FOREWORD

As institutions begin to emerge from the financial crisis and global economic downturn, their thoughts are turning towards preparations for the recovery. They are re-configuring business models to suit the new financial landscape, re-aligning their workforce to meet new levels of demand, and re-building customer relationships that have been unsettled during the crisis. There is also urgency in these efforts, as institutions recognize that these preparations must be complete before the recovery is complete if they are to make the most of the opportunities to come.

One sector currently making preparations is the hedge fund industry. Demands for increased transparency and higher frequency reporting, as well as a renewed understanding of the risks of depending on single source suppliers, means that hedge funds are having to re-invent their business models to remain viable in this new environment. These new models will require funds to bolster their risk management function, add horsepower to their collateral and counterparty risk management, get more out of their fund administrators, and refine their mix of prime brokers to "institutionalize" risk and investment processes.

This Deloitte 'point of view' outlines the steps required to achieve this new model, and outlines the important role that relationships will play in ensuring that funds and their providers operate in a more networked manner. As the financial landscape continues to transform, Deloitte's Global Financial Services Industry network is committed to providing continued thought leadership, surveys and studies on the issues most important to global financial institutions. Deloitte's aim is to help guide clients through these challenging times and provide them with insights useful in preparing for a new financial landscape.

Regards,

Stuart Opp

Global Head of Investment Management

Deloitte LLP

CHANGING MARKET DYNAMICS

The current market crisis has had a deep impact on key players in the hedge fund industry. Each participant has been forced to re-invent its operating model to manage risk and remain profitable.

Credit Crisis And Fallout Of Financial Institutions

Disruption to prime brokers such as Lehman Brothers and Bear Stearns has resulted in some hedge funds losing collateralized assets. This has brought to the forefront the counterparty risk faced by hedge funds from their prime brokerage relationships. Single-prime relationships are at maximum risk and multi-prime set-ups have been challenged with a renewed need for stringent collateral administration and counterparty monitoring. Hedge funds with AUM below $500 million, who might previously have been content with one prime broker, now may have at least two; larger hedge funds with billions of dollars in assets now may have four or five prime brokerage relationships1.

Industry-Wide Deleveraging And Lack Of Liquidity

A prominent result of the credit crisis has been the deleveraging of banks and the higher costs of financing. Some brokers estimate that the cost of internal financing across Wall Street banks is now 1.5-3 percentage points above LIBOR against about 0.6 percentage points for rehypothecated assets.2 The cost of borrowing on convertible bonds had risen 100 percent recently, while the price of loans on stocks has jumped 20 to 30 percent.3 Some investment strategies may become unsustainable in an environment where costs are sharply on the rise. In addition to monitoring and mitigating counterparty risk, hedge funds may look for innovative sources of financing.

Dependence On A Network Of Service Providers

Large hedge funds have long relied on multiple-prime brokers – for "best in class" execution, favorable lending terms, and to "hide the book" from any one counterparty. The credit crisis now adds another reason – spreading counterparty risk. According to a TABB Group report (2008), 57% of hedge fund managers claim that the leading impact of the credit crisis is an increased focus on counterparty risk. Ironically, the demand for additional prime relationships is coinciding with reduced supply, in terms of both the number of "trusted" prime brokers backed by financially sound institutions, and the increasingly restrictive terms those brokers are offering new clients.

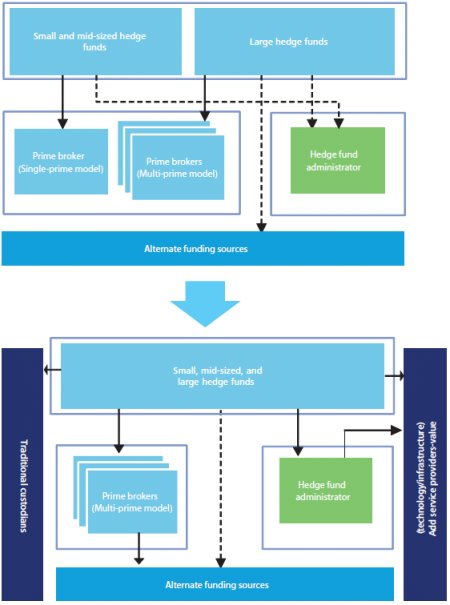

Several funds with multi-prime relationships have been outsourcing key middle-office functions to hedge fund administrators. Smaller hedge funds that had most of their trading and operating infrastructure tied to single-prime brokers will find it challenging to find a cost-effective alternative. A multi-prime model will be imperative, and the key challenge would lie in managing the additional operating burden without increasing the cost structure. In our view, the effective management of the network of players will be the most important success criteria for hedge funds.

