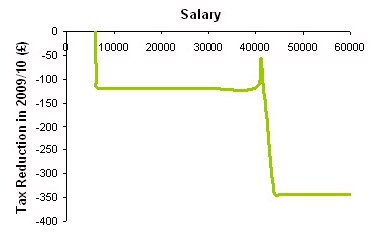

The approximate effect on income tax and NIC for 2009/10 will be as follows:

However any apparent good news for higher rate tax payers will be short lived. From April 2010:

- The tax rate for those earning more than £150,000 will be 50%

- The personal allowance will be tapered away for those earning more than £100,000. That represents a cost of up to £220 per month for those affected.

Pensions:

In 2009/10 a pensioner receiving the basic state pension (category A or B) will see an increase in the weekly amount of £4.55.

Tax credits:

A couple with two children, where one or both work at least 30 hours per week and the household income is less than £28,000, should see an increase in working and child tax credits of around £520 for 2009/10. The child benefit for two children also increased as of January 2009 from £31.35 per week to £33.20 per week.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.