Welcome to the September 2009 edition of the Insurance Market Update in which we focus upon issues in the general insurance industry. In this issue we are focusing exclusively on the motor insurance market.

Drawing on the key data contained in Deloitte's annual motor market survey, James Rakow examines historical profitability and premium inflation, the impact of the recession and the release of prior year reserves on profitability and asks whether this can continue. As always, we look forward to receiving your feedback; your views, comments and suggestions for future themes or topics are most welcome.

Are we there yet? – Outlook for the UK motor insurance market

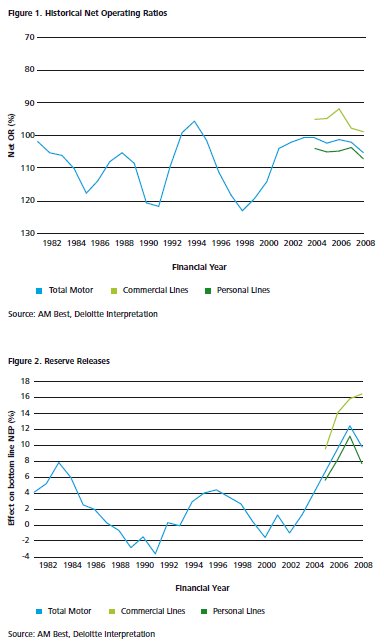

Based on the latest FSA returns, the operating ratio for the 2008 financial year, net of outwards reinsurance, was 105%. This was a deterioration of 3 percentage points from the result the market delivered in 2007.

Once again the £3 billion commercial motor market outperformed the much larger personal lines motor market, turning in an underwriting profit. The £9 billion personal lines motor market made an underwriting loss of 7p for every £1 of net premium.

Is the tank empty?

Those were the headline results for 2008 which take into account the results earned from the 2008 accident year plus the effect of adjustments made during 2008 for the business earned in previous accident years.

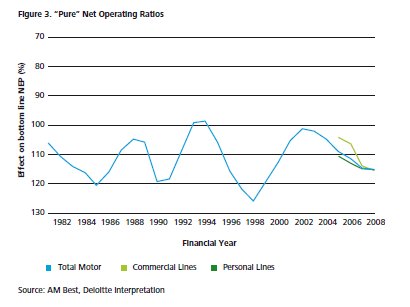

Whether by accident (through missing emerging trends) or by design (by the addition of prudential margins), over the last four years the bottom line of the UK motor insurance market has profited from an unprecedented level of support from its prior years with a total of more than £3 billion of prior year adjustments. Some of this comes from the natural release of planned margins added to the latest annual tranche of claims incurred.

But for the past two years many have expressed doubt that this level of support can continue – surely the tank must be empty now?

If only it was a simple exercise of looking at the petrol gauge. Insurers are currently under no obligation to disclose their prudential margins so the best that can be done is to look at proxy measures to assess whether the tank is running dry. One such measure is the amount of IBNR ('Incurred But Not Reported') provisions being carried by motor insurers at a market level. This IBNR pot is where many insurers place their prudential margins.

At the end of 2007, the market had close to £2.2 billion of IBNR equating to 25% of reported outstanding claims. At the end of 2008, this had dropped by £600 million to 18% of reported outstanding claims. This drop points to more modest and sustainable levels of reserve releases for 2009 and beyond.

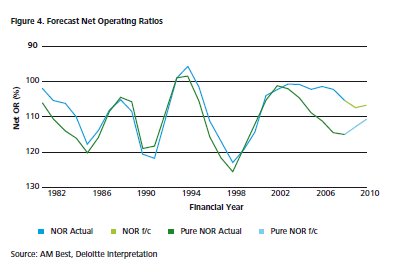

If you strip away the support from prior years which equated to 10% of the net premium earned in 2008, the resultant "pure" operating ratio for the market was 115%, identical to the pure result in 2007.

End of a bull run?

In our Quarterly Motor Insurance Report, which monitors insurers' rate movements, we have seen our index measuring premium inflation increase every quarter since the first quarter of 2007. This ended a period of three years starting in 2004 when our index measured hardly any increase in premiums.

Our index is based on quotes obtained for 1000 risks from a range of insurers. Since the bull run began in 2007, our index has increased by 20% taking the average premium from £450 to £540. One only needs to turn on the TV to see that the price comparison web sites are fighting fiercely for customers. Considering the UK consumer's hunger for seeking out a 'bargain', our premium index paints too rosy a picture.

The stark reality is that insurers who increase premiums in the hope of improving their results will often find that their customers simply move on to other insurers to get a cheaper premium. This market churn has meant that in spite of the 3-year bull run on premiums there are few signs that rate increases have been enough to turn the underwriting cycle – the headline net operating ratio is deteriorating and the pure ratio flat-lining.

These disappointing trends for insurers point to continued rate increases through to the end of 2009 and into 2010. If this is not the case, there seems little room for an optimistic outlook for the UK motor market.

Credit Crunch, Recession – where next?

The dials on the economic dashboard that insurers use to chart their course now point in directions that have never been seen before. Retail Price Inflation is now negative and the Bank of England Base Rate barely registers at 0.5%. Another benchmark, the yield on 3-year UK gilts, points to an additional pressure for motor insurance premiums to increase, as insurers seek to replace lost investment return with revenue from underwriting activity. For most of the decade prior to 2009, 3-year UK gilts had a nominal yield above 4% – currently the yield is close to 2%.

With the funds backing the technical provisions (claim and premium liabilities) of motor insurers being more than 150% of the annual premium, every percentage point lost from the investment return needs close to a 2% rise in premiums to compensate.

As the UK economy went into official recession, many looked in the rear view mirror to see what lessons could be learned from the last recession in the early nineties. We headed into that recession accompanied by rapidly rising theft claims for motor and household insurance. The cost of car theft to the insurance industry soared to an annual cost of over £500 million, representing more than 10% of premium.

A decade later, with the introduction of a number of measures such as improved vehicle security, motor theft claims now represent around 5% of premium. Many are fearful of what this recession may bring in terms of increased theft and fraudulent claims but it is undoubtedly the case that insurers have better management information and tools at their disposal than they did last time around.

Are we there yet?

The headline net operating ratio for the last 7 years has been close to 102%, dipping to 105% in 2008. In the past, results like this would have been considered as the best that one could hope for in such a competitive market and a clear indicator that premiums might begin to drop and the results deteriorate.

In the current market, we need to look under the surface of the headline result, at the result excluding reserve releases to understand why the market continues to seek premium increases. At 115%, even allowing for the fact that this figure is likely to contain some prudential margin, it is not a place where the market likes to be – many other indicators point to continued upward pressure on rates:

- reserve releases can't be sustained at levels close to £1 billion a year;

- the level of risk-free investment return is at an all time low; and

- price comparison sites continue to channel policy holders to the low cost providers, dampening the impact of rate increases.

All insurers will have in their plans where the motor insurance result needs to be in order for them to deliver the necessary return to their shareholders. Those insurers which produce results that are superior to the market average may not be far off this point. Insurers who are off the pace will be hoping that the bull run of premium increases continues well into 2010.

One plausible future

If insurers' current attempts, to put motor premiums up at a rate higher than claims inflation, are successful then we predict that the pure net operating ratio could improve from 115% in 2008 to 113% in 2009 and 111% by 2010. The long predicted reduction in the level of reserve releases must surely crystallise soon. If reserve releases are closer to a long term sustainable level of 4% to 6% of premiums then the equivalent headline operating ratio we might see in 2009 and 2010 would be close to 107%. Such an outcome would be disappointing to many insurers who would find that they had been pedalling very fast just to stand still.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.