WELCOME

As another year draws to a close, now is a good time to reflect on 2009 performance before looking ahead to the New Year. And what a year it's been! After the collapse of the global financial markets in the summer of 2008, 2009 brought with it many 'doom and gloom' headlines. Soaring unemployment, the greatest recession post Second World War and the outbreak of the H1N1 influenza virus to name just a few. The tourism industry worldwide felt the impact of the crisis with many consumers choosing the "staycation" over travelling abroad and businesses tightened their purse strings on all types of costs including corporate travel. As a result, hotels, airlines and tour operators all saw a fall in performance and sales this year.

However, as the autumn leaves fall so it is time to say goodbye to the "annus horribilis" and look forward to the New Year ahead. We are already seeing signs of new shoots. In Europe, consumer confidence is improving and a number of countries appear to have closed the door on the recession. The double-digit declines in revPAR across hotels in the region is starting to ease and although the next few months will be an uphill struggle for many hoteliers, it looks like the worst may be over and the New Year is sure to bring new opportunities.

I hope you find this European edition of Hospitality Vision useful and as ever, we value your feedback.

Best regards

Marvin Rust

Global Managing Partner, Hospitality

HIGHLIGHTS

Spanish revPAR fell 21.1% year-to-September and the tourism industry suffered a 19% drop in the number of Britons visiting in the first six months of 2009.

RevPAR fell 16.8% across the euro zone as all countries witnessed double-digit declines.

Ireland's 22.8% revPAR drop was the worst country-wide fall in the euro zone. Dublin saw a 23.9% decline.

Drops in European consumer confidence decelerated in the third quarter of 2009, down 19.2% (first quarter, down 31.3%).

Despite the 'staycation effect', UK hotels saw revPAR drop 10.5%, but London hoteliers still command the highest occupancy levels in Europe at 79.8%.

German revPAR fell country-wide by 12.0% to €47, the joint lowest (with Portugal) in the euro zone, but average room rates are also the lowest at €79.

Moscow suffered a 30.5% decline in revPAR, making it the worst performing city outside the euro zone, but Dusseldorf had the worst fall in Europe overall, with 33.3% revPAR decline.

Venice achieved the highest average room rates and revPAR results in the euro zone at €261 and €153 respectively.

Paris recorded the highest occupancy in the euro zone at 74.0% and the second highest revPAR and average room rates after Venice.

Glasgow and Edinburgh were the only cities in Europe to show positive occupancy growth and Edinburgh posted the second highest occupancy in Europe at 76.8%.

Eastern European countries such as the Czech Republic, Estonia, Latvia, Lithuania, Romania, Russia and Slovakia were hit the hardest, each reporting revPAR declines in excess of 20% in local currency.

Latvia was the worst affected with revPAR falling 42.0%.

According to the World Tourism Organisation, tourist arrivals to Europe fell 8.4% year-to-July 2009.

GREEN SHOOTS?

The past year has been one of turbulence for Europe as the economic crisis has taken its toll. With the world facing one of the most severe recessions since the Second World War, the tourism industry – usually resilient to many adversities has been seriously impacted.

As unemployment swept through Europe, consumer confidence tumbled 31.3% during the first quarter of 2009. Purse strings were drawn tighter and demand for business and leisure travel fell. According to the World Tourism Organisation (UNWTO), tourist arrivals to Europe fell 8.4% year-to-July 2009 as people chose to cancel or postpone previously made travel plans. The outbreak of the H1N1 influenza (swine flu) in April, dampened demand further in a number of European countries.

The strength of the euro against sterling and US dollar has also affected travel demand. The Spanish tourism industry – heavily dependent on the UK source market – suffered a 19% drop in the number of Britons visiting in the first six months of 2009. Major European cities such as Paris and Rome have also felt the absence of British and American tourists.

Although mixed summer weather did little to improve prospects, green shoots of recovery have begun to sprout across Europe in the second half of 2009. The continent's two major economies Germany and France have moved out of recession. Both countries reported gross domestic product (GDP) growth during the second quarter of the year, boosted by stronger consumer spending, export growth and government stimulus packages.

Despite this good news, the euro zone as a whole was still in recession with GDP falling 0.2% during the second quarter of the year. Since then, Greece, Poland, Portugal and the Czech Republic have also emerged from recession, which confirms that recovery, albeit slow, now appears to be underway. Consumer confidence across Europe has also improved with a 19.2% decline in the third quarter, still in negative growth territory, but less severe than at the start of the year.

Declines in monthly air travel have also started to ease according to the latest data from the International Air Transport Association (IATA). In August 2009, European passenger demand fell 2.8% compared to the prior year, an improvement from the 3.1% drop recorded in July.

