Welcome to the February edition of the Insurance Market Update, in which we focus on issues in the life insurance industry. With Solvency II around the corner, adopting an integrated approach to risk and capital management is becoming more and more important for insurers. This month, our article focuses on the concept of risk appetite which is at the heart of insurers' risk and capital management. Risk appetite defines the amount of risk an insurer is willing to accept to achieve its business objectives. For a risk appetite framework to be successful, an insurer needs to demonstrate it is well embedded in its day-to-day management, as well as being meaningful across the several risks it faces.

In their article, Brian Robinson and Rowena Tin explain risk appetite for life insurers whilst considering Solvency II implications and the challenges insurers face. We hope you find this edition informative and, as always, your comments and suggestions for future themes or topics are welcome.

Marylène Lanari-Boisclair

Editor

mlboisclair@deloitte.co.uk

The life insurance industry is about taking on risks and generating a return on the capital required to cover risk exposure. Adopting an integrated approach to risk and capital management, particularly in light of the new Solvency II requirements, is becoming increasingly important – risk appetite lies at its heart. Many firms will face a number of challenges around the development of their risk appetite, in particular ensuring the framework is:

- meaningful across a number of metrics and at an appropriate level of granularity; and

- embedded within the day-to-day running of the business.

This article explains risk appetite in the context of a life insurance company, as well as considering Solvency II implications and the challenges to be addressed.

Risk appetite is increasingly being viewed as a core component of an organisation's enterprise wide risk management (ERM) framework; a sign that senior management is incorporating risk management into strategic objectives.

One Man's Risk Appetite Is Another Man's Risk Confusion

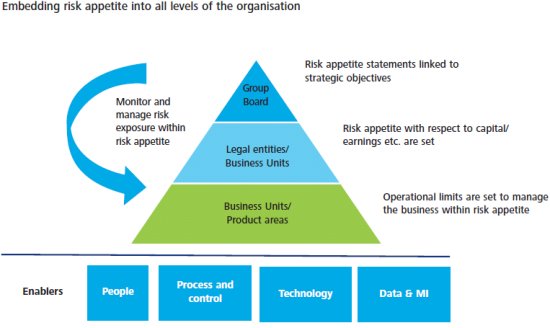

At the highest level, risk appetite defines the amount of overall risk a firm is willing to accept to achieve its business objectives. The board ultimately needs to set risk appetite and cascade it down within the firm. Management is responsible for ensuring the firm operates within the agreed appetite.

A risk appetite framework defines the approach for setting the firm's overarching risk appetite, as well as the processes, controls and methodology for setting and managing against risk limits (i.e. effectively a more detailed view of the risk appetite). The framework will be dependent on a number of factors including the nature, size and complexity of the business. The two aspects of the framework that are within the control of management are the level of granularity chosen and the suite of risk metrics used.

Which Risks To Worry About?

To monitor effectively and manage its risk exposure across different risks, a firm needs to articulate its risk appetite at a sufficiently detailed level across its risk categories.

For example, although it is operating within its overall risk appetite, an insurer may identify that a limit has been breached for a particular risk. The firm can then actively manage the position by analysing the underlying cause and taking any management actions deemed necessary to restore the risk exposure for that particular risk in line with the agreed risk appetite.

It's Not Just About Capital

To date, many life companies have only used a capital metric to define risk appetite. For example, firms have defined risk appetite as having sufficient capital to cover internal capital requirements based on a particular credit rating (e.g. AA). However, a capital metric focuses on preservation of policyholder benefits without providing sufficient insight into how the risks can be managed to meet the broader business objectives. Including other metrics in the framework, such as earnings or cashflow, allows a firm to set its risk appetite more broadly and ensures a clearer link to business objectives.

Making Better Informed Decisions And Aligning Behaviours

The review of risk appetite is increasingly becoming a key component of business planning (including capital allocation) at all levels of the firm, often being the first step in the process. Consideration of an insurer's ability and willingness to take on risk is a powerful tool in assessing the feasibility of potential plans. This can be used to set risk limits and also to identify where it has underutilised its risk appetite and where opportunities exist for increasing value.

Risk appetite can also be used as part of performance management. Linking risk appetite limits into the assessment of performance incentivises the right behaviours and encourages business units to manage themselves within overall risk appetite levels.

Linking With Solvency II

As well as assessing risk-based capital for solvency purposes, Solvency II looks at how insurers use this information in its decision-making, from strategic planning to pricing.

The Directive (level 1 text) sets out the expectations for a robust risk management system1 which is demonstrably embedded in the organisation and specifies the requirement for approved risk tolerance limits2. In CEIOPS latest level 2 advice, risk appetite is a common theme.

Thus, an effective risk appetite framework will be required to meet these regulatory requirements. Many firms are in the process of reviewing and enhancing their risk appetite framework as part of their Solvency II programmes, integrating these within their system of governance.

Facing The Challenges

Many challenges will have to be addressed going forward, from setting risk appetite through to ensuring effective performance management across business units.

To be effective, a risk appetite framework needs to be embedded into the business and set at an appropriate level across a suite of metrics. A key step, and one which the industry has found difficult to apply in practice, involves translating overarching risk appetite statements into detailed operational limits to support decision making at different levels within the business. Risk limits can be abstract in an operational context and should be converted into operational limits (e.g. volume of new business by premium, % of investment portfolio in a particular asset class) to ensure that the risk appetite is embedded within the business. This will be a highly iterative process requiring a significant amount of analysis (both on a current and prospective basis), involving the use of scenario testing to set appropriate imits that align the business objectives and risk appetite of the firm.

Clear, concise and timely reporting should allow the framework to be successful within the business itself and to ensure acceptance and commitment at board level. Many firms will need to invest in processes and technology to enable the business to monitor its risk position against its risk appetite on a timely basis, critical to successfully embedding a risk appetite framework. Ideally, reporting should include utilisation versus capacity as well as KPIs describing risk profile and performance.

In addition, having the capability to analyse the impact of future decisions on the risk profile of the business in relation to the risk appetite will be important in informing effective risk-based decision-making.

Conclusion

Solvency II will act as a significant catalyst towards embedding risk-based decision-making and performance management within the life insurance industry. Risk appetite lies at the heart of risk management, from board level through to individual business units, and many firms will need to enhance their existing risk appetite frameworks to meet the requirements of Solvency II.

To be meaningful, risk appetite frameworks will need to be sufficiently granular across a suite of metrics, not just based on a capital metric. It needs to be linked with forward looking KPIs which describe the evolution of the economic, regulatory and competitive environment to support adjustments to risk appetite.

To be effective, risk appetite frameworks will need to be fully embedded in the day-to-day management of the business, supported with timely management information and be directly linked to performance management.

Footnotes

1. Article 44 – Risk Management

2. Article 45 – Own Risk and Solvency Assessment

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.