WE ALL BREATHE AGAIN – BUT FOR HOW LONG?

The PBR did not affect farmers and landowners in the way some

thought it might.

The Chancellor announced his Pre-Budget Report (PBR) on 9 December. Focusing on the positives, farmers and landowners can breathe easily again; for a while, at least.

A wealth tax was rumoured, and although the inheritance tax (IHT) nil rate band for 2010/2011 now remains at the current level of £325,000, this is a minor irritation compared to the worry that IHT could be increased to 50% on £1m+ estates. More importantly, no changes to agricultural property relief or business property relief were made, and the capital gains tax (CGT) rate remains at 18%.

However, it would be dangerous to relax too much, and the key message must be to start planning now for the tax year ahead.

Other key points

- The small companies corporation tax rate, which was to increase in 2010/2011 to 22%, will remain at this year's 21%. This is welcome, although there was unfortunately no help announced for businesses making short-term losses.

- The real sting in this PBR was the unexpected additional increase to National Insurance. The extra 0.5% (now a full 1% from 6 April 2011) applies to both employees' and employers' contributions, therefore a total increase of 2% will apply to those drawing a salary from their own company.

- The previously announced changes to furnished holiday lettings (FHLs) from 6 April 2010 have been confirmed. Anyone with an FHL should review opportunities under the existing rules prior to 6 April 2010, particularly if contemplating a sale. Think about extra services you can provide to change the service from lettings to a 'hotel service' to keep the activities as trading. " The PBR has increased a number of green measures, particularly in relation to offshore wind projects. There was a further £400m allocation to support business investment in low carbon initiatives and help households reduce energy costs.

- VAT, will, as expected, return to 17.5% from 1 January 2010.

Smith & Williamson has produced a full commentary to the PBR. This is available on our website: http://www.smith.williamson.co.uk/pre-budget-report

ELS RENEWALS

The five-year ELS agreements are due for renewal in 2010. We outline the key actions required.

In 2010, nearly 14,000 Entry Level Stewardship (ELS) agreements will come up for renewal. Natural England (NE) has a target of 70% of the Utilisable Agricultural Area (UAA) in England to be under an environmental agreement. The area currently in schemes is just under 66%. Therefore, just to keep levels where they are, never mind increase them to the target figure, a high proportion of those ELS agreement holders will need to resign. NE hopes to get a renewal rate of around 90%.

There is a question mark over whether this rate will be achieved. The ELS has changed since it was launched in 2005, when the agreements now ending were entered into. Significantly, the loss of management plans will make it more difficult for many businesses to reach the 30 points per hectare (Ha) total. Furthermore, for those considering renewing their agreement, the fact that the scheme has changed means that they will not be allowed to simply 'tick a box' to sign up for a further five years. They will have to complete a new application form and submit associated maps.

All existing agreement holders with an ELS agreement expiring in 2010 will be sent a letter (if they have not already) stating their agreement is due for renewal. A reply card and envelope will be included. The card will ask a number of questions – 'Do you wish to renew your ELS agreement?', 'Will you be renewing using ELS online?', 'Will an agent be handling your renewal?', and 'Has you landholding changed since 2005?'

In February 2010, application packs will be sent out together with new Environmental Stewardship handbooks (3rd edition). Those that indicate they will be using ELS online will be sent log-in details rather than the normal paper application forms. ELS online includes a measuring tool and automatically calculates points. For more information, e-mail els.online@naturalengland.org.uk

The application pack will also include the final claim form for the existing agreement. To prevent any gaps between agreements, both the claim and new application must be submitted to NE two months before the start of any new agreement.

Farmers in Wales and Scotland should be receiving their SP as we go to press, while the RPA expects to make 75% of their payments by 31 January 2010.

2009 SPS conversion rate and regional area payments

The European Central Bank's official exchange rate on 30 September is used to convert Single Payments (SP) from euros to sterling. This year's rate was fixed at €1 = 90.93p; a 15% increase on last year and the most favourable rate since the Single Payment Scheme (SPS) started in 2005. The table shows previous rates.

Most UK farmers will receive a larger SP this year, even though modulation increases slightly between 2008 and 2009.

SINGLE PAYMENT SCHEME NEWS

Actual payments are currently being calculated in Scotland and Wales for 2009, with payments starting to be sent to farmers from December.

Due to the SP system in England, the Rural Payments Agency (RPA) has to calculate the regional average rates (RAP) from scratch each year. Table 2 shows the RAP for 2009 and previous years as a comparison. The regional rates in the final column are the Ha payments on former set-aside entitlements, or on any normal entitlements that don't have history within them.

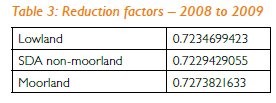

For 2009, the historic element within entitlements drops to 40% of claimants' reference amounts rather than the 55% used last year. The 'reduction factors' for the 2009 scheme are published in table 3. You cannot simply apply a reduction factor of 0.7272727, (40/55) as the total historic element paid in all entitlements is capped at 40% of the regional ceiling.

Andersons, the Farm Business Consultants, have calculated the net payment for the 2009 SPS on a hectare of arable land* should be £242.04. (*assumes arable area payments were claimed on all years during the 2000 to 2002 reference period). This compares to a payment of £215.72 in 2008 – a sizeable improvement.

For those who farm within the livestock sector, or would like a more accurate view of their SP for 2009, these rates are used as follows.

