CAUTIOUS CONFIDENCE - RESULTS OF OUR 2009 FINANCIAL SERVICES SURVEY

Our 12th annual financial services survey suggests an air of positivity among the financial services businesses in the City of London.

In line with the overall improving economic outlook, our survey results show a feeling of optimism within the financial services industry, as 62% of respondents believe the UK economy to be either stable or improved on 12 months ago. However, this is tinged with caution as there is no anticipation of a return to the booming times of pre-2008.

Business Confidence

The underlying caution embedded within the financial services industry is clearly illustrated by nearly two-thirds of our respondents continuing to believe that London's reputation as a major financial centre has been damaged by the financial crisis of the last two years. This sentiment is consistent with last year's findings, where 62% held the same view.

As with last year, New York is viewed as the biggest threat to London in terms of being the mainstay for financial services. However, more revealing is Dubai's fall from grace, with only 2% of respondents regarding Dubai as a threat to London compared to 20% last year. This is no doubt a consequence of recent news impacting the Dubai economy and its underlying confidence.

On a positive note, 39% of respondents are optimistic about their business's future prospects, which is a notable shift on the prior year where 44% of respondents were feeling pessimistic. This upbeat outlook is reinforced by 94% of respondents reporting either stable or increased turnover expectations for the next 12 months, which compares favourably to last year's survey result of 65%.

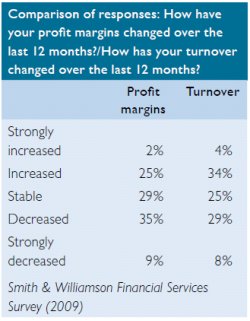

Despite a general optimistic outlook, the financial services industry has experienced some difficult challenges in the last two years and this is expected to continue, at least for the immediate future. This is revealed through respondents experiencing difficult trading conditions, which has ultimately hindered growth and profitability in the last 12 months. For example, 37% of respondents have experienced a fall in business volume, which is consistent with 39% reported last year. In addition, 44% and 37% of respondents have experienced declines in profit margins and turnover respectively, which compares with 56% and 38% respectively in last year's survey.

In 2008, businesses generally reported stable headcounts, as firms looked to make savings elsewhere. However, 2009 proved to be a year of redundancies, with 39% of respondents revealing a decline in headcount. Returning to the theme of optimism, 88% of respondents are hopeful of either maintaining or increasing headcount in the next 12 months. On a consistent note, 75% of respondents are also expecting discretionary expenditure to either remain stable or increase, which compares favourably to last year when 43% of respondents were expecting a decline.

Expenditure on regulatory compliance is immune to economic conditions, with 96% of respondents expecting it to be stable or increase in the next 12 months, which is consistent with the 95% reported last year.

Tax

Historically, changes in tax legislation have resulted in a fairly neutral response. However, in light of some noticeable changes to income tax legislation, 36% of respondents are expecting this to have a negative impact on their business. Consequently, 35% of respondents are considering plans in response to these tax changes, while 34% are looking to change the way they incentivise employees. Overall, this is consistent with 42% of respondents believing changes in UK tax legislation will be one of the key factors impeding business growth.

Changes to VAT legislation have also fallen below people's radar, with 33% of respondents expecting an increase in irrecoverable VAT due to the new VAT place of supply rules. However, not unexpectedly, 86% of respondents believe that the temporary reduced rate of VAT had no beneficial impact for their business. The survey asked respondents to select factors they believe will most affect business growth over the next 12 months. Of the ten responses available, all bar two received 22% or more of the vote, reflecting diverse views among respondents, which is in stark contrast to last year, where the top three responses of further economic factors, consumer confidence and ability to raise funds dominated the voting.

The top three factors of this year's survey were: regulation requirements, changes in UK tax legislation and consumer confidence. These findings are consistent with industry optimism as firms become more confident of economic recovery but more concerned with regulation and legislation restricting the speed and extent to which this can be achieved. 2010 is expected to be another challenging year.

SOLVENCY II – BE PREPARED, BE VERY PREPARED

31 October 2012 may seem a long way off, but for insurance firms the clock is ticking and 2010 represents a key year of preparation.

Solvency II was adopted on 5 May 2009 and will 'go live' on 31 October 2012, replacing Solvency I. It will apply to all insurance and reinsurance firms with gross premium income greater than €5m, or gross technical provisions greater than €25m.

The aim of Solvency II is to develop a single market for insurance services in Europe without any detrimental impact on consumers. Solvency II will be based on economic principles for the measurement of assets and liabilities. In support of this, it will also look to use enterprise risk management principles, regulating firms according to their inherent business risks; firms will be required to assess their own risk profile, ensuring they have sufficient capital and governance, and risk management processes to manage such risks.

Solvency I is no longer deemed to be suitable due to the belief that current regulatory requirements can lead to material differences between regulatory capital and economic capital required to run the insurance business.

