- within Corporate/Commercial Law topic(s)

Introduction

Tomorrow's winners will be those that lead the sustainability agenda.

Sustainability and corporate responsibility continues to be one of the top items on the agendas of CEOs of retailers and consumer packaged goods companies. The 2009 CIES Top of Mind survey ranked it as the number three issue, following the economy and, in second place, food safety. Although a drop from the previous year, when corporate responsibility was the number one issue, this nevertheless indicates that sustainability is more than just a passing fad, to be quietly forgotten now that the economic climate has got tougher.

Even so, given the current pressures on margins and cost reduction initiatives, it seemed to us (Deloitte and GS1 UK) likely that many companies would be re-evaluating their sustainability initiatives in light of the new economic reality. Consequently, we felt there would be value in carrying out a study that would:

- Examine in more detail companies' views of sustainability now, compared to before the downturn.

- Identify some of the key areas where companies are continuing to invest in initiatives to drive the sustainability agenda.

- Highlight key actions which companies, regulators and other stakeholders need to take now in order to continue the journey towards creating the wholly sustainable enterprise.

The study has combined two surveys of GS1 UK's membership, one in summer 2008 and the other in spring 2009, together with a number of interviews with retailers, suppliers and other stakeholders. With approximately 800 responses, we believe that this is the most extensive research into UK companies' attitudes to sustainability yet undertaken. As we have analysed the findings of our research, we have identified a number of themes which echo those highlighted in the World Economic Forum's report Sustainability for Tomorrow's Consumer (2009) and we have therefore used this report as a point of reference in various parts in this document.

High commitment to sustainability

Our research reaffirms the commitment by business to sustainability, to an extent which surprised us. Over half the respondents to our 2009 survey stated that sustainability had become more important since the previous year, and a further 25% said that their commitment had been unaffected by the economy.

However, there was evidence that companies were deferring initiatives which entailed significant capital expenditure, or where the business benefits were unclear, preferring to focus on those areas where there was an immediate or short-term payback.

Four action areas

Our research identified four key areas where companies are focusing their efforts as they drive their sustainability agendas forward through the current downturn and beyond:

Product and process innovation

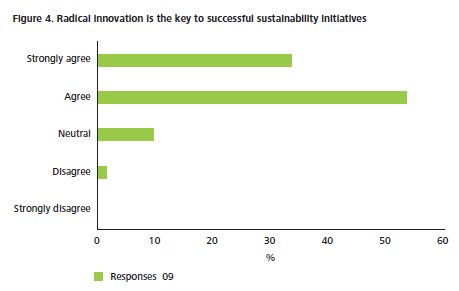

88% of respondents to our survey agreed or strongly agreed with the statement that "radical innovation is key to successful sustainability initiatives". We heard examples of companies that were planning innovations to their products, manufacturing processes or distribution and logistics operations. Some of these were being deferred in the present economic conditions, but the intention was clearly to proceed with them once we are beyond the downturn.

The implication is that the future sustainable business will be one which is able to manage its innovation processes effectively, can introduce new products and processes quickly, and is able to spot the winning propositions early, reducing wasted resource and spend on unsuccessful projects.

Informing and engaging with the consumer

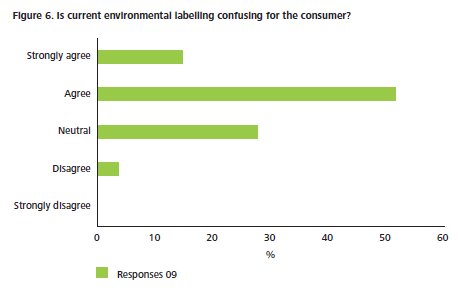

Opinions were split regarding who is really driving the sustainability agenda, the consumer or the businesses which serve them, with 53% stating that it was the consumer who was leading and 47% stating that it was a business-led agenda. However, where there was much clearer agreement was the view that current labelling standards are highly confusing for the consumer, with 67% of respondents believing this to be the case. This is further supported by the recent study undertaken by Deloitte for the Coca-Cola Retailing Research Council Europe – Exploring the third dimension, relevant and timely information to empower shopper choice (2009). The study found that the plethora of information and different label types currently in use serve only to confuse the shopper, who often chooses to just ignore the information provided. However, the research also found that there is a substantial segment of the consumer market (including the green shopper) which is actively looking for more information about products. There is consequently a largely unexploited opportunity to influence this segment by providing clearer information. Enhanced industry standards and new technologies are likely to play a role in enabling this.

