2008 Was The Peak, 2009 Is Slowing, And The Forecast Is Challenging

The global aerospace and defence (A&D) industry capped off a record-setting five-year period in 2008, with strong growth in sales revenue of 7.9% to $595 billion and earnings of $54.2 billion1. However, the global economy slipped into economic turmoil in the fourth quarter of 2008, resulting in orders for new commercial aircraft dropping dramatically and business jet manufacturers entering a deep slump. The result was declining financial performance for the entire industry on average, which continued the negative trend into the first half of 2009. Military equipment spending, led by the U.S. Department of Defence (DoD), is moderating, and several weapons platform programs are being terminated or transformed.

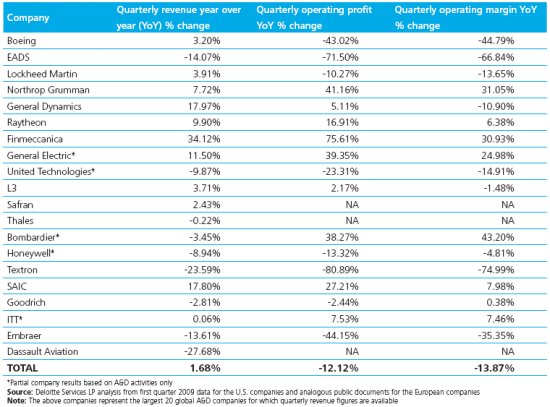

Financial performance fell across the board for the top 20 global A&D firms. In the 2009 first quarter financial results, sales revenue growth fell 83%, down from 10% to 1.7%. Operating profits decreased 12%, while quarterly operating margin declined by 13.9%, from 10.3% to 8.9%. Figure 1 shows the financial performance for the top 20 global industry firms and as a group.

As we near the close of the second quarter of 2009, the key question on the minds of the industry executives and shareholders: when is the A&D industry expected to rebound?

Figure 1: Top Twenty Global A&D Companies' First Quarter 2009 Verses First Quarter 2008

Commercial Aircraft

Industry pundits and forecasters expect the bottom of this recession to be forthcoming in the next six months, and a rebound in demand for commercial passenger travel to start increasing within 12 months. Commercial aircraft producers have indicated that credit financing facilities exist for most customers taking delivery for the remainder of 2009, and that credit financing may be challenging, but should be available to finance most aircraft purchases in 2010. Indeed there are early signs that the bottom is approaching, with recent news of large aircraft orders being planned, from airlines seeking to take advantage of potential price concessions, and flexibility typically found prior to the end of down cycles.

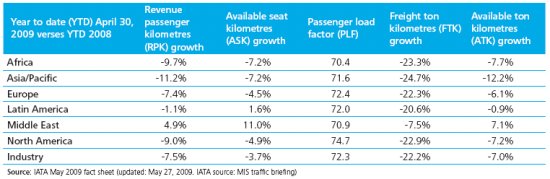

The global airline industry continues to forecasting declining revenues and increased operating losses, due to on-going adverse trends in passenger and freight traffic. According to International Air Transport Association (IATA) the organization "nearly doubled its forecast for losses this year to $9 billion for the global airline industry, amid what it said were the worst conditions it has ever faced. IATA said it now expected revenues across the industry to fall 15% to $448 billion this year and its new loss forecast was nearly twice the $4.7 billion it had projected as recently as March 20092". Furthermore, international revenue passenger kilometres (RPKs) declined 7.5%, and freight traffic growth declined 22.2% year to date through April 30, 2009 (see Figure 2). Between the IATA statement and the actual data indicating a significant falloff in passenger travel and dramatic decline in freight traffic, the commercial aircraft producers are expecting far fewer aircraft orders than experienced in the last several years. As can be seen in Figure 2, most of the regions of the world are experiencing a significant falloff in passenger and freighter traffic.