Regulatory Changes And Enhanced Scrutiny On Short Selling

New regulations such as restrictions on short selling are putting increased pressure on many hedge fund business models. As regulatory pressures increase particularly in the US and EU, funds will have to improve business risk management capabilities, with increased focus on credit and liquidity risk.

Regulators may demand information on leverage and counterparty risk exposures from hedge funds and their service providers. The UK Financial Services Authority is already obtaining leverage information from prime brokers.

Hedge funds are looking for safer havens to house their balances as their dependence on service providers continues to increase.

Increased Institutional Investment Resulting In Need For More Transparency Among Firms

Institutional investors are demanding that hedge funds increase transparency in investment operations. Requirements include real-time data on risk reporting, clearing information, and administrative functions.

- Implications for hedge funds

-

- Need for higher frequency of reporting

- Accessibility to real-time data

- Compliance with regulatory norms

- Implications for hedge fund administrators

-

- Human capital to price and process illiquid over-the-counter (OTC) derivatives to generate real-time data

- Ability to provide additional services as hedge funds' dependency on service providers increases

- Implications for prime brokers

-

- Financial stability and creditworthiness, as hedge funds evaluate their partnerships more closely to diversify their risk

EVOLVING OPERATING MODELS OF HEDGE FUNDS

The move from a single-prime to multi-prime model has re-defined the operating relationship between hedge funds and their service providers. Fund management flexibility will drive complexity of the operating model.

The Old Operating Model Is Losing Ground

Prior to the current market dynamics, small- and medium-sized hedge funds mostly followed a single-prime model. Prime brokers provided major infrastructure support for trading, execution, clearance and custody, financing, and reporting, among other things. However, there was major risk exposure, both operational and credit based, to a single financial institution. The challenge for smaller funds was to get prime brokers to provide them with adequate attention, compared to their larger and more profitable clients.

Even though large hedge funds were spreading counterparty risks and using a multi-prime model, the prime relationships were typically split by fund, strategy, or trading market. In that case, the fund's legal entities were effectively in a single-prime model with risks concentrated on one counterparty. Moreover, hedge funds had to manage multiple relationships, constantly monitor balances, financing and margining trends, and risk. This in turn required complex internal infrastructure at additional cost.

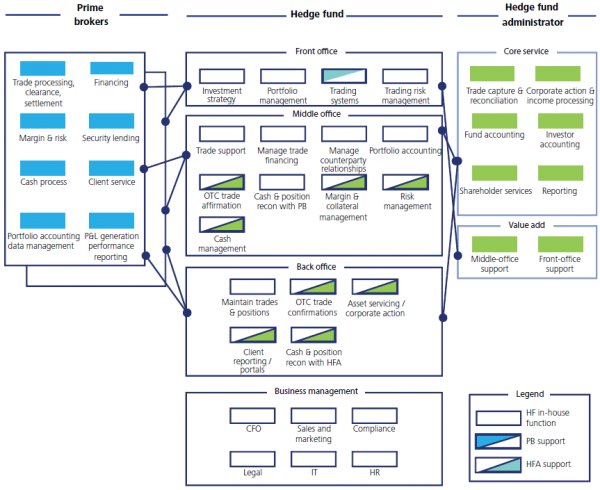

|

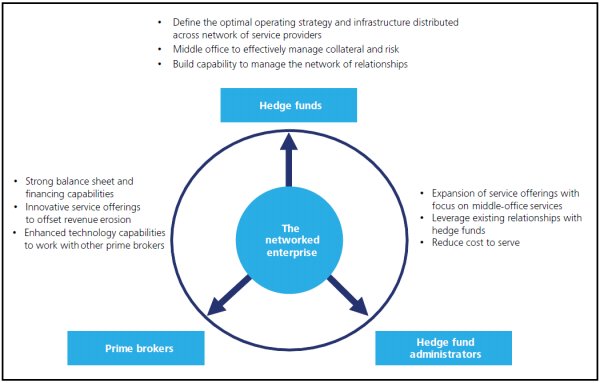

New Operating Model – Networked Enterprise The market conditions have forced hedge funds towards a multi-prime model. Not only do they have to spread counterparty risk, but they are also required to support multiple execution platforms such as complex reconciliation, trade allocation, counterparty risk monitoring, and collateral administration among other functions. This requires hedge funds to strengthen their middle-office function. Some of the funds may find it easier to outsource these activities to hedge fund administrators or other service providers. Larger hedge funds will want to consider flexible contracts that allow for smoother data aggregation and shifting of balances, while protecting their collateral. They will also want to optimally distribute assets under management to various prime brokers. Smaller and medium-sized funds will need to focus on identifying new prime brokers to diversify counterparty risk. This will, however, increase the cost of monitoring additional accounts. Prime brokers at those institutions considered sound are demanding much stiffer terms than previously, wanting high proportions of the deal flow, and imposing higher haircuts on collateralized assets. |