The implication is that tomorrow's successful businesses will be those who have exploited the opportunity to engage with shoppers and consumers, and provided them with the information they need. Additionally, standards bodies, regulators and interest groups all have a role to play in ensuring the development and adoption of industrywide standards, which meet consumers' information needs.

Organisation and accountability

Over half of the respondents to the 2009 survey stated that it was the CEO who owned the sustainability agenda in their organisation, up from 48% the previous year. In those organisations where this was not the case, ownership was spread across many different job titles and functions, from supply chain to marketing and finance. We believe that the trend towards the CEO taking ownership is correct, given the fact that sustainability touches every part of the enterprise and that the development of a wholly sustainable enterprise, across environmental, social and economic dimensions is a key strategic priority for many businesses.

In our view, the sustainability agenda in the future sustainable business will be owned by the CEO. For those businesses where this is not currently the case they should review current responsibilities and consider reallocating them to the CEO.

External collaboration

Finally, many companies who are leading the way in the drive towards sustainability are doing so in recognition that they can achieve more by collaborating with others, including customers, suppliers, even competitors. Probably the best known example of this is where businesses are collaborating in the distribution of products, including competing products, because of the reduction in distribution miles and cost. However, other areas, such as product and process innovation, could also be positively impacted by improved collaboration, and the increasing adoption of new collaborative technologies and industry data standards can only help achieve this.

The implication for businesses aspiring to become sustainable enterprises is that they need to be actively looking for ways to encourage collaboration, both within and outside the enterprise. Introduction of collaboration technologies and participation in industry-wide initiatives can play an important part in achieving this.

In summary, the evidence of our research indicates that sustainability will remain an important business issue, both throughout the downturn and beyond. Companies that fail to act risk being left behind, whereas there are significant opportunities for those that get ahead of the game.

The report follows the below structure:

- In section 1, we summarise our respondents' views on the impact of the economic crisis on their sustainability initiatives.

- In section 2, we take a closer view of the four key themes of product and process innovation; informing the consumer; organisation and accountability; and external collaboration, drawing out the implications for businesses and other stakeholders.

- In section 3, we summarise our conclusions, in particular focusing on specific actions businesses should be taking as they look forward to the end of the downturn.

We would like to thank all those who have contributed to this report and trust that you will find it helpful as you continue the journey towards becoming a wholly sustainable enterprise.

Business attitudes to sustainability in the current economic climate

The economic downturn has led to a focus on rapid payback initiatives, but forward-looking firms are already starting to plan for the recovery.

Sustainability issues have become more important during the economic downturn

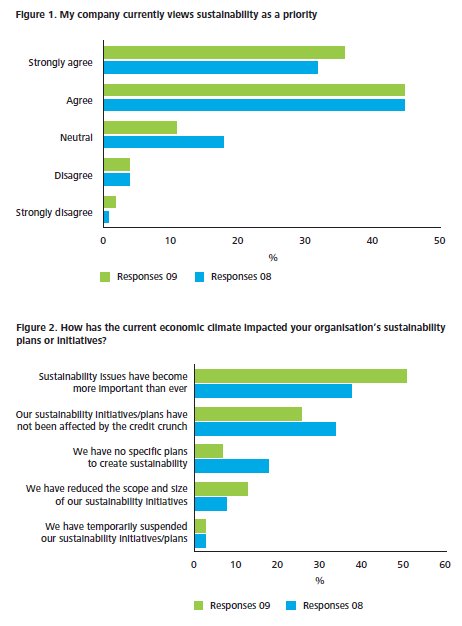

Sustainability is still very much on the CEO agenda of the organisations we surveyed. More than that, the proportion of respondents who agreed or strongly agreed that their company viewed sustainability as a priority actually rose between the two survey points, from 77% in 2008 to 83% in 2009. In contrast, those who disagreed that sustainability was a priority for their firms represented a very small and declining minority of about 5% of the population.

Furthermore, when questioned about the specific impact of the economic downturn, over half of those surveyed in 2009 responded that sustainability issues had actually become more important, with a further 26% claiming that their plans had not been affected. However, the proportion claiming to have reduced the size and scope of their initiatives has jumped from 8% to 13% over the past year.