Figure 2: International Traffic Results

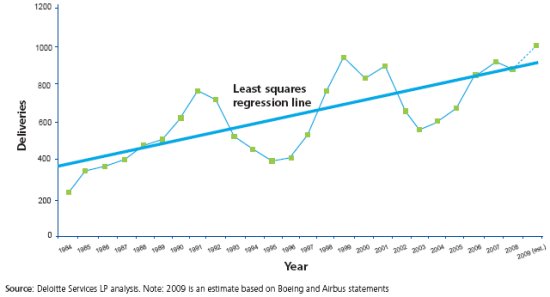

Despite the recession and falloff in RPKs, air traffic growth over the next 20 years is expected to be 4.9% on an annual basis, significantly higher than the global GDP rate3. The market demand for new commercial aircraft is 29,000, worth and estimated $3.2 trillion4. With 36% of the backlog of large commercial aircraft, Asia Pacific is quickly becoming the largest market for new orders5. In 20 years, 82% of the fleet flying at that time is expected to be new fuel efficient, more comfortable and green aircraft, placed in service after 20086. Thus, the long-term outlook for air travel remains optimistic, with rises in aircraft production, despite the short-term industry challenges. Indeed Figure 3 illustrates that each aircraft production down cycle is followed by ever higher up cycles in aircraft production. Note that the trend line uses 25 year historical data, illustrating a 3.5% rate of growth.

Figure 3: Aircraft Deliveries: 1984 – 2009

Business Aviation

For business jet producers, the outlook is much more severe, with orders being cancelled or deferred. Significant layoffs have occurred within the major business jet and general aviation manufacturers.

The pace of deliveries is expected to slow in this industry sub-segment, where corporations, the main customers of business jets, have found it unfavourable to own this type of transportation mode, given the negative publicity at the auto industry bailout hearings early in 2009. In addition, with corporations being impacted by the recession, they are finding other means of transporting executives for the time being.

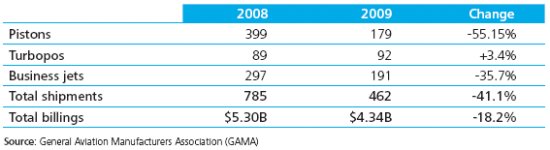

For wealthy individuals, business jets are a luxury that becomes discretionary during tough economic times, and in this current economic crisis, many orders are being deferred and cancelled due to affordability. New markets in Russia, the Middle East, and China exploited by business jet producers over the last few years have diminished. Oligarchs, sheikhs, and the new economy wealthy are even cutting back as the pace of local economic development and the price of oil has subsided. As seen in Figure 4, business aircraft deliveries have fallen off dramatically, with a 41.1% reduction in total shipments in this first quarter.

Figure 4: First Quarter 2009 Shipments Of Business And General Aviation Aircraft Manufactured Worldwide

By comparison, business aviation deliveries dropped a dramatic 34% post 9/11, but grew in the next five years to record levels7. However, this business jet subsegment recession has been described as equal to or worse than in 2001. Indeed Hawker Beechcraft has announced plans to lay off about a third of its workforce in 20098. Cessna announced in the first quarter the intention of laying off almost 40% of its workforce9. Gulfstream, at the high end, has even announced layoffs of 12% of its workforce10 .Finally, Embraer is expected to deliver 28% fewer business jets in 200911. Therefore, the short-term outlook for business jets continues to look harsh, although long term, this segment has demonstrated resilience, usually leading to ever high levels of production.

Defence

The U.S. defence spend is approximately 42% of the global spend on military weapons procurement and development12. Thus, it is instructive to assess where is U.S. spending going and to understand the overall global trends. For 2009, the U.S. DoD spend is budgeted at approximately a 4% nominal increases over 2008, but accounting for inflation, this represents about a 2% increase. However, the budget must accommodate a 2.9% pay raise for members of the armed services, 93,000 additional troops, increased funding for health care, and the wounded warrior program13. This leaves a lower percentage of the budget for the weapons development programs and for procurement of mature in-production weapons and platforms. Indeed, Secretary Bob Gates has recommended termination of the F-22 fifth generation stealth fighter, the VH-71 Presidential Helicopter, the Future Combat System, and the Transformational Satellite Program (TSAT), in addition to a number of changes, terminations, and redirections that he has proposed14. As can be seen in Figure 5, U.S. defence spending is moderating and levelling off from the previous levels of increases over the last several years.