HEDGE FUNDS — THE ULTIMATE NETWORKED ENTERPRISE

The market dynamics and complexity of investment strategies and products has changed the playing field of the industry. As a result, it has become imperative for hedge funds to carefully select and manage their partners. In the networked enterprise model, relationship management will take center stage for hedge funds.

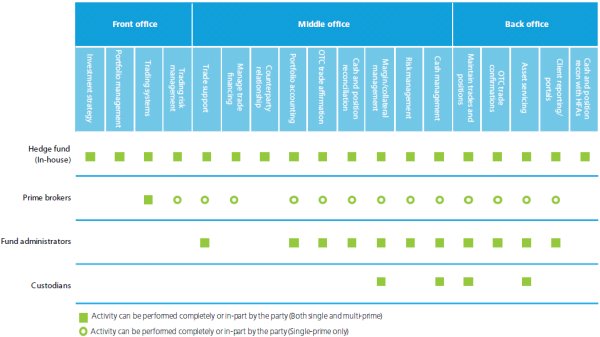

Hedge funds will have to identify front-, middle-, and back-office functions that need to be built in-house versus those outsourced to partners. This becomes more complicated in the multi-prime and multi-HFA model. They will not only have to identify key partners who can provide the services needed, but also employ a disciplined approach to monitor services provided and continually evaluate the partnerships.

Guiding Principles

Acceptable trade off between "flexibility to offset risk" and "complexity of operations"

- Flexibility to offset risk and adjustment to turbulent market conditions is predicated by dependence on multiple players (e.g., prime brokers, fund administrators, and custodians)

- Complexity is rooted in (i) more than one choice to source key operating functions, (ii) business decisions to integrate management of portfolios across prime relationships, and (iii) need for new internal functions to manage the network

- Relationship management will take center stage. "One size fits all" approach will not work

- If you cannot manage your network, you will likely not be successful

KEY FOCUS AREAS FOR HEDGE FUNDS IN THE NETWORKED ENTERPRISE MODEL

The networked enterprise model will add increased complexities to hedge fund operations. Funds will need to decide upon what to build in-house and where to partner to achieve desired results.

|

Build The Middle Office That Fits Your Operating Strategy Hedge funds need to determine their optimal operating strategy and factor in roles various service providers will play in providing necessary capabilities. Although most large firms will build their own middle-office, service offerings from fund administrators and custody players will prove to be compelling from both a cost and capability standpoint. Managing the network of service providers will require additional capabilities that the hedge funds will need to build and staff up in-house. Add Horsepower To Your Collateral Management The multi-prime model will only increase the need for improved collateral management. Some hedge funds will benefit by outsourcing to enterprise collateral management service providers or implementing vendor solutions to efficiently manage their collateral across various parties. In addition to spreading collateral across parties, independent valuation of illiquid assets, zero over-collateralization, and optimal collateral composition will be the key focus areas. Plan Risk Management Risk management will see a balance of focus between market risk for investment strategies and counterparty risk. In a multi-prime model, a single broker's risk report will show only a partial picture of the risk profile. Risk management will need to be a central function that aggregates positions across all providers. Take this opportunity to separate risk management from investment management. Choose The Right Mix Of Prime Brokers The choice of prime brokers should be guided by aligning the fund manager's needs to the prime broker's capabilities—balance-sheet strength, execution platform, geographic presence, flexible financing/margining options, and product coverage. Get The Most From Your Hedge Fund Administrator Hedge fund administrators can help hedge funds outsource several middle- and back-office functions. With the increased complexity of the middle- and back-office, hedge funds should at least understand the range of services available from their administrators. |

BUILD THE MIDDLE OFFICE THAT FITS YOUR OPERATING STRATEGY

To succeed in the networked environment, hedge funds must critically evaluate their operating strategy, which will drive their data aggregation and control requirements.