The downturn means companies have focused on initiatives delivering rapid ROI

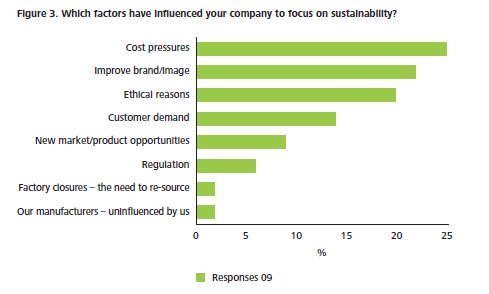

The biggest single driver of firms' sustainability initiatives was the potential to drive cost out of the business in response to ever-increasing pressure on margins. However, it is clear that firms are also concerned with their brand image and reputation in the marketplace, and also that many business leaders feel that for ethical reasons this is "the right thing to do". So, it would be to misrepresent the truth to say that firms are primarily doing these initiatives to save cost or, even more cynically, repackaging cost-saving initiatives as "green". We have found little evidence of this being the case. Having said this, there was evidence from our interviews that companies were reappraising initiatives which either did not deliver tangible financial benefit, or which required significant capital investment and had a long payback period. We believe this is the reason for the jump in the number of firms reducing the scope and size of their initiatives.

Preparing for the upturn?

Whilst it is hardly surprising to find that firms are focusing more on initiatives with rapid payback, given that many are engaged in a fight for survival and have been suffering from limited access to capital. The signs are that as the economy picks up, many firms will start to look again at other, longer term initiatives which do not deliver due to the other drives shown in Figure 3, like the need to improve the firm's brand or image, ethical reasons and consumer demand. After analysing the findings from the survey and the qualitative interviews, we believe we have identified four, interconnected themes which companies are focusing on as they look to develop their longer term sustainability strategies. These are: product and process innovation; engaging and informing the consumer; collaboration and organisation and accountability. Our belief is that companies who focus on these four areas, and understand the connections between them, will be those who in future are recognised for embedding sustainability at the heart of their strategies. Our further belief is that these firms will be among those who emerge from the current downturn best placed for future success.

Radical innovation

Most individual firms are focused on innovation to drive incremental improvements. The challenge is whether this will deliver the step change required to address the environmental challenges we face.

"Breakthrough thinking is needed to adapt existing operational strategies and to develop new supply chains that achieve sustainability goals while still optimising cost and service levels." (Sustainability for Tomorrow's Consumer, 2009)

There is growing evidence of the scale of the task we face in rising to the sustainability challenge. With 70 million people a year joining the global middle class, the growing demand placed on our limited natural resources is very quickly going to outstrip supply. The consumption habits of the UK would simply not be sustainable if adopted globally. The recent volatility we have seen in energy costs is just a foretaste of what is to come unless we are able to radically change our habits.

Given the trend we have already discussed, of companies focusing on short-term, incremental improvements during the downturn, it was important to test to what extent our respondents agreed with the imperative for radical innovation. The results showed a remarkable level of support, with 88% agreeing or strongly agreeing that this was key to success.

Although this level of support is encouraging, it is less clear what our respondents meant by 'radical'. Certainly, in our interviews there were plenty of good examples of highly innovative practices.

Examples included: a consumer products company considering the use of "cattle grid" rollover technology to generate energy from traffic entering and exiting its premises; evaluating energy efficient depots, requiring significant capital expenditure and evaluating changes in logistics processes to save distribution miles. All of these were excellent examples of innovative practices, requiring varying levels of capital expenditure and with different levels of ROI.

However, what is clear is that the impact that a single enterprise acting alone can only achieve limited impact. Truly radical innovation will require firms to redefine the relationship with their consumers, creating new value propositions for a "dematerialised" world. Such a mindset change can only be created by a more collaborative approach, by firms, even competitors, working together. We believe that the sustainability leaders of tomorrow will be those who collaborate best today with multiple stakeholders, including customers, suppliers, competitors, industry bodies, regulators and pressure groups.

In summary, our survey supports the view that the sustainable enterprise will increasingly have excellence in innovation as a core competence. That means it will have the ability to engage with its employees and external stakeholders, identify good ideas and implement them quickly. It will have good governance processes, to ensure that resources are allocated to the right projects, supported by technologies that both promote collaboration and manage project portfolios.

Conclusion

Businesses that are serious about sustainability should look at their innovation processes, from generation of ideas, to project governance and portfolio management tools.

Key questions:

- How quickly can we implement a change to existing processes?

- How quickly can we launch a new product?

- How much do we waste on projects that never get implemented?

- How good are we at generating new ideas by engaging with internal and external stakeholders?

