upon "scientific principles", but there are other important considerations. Using the breakeven method can cover our costs, but still let us teeter on the edge of bankruptcy, due to volume considerations. As you can see from Figure 1 below, after we start making 10,000 units a month, our breakeven cost is $ 3.80- but that still does not provide the pricing information, per se. So, we pick some multiple for the pricing (120%)- and, as long as the volume holds or increases, our company is profitable.

Another approach is to match our pricing to our competition- and hope to eke out a profit. While this is another very popular method, it often leaves plenty of dollars on the table. The cost and competition model does not take into account how your customers value your product/service. It may even push customers away from buying your goods and services ("How can they claim to be so good, yet so cheap?"). This is often done in the apartment rental industry. A survey of available apartments is prepared. Then one compares the rents the others are charging to find where you belong in the strata. However, there we need to do some "massaging": Are our apartments nicer; did we refurbish recently, who is closer to the mass transit, etc. But, that is still guesswork and can still leave money on the table.

We can also use the same product case from Figure 1 above. There, we can see that if the competition were charging $ 4.00 per unit, our unit profit would be $ 0.20- assuming we were producing AND selling 10,000 units monthly. (Actually, this chart shows us that we need to lower our variable costs dramatically to render this a profit-generating business, but that is for another discussion.)

The real truth is that there is NOT a correct price for everything, but rather a range of prices for different combinations of products and different customers. You don’t see how this applies? Well, if you went to an auction- or watched a product go for sale on eBay.com, then you can see that customers bid a wide range for the same exact item. Or, you may be a consultant who provides support over the telephone - do you price per minute or per call? And, then, what happens when one customer monopolizes your whole day- or one customer gets his answer in ten seconds? Or, do you recall paying $ 2.00 for a can of pop in a convenience store, $ 1.00 in a pop machine, and grimace when twelve cans of that same pop cost you $ 3.50?

So, how do we charge for that new product or service? In addition to the breakeven analysis, some of our clients have used what they call is an incremental pricing approach. That means if the new product costs 10% more than the existing one (or has 10% more features), they charge 10% more for this newer version of the product. Or, they may price the product just above or just below their major competition. Too much- and we have no sales, too little not only cuts our revenues, but sets the perceived value too low in the marketplace. And, once you hit the market, charging more for your product is a very steep climb.

The fact is that the lowest price does not garner the highest number of customers. If you were to plot some of your historical sales by volume and by price (or volume and discount) as is shown in Figure 2, you will see that lower prices do not have a directly proportional relationship to your pricing.

There almost always is a gap between what your customers are willing to pay and what you charge for your product or service. The art- and the mystique- is to narrow that gap to the smallest amount possible. If we had infinite time and money (yeah, that’s us, all right), we could employ researchers or students to compute discrete-choice analysis, where customers see different products/services with different features and then judge the price ascribed to them. This method could provide you with a mix of features and pricing.

But, as you well know, you don’t have that luxury (but, if you do, by all means compute away). Well, then, how about asking the customers that provide some 50% of your sales (by volume)? Ask your customers what they would substitute for your service if it did not exist. This will provide you with the options that exist, reveal how well they fare for your customers, and therefore detail the true value of your product or service. In so doing, you can begin to determine what is the value of the service and quality, vis a vis the competition, as well as other factors.

If you are offering a "me-too" product, then the room to maneuver is very small. An evolutionary (enhanced product) or revolutionary (radical changes) new offering have a wider choice of pricing. The truth is we always seem to focus on the lowest possible pricing. We should change that and focus on the price ceiling. However, you must recognize that that is the theoretical number; most of the time, the customer will not bear that burden.

You call also sell different versions of the same product or service to different customers. In our case above that means a different price for chains, individual clinics, overseas customers, and federal hospitals. A minute change in the product (or in the case above, how it was delivered) can mean a significant increase in perceived value. You can view it as offering good, better, best. Restaurants often exploit this technique by offering early bird discounts, bars with happy hours, and car washes with discounts for Tuesdays. Or, you can offer your product with and without technical support (and charge much more for technical support for those who opted out). However, remember that if you offer too many choices, then you have developed a nightmare for your administration of the pricing structure.

The caveat is that if your customers have no comprehension of the logic behind it, the pricing structure will probably not pan out for your company. And, that means that your employees must understand the structure. That way when a potential customer inquires, your staff can outline the features that derive.

One of the hardest parts is to convince the sales team that low prices aren't always the answer to closing sales. And, if your salespersons get paid based on volume, they have nothing to gain. It is best to compensate your salespersons on either a combination of volume and profit, or simply on profit.

A pricing team approach may be in order- using marketing, sales, operations, and finance (which for some companies could be two individuals; for others in the hundreds). Marketing defines the value pricing scenario, finance provides the true costs, sales provides the competitive information, and operations informs the team of what they can make in a given period. By integrating all these factors, you can develop the financial goals and the new product pricing. Ideally, this will also integrate the customers wants and needs- and to paraphrase the MasterCard advertising series- the results are priceless.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.