After an intense schedule of joint meetings discussing insurance in March, it now seems unlikely that the Exposure Draft (ED) on insurance accounting will be published in May as planned. The International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB) met six times over two weeks in March and managed to discuss insurance accounting for a total of approximately twelve hours: a record since the beginning of the joint project. Although the Boards reached several common tentative decisions, the hours of debate also resulted in a few but very significant disagreements on the subject of risk adjustment and day one calibration.

Many topics were tabled during those meetings; among others, the definition of insurance, the scope of the insurance standard and disclosure were discussed at length and, for the most part, agreed upon. The main outcome though is the disagreement between the Boards on risk adjustment where the FASB reverted back to its earlier preference for a composite margin rather than an explicit risk adjustment, as tentatively agreed in October 2009.

The IASB however reiterated its support for an explicit, re-measured risk adjustment with a clear measurement objective consistent with general liability accounting under IAS 37, i.e. the current amount an insurer would rationally pay to be relieved from the risk.

The other significant change of heart was on the part of the IASB which has now gone back to its 2009 position in favour of calibrating the initial liability to a consideration receivable net of incremental acquisition costs. This would be instead of calibrating to a gross consideration receivable before deduction of acquisition costs, avoiding the recognition of a loss on day one to the extent it relates to incremental acquisition costs.

The other divergence between the Boards was on the issue of participating contracts and how the cash flows should be treated when measuring the insurance liability. As expected from last year's discussions, the IASB prefers to consider payments arising from participating features as contractual cash flows and thus part of the insurance contract liability; the FASB on the other hand narrowly favours a view that recognises a liability equal to the legal or constructive obligation and the remaining part as equity.

Acquisition Costs and Day One Measurement (16 March)

On the basis of industry opposition and targeted field testing results, the Staff invited the Boards to reconsider their tentative decision and set out alternative approaches to acquisition costs as well as how they should be dealt with on initial calibration of the insurance liability. The Staff asked the Boards which of the following approaches the Exposure Draft (ED) should propose:

- Recognise all acquisition costs as expense when incurred and no revenue recognised at inception with the initial liability calibrated to the gross consideration receivable (as per current tentative decision).

- Direct measurement of the contract liability should be calibrated to the consideration receivable net of incremental acquisition costs.

- The incremental acquisition costs should be included in the contract cash flows to determine the residual margin at the inception of the contract.

Some Board members made the point that the previous decision was a strong one and that there was no reason to treat insurance differently from other industries. This was the majority view of FASB, of which 4 members voted for approach A (as per previous tentative decision).

The IASB members were split on the issue (IASB – 9 in favour of B or C, 6 in favour of A); however, the majority expressed a preference for either approach B or C, which in effect has the same effect on profit or loss recognition.

Given the IASB's tentative decision, the Staff was asked to investigate further the advantages and disadvantages of both approaches B and C. Distinctions between these are likely to be presentational rather than affecting profit or loss and will be most relevant where acquisition costs are incurred over an extended period, and not just at or shortly after inception of the contract.

It was also noted that some acquisition costs may be recoverable either from the policyholder or third parties. For example, many long term contracts contain implicit or explicit recoveries of amounts from policyholders on early termination that are designed to mitigate the economic effect of acquisition costs. These features will be investigated and could enable the Boards to reach some convergence.

In the event the divergence between the Boards is not resolved, there remains the possibility of having both options presented in the ED. There will however be an opportunity at the April joint meeting for the Boards to attempt and resolve their disagreements.

Risk Adjustment (17, 22 & 23 March)

At the educational session on 17 March the Staff presented a paper to the Boards on the subject of option pricing and risk.

The Staff's recommendation is to not require a particular method for determining a risk adjustment and instead, ask for specific disclosures by line of business relating to:

- The amount of the risk adjustment at the reporting date.

- The type of approach and methodology chosen to determine the risk adjustment and the reasons for choosing a particular approach.

- The reasons for using different methodologies between lines of business (which highlights that it would be acceptable to use different techniques across business lines).

- The reasons for and impact of change in methodology since last reporting date.

- Details of inputs used, such as a description and sensitivity analysis around selected inputs.