The fall in premium seat sales on international routes is also slowing sharply, which correlates with the improving prospects to world trade over the summer. However demand is still weak and there is a lot of competition between airlines to lure back these premium travellers.

With three quarters of results, this report takes a look back and reviews hotel performance across Europe in 2009 to date. We look at the cities that have suffered during the economic downturn and search for the shining stars amid the gloom.

DOOM AND GLOOM FOR HOTELIERS?

Around the world, hoteliers felt the effects of the economic crisis during 2009, with all regions reporting double-digit revenue per available room (revPAR) declines year-to-September.

Europe suffered the sharpest fall worldwide in US dollar terms, with revPAR plummeting 27.1% to US$80. In Euros the decline was less severe but still fell 19.2% to €58, knocking €14 off absolute revPAR. Despite this loss, Europe still reported some of the highest occupancy and average room rates in the world, securing second place behind the Middle East as shown in table 1.

Table 1. Global Hotel Performance – Year-To-September 2009

In And Out Of The Euro Zone

Hotel performance results from STR Global show most countries in Europe reported double-digit revPAR declines year-to-September as represented in figure 1.

Figure 1. European Country Performance Year-To-September 2009 (Local Currency)

The euro zone as a whole saw a 16.8% fall in revPAR, driven almost equally by drops in occupancy and average room rates, as seen in table 2. The strength of the euro against sterling in particular deterred travellers from the traditional European hotspots of Spain, France and Italy.

Table 2. European Hotel Performance – Year-To-September 2009

Countries outside the euro zone did not emerge unscathed either, with revPAR falling more severely, down 21.9% year-to-September. Average room rates led much of the decline here, down 15.8% to €92, and while occupancy also declined it remained higher than in the euro zone at 63.5%.

Eastern European countries such as the Czech Republic, Estonia, Latvia, Lithuania, Romania, Russia and Slovakia were hit the hardest, each reporting revPAR declines in excess of 20% in local currency.

Two years ago some of these destinations were enjoying an influx in tourist arrivals and were on many people's holiday wish-list, but they are no longer the cheap weekend breaks they once were. Combined with the economic crisis, many hoteliers have felt the heat. The worst affected country was Latvia, with a revPAR decline of 41.7%.

The Rain In Spain

Of Europe's top three holiday destinations, Spain has been hit the hardest, due to a fall in the number of tourists from its major source markets – the UK, Germany and France. Britons in particular have shunned the country as sterling weakened against the euro. Spain has also met intensified competition from countries further east including Turkey, Tunisia, Egypt and Morocco.

With revPAR falling more than 20% during the first nine months of 2009, Spain was the third weakest performing country in the euro zone, behind Ireland and Monaco. The country not only saw a decline in the number of international tourist arrivals, but the domestic market also contracted as the rate of unemployment soared to 18.9%, the highest in the euro zone.

Spain's two key cities Barcelona and Madrid both reported significant declines in hotel performance, with revPAR falling 22.5% and 30.5% respectively. The main driver of decline in Barcelona was a 15.7% fall in average room rates to €113, but occupancy also fell 8.1% to 64.4% year-to-September 2009.

Meanwhile, as demand falls, supply growth continues. A number of new hotels have opened so far this year, including the 262-room Diagonal Zero and the 473-room W Barcelona, the first W hotel to open in Western Europe. A wave of new openings in the pipeline over the next two years suggests that Spanish hotel performance may struggle for some time. The country has the second highest number of new hotels under construction in Europe with 63 hotels, equating to 7.669 rooms, according to Lodging Econometrics (LE), with 29 due to open in 2010.

US Travellers Give Italy A Miss

According to UNWTO, Italy saw a 4.4% decline in international tourist arrivals year-to-June 2009. Combined with the economic downturn (GDP in Italy is predicted to fall 5.0% in 2009), this led to the drop in hotel performance.

RevPAR fell 17.4% to €69 year-to-September 2009. Although occupancy dipped to 55% for the period, average room rates in Italy secured fourth place in the euro zone at €125, behind Monaco, France and Greece.

American tourists have been sorely missed. The US is Italy's largest and highest spending source market, but the number of visitors has been falling for the past few years, and this decline has been exacerbated by the weakness of the US dollar against the euro.