Fund Management And Operating Strategy

Integrated Versus Non-Integrated Management

- If the fund manager splits the portfolio or fund across multiple-prime brokers to get better financing and spread risk management, the aggregation of positions, balances, and risks need to be handled away from each prime broker. These activities will be performed in the middle office

- For non-integrated management where each prime broker has the complete portfolio or fund, the hedge fund can use the prime brokers' capabilities to provide risk and portfolio reporting. The scenario is similar to a single-prime model and does not guarantee counterparty risk mitigation

Overlap Of Activities Across The Value Chain

- Both prime brokers and hedge fund administrators have been increasing the scope of services they provide. Therefore, hedge funds have more choice to source middle-office functions from service providers

- Hedge funds' focus on becoming independent financial institutions to reduce risk exposures created by service providers may lead to some large hedge funds performing end-to-end operations in-house

- Small and medium hedge funds may make use of their hedge fund administrators or specific middle-office service providers

Growth Of Partnership Model

Prime brokers are trying to get a bigger share of middle-office services in a multi-prime environment by forging new partnerships with fund administrators and technology providers. This allows them to offer an independent platform and mitigates any concerns over conflict of interest.

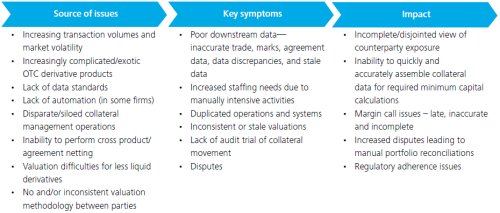

ADD HORSEPOWER TO YOUR COLLATERAL MANAGEMENT

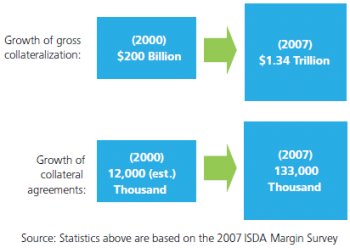

Collateral management was historically regarded as a peripheral activity, but is now considered a critical and integral middle-office function.

According to the International Swaps and Derivatives Association (ISDA), the value of collateral in the marketplace to offset derivates exposure exceeds $2 trillion.4 Hedge funds are looking to value derivatives and collateral for their portfolios on a daily basis. One of the themes that have come out in the past few months is that when you trade bilaterally, any excess collateral you leave equates to credit risk and hence the need to call back the same from the counterparty. Such checks were performed earlier on a weekly basis, but given market conditions the norm is shifting to a daily basis. An enterprise wide, global and accurate view of collateral, and of the terms and conditions of the collateral agreement, can help companies navigate dangers of reassignment of derivative contracts. At the heart of the collateral management challenge is the valuing of collateral. Firms also need to accurately price the derivatives for which they are providing collateral to make sure they haven't provided too much.

Hedge funds are investing in collateral management software that enforces collateral agreements. For example, under what conditions does the collateral become collectable? Where does the collateral reside?

Who is the contact at the entity that's holding the collateral? Custodial banks, who manage collateral as a service for others, also work with the clients to ensure that there's a broad array of collateral, and that there's not too much of any particular type of collateral, by screening for eligibility and concentration limits.

Why Is Collateral Management Particularly Important Today?

Significantly Increased Volatility

More margin calls and due-to/due-from activity

- Tight credit markets and liquidity issues

- Defaults and resulting collateral impairment (Bear Stearns, Lehman Brothers, others)

Significantly Increased Volumes

- Significant increase in Repo and OTC derivatives volumes

- Continued increase in these volumes projected

- More counterparties trading a wider range of derivative products

Proliferation Of More Exotic Derivative Products

- Longer term, less liquid, and difficult to value

- Fueled by increasingly complicated, and global fund Strategies

Source: 4 – The International Swaps and Derivatives Association 2008 Margin Survey

PLAN RISK MANAGEMENT

Risk management will take center stage in the networked enterprise model. Managing a larger network of relationships in uncertain market conditions will require funds to reassess their risk management processes.