- A roll forward identifying new business, expired business and changes.

Following the presentation from the Staff, a long debate made clear that the majority of FASB and some members of the IASB are concerned with not having an agreed methodology. In particular, their concern focuses on the little control over the amount of risk adjustment that will be determined by insurers if the Staff proposal was to become the future IFRS/US GAAP. These Board members are not satisfied with the Staff strategy that would rely on users of accounts to utilise these disclosures and on the resulting market forces to produce conformity in the valuation techniques adopted.

The Staff reiterated its favour for the building blocks approach to determine an explicit re-measured risk adjustment. Although no single technique seems to achieve all the characteristics that are sought by the Boards, the building blocks approach and proposed disclosures appear to ensure a common understanding, across all users, of the basis on which a risk adjustment has been included in the overall insurance liability.

Following the educational session, the Staff asked the Boards to reaffirm their decision to define the risk adjustment as the "amount the insurer requires for bearing the uncertainty that arises from having to fulfil the net obligation arising from an insurance contract".

The Boards did not vote at this stage on either recommendation and asked the Staff to develop a clearer expression of the objective, more certainty over the choice of methods, guidelines to evaluate what model would be more appropriate in what circumstances and real life numerical examples comparing the various methods.

When this subject was tabled again during the second Board week, the choices offered by the Staff were:

- Approve the Staff recommendation not to require a particular method.

- Limit the available methods.

- Refine the objective for the risk adjustment where

possibilities are:

- The amount a market participant requires for bearing risk when taking over the insurance obligation (exit notion).

- The amount the insurer would require today for assuming the (remaining) risk from the policyholder or another party (entry notion).

- The amount the insurer would rationally pay to be relieved of

the risk (the objective for the risk adjustment used in the

IASB's recent ED on IAS37).

- Adopt a composite margin approach. The Boards found themselves divided again after four months of agreement on this very matter.

The IASB voted 8 in favour of retaining an explicit re-measured risk adjustment and developing an objective for the risk adjustment and 7 in favour of adopting a composite margin approach. The FASB voted the opposite way: 1 in favour of retaining an explicit re-measured risk adjustment and developing an objective for the risk adjustment and 4 in favour of adopting the composite margin approach (the position FASB had adopted for most of 2009 before accepting the IASB view last December). In a follow-on vote, a majority of the IASB voted for the refined objective to be the amount the insurer would rationally pay to be relieved of the risk (i.e., the objective of the risk adjustment used in the current draft of the revised IAS 37).

The Staff pointed out that, in the event a composite margin is selected, many issues would have to be addressed such as, the method for releasing that margin and the inclusion, or not, of a risk adjustment in the liability adequacy test at inception for those contracts with a day 1 loss, and in any subsequent liability adequacy tests. Furthermore, the earlier decision of not unbundling embedded derivatives may need to be revisited if there is no re-measurement of the risk adjustment.

To conclude the discussions on risk adjustment, the Staff agreed to refine the measurement objective, produce additional guidance on desirable features of a selected methodology and further consider the proposed disclosures, as well as considering the "old" FASB position to build a composite margin accounting model. Although the Boards will probably discuss this subject again at the joint meeting taking place in the week of 19 April, if an agreement is not reached between the IASB and FASB we may see the two alternatives proposed in the ED.

Participating Contracts (23 March)

Another significant topic on which the Boards did not reach agreement was the way in which to treat the participating cash flows when measuring insurance liabilities. As agreed at the last meeting on this subject (November 2009), the Staff recommended two views on which they asked the Boards to vote:

View A: to consider payments arising from participation features as contractual cash flows as any other; or

View B: to recognise a liability up to the amount of legal or constructive obligation and the remaining part as equity.

The IASB was strongly in favour of View A (11:3) as several members consider a participating contract as "one transaction", with payments that are interrelated and dependent on each other. It was also pointed out that assessing which part of the cash flows is liability and which is equity would be too cumbersome and not particularly useful for the users. The FASB on the other hand did not reach the same conclusion as it marginally favoured View B (3:2) which would require an insurer to recognise a liability for participating benefits to the extent that it has a legal or constructive obligation to pay those benefits. Under View B, cash flows expected to be paid above that level of obligation would be treated as equity.