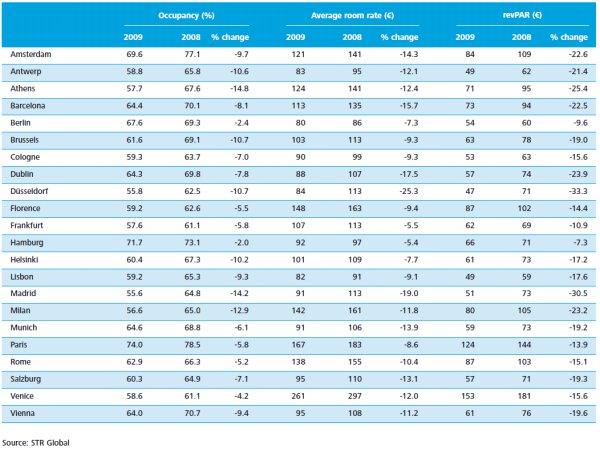

Florence, Milan, Rome and Venice all suffered with revPAR declines of more than 14.0% year-to-September 2009 as can be seen in table 3. Despite these declines, Venice was Italy's shining star with the highest average room rates and revPAR results in the euro zone at €261 and €153 respectively.

Table 3. Hotel Performance In Selected Euro Zone Cities – Year-To-September 2009

Tourism Favourite France Also In Trouble

France, the world's largest tourism destination, has suffered a 7.5% drop in visitors to 15.9 million for the first six months of 2009, according to the Paris Tourism Office. Dwindling demand, shorter booking times and pressure on average room rates led to a 13.9% revPAR decline in the capital to €124.

Despite this fall in performance, Paris still boasts the second highest absolute revPAR and average room rates (€167) in the euro zone after Venice. The 74.0% occupancy achieved catapulted Paris into first place in the euro zone and a comfortable third place across Europe as a whole, beaten only by London and Edinburgh.

To stimulate the French economy and lure more tourists back to the country, the French government has announced that businesses in Paris, Marseilles and Lille will be allowed to operate on Sundays, breaking a centuries old tradition. The new law permits shops, department stores and shopping malls to open in tourist zones. Whether or not this move will boost tourism revenues remains to be seen.

Germany Struggles Despite Quick Recovery

Germany was one of the first countries in Europe to exit the recession earlier this year, but tourism has struggled and hoteliers have felt the extent of the economic downturn. Country-wide revPAR fell 12.0% to €47, the joint lowest (with Portugal) in the euro zone, and average room rates were also the lowest in the euro zone at €79.

A slowdown in trade fair business, stagnating leisure demand and an increase in hotel supply in a number of cities led to a considerable variation of results across the country. Düsseldorf reported the largest fall in revPAR, down 33.3% year-to-September, while Hamburg, Berlin, Frankfurt and Cologne reported less severe declines. Germany's national airline Lufthansa recently announced a 7.4% reduction in its number of weekly flights during the winter months due to weaker demand, particularly on its intra European routes. Looking ahead however, as the economy in Germany improves during the latter part of 2009 and into 2010, business and leisure demand should gradually pick up.

Out Of Luck For The Irish

Ireland has been a huge growth market in recent years, with a strong economy and booming business sector. The Emerald Isle has been hit particularly hard by the credit crunch, with GDP expected to fall 7.0% in 2009 according to the Economist Intelligence Unit (EIU).

Tourist arrivals fell 10.4% during the first seven months of 2009 according to the Central Statistics Office Ireland. One of the key factors affecting performance was Ireland's reliance on the UK source market, which contributed 15% fewer visitors this year compared to last.

The capital Dublin suffered a 23.9% decline in revPAR year-to-September 2009 to €57. Although occupancy dipped to 64.3%, it was a 17.5% decline in average room rates to €107 which led much of the decline.

Tourism Ireland recently announced an €18 million autumn marketing campaign to promote the country to potential holiday makers, in an attempt to drive business during the final few months of this year and into next. The key markets targeted will be the UK, Europe and North America.

UK – Year Of The Staycation

The UK was at the heart of the financial crisis last year and, unlike some of its European counterparts, is still in recession. In Q2 2009 GDP was down 0.6% and fell a further 0.4% in Q3, the sixth successive quarter of decline, making it the longest and deepest recession in the UK since records began in 1955. The economic crisis has had a huge impact in the UK, with national debt hitting a record £801 billion in July. The unemployment rate reached its highest level for 13 years in summer 2009 and is set to rise further still through 2010.

Many cash strapped Brits have chosen to holiday at home. According to VisitBritain, 26 million people took 'staycations' during the first six months of 2009, a 14% increase on the same period last year. This rise was not only a result of the economic downturn. The strength of the euro against sterling made travelling to Europe more expensive for British travellers than in previous years. As a result, outbound travel from the UK fell 17%.

However, despite the staycation effect, hotels in the UK have been on a downward spiral for most of the year, with year-to-September revPAR dipping 10.5%, as business travel slumped and more domestic holidaymakers turned to self-catering and budget accommodation such as camping and caravanning.

The Road To 2012

Hoteliers in the capital reported better results than the UK as a whole, with London revPAR down 7.6% year-to- September to £90 as seen in table 4. Despite £9 being knocked off average room rates to settle at £113, London hoteliers still commanded the highest occupancy levels in Europe at 79.8%. According to LE, there are currently 20 hotels under construction in the capital, equating to more than 5,000 rooms, with nine of them expected to open next year. According to the latest forecasts from STR Global, hotels in the capital are not expected to report growth until the third quarter of 2010.