- Take the 2008 entitlement value and subtract the 2008 regional element (i.e. €141.93 in the English lowland). This gives the historic element within the 2008 entitlement.

- Multiply the historic element from 2008 by the reduction factor outlined above to get the 2009 historic element.

- Add the 2009 regional rate (€190.47 in the lowland) to the 2009 historic element; this produces the 2009 normal entitlement value.

- To get the final sterling payment, it is then necessary to convert at €1 = £0.90930, and take off the 19% deduction for modulation.

To calculate the total SP value for 2009, remember to include any proteins or energy crop payments. There is a complication if there is an element of sugar compensation in the entitlements; we will not attempt to outline the calculation process here as it becomes very involved.

The RPA's payment targets are similar to last year, i.e. to make 75% of payments by 31 January, and 90% by 31 March 2010.

Minimum claim size and crop-supplement payments

From 2010, the minimum claim size eligible for the English SPS will be 1 Ha. Until now, the minimum claim size has been 0.3 Ha. The new size is a result of the Health Check, which allowed member states to limit the number of very small applications under the scheme.

The Welsh Assembly Government has also agreed a 1 Ha minimum, but Scotland has broken the consensus and gone for 3 Ha. This is to align it with the minimum Less Favoured Area Support Scheme (LFASS) claim size.

The Department for Environment, Food and Rural Affairs (Defra) has also announced the future of the protein crops supplement. This will continue at its present rate of €55.57 per Ha for the 2010 and 2011 scheme years. It will then disappear for 2012, with the money going into the pot for the flat rate payment. The Nuts area payment will be treated in the same way.

Reminder

The 2009 year was the last for the energy crops supplement.

FBI RESULTS

Most farm types realised an increase in FBI for the year to February 2009.

Defra has released its latest Farm Business Income (FBI) results. The figures run for the period March to February, covering the 2008 harvest and including the 2008 SP.

Average farm business income for all farm types increased marginally to £50,900 compared to £49,800 (in real terms at 2008/09 prices) in 2008, although this figure masks a large variation between the different farm types.

The table illustrates the average FBI by farm type. Just about all the different farm types realised an increase for the year ending February 2009. This is due to an increase in the SP through a more favourable exchange rate compared to the previous year and, although input costs were a lot higher, the better prices for most commodities, particularly in the beef, lamb and pig meat sectors more than offset these.

Specialist pig enterprises saw the biggest year-on-year increase, albeit from a very low base. Firmer livestock prices have meant grazing livestock farms, both in the LFA and in the lowland saw large percentage increases compared to a year earlier, although again these were from a relatively low base. Firmer milk and cattle prices resulted in better FBI for dairy farms, with output more than offsetting the increased feed and fertiliser costs.

Of those farms which are cropped, cereals farms saw a fall in FBI while general cropping farms experienced a year-on-year increase. Both enterprises had a significant increase in output as the abolition of setaside and increased prices realised from the previous harvest encouraged larger plantings. But considerable increases in machinery running costs and other variable costs more than offset the increases in output on cereal farms. Inputs on general cropping farms increased, but to a lesser extent resulting in an overall increase in FBI by 14% (in real terms at 2008/09 prices).

FBI figures are based on results from the Farm Business Survey. FBI represents the financial return to all unpaid labour (farmers and spouses, non-principle partners and their spouses and family workers); it is the same as net profit.

EID UPDATE

Key rule change to save millions for the sheep industry

New rules for the New Year – the EID rules come into force on the last day of the year.

On 31 December 2009, the new electronic identification (EID) rules for sheep come into force. Since the summer edition of the Agricultural Bulletin, the industry has managed to secure a key change to the rules. The change will allow electronic tags to be read at approved central recording points such as markets and abattoirs, instead of on-farm.

The rule change is expected to save the UK sheep industry £7m to £18m each year. The change will mean that where the number of animals is too large to allow manual reading, farmers will be able to have their electronic IDs read at a central recording point and the information sent back to them, instead of having their own readers.

Farmers will be required to electronically identify all sheep born after 31 December 2009. They will not have to electronically identify those that were born before 31 December that are already tagged. Furthermore, under the slaughter derogation, sheep that are intended for slaughter at less than 12 months of age do not need to be electronically identified; but this could potentially cause a lot of work.

Under the new rules, where a batch of sheep is moved off the holding, the flock register must record the number of animals from each original holding. However, if the lambs were bought as stores from a number of holdings this could prove difficult. Currently, producers only have to record the total number of animals in the batch. In this scenario each tag will have to be read; where large numbers are involved this would be very time consuming.

With the new rule allowing central reading points, Defra has consulted with stakeholders whether to introduce a single electronic 'slaughter' tag as a voluntary option, alleviating some of the burden described above. This would mean that when handling large numbers of sheep no manual reading of the tags would be required. An electronic slaughter tag would cost more than a normal tag but less than a full electronic identification tag. It will be up to farmers to decide which to use, depending on the market at which they are aiming their livestock. Some farmers may be reluctant to buy lambs without electronic tags due to the increased work.

A further benefit of central point recording will be realised from 1 January 2011. From this date, movement documents will need to contain individual identification for each sheep. Again, this would be very time consuming and mean that in the case of high numbers of sheep an on-farm electronic reader would be required, but with central point recording the individual numbers can be sent back so that the flock register can be updated.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.