Issues relating to mutual insurers and contracts without significant insurance risk but with discretionary participation features are still to be considered by the Boards. Given the marginal FASB preference for View B, an agreement may be reached on this issue in April.

Definition of Insurance Contract (22 March)

The Boards discussed several aspects of the definition of insurance. The FASB Staff explained that USGAAP defines insurance "business" instead of defining insurance "contract". The Staff recommended that the current IFRS 4 definition of an insurance contract be carried forward to the ED, using the IFRS4 terminology "compensation" instead of the US GAAP terminology "indemnification". The Boards were unanimously in agreement with this recommendation.

In a similar vein, the Boards discussion on the description of significant insurance risk, a key component of the IFRS 4 insurance contract definition, produced a unanimous approval of the Staff recommendation to bring forward to the ED the description of "significant", although amended to change the factors considered in evaluating the significance of insurance risk from absolute amounts to present values.

For historical reasons outlined by the FASB Staff, US GAAP currently requires both timing and underwriting risks to be present for contracts to transfer significant insurance risk and qualify as insurance contracts. Under IFRS 4 however, either timing or underwriting risk is required to be present. The Staff recommended that the role of timing risk in identifying insurance risk should be disqualifying rather than a primary condition for determining insurance risk in a contract. For example, the lack of timing risk could have the effect of eliminating the underwriting risk – if contractual terms delay timely reimbursement to the policyholder thus significantly reducing insurance risk. The Boards unanimously voted in favour of this recommendation which will result in a change to current US GAAP.

The second question on insurance risk aimed at the existence of the risk itself with two tests considered to establish the presence of insurance risk for a single contract:

View A: the test should be on the range of possible outcomes and the significance of reasonably possible outcomes relative to the mean, i.e. the variability of outcomes should be significant.

View B: in addition to a test on variability of cash flows, there should also be a test to identify a possible outcome, in which the present value of the net cash flows (premiums less claims/benefits) is negative, i.e. a contract loss test.

Although the Boards agreed on the previous recommendations, they remained divided on the requirement for a loss test in addition to the variability of cash flows test. The IASB voted in favour of View A whilst the FASB preferred View B (IASB – 9 in favour of A, 6 in favour of B; FASB – 3 in favour of B, 2 in favour of A). This unresolved issue is likely to be significant for certain reinsurance contracts and may also be relevant to other contract type. In that respect the Boards still have to discuss the accounting regime that will apply to financial guarantee contracts and health insurance contracts issue by an entity that is not a regulated insurer.

Scope (22 March)

The Staff recommendation was substantially approved with a couple of modifications resulting in the following being scoped out of the insurance contracts standard:

- warranties issued directly by a manufacturer, dealer or retailer;

- residual value guarantees embedded in a lease;

- residual value guarantees issued directly by a manufacturer, dealer or retailer;

- employers' assets and liabilities under employee benefit plans and retirement benefit obligations reported by defined benefit retirement plans; and

- contingent consideration payable or receivable in a business combination.

The Boards decided to continue the IFRS 4 approach to warranties (based on the identity of the issuer).

Board members expressed a preference for excluding fixed fee service contracts. However, because these may provide benefits in kind rather than cash, they concluded that they would need to discuss this further when they consider whether health insurance contracts issued by non insurers should be within the scope of the insurance standard. They will also discuss at a future meeting whether financial guarantee contracts should be within the scope of the insurance standard.

Release of Residual Margins and Recognition of Revenue (15 March)

Following some discussion around the Staff recommendation to "release the residual margin in a systematic way that best reflects the exposure from providing insurance coverage from providing insurance coverage", the Boards tentatively decided that the insurer should release the residual margin on the basis of passage of time, i.e. straight line. A caveat was however added in that, if the insurer expects to incur benefits and claims in a pattern that differs significantly from passage of time, the residual margin should be released on the basis of the expected benefits and claims (IASB – 10 in favour, 5 against; FASB – 4 in favour, 1 against).