Engaging with the consumer

The consumer remains confused about sustainability and the impact of the choices they make. Businesses that engage with consumers most effectively will be tomorrow's winners.

"Businesses tend to respond to consumers – if consumers change, then businesses will change. The challenge for business is to know when best to anticipate consumer behaviour and lead accordingly, and when to follow existing trends." (Sustainability for Tomorrow's Consumer, 2009)

Shoppers' increasing tendency to take into account the green credentials of products when choosing what they put in their baskets has been a growing trend in recent years. Consumer products companies and retailers are well aware of this and have been developing new products and practices in response to it. One of our interviewees from a well-known not for profit environmental group commented that "businesses have been approaching us more in the last five years. Consumer opinions around fair trade and sustainability are causing changes in the way businesses behave."

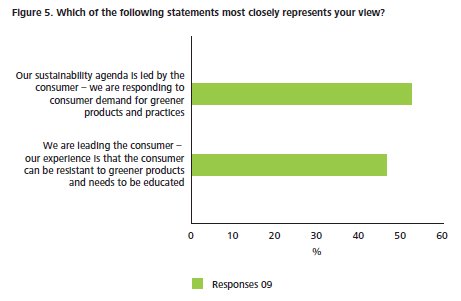

However, when we asked businesses who they felt was leading the agenda, the business community or the consumer, opinions were divided. Whilst a small majority felt the consumer was leading, a substantial minority believed that consumers needed to be educated and could be resistant to the introduction of new products which, for example, required a change in behaviour. Figure 5 summarises our respondents' views.

Our face to face interviews found support for both sides of this argument but, in our judgement, the leading companies were those which were setting the agenda, not waiting for the consumer to drive it. A director in a leading FMCG logistics function commented that "consumers are not driving change. They can't change fast enough for us."

This suggests two things. First, whilst there is a substantial and growing minority of shoppers who care enough about sustainability that it influences their choice of product, the majority of shoppers do not fall into this category and make their choices based on other criteria.

Deloitte research suggests that the proportion of shoppers who actively seek out environmental information about products before making their selection is about 17% (Exploring the third dimension, 2009). The implication is that the majority shoppers are not actively seeking this information and may be harder to influence. Secondly, there is growing evidence that those shoppers who do actively seek out environmental information are often confused by the plethora of information and different labelling standards in use, not to mention the complex trade-offs that exist between factors such as food miles, production methods, and fair trade, amongst many others.

Our survey lends further weight to this argument. We specifically asked our respondents for their views on whether current labelling standards were confusing for the consumer. 67% either agreed or strongly agreed with this statement.

The Exploring the third dimension report also makes clear the likely role of technology in delivering information to shoppers that cannot easily be communicated on a label, for example via mobile phone, smart carts in store and other methods. We believe that there will be increasing opportunities for consumer goods companies and retailers to communicate and educate their consumers over the coming years, and those who exploit this technology effectively are most likely to win in the marketplace.

Conclusion

The onus is on the business community to help the shopper make clear choices by doing a much better job of engaging, educating and informing them than is currently the case. Industry standards bodies, such as GS1, have a role to play in this by supporting the development and adoption of clear standards, which make it easier for shoppers to compare products when making a choice.

Key questions:

- How good a job do we do of engaging with and informing our consumers?

- Are we waiting to be led by the consumer, or are we actively trying to educate, influence and lead?

- How clear is the sustainability information we include on our labels?

- Are we keeping up to date with the development of emerging standards?

- What role is there for technology in better communicating information?

Collaboration

Working together can not only reduce end to end supply chain costs, it can also introduce sustainability.

"Breakthrough thinking is needed to adapt existing operational strategies and to develop new supply chains that achieve sustainability goals while still optimizing cost and service levels. This thinking will require additional collaborations upstream and downstream in the value chain with both existing and indirect partners." (Sustainability for Tomorrow's Consumer, 2009)

The case for increasing collaboration between organisations as a precondition to achieving a step change in UK business' response to the sustainability agenda is growing, based on the following arguments:

- Most companies, particularly SMEs, do not have the scale to influence the changes in consumer mindsets which are required to drive real change.

- Supply chains are by their nature collaborative. In order to develop new, sustainable supply chains, collaboration between upstream and downstream trading partners is a pre-requisite.

- The drive towards common industry standards and clearer labelling is only achievable via collaboration with industry bodies and standards organisations.