Risk Management Process

- Risk Identification: Define the overall risk profile based on the size, nature of business, portfolio constitution, and investment strategies, and measure its fit with the firm's risk tolerance capability

- Risk Measurement: Identify the categories of risk applicable to the fund and define both qualitative and quantitative methods to measure the risk. Appoint a committee to oversee the process of measurement

- Risk Monitoring: Define risk tolerance limits and the frequency of risk monitoring. Make available clear crisis management guidelines to address any adverse risk situation

- Risk Governance: Establish an integrated risk management framework. Define policies and procedures around measurement and monitoring criterion. Appoint knowledgeable personnel to supervise risk analysis. Define periodicity of management reports along with clearly defined exception processes

Critical Risk Measures In Focus

- Liquidity Risk: Regularly conduct liquidity stress scenario analysis to assess impact of investor redemption and availability of capital in markets

- Leverage Risk: Monitor leverage with a frequency appropriate to the portfolio and keep leverage within the risk profile established for the fund

- Market Risk: Evaluate risk exposure to different market variables and asset classes. Develop appropriate risk engines for various product types and monitor that risk limits are not breached

- Counterparty Risk: Assess creditworthiness of counterparties and continuously monitor margin requirements and collateral administration for client positions

- Operational Risk: Develop strong Management Information System (MIS) reporting framework and infrastructure. Maintain data consistency and integration across systems

- Legal And Compliance Risk: Appoint a dedicated management team to drive compliance to regulatory standards

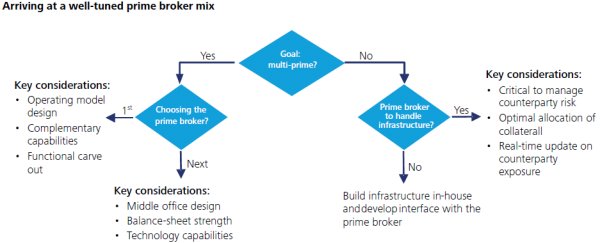

CHOOSING THE RIGHT MIX OF PRIME BROKERS

Efforts should be made to critically assess capabilities of prime brokers and build a multi-prime model tuned for the requirements of the business.

Criteria For Choosing Prime Brokers In Current Scenario

The choice of prime brokers should be guided by aligning the fund manager's needs to the prime broker's capabilities. Balance-sheet strength, financing flexibility, and robust operational infrastructure have become key decision criteria in choosing the right mix of prime brokers. However, it is necessary to set up a structure that allows for ease of data aggregation and asset transfer between primes, so as to maintain flexibility.

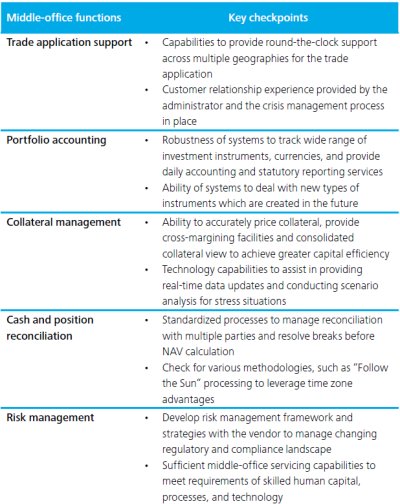

GET THE MOST FROM YOUR HEDGE FUND ADMINISTRATOR

Given increased focus on operational infrastructure efficiency in a multi-prime set up, hedge funds may choose to utilize their hedge fund administrators' capabilities.

Key Outsourcing Functions And Impact On Hedge Funds

Challenging market conditions require wider support from fund administrators in terms of improved capabilities, ranging from more frequent net asset value (NAV) calculation to risk reporting, cash and collateral management. Outsourcing the middle-office functions to hedge fund administrators (HFAs) can enable hedge fund managers to avoid infrastructure buildup.

Role Of Hedge Fund Administrators In A Multiprime Setup

As hedge funds add prime brokers, the cost and effort to consolidate data across the various systems increases. In the recent market turmoil, increase in operational expenses has driven fund managers to look for variable cost models such as outsourcing. HFAs view it as an opportunity to assume a more integral role in the hedge fund's investment process where service offerings of HFAs and traditional prime brokers overlap.

Services That Can Be Provided By Fund Administrators:

Administrative – Counterparty monitoring for additional accounts and points of contact

- Front office – Support trading applications and order management across multiple primes

- Middle office – Providing aggregated portfolio reporting and risk management

- Back office – Managing trade allocations and reconciliations, resolving breaks for NAV calculation

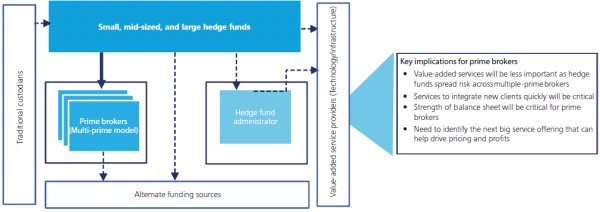

IMPLICATIONS FOR PRIME BROKERS

Prime brokers are experiencing a major shift in their business model. Their focus on developing deep relationships with a few hedge fund clients is no longer working in a multi-prime environment where risk diversification and access to capital is taking center stage.

