UK:

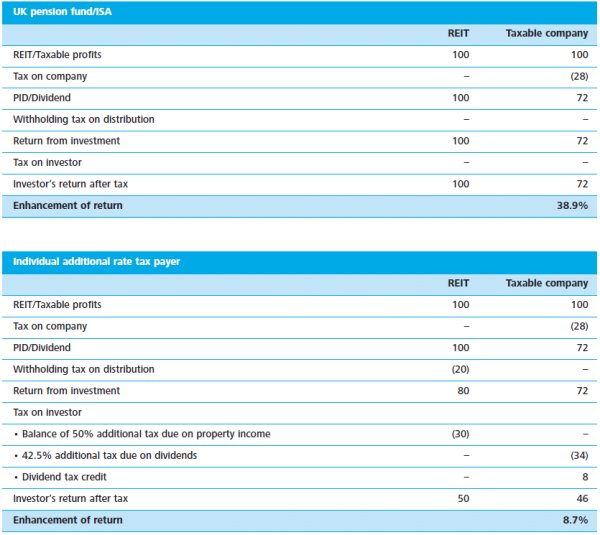

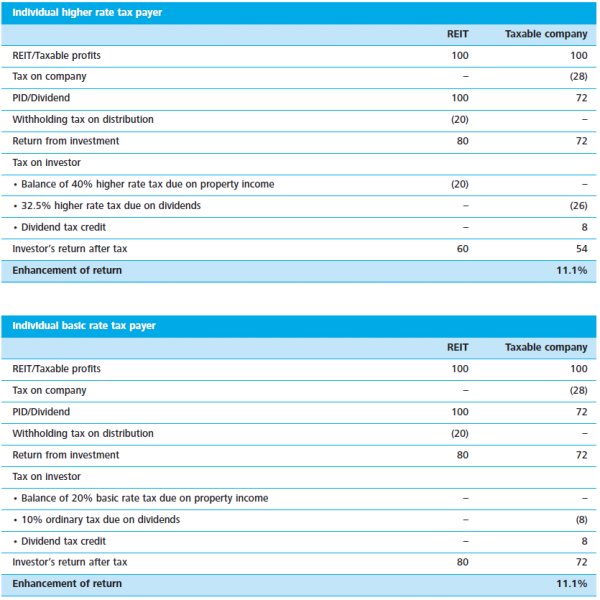

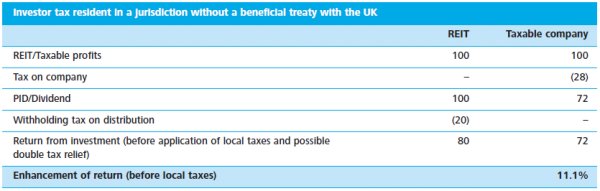

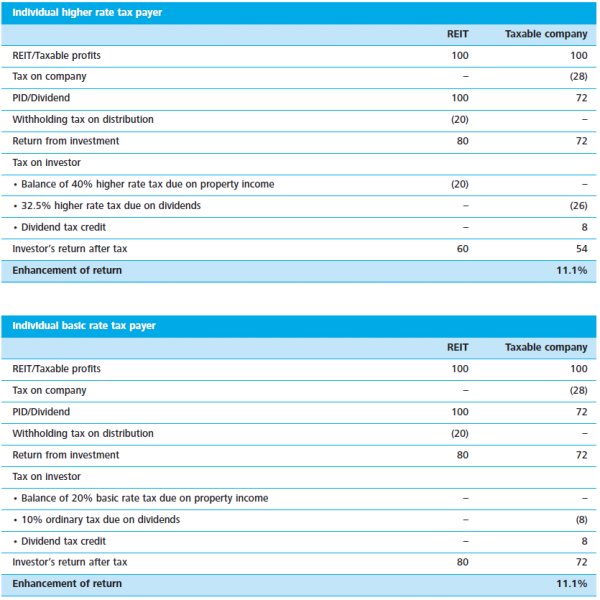

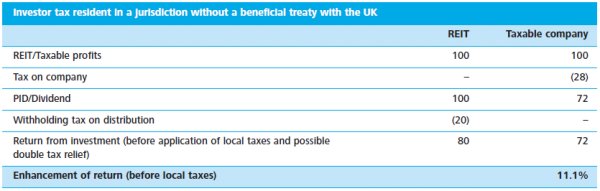

Comparison of Investor Returns from a UK REIT and a UK Taxable Company

To print this article, all you need is to be registered or login on Mondaq.com.

The tables below demonstrate the enhanced returns that may arise

from investing in a UK REIT as compared with investing in a normal

taxable UK company, from the perspective of different potential

investors.

Please note that these examples are based on the assumption that

the profits of the REIT are distributed as a PID and the after tax

profits of a taxable company are distributed as a normal

dividend.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

POPULAR ARTICLES ON: Strategy from UK

Five Reasons To Use A Risk Register

WTW

Using a risk register to capture, organise, manage and utilise risk information is commonly perceived as a component of strong governance.

Updates From The FCA On SDR And Greenwashing

Arnold & Porter

On November 28, the United Kingdom Financial Conduct Authority (FCA) published a policy statement (Policy Statement) on its upcoming sustainability disclosure requirements (SDR).