- Collaboration allows the sharing of risk between several parties.

- The goal is radical innovation. Businesses need to recognise that they do not have a monopoly of good ideas, they need to engender a culture which enables innovative ideas to be captured from a variety of sources, both internal and external to the organisation, including: consumers and shoppers; employees; customers; suppliers; industry groups; even competitors. Equally, businesses will sometimes need to be prepared to share ideas with others.

Some companies will find this more difficult than others. Some have a "not invented here" mindset, and are more protective of information than open to sharing it with others. These companies will need to make a cultural shift if they are to make a real contribution to sustainability.

In our survey, we asked companies which third parties they were collaborating with to achieve sustainable supply chains.

Perhaps not surprisingly, collaborative relationships with suppliers and sub-contractors were the most commonly reported. Perhaps more surprisingly, less than 40% of our respondents said that they were working with their customers on sustainable supply chain initiatives, and only 15% said that they would like to do so in future. This indicates an area of potential improvement since there is no doubt that the major retailers in particular have a hugely important responsibility in driving the sustainability agenda forward. Logistics providers are another category where there seems to be considerable scope for improvement, with only 40% of our respondents saying they were collaborating with them, and a further 24% saying they would like to do so.

We also note that, outside the direct participants in the supply chain, there is relatively little collaboration with other parties such as government, industry bodies and associations. Again, we feel that there is considerable scope for improvement here. IGD's sustainable distribution initiative, which saw 37 UK food retailers and manufacturers working together to save food miles and diesel consumption, is a good example of the role industry bodies can play.

Although our survey did not specifically ask whether companies were collaborating with competitors, we are aware of several notable examples of leading companies who are doing just that, for example collaborating in the distribution of competing products to reduce both overall food miles and costs for both parties. This seems to us to be the mark of a mature organisation, which has already made the mindset change we referred to earlier. Another characteristic of leading organisations is that they are not satisfied with the progress made to date and want to drive further improvements. But as one interviewee told us: "collaboration is the necessary ingredient to take it further and become more sustainable. 20% of trips are still empty and 'full vehicles' only have perhaps 60% full cube."

Conclusion

There is still much to be done in the area of collaboration. Whilst we believe that the idea of collaborative distribution is quite widely accepted, and starting to gain traction, collaboration in other areas such as product innovation and engagement with the consumer is less well established. Many companies say they are collaborating, but principally they seem to mean with their immediate trading partners in the supply chain. It appears to us that the leading companies of tomorrow will be those who actively promote a culture of collaboration across the whole organisation, who actively participate in industry forums, who are constantly looking for ways of working with such diverse organisations such as environmental lobby groups, not for profit organisations, technology vendors, standards organisations and even competitors. Those who believe in a "not invented here" mindset will find themselves increasingly marginalised and unable to make a meaningful contribution.

Key questions:

- Do we have a culture of collaboration? If not, how do we go about creating one?

- Can we collaborate more effectively with our trading partners, particularly our key customers?

- Do we participate as much as we should in industry bodies, special interest groups and other bodies outside our immediate supply chain?

Organisation and accountability

Accountability for sustainability should rest at the CEO level. Responsibility for sustainability should be woven into all levels and operations.

Sustainability requires a strategic response. From the three imperatives we have already discussed, radical innovation; engaging the consumer and collaboration, it is clear to us that these are themes which cut across all functional areas, and which will require a fundamental culture shift in many organisations.

Market leading firms have long since recognised that core business models must adapt to the sustainability challenge. There is agreement amongst these firms that these initiatives need to be led from the top if they are to succeed. As noted by one leading industry figure, "the best organisations operate sustainability from the top and there is a very clear resource dedicated to the sustainability issue."

In our survey, we asked who owned the sustainability agenda in our respondents' companies.

In both the 2008 and 2009 surveys, the responsibility for the sustainability agenda was found to lie primarily at the CEO level, and the trend seems to be growing. One interviewee suggested that it was the fuel crisis of 2008/9 that first acted as a catalyst, providing a number of sustainability initiatives with a boardroom visibility they had not previously enjoyed. However, the proportion of companies where the CEO is responsible is still only around 50%, suggesting to us that there is still a large number of companies who have yet to fully grasp the strategic nature of the challenge. More positively, we were pleased to note that the proportion of respondents who did not know who was responsible for sustainability in their companies had halved from 11% to 5% in the year between the two surveys.