Pillars

Commonly known as 'Basel for insurers', Solvency II is similar to Basel II, which governs the regulation of banks, building societies and investment firms. The best example of this comes via the Solvency II framework, which is also based on a three-pillar approach.

Pillar 1 – Quantitative Requirements

Pillar 1 applies to all firms and considers quantitative requirements, including own funds, technical provisions and calculation of the Solvency II capital requirement (the solvency capital requirement (SCR) and minimum capital requirement (MCR)), through either an approved full or partial internal model or the European standard formula approach.

Pillar 2 – Firm Assessment And Supervisor Review

Pillar 2 requires an additional capital assessment by placing the emphasis on firms to conduct an internal assessment of its inherent business risks and internal controls, referred to as the own risk and solvency assessment (ORSA), which is subject to supervisory review and approval.

Pillar 3 – Public Disclosure And Regulatory Reporting Requirements

The requirements to disclose information relating to risk and capital levels, designed to help exert discipline of market influence. Pillars 2 and 3 combined are now referred to as Pillar 5.

Pillar 1 represents the quantitative element of Solvency II, whereas Pillar 5 is more qualitative in nature, given its reporting, disclosure and risk management requirements.

Solvency II is being led by the European Union (EU), which is adopting a procedure known as the Lamfalussy approach. This splits the regulatory framework into four levels.

Level 1: directives setting out a framework of principles.

Level 2: measures implementing the principles in the Level 1 directive. The European Commission (EC) develops these measures with technical input from the Committee of European Insurance and Occupational Pensions Supervisors (CEIOPS) and adopts them following consultation with member states through the European Insurance and Occupational Pensions Committee of representatives from Finance Ministries (EIOPC).

Level 3: CEIOPS produces joint recommendations and consistent guidelines and measures. These may include guidance for national regulators to ensure consistent interpretation of the Level 1 directive and Level 2 measures.

Level 4: enforcement by the EC to ensure effective and consistent implementation of EU legislation.

Implementation

Many insurance firms will have to make fundamental changes within their business, while at the same time continuing to run existing business operations. All of which will require time, resource and finance.

Detailed below are some key areas insurance firms may wish to consider, if they have not already done so, as part of the implementation process.

Gap Analysis

In essence, before an insurance firm commences any significant implementation work, it first needs to identify which 'gaps' need filling. A firm needs to identify its implementation date and then work backwards by plotting its current position, thereby identifying the gaps that need to be filled. Once the gaps have been identified, an overall implementation plan can be formulated in respect of how and when the gaps are to be filled.

Internal Models

Many firms will want to adopt their own internal model for calculating capital requirements under Pillar 1. As at November 2009, approximately 100 insurance firms had already indicated to the FSA that they would like to take this approach.

If they do wish to take this approach it is crucial that they communicate with the FSA immediately, expressing their intentions, as well as their expected timeline for developing the model and submitting their application for approval. The FSA has already indicated that it will need six months to review completed applications. Furthermore, due to its own resource constraints, the FSA has introduced a pre-application approval process requiring insurance firms to demonstrate their commitment to adopting an internal model before they are even allowed to submit their application.

In light of this, and in the context of each insurance firm's resources and timeline, firms should ensure they have a back-up plan for 2012 implementation, that being either the standard formula under Pillar 1 or a partial internal model.

Group Supervision

The directive does not include the 'group support' regime, whereby subsidiaries meet their MCR using locally held capital but rely on a parental guarantee to meet their SCR, although this is expected to be reviewed three years post implementation of Solvency II.

However, lead supervisors will still be required to review the group SCR calculation and specify capital add-ons where necessary, in consultation with local regulators.

Culture

A key consequence for insurance firms will be the impact on culture. Solvency II will require firms to understand their inherent risks and how best to manage those risks. In particular, the board will need to demonstrate its awareness of such factors and lead from the front – delegation of tasks will be permitted, but not overall responsibility and awareness.

Resourcing

One key criterion insurance firms must assess early on will be their own resourcing requirements, both for implementation and on-going requirements. This will encompass not only personnel but may also include systems and processes, financial investment and professional advisers.

|

There is no hard and fast rule for implementation and every insurance firm is different, both in terms of its resources and related requirements. However, one rule is applicable to all insurance firms: preparation is fundamental. So the earlier firms start, the easier implementation of Solvency II will become. In particular, as the implementation date approaches, resources will become more scarce – so firms beware, as you could be found wanting. |

OFFSHORE FUNDS - ARE YOU READY FOR THE NEW REGIME?

After much consultation, the reporting regime for offshore funds came into effect on 1 December 2009, replacing the distributor fund regime.

