With effect from 6 April 2019, the UK's capital gains tax (CGT) regime for non-residents was extended to include UK commercial property as well as indirect disposals of UK real estate (whether residential or commercial).

For disposals made on or after 6 April 2019, non-resident individuals, trustees and partnerships are chargeable to UK capital gains tax and non-resident companies are subject to corporation tax.

Direct Disposals of UK Real Estate

All non-residents (including individuals, trustees, partnerships, companies, widely held funds, collective investment schemes and life assurance companies) are now subject to UK tax on a direct disposal of UK real estate.

Commercial Property

Commercial property values are rebased to 5 April 2019, so that only the gain arising from 6 April 2019 is chargeable to tax. There is an option to calculate the gain (or loss) using the original acquisition cost, and this may be useful where a property is standing at a loss. There is no option, however, to time apportion the gain into periods pre and post 6 April 2019.

We would recommend that non-residents owning UK commercial real estate obtain a valuation as at April 2019 to provide as evidence should the valuations be queried by HMRC on a future disposal.

The tax rates for individuals are 10% or 20% (20% for trustees). Companies pay corporation tax on their gains (currently 19%, reducing to 17% from April 2020).

Residential Property

For residential property, the rebasing date of 5 April 2015 remains unchanged. The rates remain at 18% / 28% for individuals, and 28% for trustees. For companies, the gain is charged to corporation tax. ATED-CGT has been abolished.

For persons brought within the charge to tax on residential property gains with effect from 6 April 2019 (e.g. non-resident widely-held companies), property values can be rebased to 5 April 2019.

Losses

Under the new regime, losses realised on UK residential property can be offset against gains on UK commercial property and vice versa. Group relief will be available for losses realised by a group company, provided the relevant conditions are met.

Indirect Disposals of UK Real Estate

An indirect disposal is a disposal of an interest in an entity that holds UK real estate (whether commercial or residential property). This includes a disposal of shares in a company (or holding company) that owns UK real estate, an interest in a partnership or an interest in settled property deriving its value from UK land, as well as disposals of interests in UK funds (e.g. REITs, PAIFs), where the following two conditions are satisfied:

- The entity is 'property rich'

(at least 75% of the value of the company's 'qualifying

assets' derives from interests in UK land). The 75% test is

based on the market value of the assets of the company and is not

reduced by liabilities.

The legislation introduces a trading exemption that applies where all of the interests in UK land are used in a qualifying trade, other than those of an insignificant value. To benefit from this exemption, a qualifying trade must have been carried on by the company, on a commercial basis, for at least one year at the time of disposal, and must continue to be carried on after the disposal.

The trading exemption is likely to benefit investors in the retail and hotel industry.

Companies which do not meet the trading exemption may still qualify for the Substantial Shareholdings Exemption (SSE) as the trading test for the SSE is less restrictive. - The non-resident holds an interest of 25% or more (including interests of connected persons), in the entity at the date of disposal, or has done so at any point within the previous two years unless this was for an 'insignificant period'. Connected persons for these purposes include relatives and persons 'acting together' to secure or exercise control over the company. This test does not apply to investors disposing of interests held in funds.

Rebasing to 5 April 2019 also applies. It is the value of the interest in the entity (e.g. the shares), rather than the property itself, that is rebased. The gain is therefore calculated by reference to the increase in the value of the interest in the real estate entity rather than by reference to the increase in the value of the real estate itself.

Alternatively, it is possible to elect to calculate the gain by reference to the original cost of the interest, provided that, if a loss is produced by using the original cost, this is not an allowable loss. As for disposals of commercial real estate, it is not possible to time apportion gains on indirect disposals. Valuations of interests should therefore be obtained at April 2019.

Tax Treaties

Some tax treaties override the UK's domestic taxing rights on disposals of UK property. This would not normally be the case in relation to direct disposals of UK real estate but could apply where a UK property is held in an overseas partnership or where shares of a UK property holding company are sold and a treaty allocates taxing rights solely to the country where the shareholder is resident.

In order to prevent 'treaty shopping', where a double tax treaty is used to circumvent these rules, the legislation contains anti-avoidance measures that allow HMRC to counteract tax advantages where the advantage is contrary to the object and purpose of the double taxation treaty.

The government also plans to re-negotiate certain treaties (e.g. the UK/Luxembourg) so that the UK's taxing rights are preserved on disposals involving UK land.

Tax Filing and Payment Obligations

Non-resident individuals are required to file a tax return reporting the disposal and to pay the tax due within 30 days following the date of disposal. The return is required even if there is no tax to pay. If the individual already files self-assessment returns, payment of the CGT liability can be deferred until the usual deadline of 31 January following the tax year in which the disposal was made.

Non-resident companies will need to register for corporation tax within three months of the date of disposal. Payment of the tax is due within the normal corporation tax deadlines (usually 9 months and 1 day after the end of the accounting period in which the disposal takes place). In cases where a company has no other UK property assets following the disposal, the accounting period will be one day long; the date of disposal takes place. If the gain exceeds £1.5m, an earlier deadline of 3 months and 14 days will apply.

Non-UK Company Becoming UK Resident

Where a non-UK resident company becomes UK resident on or after 6 April 2019, and subsequently disposes of UK real estate, the value of the real estate can be rebased to 5 April 2019 (commercial or indirect sale) or 5 April 2015 (direct disposal of residential property).

This contrasts to the position for individuals or trustees who become UK resident after 6 April 2019, who are not able to benefit from rebasing on a disposal of UK real estate whilst UK resident.

It should be noted, however, that where a non-resident company has become UK resident after 6 April 2019, the portion of the gain arising prior to the rebasing date may still be taxable on UK resident shareholders under s3 (formerly s13) TCGA 1992.

Next Steps

Given the complexities arising from ever-increasing legislation in this area, non-resident investors considering investing in UK real estate should take professional advice to ensure their affairs are structured as tax efficiently as possible depending on their circumstances and objectives.

Existing structures should be reviewed to determine the impact of the new rules.

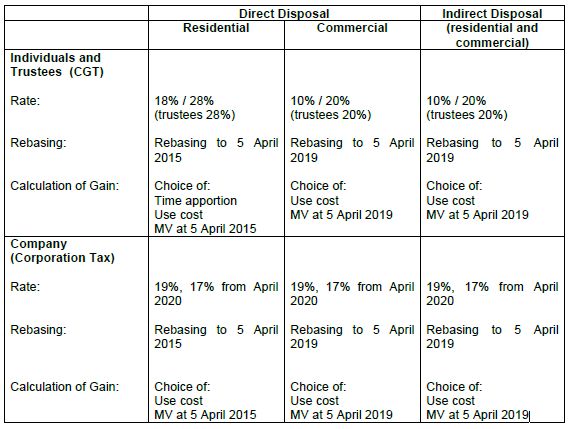

Summary Table

The table below summarises the tax position for disposals of UK real estate on or after 6 April 2019 by non-residents.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.