Although accountability should ultimately rest with the CEO, responsibility for sustainability should permeate every level of the business. Indeed as one of our interviewees said, "it is key if you're going to have results, to spread the responsibility through the organisation, and give people ownership for their part of the jigsaw."

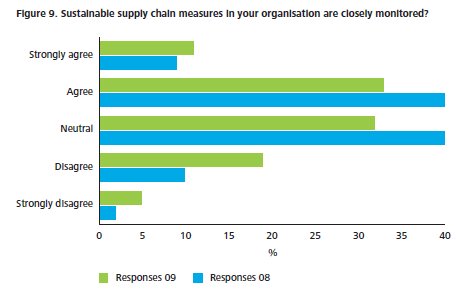

Sustainability should be supported by appropriate KPIs

Discussions with sustainability leaders revealed that a top-down approach to sustainability should be supported by a well-structured monitoring programme. Key performance indicators and targets are needed to provide a focus on achieving results.

One interviewee commented that "we have an environmental organisation. Warehouse managers are held responsible for their own waste. The transport team has a sustainability plan. Each section of operation has a sustainability plan. It is an integral part of the company's KPIs."

However, our survey indicates that there is still room for improvement in this area, with only 44% agreeing or strongly agreeing that sustainability KPIs are closely monitored, which is a small decrease since 2008.

Engaging employees in culture change

Many of those interviewed commented that employees were easier to engage in sustainability initiatives than they had expected. The majority of staff had a natural interest in the environment, and when engaged appropriately were natural supporters. Additionally, there is growing evidence that being recognised as a sustainable business is important in attracting top talent. In this way, a virtuous circle can be achieved, with some businesses becoming recognised externally for their sustainability credentials attracting the brightest and most committed to contributing to further improvements.

Conclusion

Given the strategic nature of this issue leading companies will have clearly defined ownership at the CEO level, whilst looking to permeate responsibility throughout the organisation. They will have implemented a series of KPIs in order to provide focus and will closely monitor performance against those KPIs. By engaging their entire workforce, they are creating a powerful driver for change, and the ability to attract talent into their organisations.

Key questions:

- Have we clearly allocated accountability for sustainability at the top of the organisation?

- Have we distributed responsibility throughout the different organisational layers?

- Have we implemented KPIs and are we using them to monitor progress?

- Have we engaged the whole workforce?

- What is our reputation as a sustainable organisation? Are we recognised as such by the talent we want to attract?

Concluding thoughts

Sustainability is a key strategic issue for all businesses. Organisations that choose not to respond to this agenda will find themselves increasingly at a competitive disadvantage and will become marginalised.

"Companies that take the lead on sustainability will be market makers rather than market takers". (Sustainability for Tomorrow's Consumer, 2009)

It is clear from our research that despite troubled economic times the sustainability agenda is here to stay. Sustainability benefits associated with supply chain efficiency and operational improvements are well established in leading retail and consumer product companies. Businesses that choose not to respond to the sustainability challenge will find themselves increasingly marginalised. Sustainability is no longer a "nice to have" but a "must have".

The four themes we have discussed together set out a strategic change agenda for companies wishing to respond to the sustainability challenge: radical innovation, engagement with consumers, external collaboration, reinforced by clear organisational accountability and KPI framework. There are many interconnections between these themes, and for us the goal of achieving a truly collaborative culture is somewhere near the heart of the agenda.

It may seem a daunting challenge. However, during the course of our research we have come across many companies who have made significant progress along this journey. They have told us that they have found it surprisingly easy to effect significant cultural change, because of the importance of the issue, which affects all of our futures. We believe this should give encouragement to other companies who are only just starting their journey.

Methodology

This research is aimed at understanding how attitudes and initiatives towards sustainability have been impacted by the global economic downturn.

Deloitte and GS1 UK developed two linked surveys that would generate an understanding of how the attitudes of businesses towards sustainability have changed over time, framed against the background of the recent global economic downturn.

The first survey was launched in May 2008 to over 19,000 different organisations, consisting of Small and Medium Enterprises (SMEs) representing a broad cross section of consumer goods businesses.

The second survey was launched in April 2009, targeting the same organisations as the first survey. Additional questions were included in the second survey in response to emerging themes from the interviews. In total, 762 organisations responded to the survey over two years.

In parallel a number of qualitative interviews were conducted with senior supply chain and sustainability leaders at global consumer goods companies. These generated insight into the organisations approach to the sustainability agenda and how their approach has evolved in the face of the credit crunch.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.