One presentational issue that created more debate was the proposal from the Staff for the residual margin to accrete interest. The Staff argued in favour of the interest accrual noting that as the residual margin is the net effect of expected inwards and outwards cash flows expected under the insurance contract measured on a present value basis, the residual margin should similarly be measured on a present value basis rather than considered a fixed amount determined on inception of the contract.

The event of the Boards not reaching an agreement on the inclusion of a separate risk adjustment would affect this decision profoundly because the release of that composite margin would require further consideration by the Boards.

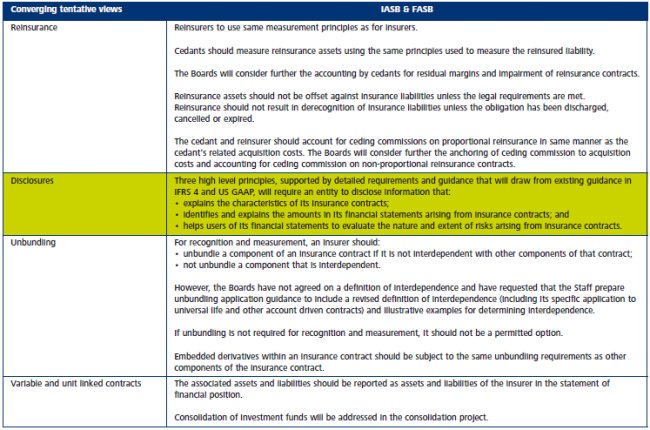

Disclosures (24 March)

The Staff recommendation is for three high level disclosure principles that require an entity to disclose information that:

- explains the characteristics of its insurance contracts;

- identifies and explains the amounts in its financial statements arising from insurance contracts; and

- helps users of its financial statements to evaluate the nature and extent of risks arising from insurance contracts.

These principles are to be supported by detailed requirements and guidance that will draw from existing guidance in IFRS 4 and US GAAP.

Although the Boards agreed with the general principles outlined in the paper, they also commented on the lack of detail and explanation of the requirements.

In particular it was noted that the proposals, especially relating to the characteristics of the contracts, could lead to excessive detailed disclosures or very limited high level boiler plate disclosures. Some Board members also requested that the principle relating to risks be more specific in relation to the uncertainty of cash flows. Another important feature not discussed in the proposed disclosures is the level of disaggregation that will be adopted, for example between life and non-life business and/or different lines of business.

The Boards made it clear that a lot of work remains to be done in the area of disclosure and also pointed out that they will need to agree on the presentation principles before they can conclude on disclosures.

A Board member noted that the disclosure requirements should not refer to other standards (as is currently the position with IFRS 4 referring to IFRS 7) and therefore all relevant disclosure principles and requirements should be brought into the new insurance standard.

Timetable and Next Steps

The timetable paper was not discussed at any of the meetings. Given the divergence of opinions that emerged during those two weeks, it now looks unlikely that the ED will be published in May, as per the published timetable.

All the subjects that were due to be discussed on the agenda were addressed during the March meetings. However, many of those subjects now require further analysis from the Staff or would need a new resolution from the Boards. In particular, the following subjects will need reconsideration:

- Divergence of opinions relating to calibration of the residual margin at inception.

- Divergence of opinion relating to the risk adjustment and consequent approach to margins.

- Divergence of opinions relating to participating contracts.

- Accretion of interest on the residual margin.

- Scope relating to financial guarantees, fixed fee service contracts and health insurance contracts.

- Scope and accounting regime for investment contracts with discretionary participation features.

- Detailed guidance on presentation and disclosures.

The Boards are due to meet again in the week of 19 April to discuss the following:

- Unbundling and embedded derivatives.

- Level of aggregation and diversification benefits.

- Detailed guidance on contract boundaries.

- Discount rate selection criteria.

- Unearned premium approach.

- Transition in conjunction with financial instruments project.

- Recognition and derecognition.

- Business combinations.

Although the ED may be delayed beyond May 2010 the Boards are converging on many new areas, despite reopening two significant "old" differences, and remain committed to delivering the insurance standard by June 2011.

Appendix. Summary of Tentative Decisions to Date

![]()

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.