The new openings will represent an increase in supply in 2010 of approximately 2.2%.

Table 4. Hotel Performance In Selected Non-Euro Zone Cities – Year-To-September 2009

Scottish Hoteliers Fare Better Than The South

In Scotland, hotels in Glasgow and Edinburgh have fared better than their fellow hoteliers in England, reporting revPAR declines of just 1.1% and 4.2% respectively. Glasgow and Edinburgh were the only cities in Europe to show positive occupancy growth and Edinburgh posted the second highest occupancy in Europe at 76.8%.

With some of the lowest average room rates in the UK, Scottish cities continue to attract both corporate and leisure business. In September Glasgow hosted The Music of Black Origin (MOBO) awards, the first time they had been held outside London, offering a welcome boost to hoteliers in the city.

Oversupply In Prague

Hoteliers in Prague reported some of the worst revPAR falls year-to-September down 26.4% to CZK 1161. This was driven by declines in both occupancy and average room rates, down 13.7% and 14.6% respectively.

Prague has seen several new openings during 2009 totalling more than 900 rooms, including the Sheraton Prague, Clarion Congress, Kempinski Hybernská and the Buddha Bar hotel. This influx of supply, combined with a fall in the number of international tourist arrivals to the Czech Republic, has impacted hotel performance. As the recession subsides and some of Prague's key source markets such as Germany recover, the city's hotels should start to show signs of recuperation.

Moscow Growth Decade Comes To An End

The Russian capital, Moscow, has enjoyed strong revPAR growth for the last decade, during which a general lack of supply allowed hotels to push up average room rates.

This came to an abrupt halt this year when the economic downturn and decline in business demand drove occupancy down to 57.8% year-to-September, knocking RUB1711 (approximately US$60) off average room rates. The result was a staggering 30.5% decline in revPAR, making Moscow the worst performing city outside the euro zone.

A number of new hotels have continued to open including the 217-room Holiday Inn Moscow Simonovky in July, the 147-room Ibis Moscow Paveletskya in September and the 366-room Renaissance Moscow Monarch Centre due to open in February 2010. A number of other hotel projects have been cancelled or postponed due to the downturn which will certainly help existing hoteliers when demand picks up again. Despite this, the city remains one of the top five in Europe in terms of new projects in the pipeline according to LE which can be seen in Table 5.

Table 5. Top Five European Markets With The Most Hotel Projects

Turkish Delight?

The Turkish Ministry of Culture and Tourism has set out its goals for the next 15 years, aiming to position the country as a world-recognised brand and to propel it into the top five global tourism destinations, attracting 63 million visitors by 2023.

Although there are signs that the recession in Turkey has started to bottom out, the EIU estimates that GDP will shrink by 5.7% this year, before seeing growth return in 2010. Whilst international tourist arrivals have declined in many countries this year, Turkey has bucked the trend with a marginal rise of 0.8% year-to-August to reach 18.7 million visitors.

The largest source markets for Turkey include Germany, Russia and the UK. British visitors were the only source market to show growth year-to-August, up 12.4%, with Brits enticed by the value of Turkish lira against sterling, compared to the euro. Turkish Airlines increased their flight capacity from the UK to Turkey over the summer.

Year-to-September hotel performance has not fared so well. Istanbul revPAR was down 9.0% to TRY191, performed better than some of its European neighbours, but occupancy fell 11.0% so far this year, to 64.4%.

Nevertheless, as Istanbul prepares to be the 2010 European Capital of Culture and Germany – one of the country's key source markets – emerges from recession, the future looks promising for hoteliers across the country.

LONG ROAD TO RECOVERY

Signs of tentative recovery are on the horizon for many countries, but ripples from the economic downturn will continue to be felt across Europe. Some countries may see growth by the end of 2009, but this will not be enough to compensate for the losses seen so far.

The spectre of another outbreak of the H1N1 influenza still looms and could tip European economies back into recession as productive resource is taken out of economies and travel plans stall.

Consumers are leaving travel bookings to the last minute, partly due to continuing concern surrounding the job market and also in hope of picking up the best bargains. Business travel will also remain weak for some time to come, in line with tighter corporate travel budgets. Even as more European countries emerge from recession, it may take some time for business and leisure demand to bounce back and hoteliers to start reporting positive results once more.

As the year draws to a close, the picture is looking less bleak than at the beginning of 2009 though it remains clouded in uncertainty. European hoteliers face an uphill struggle to return to the strong performance growth seen in recent years, but the region at least appears to be moving slowly in the right direction.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.