Hedge funds will be spending a lot more time and effort assessing the operating stability of prime brokers as well as managing and moving collateral between them to provide most flexibility and reduce risk of failure. Stronger emphasis on collateral management coupled with increased need to reduce risk will result in the need for collateral administration across multiple parties. The distributions of financed and non-financed balances across prime brokers and pure play custody players will increase collateral management complexity and reduce cross-margining opportunities.

The market is bifurcating, with high demand for those prime brokers perceived as having balance-sheet stability. Prime brokers in that position are dictating the terms of trade with hedge funds — demanding higher shares of the trading book to offset the more conservative leverage terms (and therefore lower revenues). Prime brokers who are perceived as less sound will need to compete on pricing, lending, and execution platforms, as well as ancillary services. The networked enterprise model will add increased complexities to hedge fund operations. Funds will need to decide upon what to build in-house and where to partner to achieve desired results.

Prime brokers will be required to improve capabilities to deal with new clients — throughput volume, risk management, and account on-boarding processes. Existing capabilities like portfolio accounting and risk management may lose favor among the hedge funds adopting the multi-prime model. They will need to find the next differentiating factor that will differentiate them and wherein they can raise prices to drive profitability.

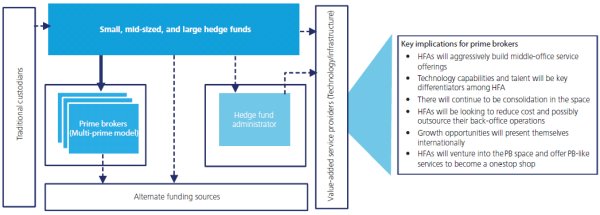

IMPLICATIONS FOR HEDGE FUND ADMINISTRATORS

Hedge fund administrators are being challenged by handling increased product complexities, technology scalability, and international growth. They are being forced to focus on a dwindling number of profitable clients and increase service offerings to drive margins.

The growing complexity of the multi-prime model and increased focus on establishing a middle office will require hedge funds to choose between build vs. outsource options. Smaller hedge funds may prefer not to invest in internal infrastructure and look for service providers to provide the necessary capabilities and improve time to market. Larger hedge funds may build capability in-house to have more control over the network.

Hedge fund administrators and custodians have ramped up their service offerings for key middle-office functions and will get the lion's share of processing. In fact, we expect some large hedge funds will use a combination of prime brokers, administrators, and pure play custodians to leverage technology and diversify risk. Hedge funds will also have to determine how the performance of these hedge fund administrators should be evaluated. There will be continued consolidation in the hedge fund administration market, and smaller hedge funds will fight to get attention from their service providers.

While hedge funds outsource middle offices and cut costs, hedge fund administrators will need to cut costs and potentially look into moving their back offices to cheaper locations. Some hedge fund administrators will begin offering prime broker-like services to improve profitability and further increase competition in the market. The growing global hedge fund industry is likely going to see hedge fund administrators move internationally to grow revenues and offset risks. Hedge fund administrators will also see continued specialization within themselves wherein multi-service hedge fund administrators target large funds while niche players target smaller ones.

NETWORKED ENTERPRISE BLUEPRINT

CONCLUSION

Changing market dynamics have added complexity to the hedge fund industry. Declining revenues, increased risk, and current operating models require each player to reassess its business model in an attempt to be successful amidst the market turbulence.

The networked enterprise model will be the future operating model in this industry. Relationship management, collateral and risk management, and cost optimization will be key operating themes of focus. With the increased number of players and relationships, companies will have to reassess services provided, cost structure, and middle and back-office organizations. Hedge funds will look to reduce risk and dependence on a few prime brokers. Prime brokers and hedge fund administrators will focus on expanding their service offerings. Additional funding sources will become part of this model over time and diversification of risk across counterparties will increase.

Players who can adapt to the changing environment and make rapid changes to their business models should be able to handle the market turbulence. Being nimble and making bold operating and business decisions will be critical to success

Footnotes

1. Banks Battle for Prime Brokerage Market Share, HedgeWorld News, October 9, 2008

2. Collapse of Lehman leaves prime broker model in question, Financial Times, September 25, 2008

3. Citadel, TPG-Axon Stumble Toward Worst Year in Hedge-Fund Swoon, Bloomberg, September 26, 2008

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.