The purpose of the offshore fund regime, like the previous distributor fund regime, is to ensure that where a person from the UK invests into an offshore fund, realisations from those funds are taxed as income rather than gains, unless certain conditions for approval as a 'reporting fund' are met. The income of reporting funds is broadly taxed as it arises. Disposal of units in reporting funds will qualify for capital gains treatment.

Funds currently certified as 'distributor funds', and certain other funds under the same umbrella, can apply to continue to be treated as distributor for a limited period. The fund's management will need to consider whether this is beneficial.

Offshore Fund

An 'offshore fund' is a mutual fund resident outside the UK that has arrangements with respect to property of any description, where the following points hold true.

- The arrangements enable participants to take part in holding/receiving profits from property.

- Participants do not have day-to-day control of the fund management.

- Investors would expect to be able to realise their investment on a basis calculated entirely, or almost entirely, by reference to the net asset value of the property or an index of any description.

All offshore entities with UK investors will therefore need to consider their status.

Reporting Regime

To be a 'reporting fund', an election must be made in advance of the relevant accounting period (compared to the arrears-based distributor regime), providing some certainty for investors on tax treatment. Funds that previously were not qualifying offshore funds, but now qualify, would need to apply for reporting fund status to HM Revenue & Customs (HMRC) generally by 31 May 2010.

Investors are taxed annually on the amount reported to them, i.e. on their allocation of the reportable income of the fund, irrespective of whether they receive any distributions from the fund.

The new regime requires reports to be made to HMRC and fund participants, in addition to the normal tax calculation of the fund's reportable income. The report sent to investors should include the amount and date of distributions made (relating to the reporting period) per unit, excess of reportable amount over distributions and a confirmation that the fund remains a 'reporting fund'.

The report to HMRC should include audited accounts, reportable income calculation, a copy of information sent to investors and distributions made in the reporting period, the number of units in issue at the end of the period and the income per unit and a declaration.

The new regime seeks to simplify the rules and lessen the administrative burden on funds, although it has downsides for investors, potentially causing them to suffer income tax on amounts not yet received.

THE REMUNERATION CODE

The FSA's remuneration code came into effect on 1 January. How will this affect your firm?

During August 2009, the FSA issued Policy Statement PS09/15, Reforming remuneration in financial services, which sets out its remuneration code (the Code) for large banks, building societies and broker dealers.

Application

The Code came into force on 1 January 2010 and impacts remuneration awards granted in respect of the 2009 performance year. It applies to firms that meet at least one of the following conditions.

- The firm is a UK bank or building society that had capital resources exceeding £1bn on its last accounting reference date.

- The firm is a BIPRU €730k firm that had capital resources exceeding £750m on its last accounting reference date.

- The firm is a full credit institution, a BIPRU €730k firm or a third country BIPRU €730k firm, is part of a group and on the firm's last accounting reference date total capital resources held within the group by UK banks or building societies exceeded £1bn, or by BIPRU €730k firms exceeded £750m.

The Code has been incorporated as a new chapter in the Senior Management Arrangements, Systems and Controls (SYSC) Handbook, with the general requirement that "A firm must establish, implement and maintain remuneration policies, procedures and practices that are consistent with and promote effective risk management." There are eight principles in the form of evidential provisions covering governance, performance measurement including non-financial metrics and risk adjustment, and remuneration structures. Satisfying these tends to show compliance with the general requirement.

The Code covers all aspects of remuneration that could have an impact on effective risk management including wages, bonuses, long-term incentive plans, options, hiring bonuses, severance packages and pension arrangements.

It is concerned with the risks created by the way remuneration arrangements are structured, not with the absolute amount of remuneration, which the FSA sees as a matter for firms' remuneration committees. However, the FSA may ask such committees to provide evidence of how well the firm's remuneration policies meet the Code's principles, in addition to expecting relevant firms to use the principles in assessing their exposure to risks arising from their remuneration policies as part of their internal capital adequacy assessment process.

Smaller Firms

In chapter six of CP09/10, the FSA invited feedback on whether the code should be extended to other FSA authorised firms. During December 2009, a feedback statement on the matter was published.

At this stage, the FSA has stated that it does not intend on introducing any new rules, nor does it plan on extending the existing rules to any new sectors as there are a number of EU directives on remuneration that are yet to be finalised, in addition to the recently published recommendations in the Walker Review. Instead, it has committed to reviewing the effectiveness of the Code in mid-2010 and will take the opportunity to consider these points, before reaching a final decision on whether to extend the Code to other authorised firms.

Going Forward

In the meantime, the FSA has announced that it expects all firms to continue to focus on remuneration risk management, and that it will continue to address the issue as part of its normal supervisory activity.

If your firm is outside of the scope of the Code, best practice dictates that you consider the Code and apply it proportionately by ensuring that you have a remuneration policy which is proportionate, not too costly to implement and does not put the organisation at a competitive disadvantage.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.