Figure 5: Discretionary U.S. Department Of Defence Budget

Department Of Defence

Proposed spending is focused on irregular warfare, targeting asymmetric threats found in current and expected future conflicts. Weapons and technology priorities are in the cyber security, intelligence, surveillance, reconnaissance, command, control, and communications space. Delivery platforms expected to be in demand include unmanned air, land and sea vehicles, mine resistant vehicles, and miniaturized systems.

For defence contractors, these are the areas that will generate growth in 2009 and beyond. In particular, the number and variety of large hardware-based platforms is expected to decline and more innovation and capability will be found in software integration. Mission capability will increasingly be created by IT services firms, which are well poised to create competitive advantage through innovation in battle space management, directed energy, precision engagement, threat identification, as well as energy and infrastructure security.

Wild Cards That May Impact Defence Spending

Defence spending is subject to current global events. To that end, any number of wild-card catalysts may ignite new defence spending, with the velocity and direction of that spending dependent on the particular threat faced. These include the rapidly maturing nuclear threat in Iran and growing instability in Pakistan. North Korea's continued long range strike and nuclear arms development continues to pose a threat to regional stability. Additional wild cards include low-level tensions between the U.S. and Russia over buffer states (Georgia, Ukraine, and Kazakhstan), piracy in commercial shipping lanes off the coast of Somalia and in the Malacca Straights, and Chinese policy shifts on Taiwan. Tensions between India and Pakistan have yielded problems in recent years and could potentially flare as well.

However, there are two reasons for financial optimism among defence contractors. The average age of the U.S. air force fleet in 2008 was 24 years15. There are instances where the service is relying on aircraft that are over fifty years old. This equipment will need to be replaced. Secondly, over the long term, defence will be an innovator of technology for the industry. In the past, technology (such as global positioning system/GPS) developed for military use has made its way into broader consumer markets. Today, areas to watch include the miniaturization of technology, robotics, alternative energies, and new developments in reconnaissance and surveillance. By focusing on product innovation, process improvements, and new revenue opportunities, defence companies will be well positioned for an economic turnaround.

Solutions For The Future

In the current environment, it is difficult to forecast with accuracy due to the unprecedented nature of the economic downturn. That said, there are six reliable tactics that A&D companies will have to execute well in order to successfully position themselves to thrive as the economy recovers:

- Help customers reconfigure solutions that are more affordable and develop strategies for programs under consideration for termination, new competitive selection, or revamping

- Protect the commercial backlog by applying risk mitigation and financing alternatives

- Develop a global business model, particularly in the Middle East and India where commercial and defence opportunities are maturing

- Aggressively manage costs and set effective targets while achieving mission assurance for the customer

- Take advantage of new opportunities in the acquisition space

- Identify and capture technology directions and funding for emerging defence and security priorities

History indicates the overall innovation and financial success in the A&D industry, but the next two years will be a true test of resilience for global sector manufacturers. The industry is in the midst of a game-changing challenge and those who adapt and capitalize on the new opportunities will prevail.

Footnotes

1. Deloitte LLP study: "2008 Global Aerospace & Defence Industry Performance Wrap-up"

2. Associated Press: IATA: "Global airline industry nearly double loss estimate to$9 billion", June 8, 2009

3. FT.com: "Boeing trims delivery outlook," June 12, 2009

4. FT.com: "Boeing trims delivery outlook," June 12, 2009

5. JP Morgan — All About Aerospace & Defence 2009, January 6, 2009

6. Boeing current market outlook 2008-2027

7. General Aviation Manufacturers Association (GAMA): 2008 General aviation statistical database and industry outlook

8. Associated Press: "Hawker Beechcraft announces 2,300 layoffs," February 3, 2009, and Reuters

9. Associated Press: "Cessna Aircraft warns more layoff coming," June 4, 2009

10. Associated Press: "Gulfstream: 1,200 layoffs, 1,500 furloughs, " March 6, 2009

11. Flightglobal.com: "Forecasts 2009: Business Aviation: From boom to gloom, " January 13, 2009

12. SIPRI (Stockholm International Peace Research Institute), Deloitte Services LP estimates

13. Department of Defence 2010 budget overview

14. Defence budget recommendation statement (Arlington, VA) As prepared for delivery by Secretary of Defence Robert M. Gates, Arlington, VA, Monday, April 06, 2009

15. Standard & Poor report

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.